FXOpen

AUD/USD is moving lower below the 0.6880 support zone. NZD/USD is also declining and might accelerate lower below the 0.6220 support.

Important Takeaways for AUD/USD and NZD/USD

· The Aussie Dollar started a fresh decline from the 0.7000 resistance against the US Dollar.

· There is a key bearish trend line forming with resistance near 0.6880 on the hourly chart of AUD/USD.

· NZD/USD also started a fresh decline below the 0.6285 support zone.

· There is a major bearish trend line forming with resistance near 0.6260 on the hourly chart of NZD/USD.

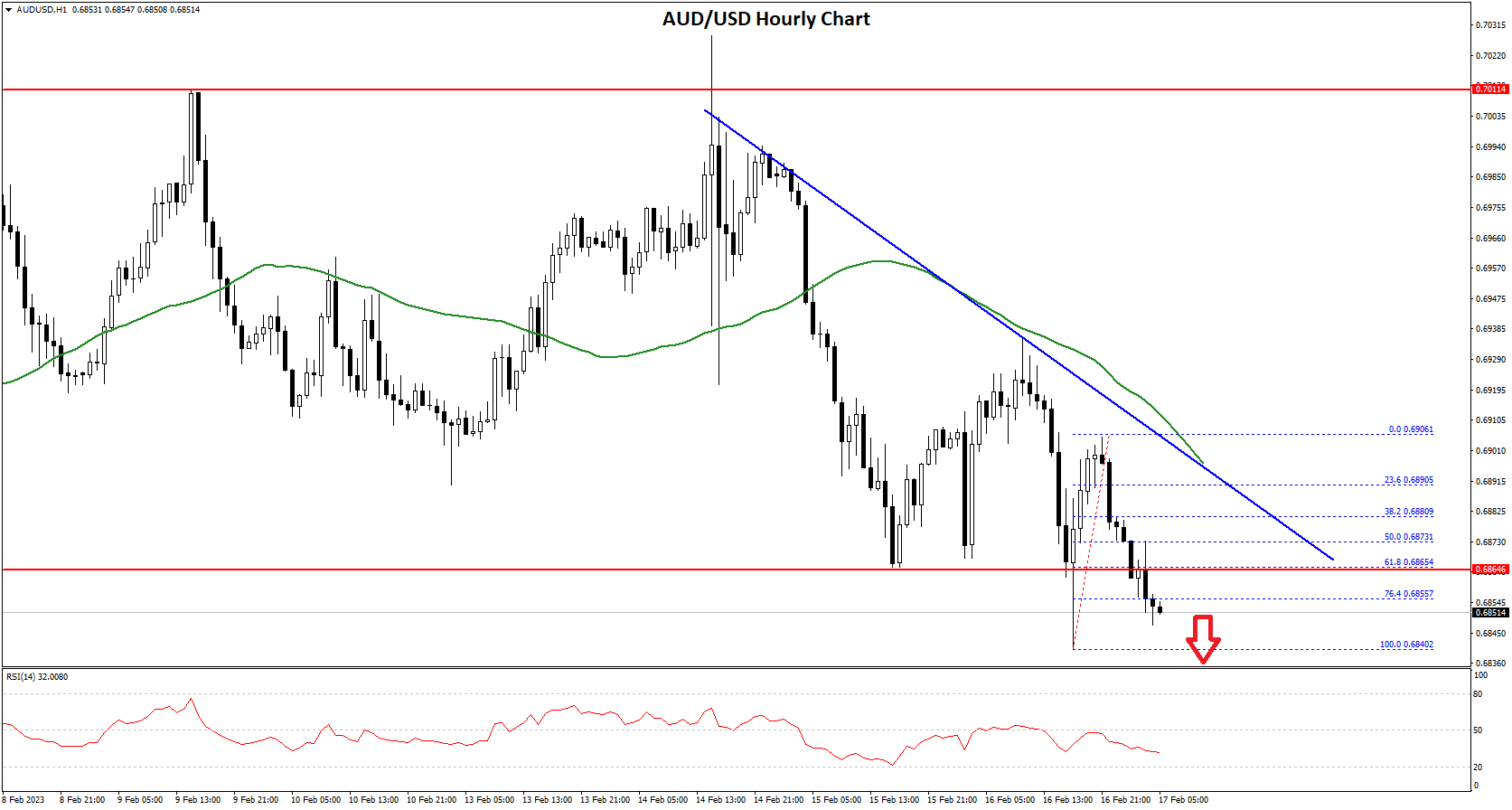

AUD/USD Technical Analysis

The Aussie Dollar struggled to clear the key 0.7000 resistance zone against the US Dollar. The AUD/USD pair even spiked above the 0.7000 level before the bears appeared.

The pair traded as high as 0.7028 on FXOpen and started a fresh decline. There was a clear move below the 0.6920 and 0.6880 support levels. Recently, the pair declined below the 50% Fib retracement level of the recovery wave from the 0.6840 swing low to 0.6906 high.

The pair is now trading below 0.6860 and the 50 hourly simple moving average. There is also a key bearish trend line forming with resistance near 0.6880 on the hourly chart of AUD/USD.

It is trading just below the 76.4% Fib retracement level of the recovery wave from the 0.6840 swing low to 0.6906 high. On the downside, an initial support is near the 0.6840 level. The next support could be the 0.6800 level.

