FXOpen

Whether you are a professional or a beginner trader, you should be equipped with strategies. They involve accurate points on where to enter and exit a trade — only by following specific rules can you stay afloat in Forex trading. Below you will find three effective trading approaches.

How to Choose Effective Foreign Exchange Trading Strategies

Here are the key factors that will affect your choice.

Timeframe

A timeframe is essential when choosing a Forex strategy. There are short, medium, and long-term timeframes. Short-term periods include 1, 5, 15 and 30-minute timeframes and an hourly chart. Medium-term periods are presented by 4-hour and daily charts. Long-term timeframes are weekly, monthly, and yearly.

The timeframe determines the length of your trade and the size of your potential income. Short-term positions imply low potential income, but it’s compensated with their high frequency. Medium-term trades may bring higher profit, but the outcome will depend on market conditions. The long-term position’s profit depends on your initial balance.

Experience

Another point to consider is the experience you have. For instance, short-term trades might seem easier, but entering and exiting the trade at the right moment is challenging. Therefore, such trades are usually made by experienced traders.

Account Balance

It’s also important to consider the amount of funds you have when choosing the best trading strategies on Forex. To stay afloat for months, you will need to have a considerable amount as the price will move in your favour and against you. When trading on a margin account, the risks rise significantly.

Let’s consider strategies you can use when at FXOpen.

Scalping

Scalping is one of the most popular FX trading strategies used on low timeframes where an asset’s rate rapidly changes. The idea is to open numerous trades to compensate for their short period — usually, positions close within 30 minutes. Scalping involves the use of leverage.

Leverage is an instrument which allows traders to borrow funds from a broker to open larger trades. However, it bears additional risks. Before using leverage, learn its features to understand the mechanism fully.

Scalping is among the few Forex strategies that work for news trading. Important news and events increase volatility, providing numerous trading opportunities for a short period.

Also, traders use technical analysis for scalping. It might be worth using leading indicators as they can forecast a trend reversal. The most common leading tools are the relative strength index (RSI), moving average convergence divergence (MACD), stochastic oscillator, and average directional index (ADX).

Scalping and Stochastic Oscillator

There are many types of scalping approaches. We will consider a currency trading strategy with the stochastic oscillator you can practice on the FXOpen TickTrader platform.

Enter the Market

The strategy is usually applied to a 15-minute timeframe. It doesn’t work when a price consolidates — a market should move within a solid trend. The Stochastic oscillator might work better with a length of 9.

Trendlines are one of the key strategy elements. A price should touch the upper line if it’s a bullish trend and the lower line if it’s a bearish trend.

- If the asset is near the upper trendline and the stochastic oscillator left the overbought area (80-100 range), this suggests you should go short.

- If the asset is near the lower trendline and the Stochastic left the oversold area (0-20 range), this suggests you should go long.

Take Profit

- You can consider closing a short position as soon as the stochastic oscillator enters the oversold area.

- You could close a long position as soon as the stochastic oscillator enters the overbought area.

Stop Loss

- In sell trade, you may set a stop-loss order from two to ten pips above the entry point, considering the closest resistance.

- In a buy trade, you may place a stop-loss level from two to ten pips below the entry point, considering the closest support.

Look at the chart above. A buy condition occurred once the indicator left the oversold area (1). The trade would be closed with profit when the Stochastic entered the overbought zone (2). A stop-loss of 10 pips would limit risks.

Swing Trading

Swing trading is among the top Forex strategies used on different timeframes. It’s based on the assumption that the price can’t constantly move in one direction. Even within strong trends, the rate corrects — moves against the overall trend. Traders use such movements to both buy and sell within the trend.

