FXOpen

The AUD and CAD are trading in corrective mode, reflecting market caution ahead of today’s Federal Reserve and Bank of Canada meetings. Investors are locking in some profits after a volatile start to the week and prefer to wait for updated guidance from policymakers on the future path of monetary policy.

Over the coming trading sessions, focus will be on decisions from the Bank of Canada and the Fed, as well as the accompanying statements and press conferences. Central banks are setting the tone for the day, meaning reactions in AUD/USD and USD/CAD could be sizeable and highly volatile in the hours ahead.

USD/CAD

Late last week, USD/CAD fell sharply, breaking through key support levels at 1.3890–1.3930. However, a rebound from the psychological 1.3800 level led to consolidation within the 1.3800–1.3860 range. Technical analysis points to the potential for a corrective move back towards the previously broken support, as a “piercing pattern” has formed on the daily chart.

A sustained move above 1.3860 could signal a recovery towards 1.3890–1.3930. If negative news for the US dollar emerges, a renewed test of 1.3800 is possible, followed by a decline towards 1.3730.

Key events that may influence USD/CAD in the near term:

- today at 17:45 (GMT+3): Bank of Canada interest rate decision;

- today at 18:15 (GMT+3): Bank of Canada press conference;

- today at 18:30 (GMT+3): US crude oil inventories.

AUD/USD

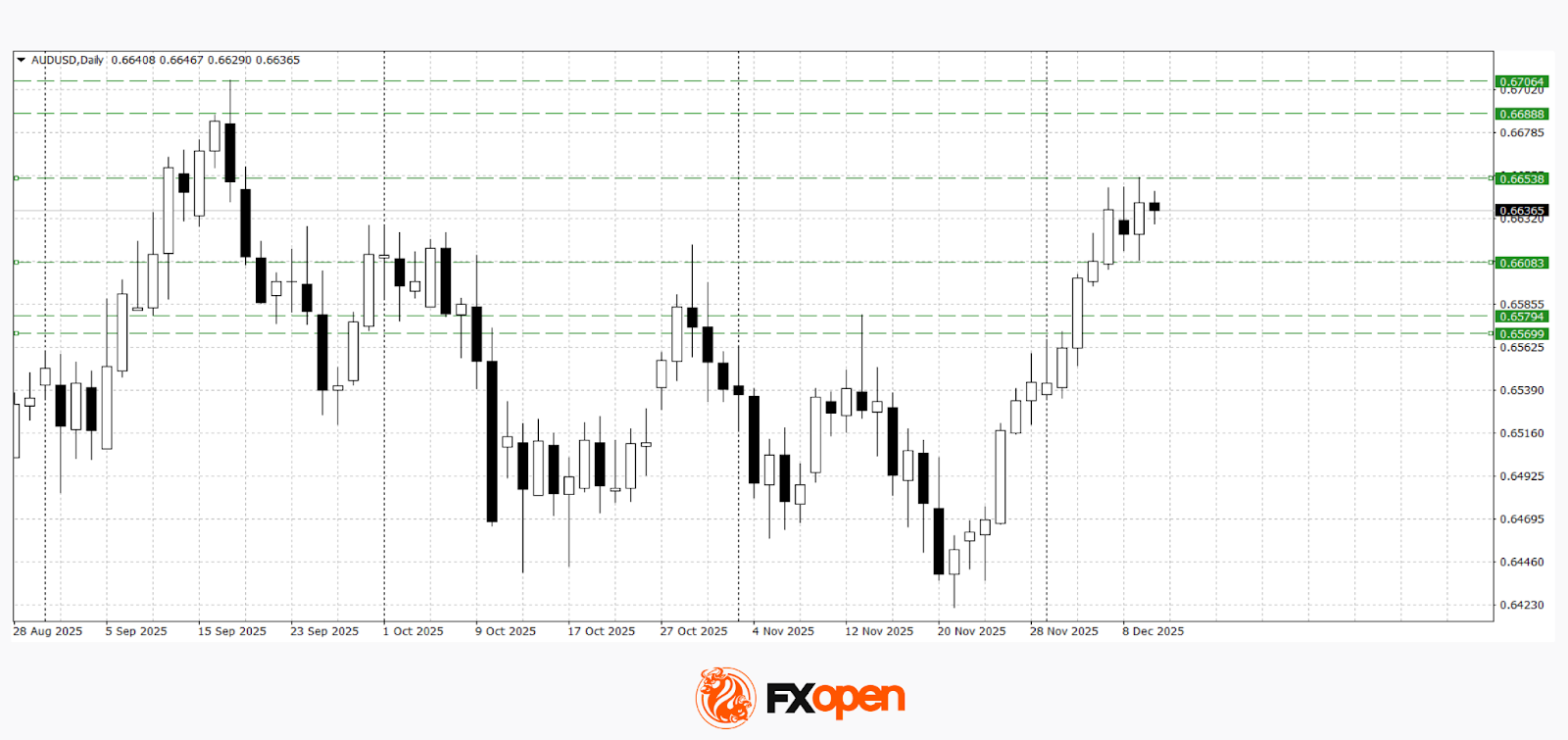

For about a week, AUD/USD has been trading within a relatively narrow range of 0.6600–0.6650. The outcome of the RBA meeting supported the Australian dollar, but the pair has yet to break above the upper boundary of this range and extend its uptrend.

A move above 0.6650 would confirm buyer control and open the way towards 0.6690–0.6710, while a downside break would increase bearish pressure with targets near 0.6550.

Key events that may influence AUD/USD in the near term:

- today at 22:00 (GMT+3): US Federal Reserve interest rate decision;

- today at 22:30 (GMT+3): Federal Open Market Committee press conference;

- tomorrow at 03:30 (GMT+3): Australia full-time employment change.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.