FXOpen

Data on the Consumer Price Index (CPI) in the US, released yesterday, had a significant impact on the pricing of major currency pairs. According to the provided report:

- The core Consumer Price Index, which excludes food and energy costs, increased by 0.3% from the previous month, while experts had forecasted 0.4%.

- Retail sales remained unchanged at 0.0%, contrary to analysts' expectations of 0.4%.

As a result of the publication of such data, the dollar depreciated against almost all major currencies. For instance, the USD/JPY currency pair retreated from its peak at 156.60, the EUR/USD strengthened by more than 100 pips within a couple of hours, and buyers of the GBP/USD pair tested a significant resistance level at 1.2700.

The main reason for the sharp decline of the dollar against G-10 currencies is likely due to the possibility that slowing inflation growth and a weak labour market could prompt the Federal Reserve to change its monetary policy direction and reduce the base interest rate in the coming months.

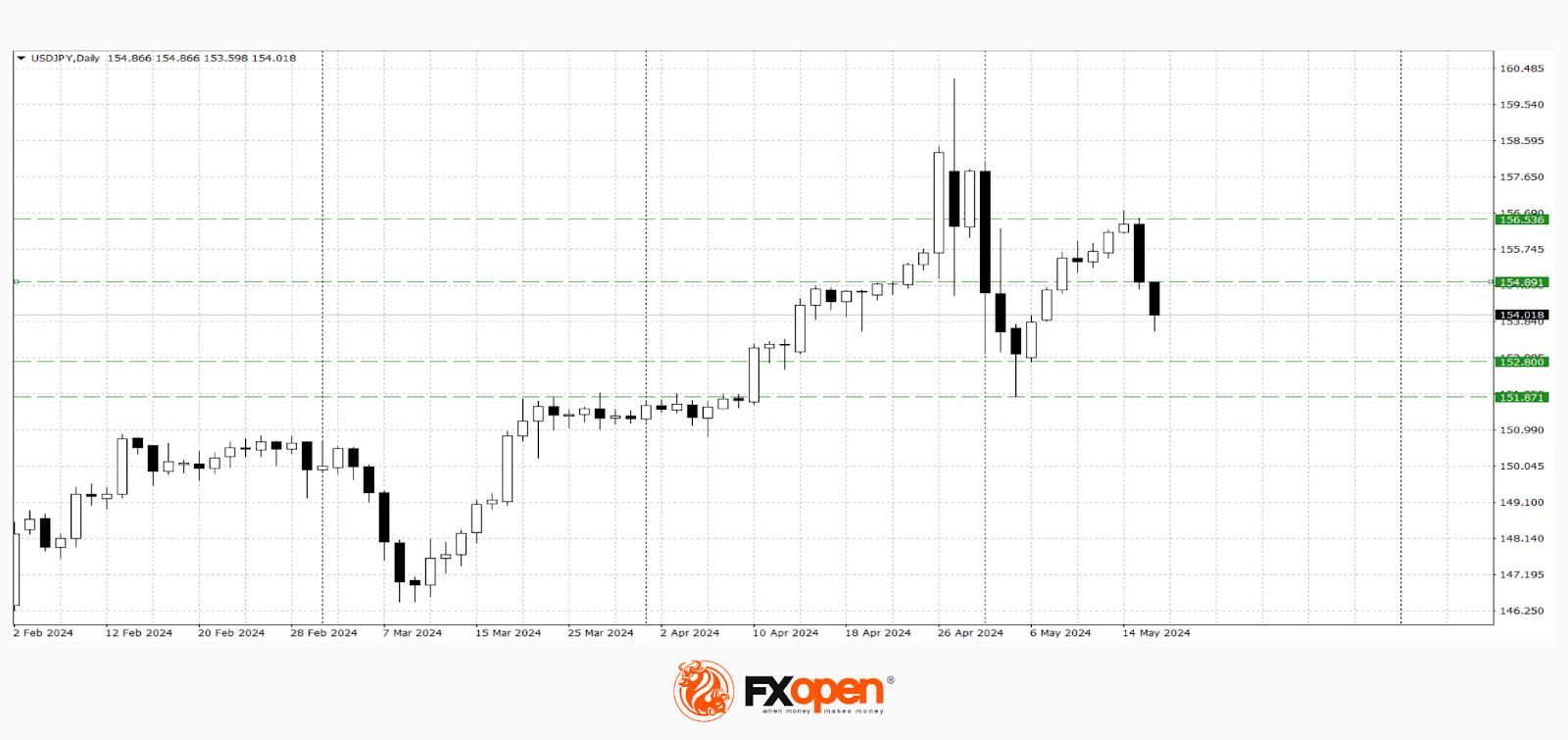

USD/JPY

According to technical analysis of the USD/JPY pair on the daily timeframe, a "bearish engulfing" pattern has formed, the confirmation of which could contribute to a retest of the important area between 152.80-152.00. If dollar buyers manage to establish themselves above 154.90, the price may resume its upward movement towards recent highs around 156.00.

Macro-economic data that could influence the pricing of the pair in the upcoming trading sessions:

- Today at 15:30 (GMT +3:00), the number of initial jobless claims in the US.

- Today at 15:30 (GMT +3:00), the Philadelphia Fed Manufacturing Index (US).

EUR/USD

Weak data from the US led to a test of the important resistance level at 1.0890 by the EUR/USD pair. According to technical analysis of the EUR/USD pair on the weekly timeframe, we observe the confirmation of a "piercing line" pattern from April 14. The nearest area where the price may rise is within the range of 1.0980-1.0940. A downward retracement is possible towards 1.0810-1.0780.

Tomorrow at 12:00 (GMT +3:00), attention should be paid to the publication of the Consumer Price Index (CPI) data in the eurozone for April.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.