FXOpen

Yesterday, the US dollar rose against all major currencies, as it is unclear when the Fed will lower rates. The main economic data this week will be the December consumer price inflation report, which is scheduled to be released on Thursday. Expectations call for headline inflation to increase 0.2% month-on-month, reaching 3.2% year-on-year growth. If data confirms that inflation continues to slow, it could increase expectations of a rate cut in March.

A New York Fed survey released Monday showed consumers see lower inflation and slower growth in household income and spending over the next few years. Last week's better-than-expected employment figures, coupled with the latest Fed minutes that expressed ambiguity about the timing of rate cuts, have dampened expectations of an imminent US policy easing. The dollar is supported by macroeconomic statistics from the United States. The National Federation of Independent Business (NFIB) business optimism index rose from 90.6 points to 91.9 points in December, while analysts expected 90.7 points, and the IBD/TIPP economic optimism index rose from 40.0 points in January to 44.7 points with a forecast of 42.0 points.

EUR/USD

The EUR/USD pair shows mixed dynamics, remaining close to 1.0930. According to EUR/USD technical analysis, immediate resistance can be seen at 1.1000, a break higher could trigger a move towards 1.1045. On the downside, immediate support is seen at 1.0910, a break below could take the pair towards 1.0875.

Yesterday, the positions of the single currency came under pressure, but traders expect the emergence of new drivers for making trading decisions. Investors are concerned about the development of the crisis in the EU and, in particular, in Germany, which could be aggravated by large-scale protests by farmers across the country. In turn, German data on the dynamics of industrial production in November showed a decrease of 0.7% after -0.3% in the previous month, while analysts expected moderate growth of 0.25%, and in annual terms the decline accelerated from -3.4% to -4.8%.

The same trading range with boundaries of 1.0875 and 1.1000 remains. Now the price is in the middle of the range and may continue to rise.

GBP/USD

On the GBP/USD chart, the pair is consolidating near the level of 1.2700. Immediate resistance can be seen at 1.2770, a break higher could trigger a rise towards 1.2826. On the downside, immediate support is seen at 1.2673, a break below could take the pair towards 1.2610.

Activity in the market remains low. Yesterday, the pound showed a decline, retreating from local highs and reacting to the publication of macroeconomic statistics from the United States. The slowdown in retail sales from the British Retail Consortium has a negative impact on the pound. The figure in December decreased from 2.6% to 1.9%. The focus of investors today at 17:15 (GMT+2) will be the speech of the head of the Bank of England, Andrew Bailey, who, among other things, may touch upon the topic of a possible easing of monetary policy later this year.

The same trading range with boundaries of 1.2610 and 1.2770 remains. Now the price is in the middle of the range, from where there is a possible movement to the upper limit.

