FXOpen

The euro and the pound have found some support after a series of declines, although neither has yet managed to break convincingly above key resistance levels. The market remains in anticipation of fresh fundamental signals that could confirm or challenge a potential trend reversal.

Traders’ focus is now on forthcoming UK economic reports, including GDP, industrial production, and trade balance data. In the euro area, attention will turn to figures on the trade balance and Italian inflation, as well as the Bundesbank’s monthly report. The upcoming IMF meeting is also likely to attract interest.

During the US session, markets will be watching construction and manufacturing data from the Philadelphia Fed. These figures could influence the dollar’s direction and set the tone for the remainder of the trading week. The market remains highly sensitive to macroeconomic developments: upbeat data from Europe or the UK could support the euro and sterling, while strong US figures may restore pressure on European currencies.

GBP/USD

For GBP/USD, the technical outlook remains mixed. As expected, the pair continued its downtrend early in the week, testing the 1.3300–1.3330 range and posting a new October low at 1.3260. On the H4 timeframe, a “bullish engulfing” pattern has formed.

Technical analysis of GBP/USD suggests potential upside towards 1.3450–1.3490. If buyers fail to defend the 1.3330–1.3360 support area, a retest of recent lows cannot be ruled out.

Upcoming events likely to affect GBP/USD:

- 09:00 (GMT+3): UK Gross Domestic Product (GDP)

- 09:00 (GMT+3): UK Industrial Production

- 11:30 (GMT+3): Bank of England Credit Conditions Survey

EUR/USD

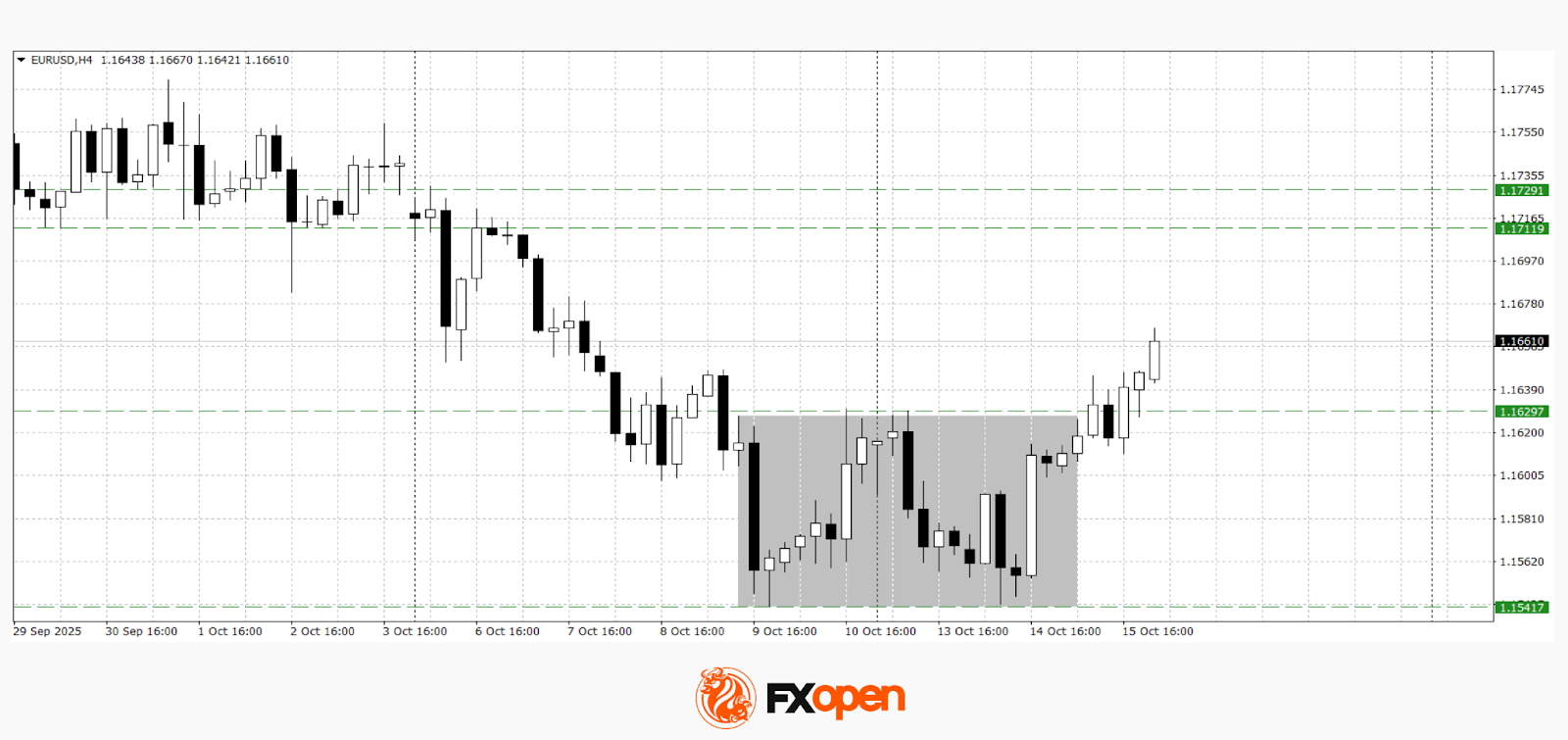

In the EUR/USD pair, buyers regained control after another test of key support around 1.1540, helping the price recover above 1.1600.

Technical analysis points to potential growth towards 1.1700–1.1720, with a “double bottom” pattern emerging on the H4 chart. Failure to hold above 1.1600, however, could trigger a renewed move towards 1.1540.

Upcoming events likely to affect EUR/USD:

- 12:00 (GMT+3): Eurozone Trade Balance

- 15:30 (GMT+3): Philadelphia Fed Manufacturing Index (US)

- 18:45 (GMT+3): Speech by ECB Chief Economist Philip Lane

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.