FXOpen

In mid-February, the volatility of major currency pairs slowed down somewhat. Leading Central Banks have taken a pause in changing monetary policy, and the incoming fundamental data is quite weak for the formation of new trends. As a result, the pound/US dollar pair was stuck between 1.2640-1.2520, the euro/US dollar pair found support just above 1.0700, and greenback buyers in the US dollar/yen pair managed to strengthen above 149. Nevertheless, the current flat movement may end this week. A lot of important fundamental data releases are expected in the coming trading sessions, which could lead to both the continuation of current trends and the formation of new trends.

GBP/USD

As the GBP/USD chart shows, the pound's decline at the beginning of this month, driven by a strong US employment report, slowed to 1.2520. On the weekly time frame, the price found support at the intertwined alligator lines. If the 1.2600-1.2520 range confirms support status, the price could retest the important 1.2800-1.2700 range. In case of a downward breakdown of the 1.2500 level, the pair may resume its downward movement in the direction of 1.2400-1.2200.

Today at 10:00 GMT+3, we are waiting for data on average wages in the UK for December last year, and at this time the change in employment and the unemployment rate for the same period will be published.

EUR/USD

Euro buyers in the euro/US dollar pair are trying to hold on to the alligator lines on the weekly timeframe. If the range of 1.0900-1.0800 remains as resistance, the pair may resume its decline in the direction of 1.0600-1.0500. Otherwise a test of 1.1000 is possible.

Today at 13:00 GMT+3, we expect data on the ZEW economic sentiment index in the eurozone for February. Economic forecasts for the EU will also be published at this time.

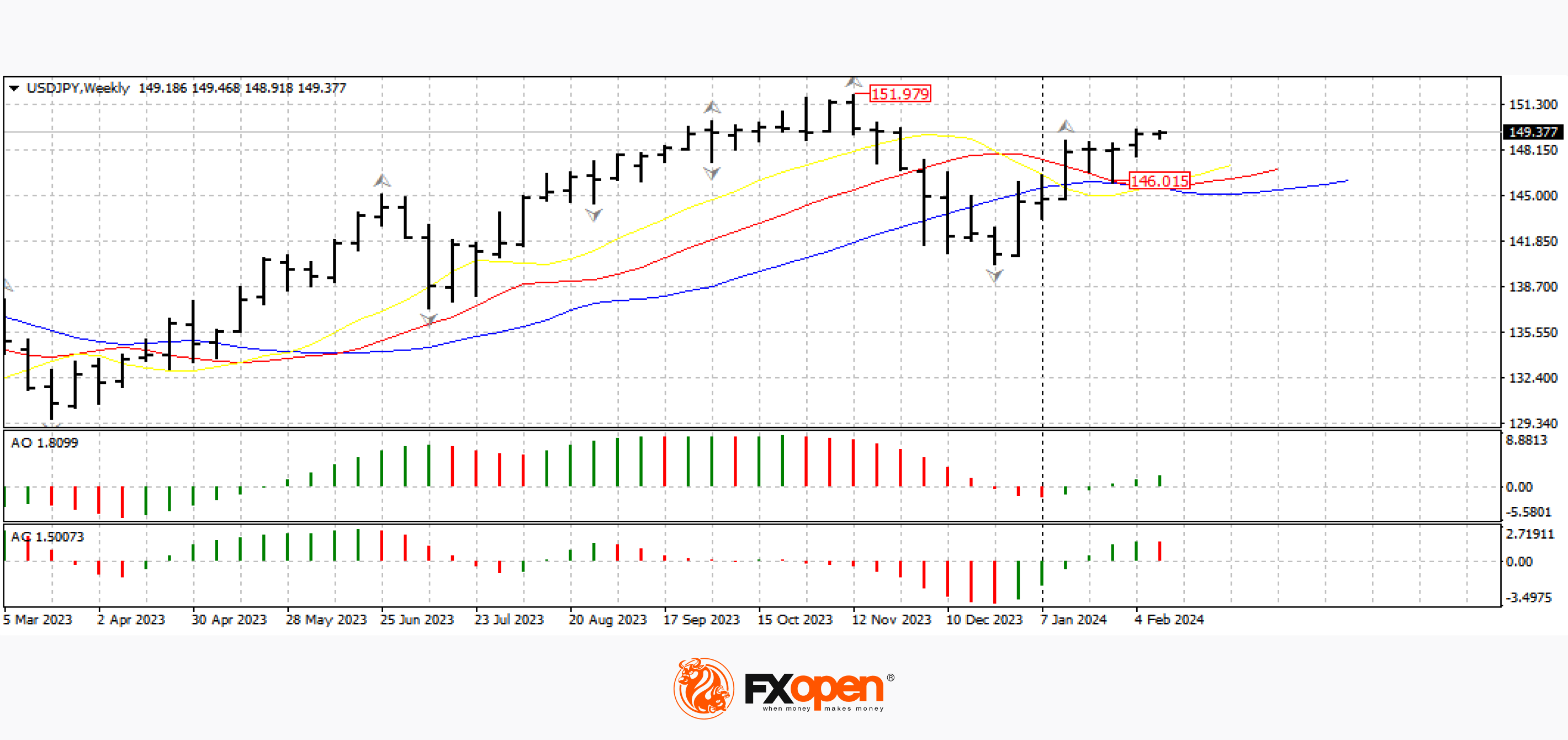

USD/JPY

Dovish comments from representatives of the Bank of Japan added strength to the downward movement in the Japanese currency, as a result, the price on the USD/JPY chart strengthened above 149.00. If the current mood in the market continues, the pair may test recent extremes at 151.00-150.00.

Tomorrow's data on the US consumer price index for January will be important for the pair.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.