FXOpen

Nvidia (NVDA) is one of the most closely watched AI and semiconductor stocks in the market. Investors looking for a NVDA stock forecast for 2026–2030 are assessing whether the company’s leadership in AI chips, data-center GPUs, and accelerated computing can sustain long-term share price growth despite ongoing volatility.

In this article, we review analysts’ Nvidia target prices for 2026–2030, outline the key drivers likely to influence the NVDA stock prediction, and examine the stock’s historical performance.

Forecast Summary

2026

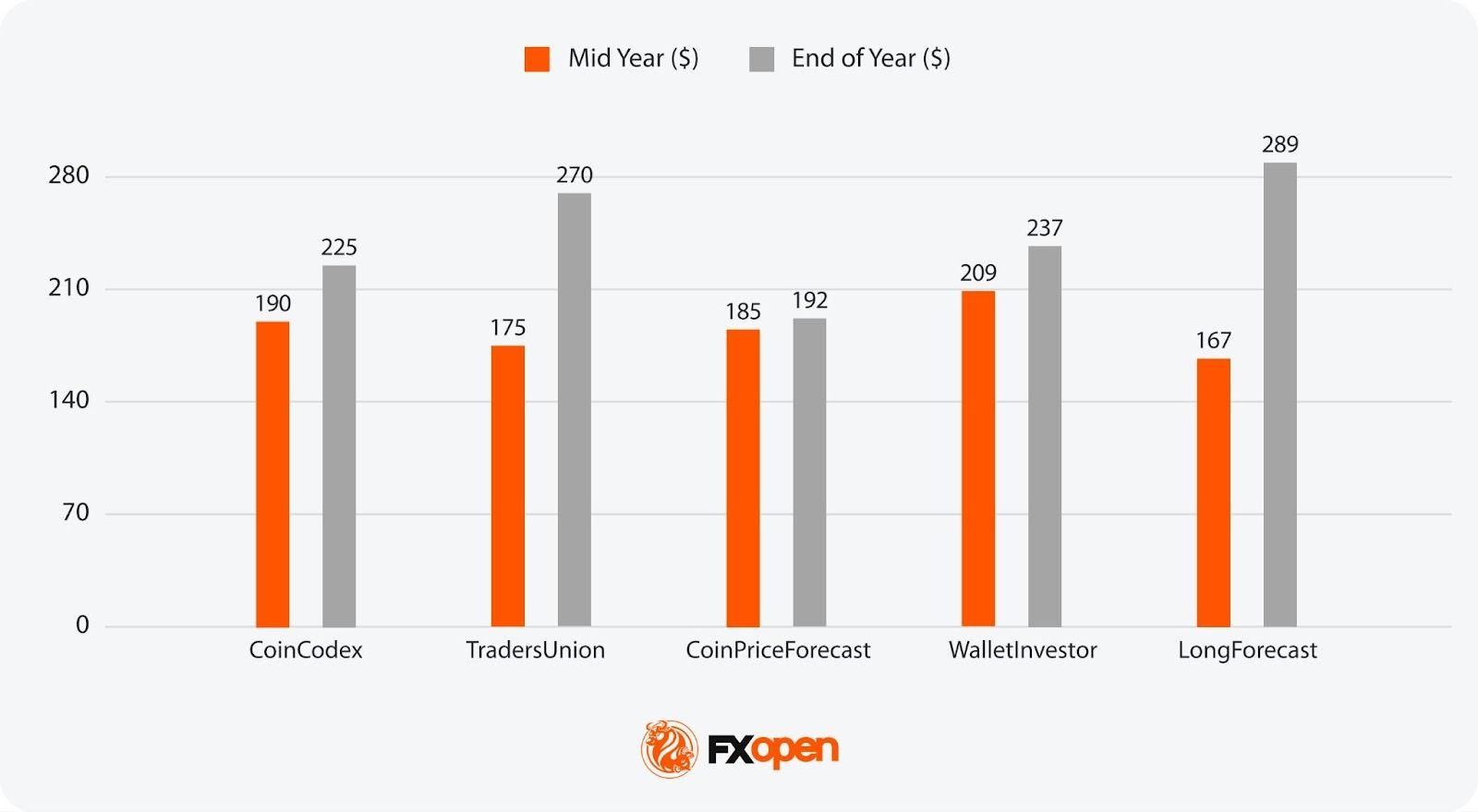

Algorithmic forecasting sources project NVDA trading between $185 and $289 by year-end, while Wall Street analysts are more bullish; Goldman Sachs and Morgan Stanley both target $250, Bank of America and Wedbush $275, and Cantor Fitzgerald holds a Street-high $300. The spread reflects uncertainty around hyperscaler spending sustainability and the Blackwell-to-Vera Rubin platform transition.

