FXOpen

The American currency is receiving support after the publication of the meeting minutes of the Federal Open Market Committee, according to which officials may begin a cycle of interest rate cuts by the end of this year, while pointing to continued uncertainty in the economy. Trading participants are in no hurry to open new positions ahead of today's publication of the December report on the US labour market. Forecasts assume a slowdown in the growth rate of new jobs outside the agricultural sector from 199.0k to 170.0k. At the same time, the unemployment rate is expected to adjust from 3.7% to 3.8%, and the average hourly wage, from 4.0% to 3.9%. At the moment, investors are evaluating a report from Automatic Data Processing (ADP), which reflected an increase in employment in the private sector from 101.0k to 164.0k, while analysts expected 115.0k. In turn, the number of initial applications for unemployment benefits for the week of December 29 decreased from 220.0k to 202.0k, with a forecast of 216.0k.

EUR/USD

According to EUR/USD technical analysis, the pair shows mixed trading dynamics, consolidating near the 1.0940 mark. Immediate resistance can be seen at 1.0989, a break higher could trigger a move towards 1.1000. On the downside, immediate support is seen at 1.0911, a break below could take the pair towards 1.0839.

Activity in the market remains quite low, as investors are in no hurry to open new positions ahead of the publication of European statistics on consumer inflation and the December report on the US labour market. Forecasts suggest a moderate rise in the eurozone consumer price index in December from 2.4% to 3.0%, which could lead to the ECB taking a pause before the expected launch of a cycle of interest rate cuts this year. Yesterday, inflation statistics were published in Germany. In monthly terms, the indicator increased by 0.1% after declining by 0.4% in November, and in annual terms it accelerated from 3.2% to 3.7%, which turned out to be slightly worse than market expectations at 3.8%. The single currency was also moderately supported by statistics on business activity: the composite index in the eurozone manufacturing sector in December rose from 47.0 points to 47.6 points, and in the services sector from 48.1 points to 48.8 points, beating neutral forecasts .

Based on the lows of two days, a new downward channel has formed. Now the price is in the middle of the channel and may continue to decline after approaching the upper limit.