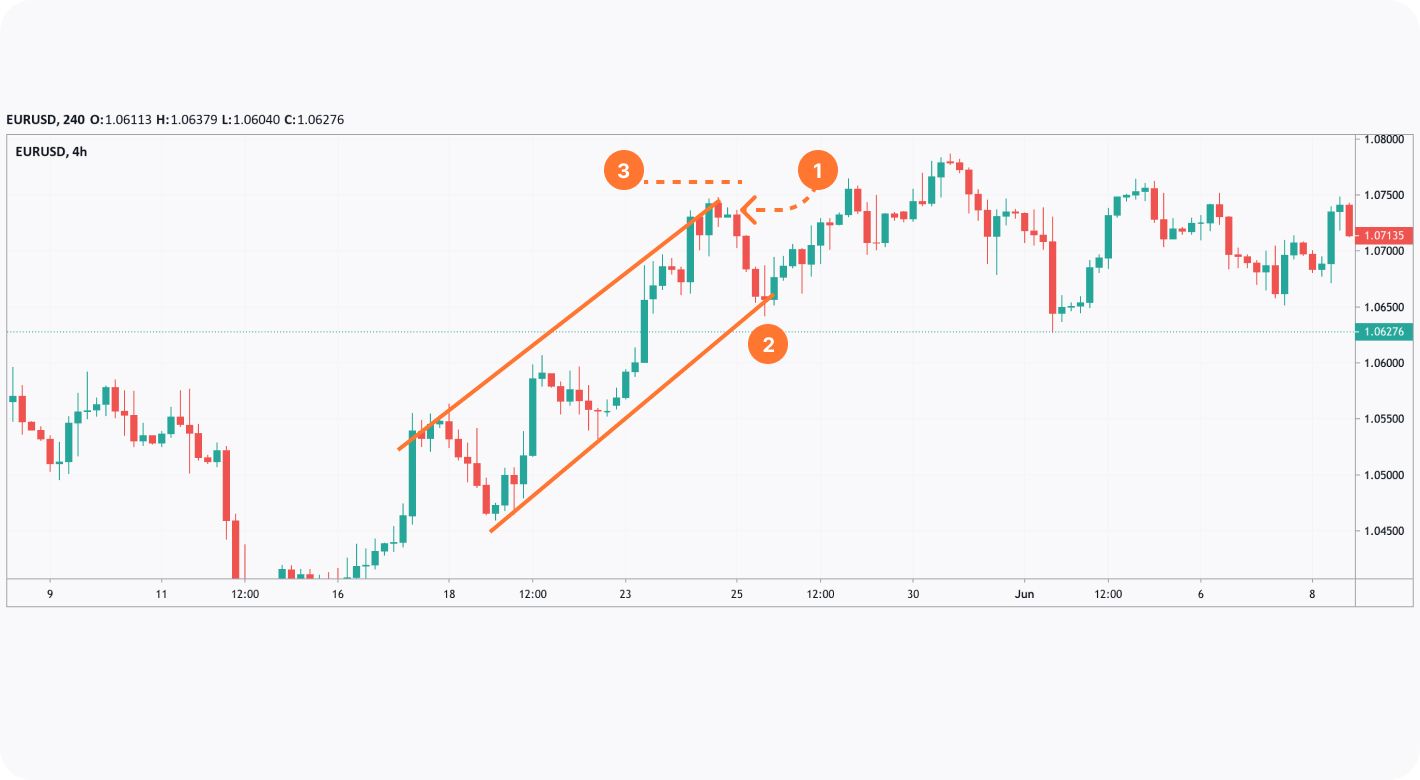

Swing Trading and Trendlines

The best way to trade currency with the swing approach is to place trendlines. Every time the price touches a trendline and turns around, it’s a swing.

A trendline is a technical analysis tool used to frame a trend and determine support and resistance levels. There must be at least two highs/lows to draw it correctly.

Enter the Market

The theory behind the strategy is to open a trade on price rebounds. That is, a sell trade may be set when a price bounces from the upper trendline, and buy conditions occur when it bounces from the lower trendline.

Take Profit

You could place a take-profit level on the opposite trendline regardless of the trade direction.

Stop Loss

A stop-loss order can be calculated in accordance with the risk/reward ratio of 1:2 or 1:3.

The chart above shows a potential sell trade. You could short when the price touched the upper trendline (1). A take-profit order would be placed on the opposite trendline (2). To limit losses, you could use the 1:3 risk/reward ratio (3).

Day Trading

Day or so-called intraday trading is one of the best Forex trading systems. It’s used when a trader closes a position before the day ends to limit risks of unexpected events that can cause enormous volatility on the next day and avoid rollover fees.

A rollover or a swap fee is an interest paid or earned when keeping a positionovernight.

Intraday trades are usually set on 30-minute and hourly charts. Same as for scalping, you can use this approach for news trading. Also, you can implement indicators and chart patterns.

Day Trading and RSI

It’s one of the most successful Forex trading strategies. Use this approach on an hourly chart.

Enter the Market

If you change the standard RSI period to 9, the indicator will cross overbought/oversold areas more often, providing more signals. According to the strategy, when the index leaves the overbought area (70-100 range), a sell position can be opened. When the RSI leaves the oversold zone (0-30 range), you may consider it as a buy signal.

Take Profit

Support and resistance levels may serve as potential profit targets. That is, traders would choose the closest support level for a short trade and the nearest resistance level for a long trade.

Stop Loss

The risk/reward ratio of 1:2 or 1:3 corresponding with the take-profit value would help you determine the stop-loss level.

The chart above depicts a potential buy trade. You could go long when the RSI crossed the 30 level from bottom to top (1). A take-profit order would be set on the closest resistance level (2). A stop-loss level would be half the potential profit (3).

Final Thoughts

If you want to find the best Forex strategy ever, you should create it yourself. Change indicators’ settings, test different technical tools, and trade on various timeframes. Try a free demo account at FXOpen to develop your effective Forex strategy.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.