2027

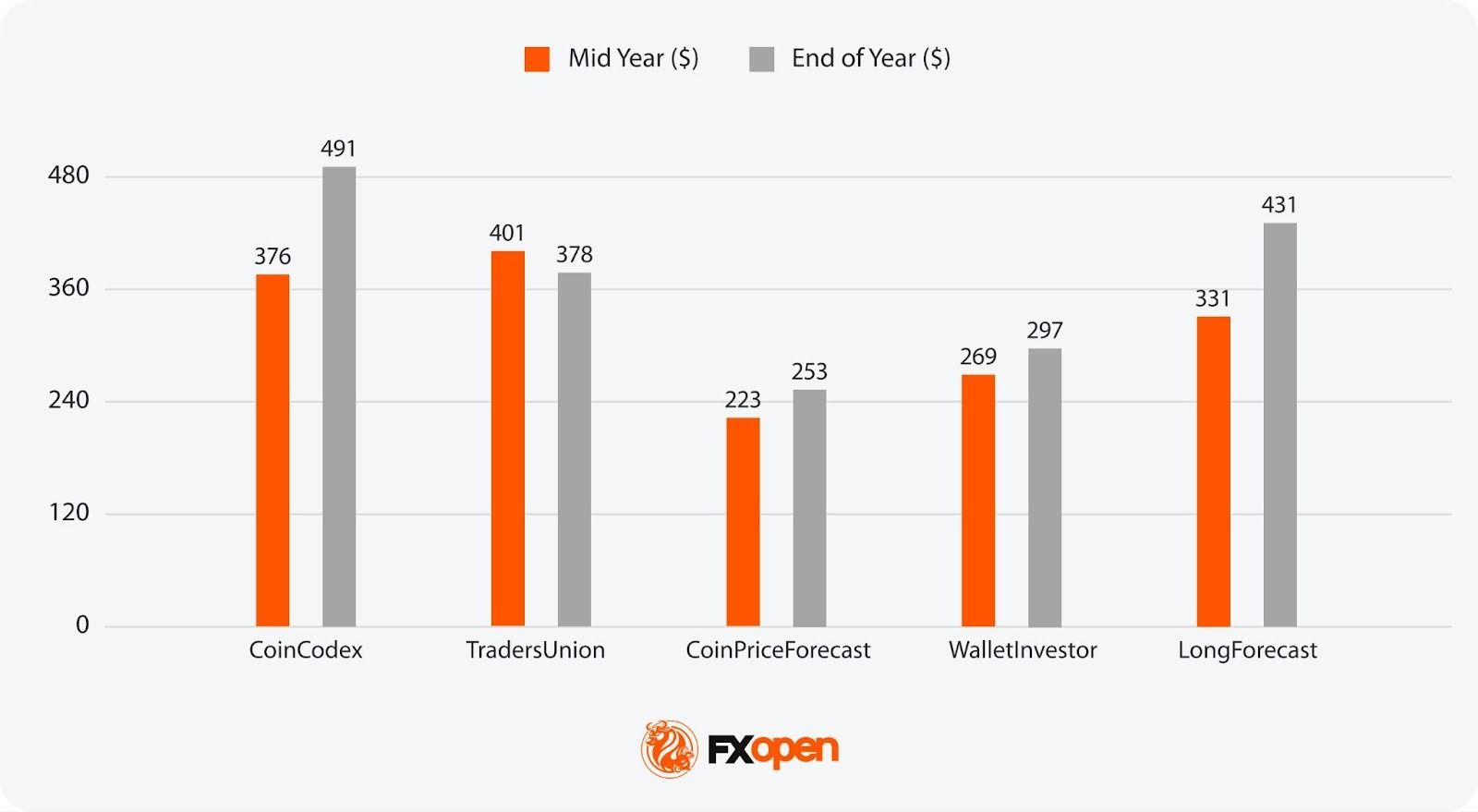

Predictions range from around $253 to $491. Those projecting higher assume NVIDIA retains dominant market share as AI investment deepens across enterprise, sovereign, and infrastructure applications.

