FXOpen

The policy of OPEC+ countries to voluntarily reduce oil production was one of the drivers thanks to which the price of WTI oil increased by approximately 40% from its low in June. In such cases, it is appropriate to use the phrase “correction is overdue.”

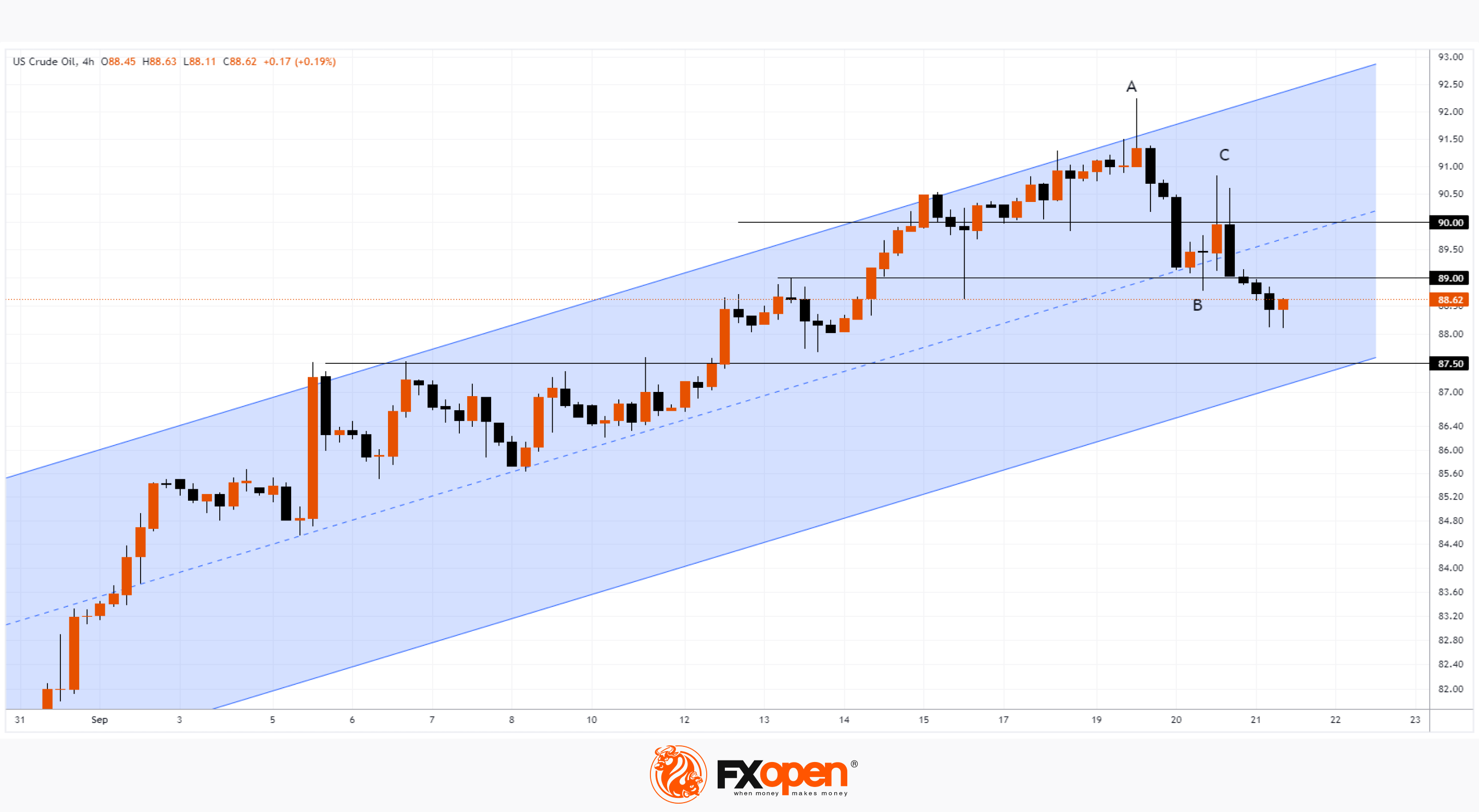

So a decline from the week's high above USD 92 to current levels seems natural. Note that the reversal began with the appearance of extremely high trading volumes in oil futures on the NYMEX exchange on Tuesday — but what if capital associated with governments of countries that do not benefit from high oil prices, which are fueling already high inflation, entered the market? If so, then WTI oil prices above 90-91 can be considered a “red line” for them.

Bearish arguments:

→ the price increase B→C is near the Fibonacci level of 31.8% of the decrease A→B, which is acceptable for a natural rollback;

→ the psychological level of USD 90 (above which the rate of price growth has slowed down) can now act as resistance;

→ the price has broken through the median line of the uptrend — now resistance can be expected from it;

→ the level of USD 89 has also been broken by the bears — it is possible that it, in turn, will slow down the bulls’ attempts to win back, if any, occur. The rate of decline is being recorded too rapidly this week.

Bulls can expect the market to find support around USD 87.5 per barrel — there is a support line (former resistance that restrained price growth at the beginning of the month), supported by the lower channel line.

Hope for a resumption of the upward trend can be given by an article in the FT that hedge funds are aiming for the price to reach USD 100 per barrel, but given the sharp change in sentiment, which is indicated by volumes and the assessment of impulse movements, they cast doubt on the achievement of this goal.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.