FXOpen

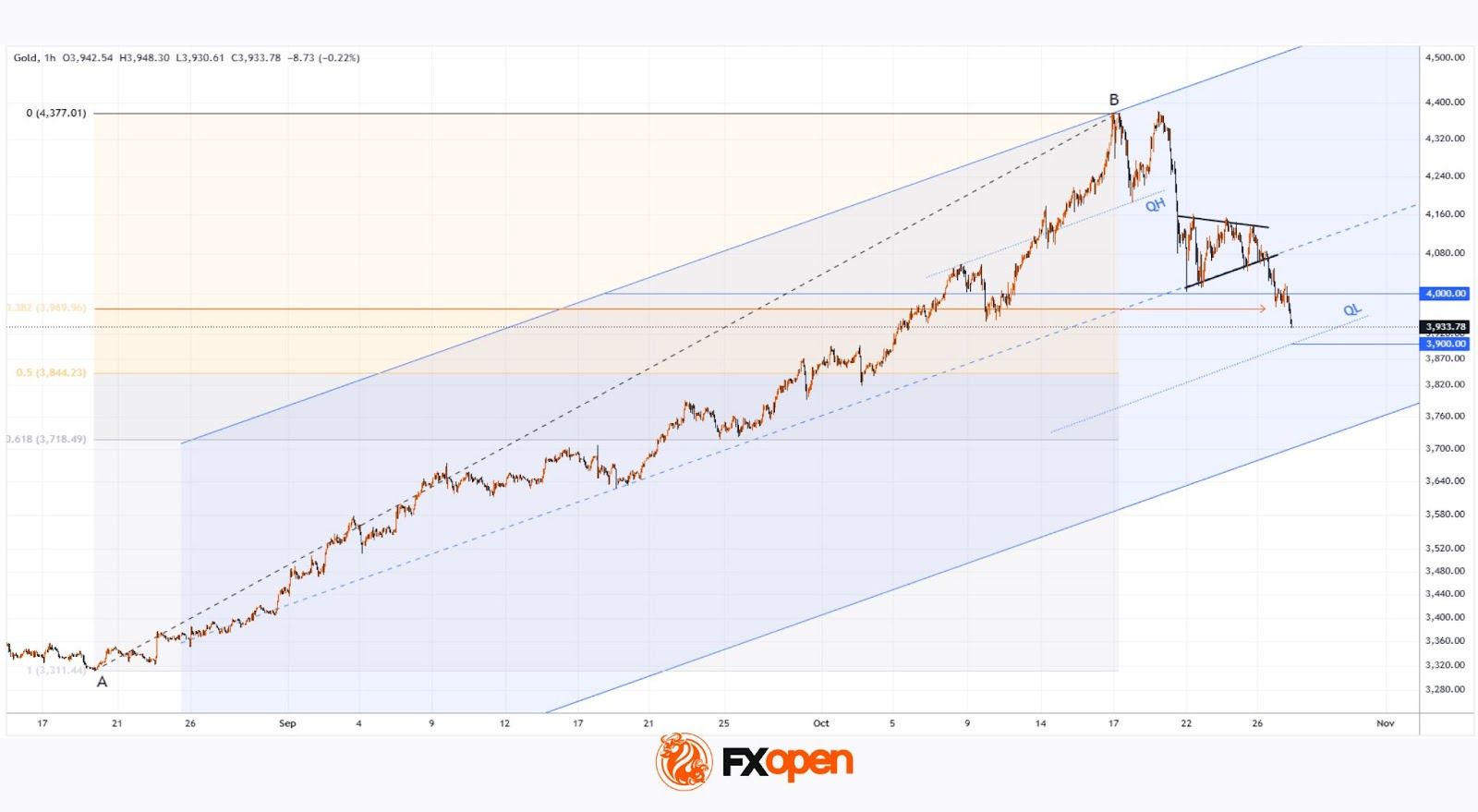

As the chart shows, the XAU/USD quote has fallen below $3,945 today — its lowest level since 6 October. The downward momentum is being driven by traders’ caution ahead of two key events:

→ the U.S. Federal Reserve’s upcoming interest rate decision;

→ the meeting between U.S. and Chinese leaders, which could help ease tensions between the world’s two largest economies.

Technical Analysis of the XAU/USD Chart

The ascending channel (shown in blue) illustrates gold’s remarkable rally from the 20 August low (point A):

→ throughout September, the median line acted as strong support;

→ the peak at point B coincided with the upper boundary of the channel;

→ the QH line — dividing the upper half into quarters — alternated between resistance and support.

The black lines mark the consolidation zone observed between 21 and 27 October:

→ its lower boundary aligns with the median;

→ the shape resembles a Symmetrical Triangle pattern, which has since been broken to the downside.

The chart highlights the confidence of sellers — bears managed to push prices through the key support area defined by:

→ the psychological $4,000 level;

→ the 0.382 Fibonacci retracement (indicated by the orange arrow).

The next potential target for the ongoing decline lies near the QL line, which coincides with the round-number level of $3,900. However, this may only serve as a temporary barrier before bears attempt to drive the price lower — towards the bottom boundary of the primary channel.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.