FXOpen

The dollar fell on Friday after US producer prices fell unexpectedly in December, fueling expectations of an imminent US rate cut. The final demand producer price index decreased by 0.1%, which was due to a decrease in the cost of goods. Prices for services remained unchanged last month, raising the possibility of lower inflation in the coming months. The US currency previously benefited from risk aversion after strikes in Yemen came in response to attacks by Iran-backed Houthi forces on shipping in the Red Sea, widening the regional conflict caused by Israel's war in the Gaza Strip. Traders see an 80% chance of an interest rate cut in March, up from around 70% chance seen before the PPI report.

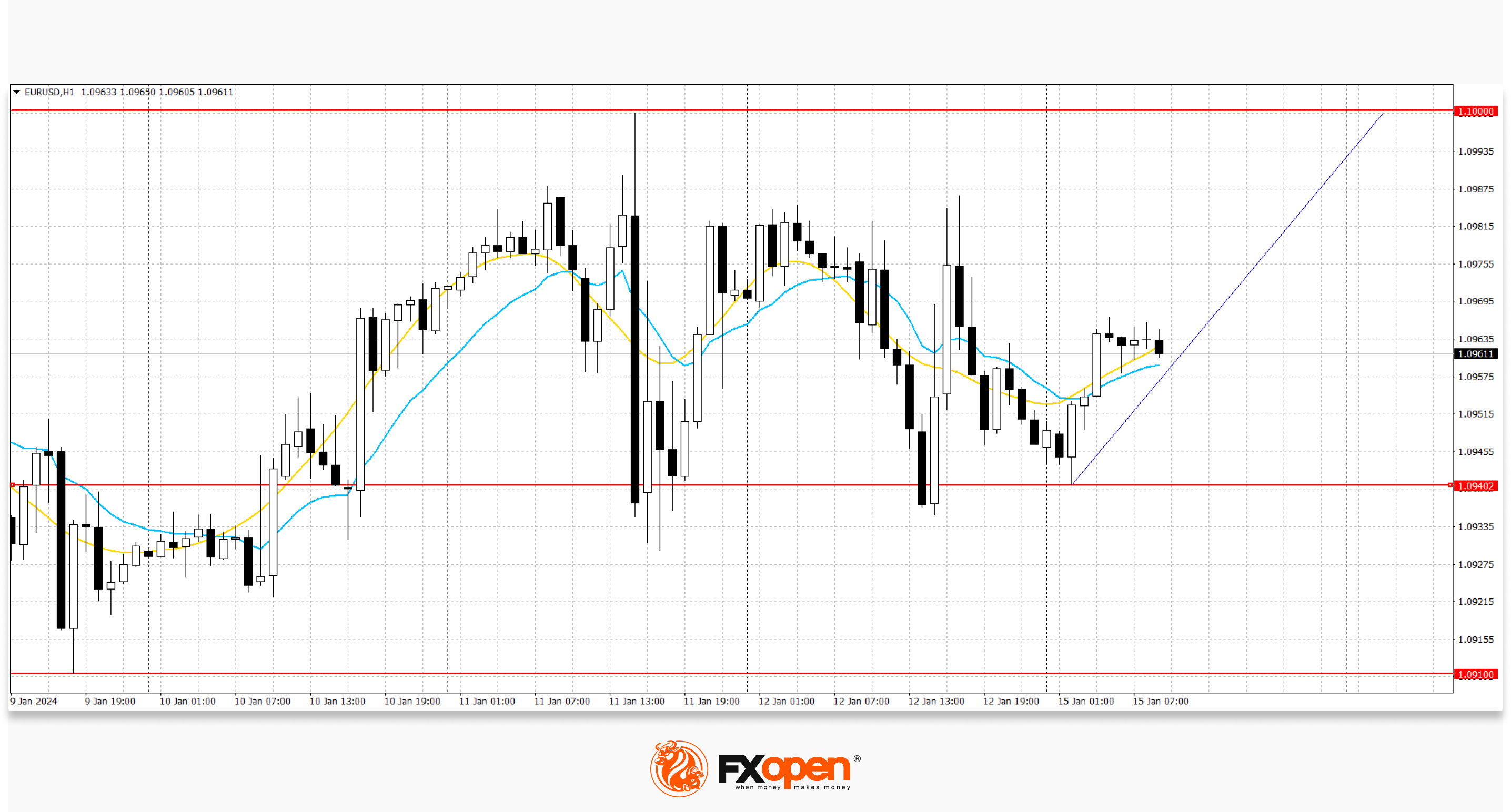

EUR/USD

The EUR/USD pair is trading around the 1.0960 level, moving away from last week's lows. According to EUR/USD technical analysis, Immediate resistance can be seen at 1.1000, a break higher could trigger a move towards 1.1045. On the downside, immediate support is seen at 1.0940, a break below could take the pair towards 1.0910.

The euro was put under pressure by soft comments from the ECB. ECB President Christine Lagarde said on Thursday that the worst of inflation is likely over and that interest rates will be cut if inflation falls to 2%. Dismissing those expectations, ECB chief economist Philip R. Lane said recent inflation data broadly supported the central bank's current views, meaning rate cuts were not on the table for debate in the near future. On the data side, France's consumer price inflation (CPI) rose 4.1% year-on-year in December, while Spain's annual inflation fell to 3.1% last month.

The trading range with boundaries of 1.0875 and 1.1000 remains. Now the price is above the middle of the range and may continue to rise.

GBP/USD

The British pound initially fell against the US dollar on Friday but is recovering today as investors react to UK GDP data. On the GBP/USD chart, immediate resistance can be seen at 1.2783, a break higher could trigger a rise towards 1.2826. On the downside, immediate support is seen at 1.2727, a break below could take the pair towards 1.2685.

The British economy grew 0.3% month on month in November, more than economists had expected by 0.2%, after contracting 0.3% in October. However, output fell 0.2% in the three months to the end of November. In recent months, the pound has benefited from inflation in the UK running higher than in the US and Europe. That has led traders to expect smaller rate cuts from the Bank of England than from its two main rivals, supporting UK bond yields and making sterling relatively more attractive in money markets.

The trading range with boundaries of 1.2783 and 1.2673 remains. The price is now in the upper half of the range and may continue to rise.

USD/CAD

On the USD/CAD chart, the pair is down slightly this morning but is trading at Friday's levels around 1.3400. Strong resistance can be seen at 1.3413, a break higher could trigger a rise towards 1.3442. On the downside, immediate support is seen at 1.3342. A break below could take the pair towards 1.3280.

The Canadian currency was little changed against the US currency on Friday as oil gave back most of its earlier gains while investors awaited domestic inflation data next week that could provide a hint on Bank of Canada policy. Canada's December inflation report will be released on Tuesday. Economists expect inflation to rise to 3.3% from 3.1% in November. The price of oil, one of Canada's main exports, fell from a two-week high after the United States and Britain launched air and naval attacks on Houthi targets in Yemen.

Over the past week, a trading range has formed with boundaries of 1.3342 and 1.3442. The price is now in the lower half of the range and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.