2028

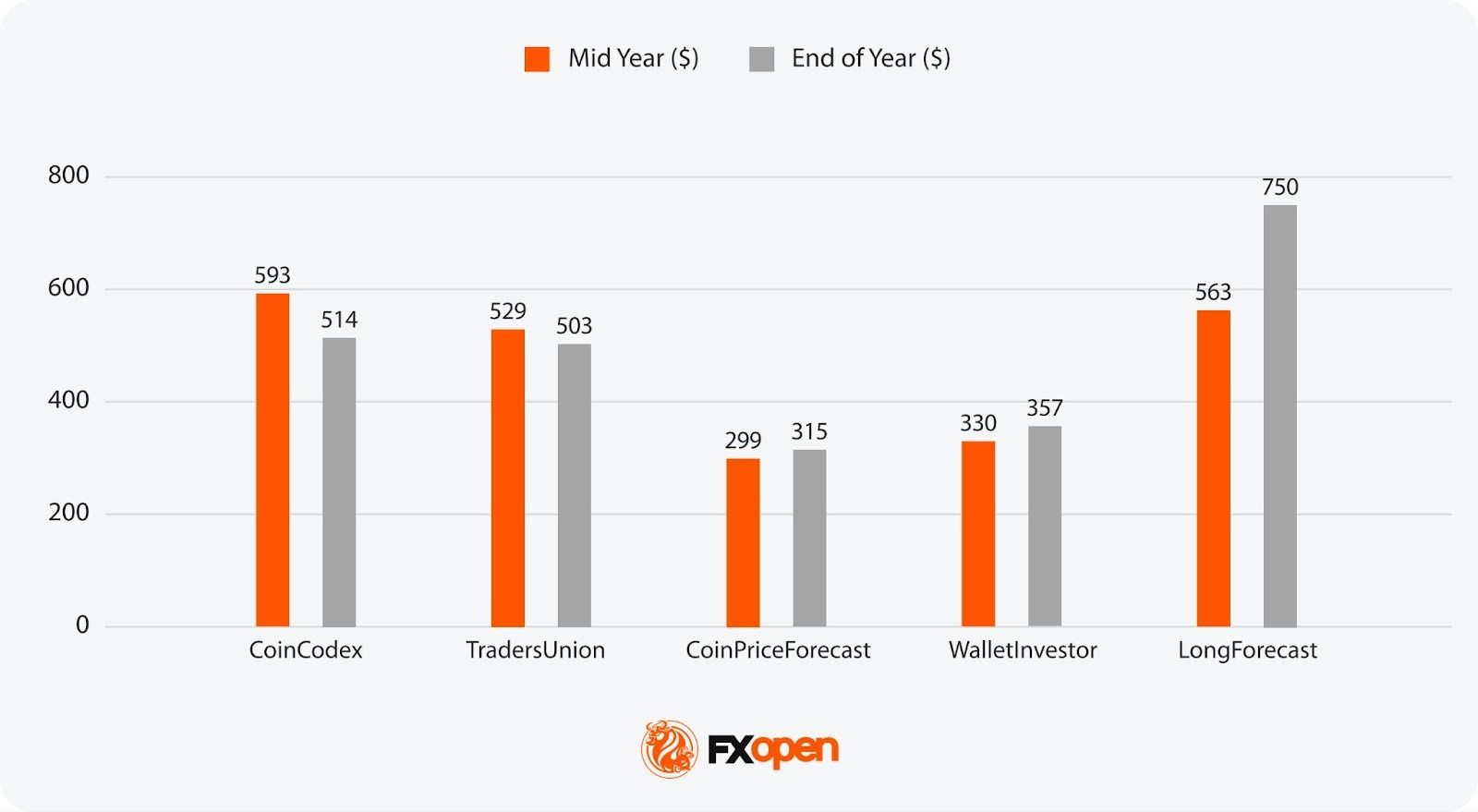

Estimates span $315 to $750. The widening gap reflects diverging views on competition from AMD and custom hyperscaler chips, and whether the shift from AI training to large-scale inference drives sustained or diminishing demand for NVIDIA hardware.

2029

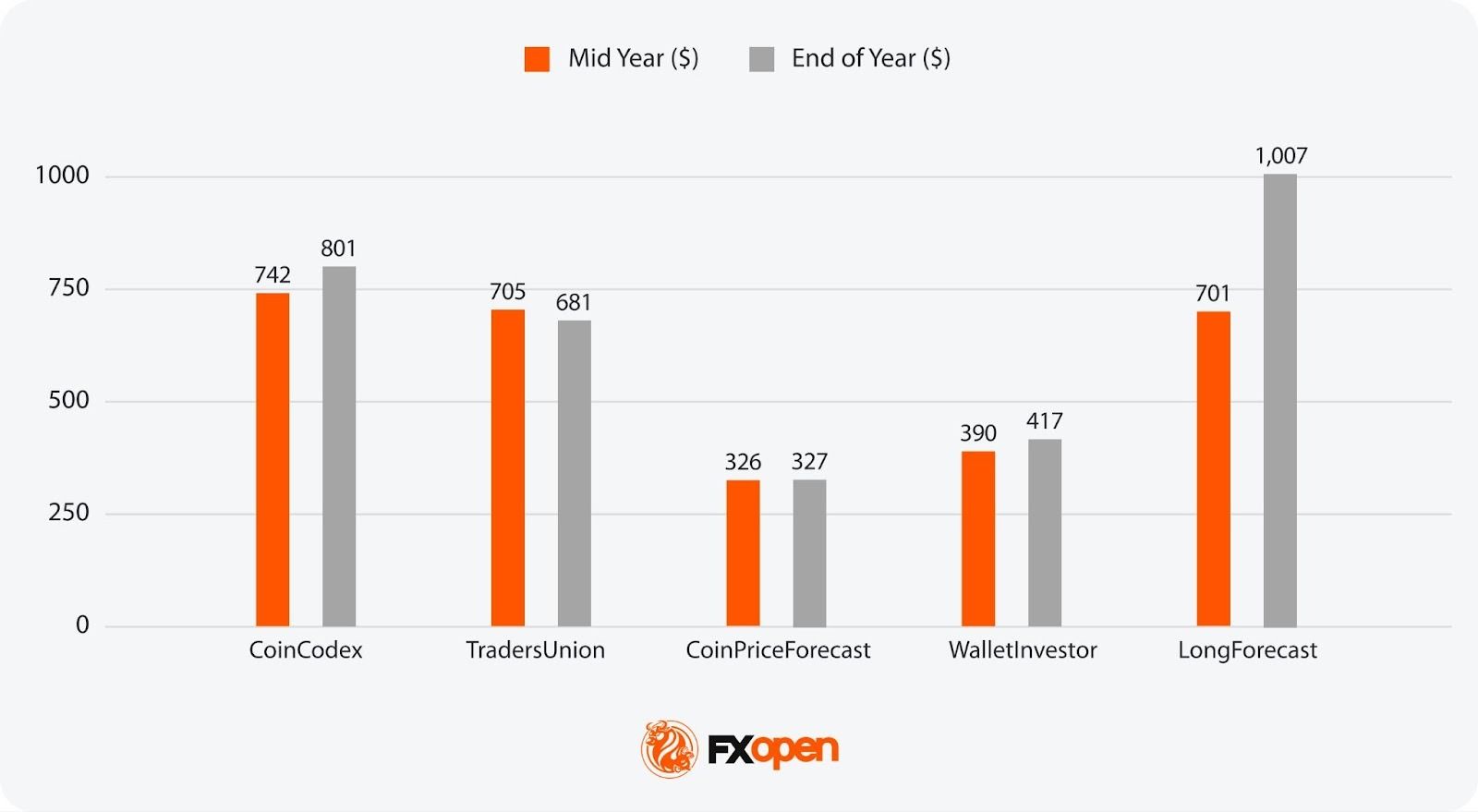

Forecasts range from $327 to over $1,000. Conservative models anticipate slowing growth as the initial AI buildout matures, while bullish sources factor in expansion into robotics, autonomous driving, and agentic AI workloads.