If there is a downside break below the 0.6800 support, the pair could extend its decline towards the 0.670 level. On the upside, the AUD/USD pair is facing resistance near the 0.6880 level. The next major resistance is near the 0.6920 level.

A close above the 0.6920 level could start another steady increase in the near term. The next major resistance could be 0.7000.

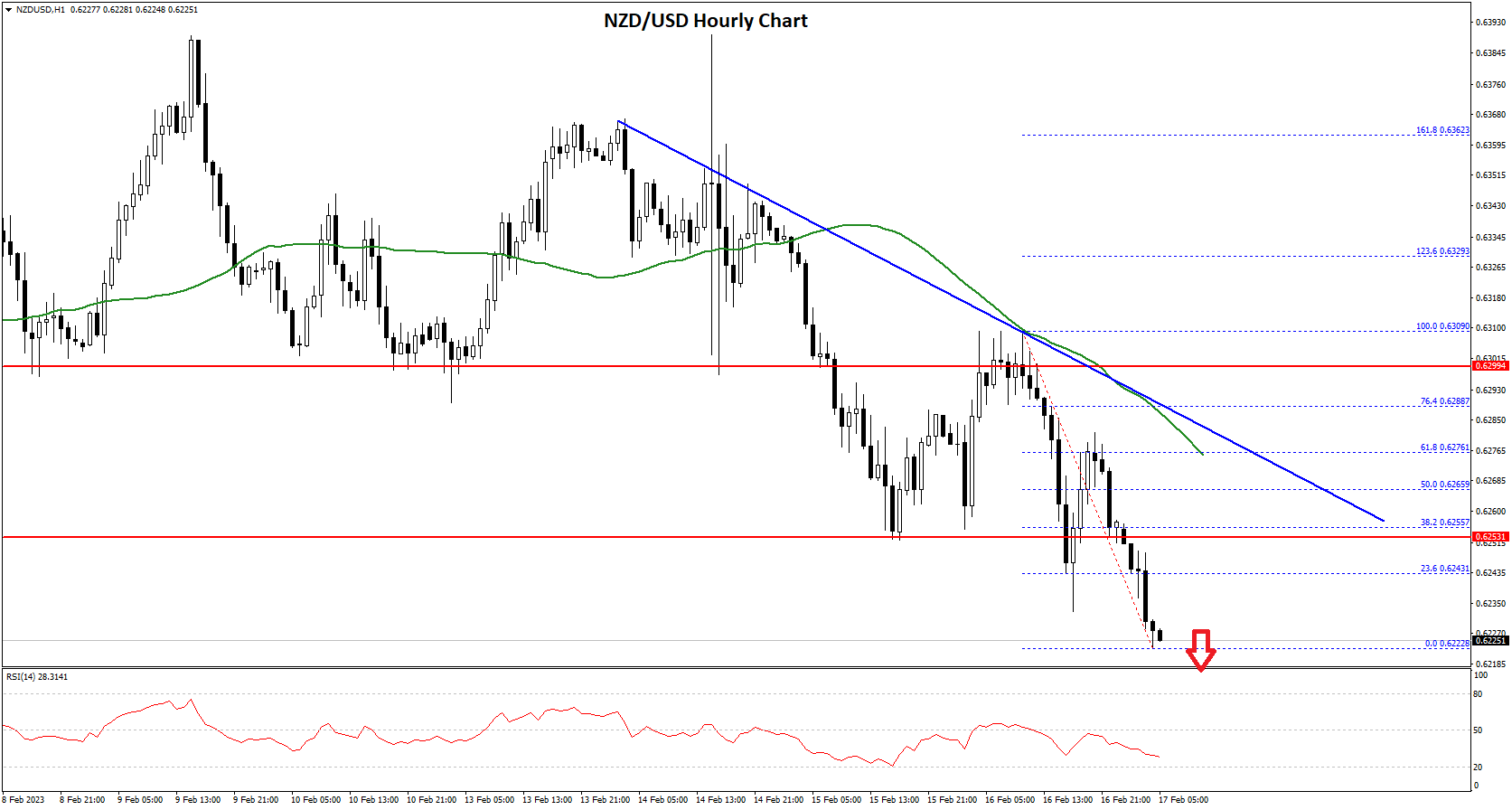

NZD/USD Technical Analysis

The New Zealand Dollar also followed a similar path from the 0.6400 resistance zone against the US Dollar. The NZD/USD pair declined below the 0.6320 support zone.

The bears even pushed the pair below the 0.6280 level and the 50 hourly simple moving average. Finally, the pair traded close to the 0.6220 support. A low is formed near 0.6222 and the pair is now consolidating losses.

On the upside, an initial resistance is near the 0.6275 level. It is near the 23.6% Fib retracement level of the recent decline from the 0.6309 swing high to 0.6222 low.

The next major resistance is near the 0.6260 level. There is also a major bearish trend line forming with resistance near 0.6260 on the hourly chart of NZD/USD. The trend line is near the 50% Fib retracement level of the recent decline from the 0.6309 swing high to 0.6222 low.

A clear move above the 0.6260 level might even push the pair towards the 0.6300 level. Any more gains might open the doors for a move towards the 0.6360 resistance zone in the coming days.

An immediate support is near the 0.6220 level. The first major support is near the 0.6200 zone. The next support could be the 0.6150 zone. If there is a downside break below the 0.6150 support, the pair could extend its decline towards the 0.6085 level.

This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.