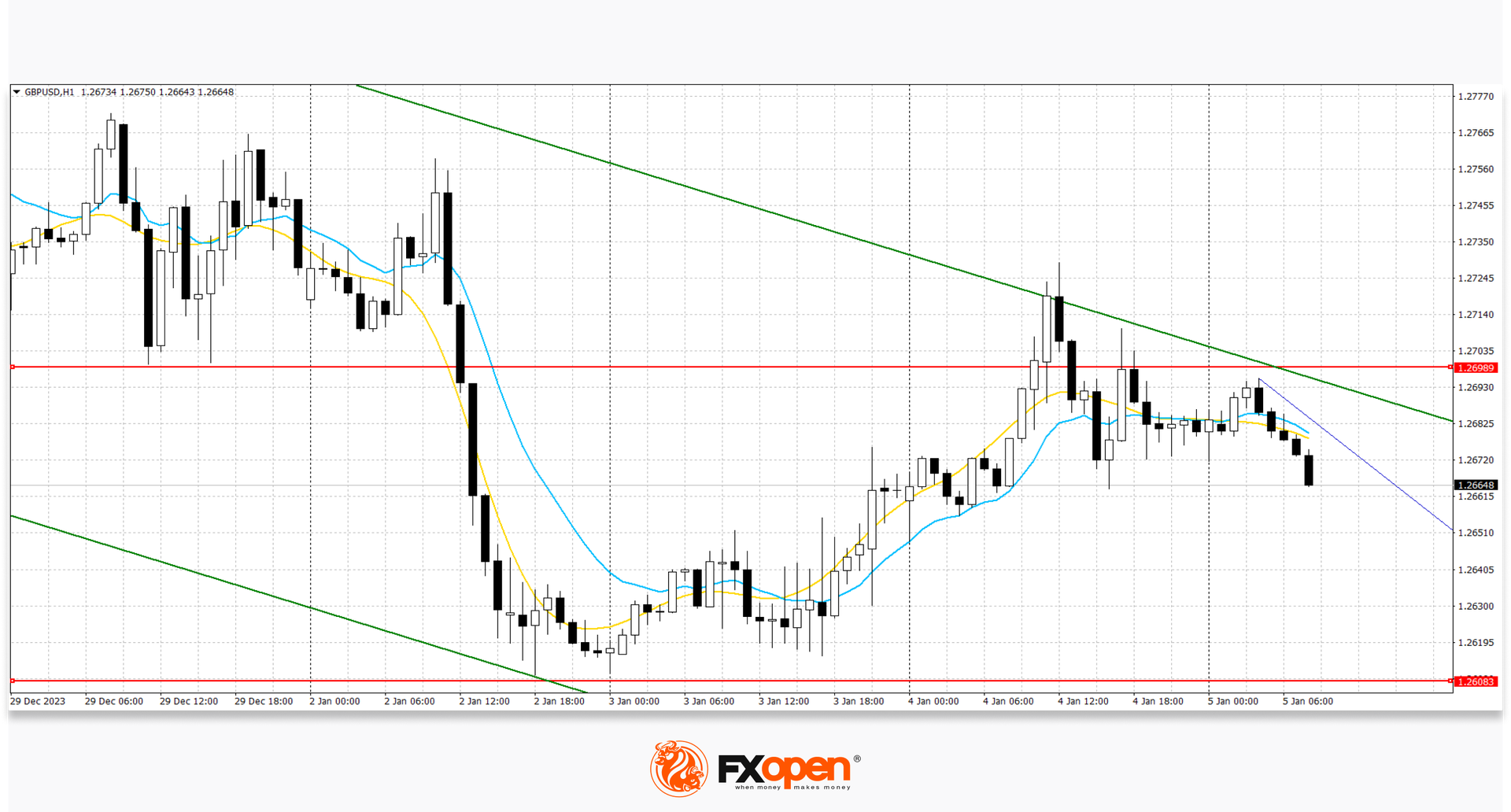

GBP/USD

The GBP/USD pair is consolidating near the level of 1.2680, demonstrating an uncertain tendency to return the positions lost at the beginning of the week. Immediate resistance can be seen at 1.2734, a break higher could trigger a rise towards 1.2778. On the downside, immediate support is seen at 1.2580, a break below could take the pair towards 1.2493.

At the same time, activity in the market remains relatively low, despite the publication of macroeconomic statistics. The pound was supported by data from the UK. In November, the volume of consumer lending increased from 1.411 billion pounds to 2.005 billion pounds, which turned out to be significantly higher than forecasts, which suggested a decrease in dynamics to 1.400 billion pounds. The number of approved mortgage applications also increased from 47.89k to 50.07k, while experts expected 48.50k. In turn, the index of business activity in the services sector from S&P Global in December rose from 52.7 points to 53.4 points, and the composite indicator, from 51.7 points to 52.1 points. The focus of investors today will be on British statistics on house price dynamics from Halifax, as well as data on business activity in the construction sector in December.

Based on the lows of two days, a new downward channel has formed. Now the price is near the lower border of the channel and may continue to decline.