2030

Long-range projections suggest $392 to almost $1,100. At this horizon, forecasts hinge heavily on whether NVIDIA maintains its estimated 90%+ AI accelerator market share against intensifying competition.

What Factors Could Impact Nvidia’s Stock Price in 2026 to 2030 and Beyond?

NVIDIA is expected to maintain its technological leadership and expand its market presence from 2026 to 2030. Analysts anticipate the company will continue to dominate the AI and data centre sectors, driving robust revenue growth. NVIDIA's innovative products, particularly its AI chips, are poised to see increasing adoption across various industries, contributing significantly to its revenue streams.

AI and Data Center Dominance

NVIDIA's leadership in AI and data centre technologies is a key driver of its stock performance. The company's AI chips are integral to the growth of AI applications across various industries, and its data centre segment continues to see exponential growth. In fiscal 2025, NVIDIA's data centre revenue reached $115.19 billion - a 142% increase year-on-year - and by Q3 of 2025, the segment had hit a record $51.2 billion in a single quarter, up 66% from the prior year, as enterprises and hyperscalers continue to ramp AI-driven infrastructure.

Revenue and Earnings Growth

NVIDIA's financial outlook is strong, with projected substantial increases in revenue and earnings. Looking ahead, analysts expect NVIDIA's revenue to continue climbing sharply. Consensus estimates project 2026's revenue at around $323 billion, propelled by a $500 billion order backlog for its leading Blackwell and Rubin chips. This growth is expected to be driven by the continued demand for AI solutions and the expansion of NVIDIA’s data centre capabilities.

Emerging Markets

NVIDIA's expansion into emerging markets such as autonomous driving, Internet of Things (IoT), and blockchain technology is expected to drive significant growth from 2026 to 2030.

Autonomous Driving

NVIDIA's DRIVE platform is becoming a cornerstone for autonomous vehicle development. Major automotive manufacturers are incorporating NVIDIA’s AI technology to enhance vehicle safety and efficiency. The autonomous vehicle market is projected to grow substantially, and NVIDIA's technology will be integral to this growth, providing substantial revenue opportunities.

Internet of Things (IoT)

NVIDIA is also making strides in the IoT sector, where its edge computing solutions enable real-time data processing for various applications. The proliferation of IoT devices across industries such as healthcare, manufacturing, and smart cities will drive demand for NVIDIA's powerful GPUs and AI solutions, contributing to long-term revenue growth.

Blockchain and Cryptocurrencies*

While blockchain and cryptocurrency* markets can be volatile, NVIDIA's GPUs are crucial for mining operations. The company’s products are highly sought after for their efficiency and performance in processing complex algorithms. As the blockchain industry evolves, NVIDIA’s technology will continue to play a vital role, offering another revenue stream.

Strategic Acquisitions and Partnerships

Analysts also highlight NVIDIA's potential for strategic acquisitions and partnerships as a growth catalyst. The company's strong free cash flow provides the financial flexibility to pursue acquisitions that can strengthen its technological capabilities and market reach. This strategic approach is anticipated to support long-term growth and sustain its competitive edge.

Market Challenges and Competitive Landscape

While NVIDIA's outlook is positive, the company faces challenges from competitors such as AMD, Intel, and emerging startups. Maintaining its technological edge and market leadership will require continuous innovation and effective execution of strategic initiatives. NVIDIA's proprietary technologies, like the Cuda programming language, provide a competitive advantage, but competitors are also advancing rapidly, which will require NVIDIA to stay ahead in the innovation curve.

Analytical NVIDIA Stock Price Forecasts for 2026 to 2030 and Beyond

In a February 2026 research note, Goldman Sachs maintained a Buy rating on NVIDIA with a $250 price target, projecting 2027 revenue of $382.9 billion and earnings per share of $8.75. The bank noted that hyperscaler capex has climbed above $527 billion for 2026 and that it remains "well above the Street" on NVIDIA's data centre revenue estimates, though analyst Jim Schneider cautioned that "stock price outperformance will hinge on revenue visibility into CY27."

Cantor Fitzgerald analyst C.J. Muse holds the Street-high $300 price target, but considers an opportunity of a growth to $400 "given growth prospects through the end of the decade." He said demand for artificial intelligence is surging and noted that Nvidia’s chip supply for 2026 is likely already sold out. According to Muse, the company is now accumulating orders for 2027 and 2028. Some time ago, after meetings with NVIDIA's leadership, Muse declared "this is not a bubble," citing hyperscaler demand that provides "significant line-of-sight into hundreds of billions of demand for the next handful of years," with a path to $50 EPS by 2030.

Morgan Stanley's Joseph Moore maintains a $250 target. Furthermore, the bank offers an even more optimistic scenario of growth to $330 if the plan is successfully executed, and a downside scenario of $150 if growth slows faster than expected. The Vera Rubin platform set to "raise the bar for performance" in the second half of the year.