USD/JPY

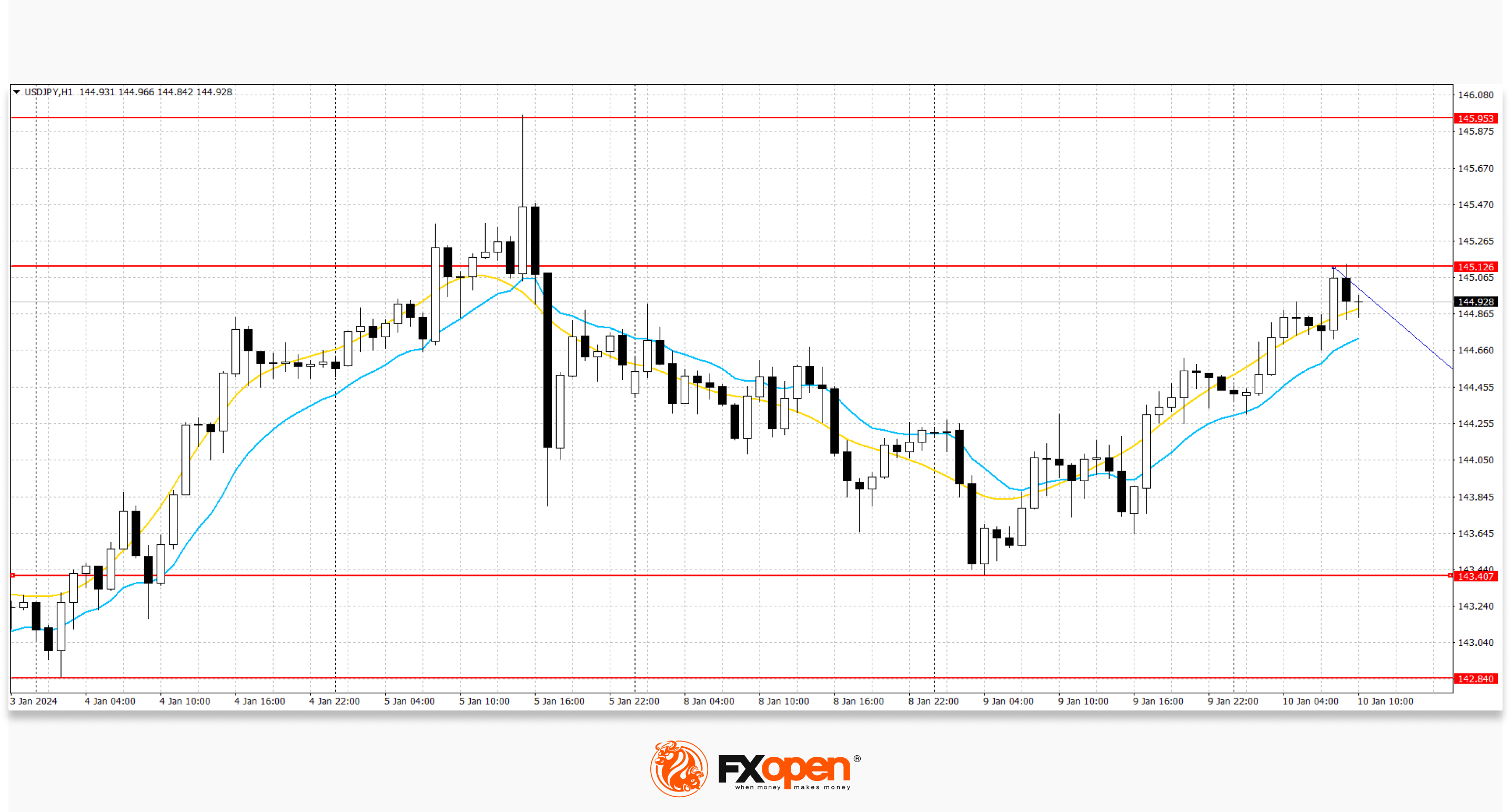

On the USD/JPY chart, the pair is showing relatively strong growth, developing the momentum formed the day before and testing the 145.00 mark for an upward breakout. Strong resistance can be seen at 145.12, a break higher could trigger a rise towards 141.95. On the downside, immediate support is seen at 143.40. A break below could take the pair towards 142.84.

Japanese statistics did not support the yen. The Tokyo region's consumer price index slowed from 2.7% to 2.4% in December, while the index excluding food and energy adjusted from 3.6% to 3.5%, reducing expectations that the Bank of Japan will abandon negative interest rate policies in the near future.

The Japanese currency is under pressure today from labour market statistics, where wages in November fell from 1.5% to 0.2%, while analysts expected the same growth rate to continue. Bank of Japan officials said they would cut monthly purchases of long-term government bonds. On Tuesday, the department purchased 150.0 billion yen in debt securities with maturities ranging from 10 to 25 years. It initially announced its intention to buy at least 100.0 billion yen in long-term bonds in one transaction, according to the Bank of Japan's quarterly plan.

Since the beginning of the week, a trading range has formed with boundaries of 143.40 and 145.95. Now the price has moved away from the middle of the range and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.