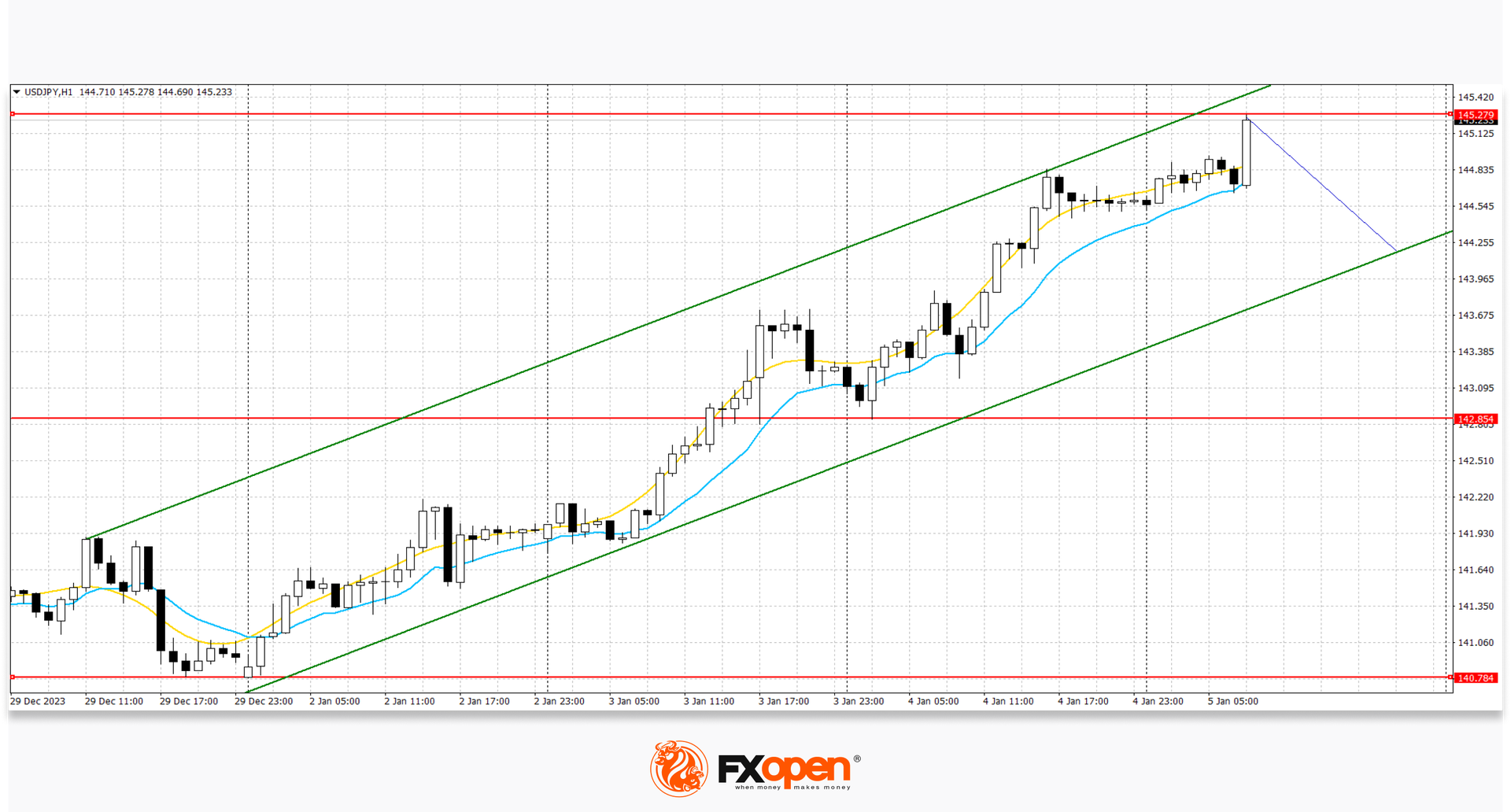

USD/JPY

On the USD/JPY chart, the pair is developing upward dynamics, updating local highs from December 19 and again preparing to test the resistance level of 145.00. Strong resistance can be seen at 144.4263, a break higher could trigger a rise towards 145.79. On the downside, immediate support is seen at 142.98. A break below could take the pair towards 141.92. The American currency is supported by technical factors, as well as macroeconomic statistics from the United States. The Japanese manufacturing PMI from Jibun Bank strengthened slightly from 47.7 points to 47.9 points.

Based on the highs of two days, a new ascending channel has formed. Now the price is in the middle of the channel and may continue to rise.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.