Bank of America reiterated a Buy with a $275 target. Analysts increased their revenue forecasts for Nvidia for fiscal 2027–2029 by 7%, 2%, and 2%, respectively, bringing projected sales to $342.33 billion, $422.75 billion, and $496.3 billion. They also lifted EPS estimates by 8%, 3%, and 3% to $8, $9.98, and $11.94 over the same period.

Likewise, Wedbush Securities analyst Dan Ives also set a $275 price target, calling 2026 "an inflection point for the AI buildout" and arguing that Wall Street is "significantly underestimating" NVIDIA's demand drivers, with the tech sector projected to rise more than 20% as AI investments deepen across software, semiconductors, and infrastructure.

NVIDIA Stock Prediction for 2026

Mid-Year 2026:

- Most Bullish Projection: 209 (WalletInvestor)

- Most Bearish Projection: 167 (LongForecast)

End-of-Year 2026

- Most Bullish Projection: 289 (LongForecast)

- Most Bearish Projection: 192 (CoinPriceForecast)

NVIDIA Stock Prediction for 2027

Mid-Year 2027:

- Most Bullish Projection: 401 (TradersUnion)

- Most Bearish Projection: 223 (CoinPriceForecast)

End-of-Year 2027:

- Most Bullish Projection: 491 (CoinCodex)

- Most Bearish Projection: 253 (CoinPriceForecast)

NVIDIA Stock Prediction for 2028

Mid-Year 2028:

- Most Bullish Projection: 593 (CoinCodex)

- Most Bearish Projection: 299 (CoinPriceForecast)

End-of-Year 2028:

- Most Bullish Projection: 750 (LongForecast)

- Most Bearish Projection: 315 (CoinPriceForecast)

NVIDIA Stock Prediction for 2029

Mid-Year 2029:

- Most Bullish Projection: 742 (CoinCodex)

- Most Bearish Projection: 326 (CoinPriceForecast)

End-of-Year 2029:

- Most Bullish Projection: 1,007 (LongForecast)

- Most Bearish Projection: 327 (CoinPriceForecast)

