FXOpen

The Australian and Canadian dollars weakened after Donald Trump announced plans to impose 100% tariffs on Chinese goods. The escalation in trade tensions between the world’s two largest economies has increased market caution and weighed on risk-sensitive currencies.

Trump stated that the tariffs would come into effect from 1 November or sooner, depending on Beijing’s response. The announcement followed China’s decision to restrict exports of rare earth metals — a move that fuelled concerns over the stability of global supply chains.

Although Trump later expressed optimism about a “constructive dialogue” with China, markets interpreted his remarks as a signal for heightened volatility.

This week, traders’ focus will remain on further comments from Washington and Beijing, as well as on oil price movements, which continue to be a key driver for USD/CAD. Any softening of rhetoric could support a recovery in commodity currencies, but if the US maintains a hard line, downward pressure on the AUD and CAD may intensify.

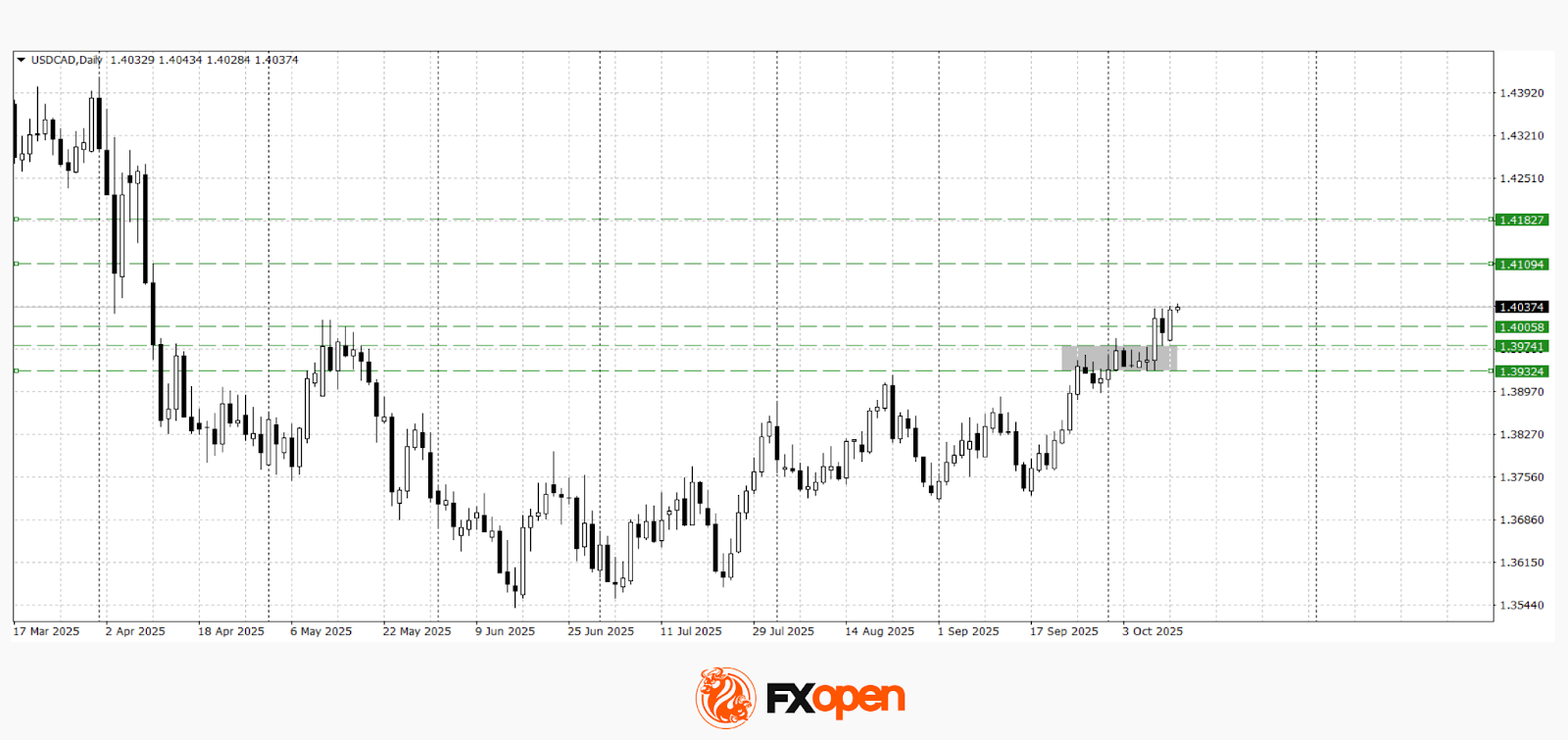

USD/CAD

News of the proposed tariffs prompted USD/CAD to break out of its medium-term range between 1.3930 and 1.3970. The pair not only pierced the upper boundary but also consolidated above the key psychological resistance level of 1.4000.