NVIDIA Stock Price Prediction for 2030 Onwards

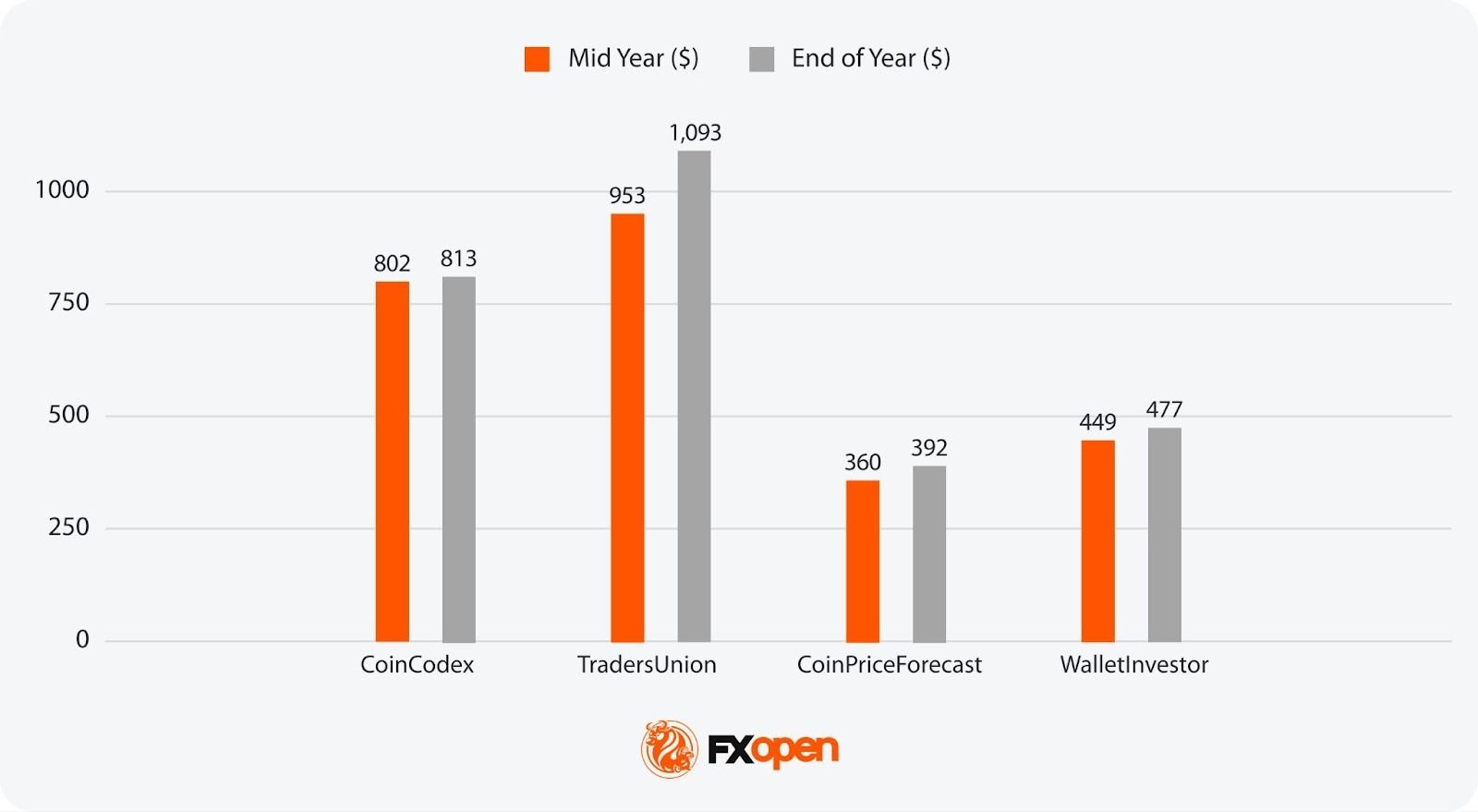

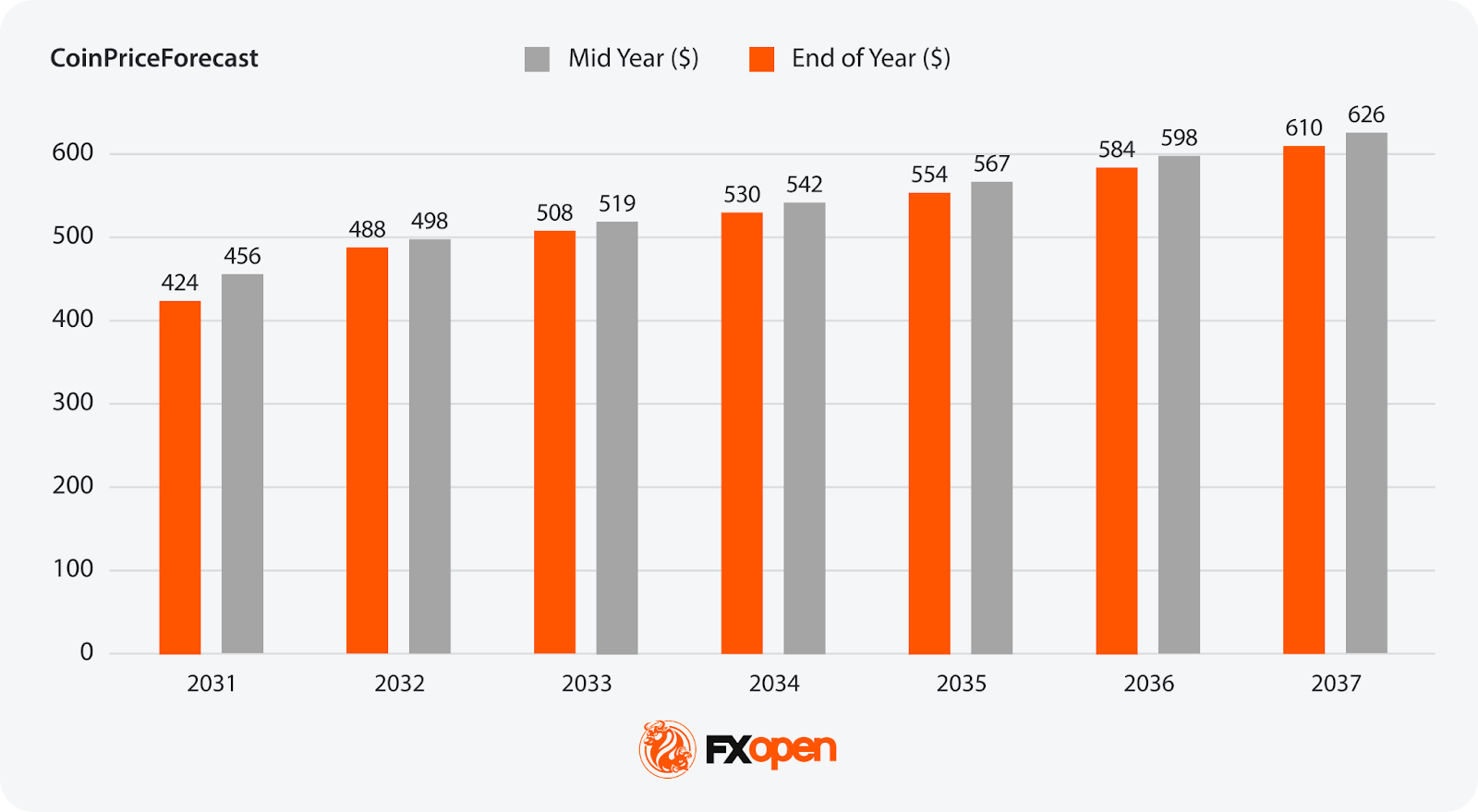

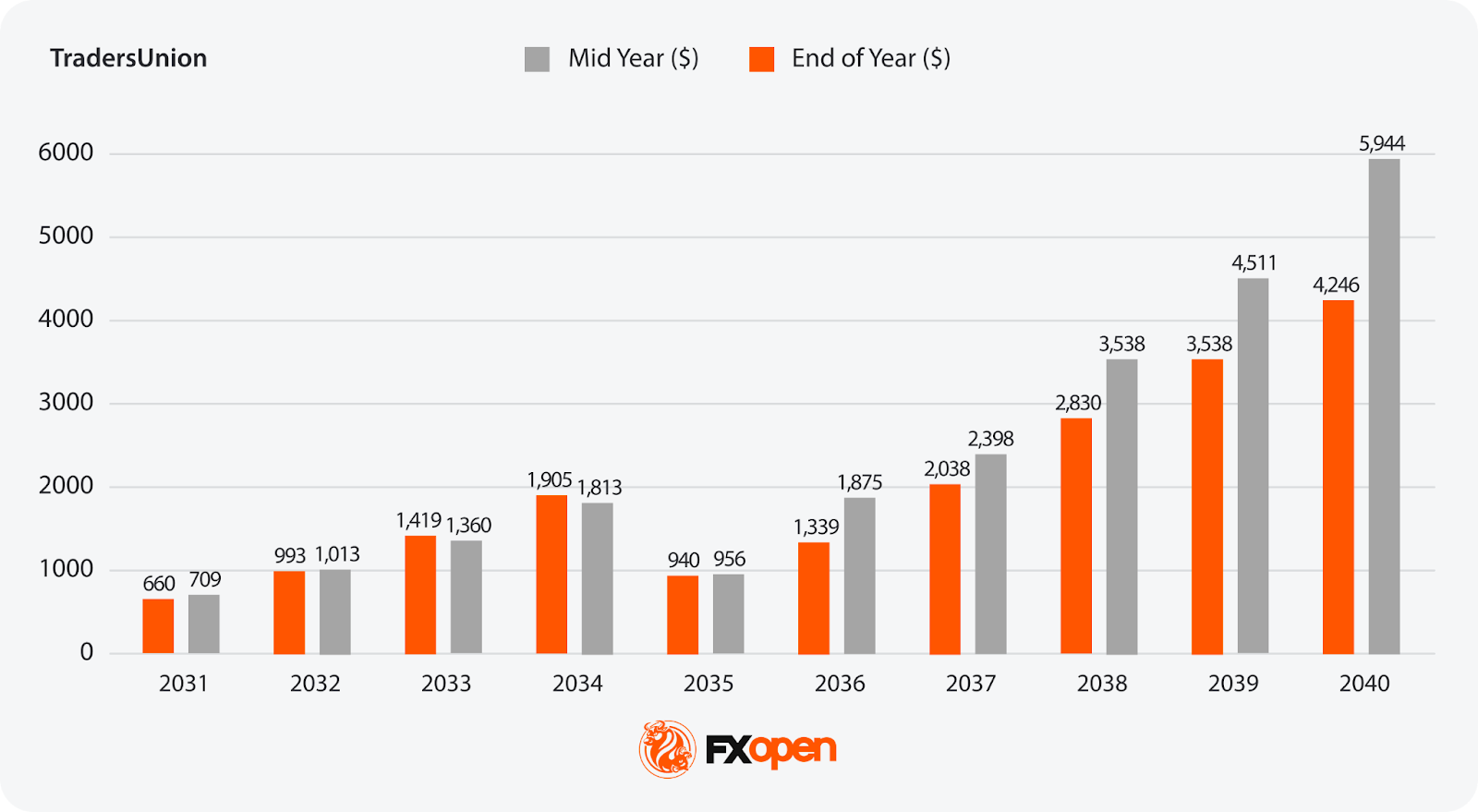

While NVIDIA stock projections beyond 2030 are uncertain, a few sources offer forecasts:

Consensus

While the NVDA stock price is generally expected to rise, the scale of that growth varies. From 2030 to 2040, predictions range from $400 in 2030 to $6,000 in 2040. The gap is wide.

NVIDIA’s Price History

NVIDIA’s stock price has undergone an extraordinary transformation since its early days, moving from a graphics pioneer to a tech powerhouse. Understanding its price history offers valuable insight into the key milestones that have shaped NVIDIA's rise in the market, from its early challenges to its recent dominance in AI and data centres. Let’s look at how NVIDIA’s stock has evolved over the years.

How It Started

NVIDIA Corporation was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem with the vision of revolutionising computing through graphics processing technology. The founders saw the potential in a new computing model focused on enabling rich multimedia experiences for consumers.

Initially, NVIDIA operated in a highly competitive environment dominated by established companies like Intel and 3dfx. In its early years, the company focused on creating high-performance graphics cards, targeting a niche market of gamers and tech enthusiasts. Their breakthrough came with the launch of the NV1 in 1995, a pioneering graphics card that introduced innovative 3D rendering capabilities.

By the late 1990s, the company had gained enough traction to go public in 1999. However, after adjusting for several stock splits, including the most recent one in June 2024, this price is equivalent to just $0.0438 (we’ll refer to the split-adjusted price from here). These early steps marked the beginning of its journey to becoming a tech giant.

Early 2000s to 2015: Building the Foundation

Throughout the 2000s, NVIDIA expanded its product line, targeting both gaming and professional markets. Significant milestones included the release of the GeForce 256 in 1999, often considered the world's first GPU.

The company's stock price rallied in the dot-com bubble, cresting $0.6 at the start of 2002. After sinking to a low of $0.06 later in the year, NVDA began a long uptrend, peaking at $0.992 in 2007, just before the 2008 financial crisis sent it plummeting back to $0.144. Continuing to expand its presence in the GPU arena over the years, NVIDIA’s stock rebounded, closing 2015 at $0.824.

2016-2017: The Boom Begins

The period from 2016 onwards marked a dramatic shift for NVIDIA. Driven by the increasing demand for GPUs in gaming, data centres, and the burgeoning field of artificial intelligence (AI), NVIDIA's stock price began to soar.

By mid-2016, NVIDIA had introduced the Pascal architecture, which significantly improved performance and efficiency. This innovation, coupled with strong financial results, saw the stock price surge to a high of $2.99 by the end of 2016, while by the end of 2017, the stock had been trading near $5.