Technical indicators suggest potential for further gains towards the 1.4100–1.4180 area. However, if the price falls back below 1.4000, a retest of 1.3970 cannot be ruled out.

Key events that may influence USD/CAD trading today:

- 15:30 (GMT+3): Canadian building permits;

- 15:45 (GMT+3): speech by FOMC member Michelle Bowman;

- 18:15 (GMT+3): remarks by Bank of Canada First Deputy Governor Rogers.

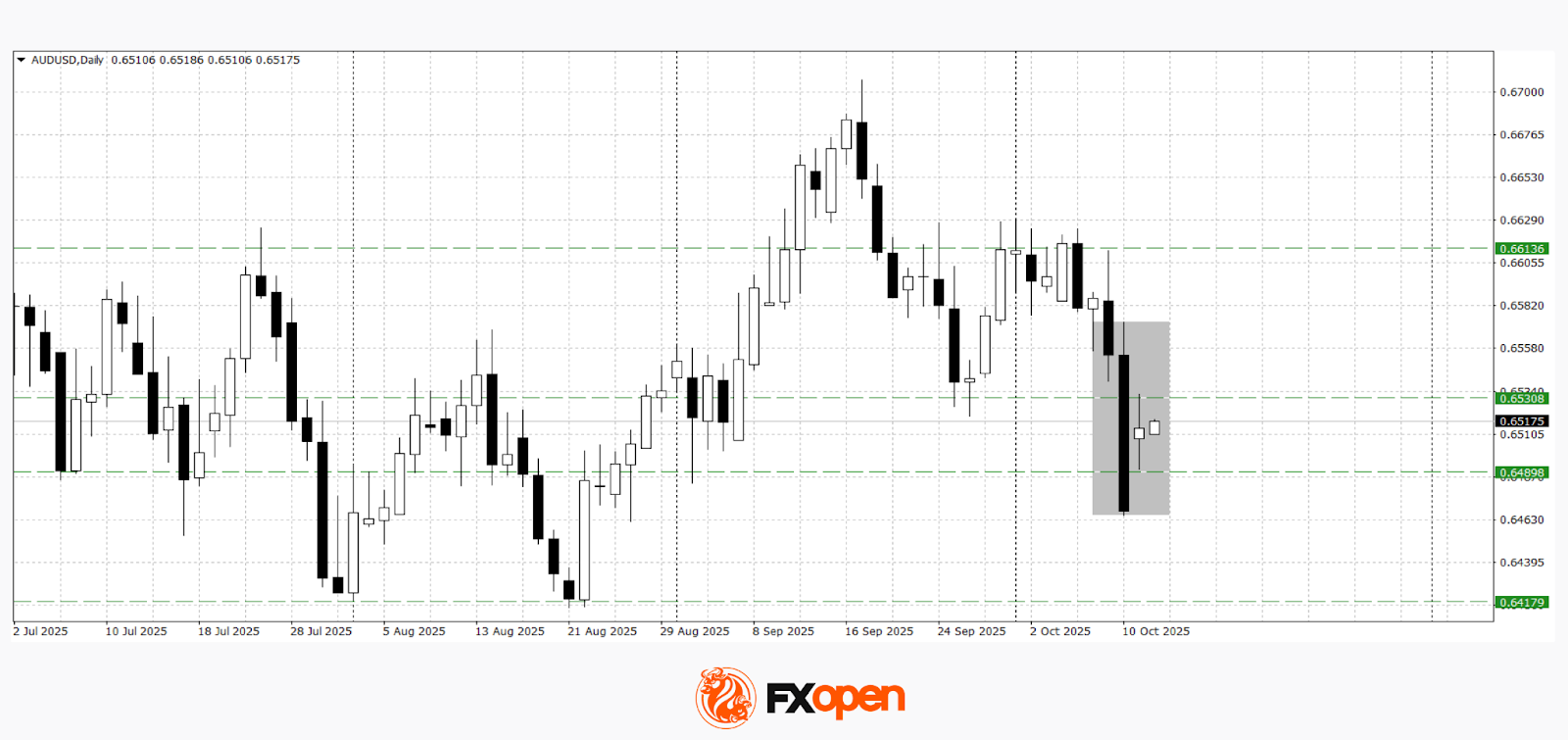

AUD/USD

Late last week, the pair fell sharply, breaking below the critical 0.6500 support level. On Monday, investors showed signs of stabilisation, pushing the price back above that threshold.

Technical analysis points to the potential for a corrective rebound, as a bullish “harami” candlestick pattern has formed on the daily timeframe. Should the pair slip below 0.6500 again, last Friday’s low could be retested.

Upcoming events that may affect AUD/USD:

- 19:20 (GMT+3): speech by Fed Chair Jerome Powell;

- Tomorrow, 03:30 (GMT+3): Australia’s MI Leading Economic Index;

- Tomorrow, 22:35 (GMT+3): speech by Reserve Bank of Australia Governor Michele Bullock.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.