2018-2020: Volatility and Growth

In 2018, NVIDIA’s stock experienced volatility due to a slowdown in cryptocurrency* mining, which had previously driven GPU sales. The stock price peaked at around $7.32 in October 2018 but closed the year at $3.38. Despite this, NVIDIA's long-term prospects remained strong, bolstered by continued advancements in AI and data centre applications. By early 2020, the stock price had rebounded to above $7.

2020-Present: Surging Ahead

While the COVID-19 pandemic caused a brief blip in NVDA’s price, the event actually further accelerated demand for NVIDIA’s products as more people turned to gaming and remote work. NVIDIA's willingness to acquire Arm Holdings in September 2020 for $40 billion highlighted its strategic expansion.

The stock price broke the $12.50 mark in mid-2020, closing 2021 at $29.41. While rising interest rates and restrictive financial conditions drove NVDA lower in 2022, to a low of $10.81, the debut of ChatGPT in late 2022 and the resulting surge in AI adoption marked a watershed moment for NVIDIA.

NVIDIA quickly became one of the world’s most valuable companies in 2023 thanks to exploding demand for its products. In May 2023, it crossed the $1 trillion market cap threshold and peaked at $50.26 in August.

NVIDIA continued to dominate the GPU and AI computing space in 2024, making a new all-time high of $148 on 7th November 2024.

Much of this bullishness has been supported by the introduction of its Blackwell architecture, designed to provide unprecedented levels of performance to AI applications and cement its leadership in the space.

The next all-time high of $149.43 was set on 6th January 2025. However, by April 2025, the stock had fallen below $100. There are several reasons for this. The US stock market had been undergoing a correction since mid-February. Many analysts suggested the market would cool off in 2025, as it would be unprecedented for it to deliver such returns for a third consecutive year. Moreover, tariff and AI-related concerns weighed on market sentiment, particularly affecting large-cap stocks. The DeepSeek case triggered a decline in NVIDIA shares. Although the market experienced a slight recovery, this incident raised doubts about the future of major AI-related companies.

However, the company soon experienced a remarkable recovery in its share price, surging to a closing price of $173.00 on 17th July 2025, marking a new all-time high. This resurgence was driven by several pivotal developments, most notably the lifting of US export restrictions on its H20 AI chips to China. The reversal of this ban, coupled with increased global capital expenditure in AI infrastructure, significantly bolstered investor confidence and contributed to the substantial rise in NVDA's share value.

On 9th July, NVIDIA’s market capitalisation reached an unprecedented $4 trillion, making it the first company to achieve this milestone. Despite ongoing concerns regarding customer concentration and potential competition from emerging players, NVIDIA’s strategic initiatives and market leadership reinforced its position in the technology sector, cementing its status as a key player in the AI revolution.

It took less than four months for the company to achieve another milestone — on 29th October 2025, NVIDIA reached $5.03 trillion in market value. Moreover, NVDA stocks continued to set new all-time highs. Despite analysts’ warnings about a potential AI bubble, the stock’s rally was supported by a massive order backlog, strategic partnerships with the US government, and expansion into the telecommunications sector.

Since then, however, NVDA has pulled back from its all-time high of $212.19, set on 29th October 2025. The stock traded sideways through late 2025 and into early 2026, closing the year at around $186 before dipping below $183 in mid-February. Broader market caution and growing scrutiny over whether hyperscaler AI spending can deliver sustainable returns have weighed on sentiment.

Now, let’s take a look at analytical NVIDIA share price forecasts.

Want to keep up to date with the latest NVDA price movements? You can head over to FXOpen’s TickTrader platform to explore live NVDA CFD charts.

The Bottom Line

NVIDIA’s future looks promising with continued growth in AI, data centres, and emerging technologies. Price outlooks are bold, and NVIDIA will certainly remain an interesting player to watch in the coming years. However, traders and investors should be very careful and implement risk management tools.

If you are interested in trading NVIDIA and other stocks via CFDs, you can consider opening an account to trade with low commissions and tight spreads at FXOpen (additional fees may apply).

FAQ

What Will NVIDIA Stock Be Worth in 2026?

Most algorithmic forecasting sources project NVDA trading only slightly above its current price of ~$187 by mid-2026, before climbing to between $190 and $290 by year-end, suggesting meaningful second-half momentum driven by continued AI infrastructure spending.

Where Will NVIDIA Stock Be in 5 Years Prediction?

Analytical five-year NVDA forecasts vary widely. Conservative algorithm-based models place the stock between $350 and $500 by 2030, while more bullish projections see it approaching $800–$1000, largely depending on how deeply AI adoption penetrates autonomous driving, IoT, and enterprise computing.

Can Nvidia Hit $300?

Some Wall Street analysts already hold 2026 price targets near or at $300, and most algorithmic forecasting models project the stock reaching this level during 2027. However, reaching $300 would still require sustained revenue growth and continued investor confidence in AI demand.

Is Nvidia Stock Expected to Go Up?

The broad consensus among analysts and forecasting services is bullish, with the overwhelming majority of Wall Street ratings currently at Buy or Strong Buy. That said, competition from AMD and custom AI chips, potential demand cyclicality, and elevated valuations all represent risks to the upside case.

Can Nvidia Hit $500 a Share?

Most long-range forecasting models expect NVDA to reach $500 sometime between 2028 and 2030, supported by projected earnings growth across AI, data centres, and next-generation computing platforms. The timeline depends heavily on whether NVIDIA can maintain its dominant market share against intensifying competition.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.