FXOpen

A weak employment report from ADR and a decline in the US services PMI contributed to the start of a corrective pullback in major currency pairs. Thus, the EUR/USD pair went above 1.0500, the GBP/USD pair is forming a bullish engulfing combination, and the USD/JPY pair fell below 149.00.

GBP/USD

The decline of the British currency was interrupted after the publication of data on the business activity index in the UK services sector for September. The indicator showed impressive growth: 49.3 against the forecast of 47.2. The composite business activity index (PMI) also turned out to be positive: 48.5 versus 46.8. Such positive statistics allowed pound buyers to find support just above 1.2000 and close yesterday with a reversal ‘bullish engulfing’ combination. If today we receive confirmation of the indicated signal in the form of any white candle, the price may return to 1.2280-1.2300.

Today's news on the business activity index in the UK construction sector for September will be important for the pair's pricing. It is also worth paying attention to the speech of Ben Broadbent, a member of the Bank of England Monetary Policy Committee.

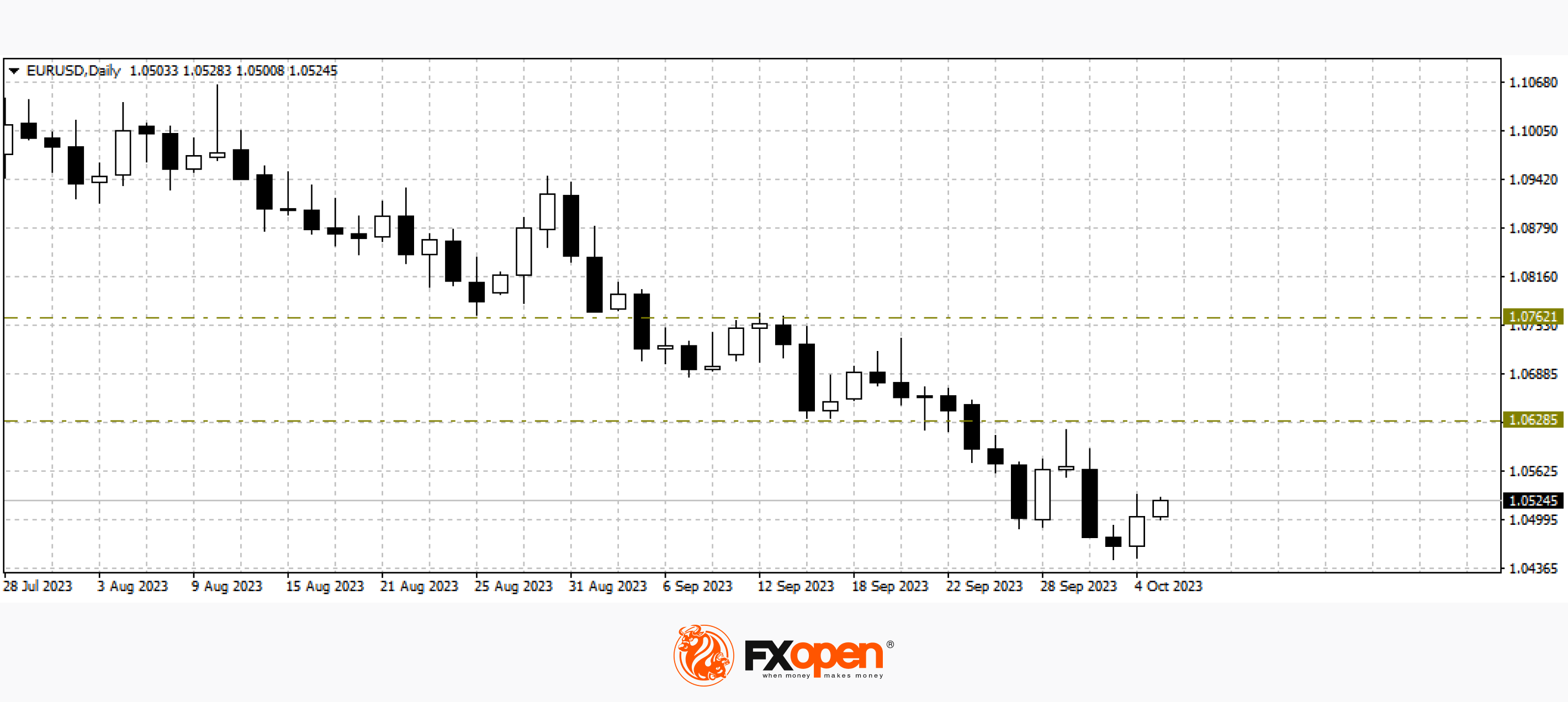

EUR/USD

Yesterday's statistics from the eurozone turned out to be quite diverse. The services business activity index increased slightly (48.7 versus 48.4), while retail sales fell in August (-1.2% versus -0.3%). However, the price of the single European currency managed to rebound from 1.0450 and strengthen above 1.0500. Bullish engulfing is on the daily timeframe. If the market closes today above 1.0500-1.0540, the start of an upward correction in the direction of 1.0600-1.0800 may occur.

Today at 12:45 GMT+3, it is worth paying attention to the speech of the representative of the European Central Bank, Philip Lane. The president of the Deutsche Bundesbank, Nagel, is scheduled to speak a little later.

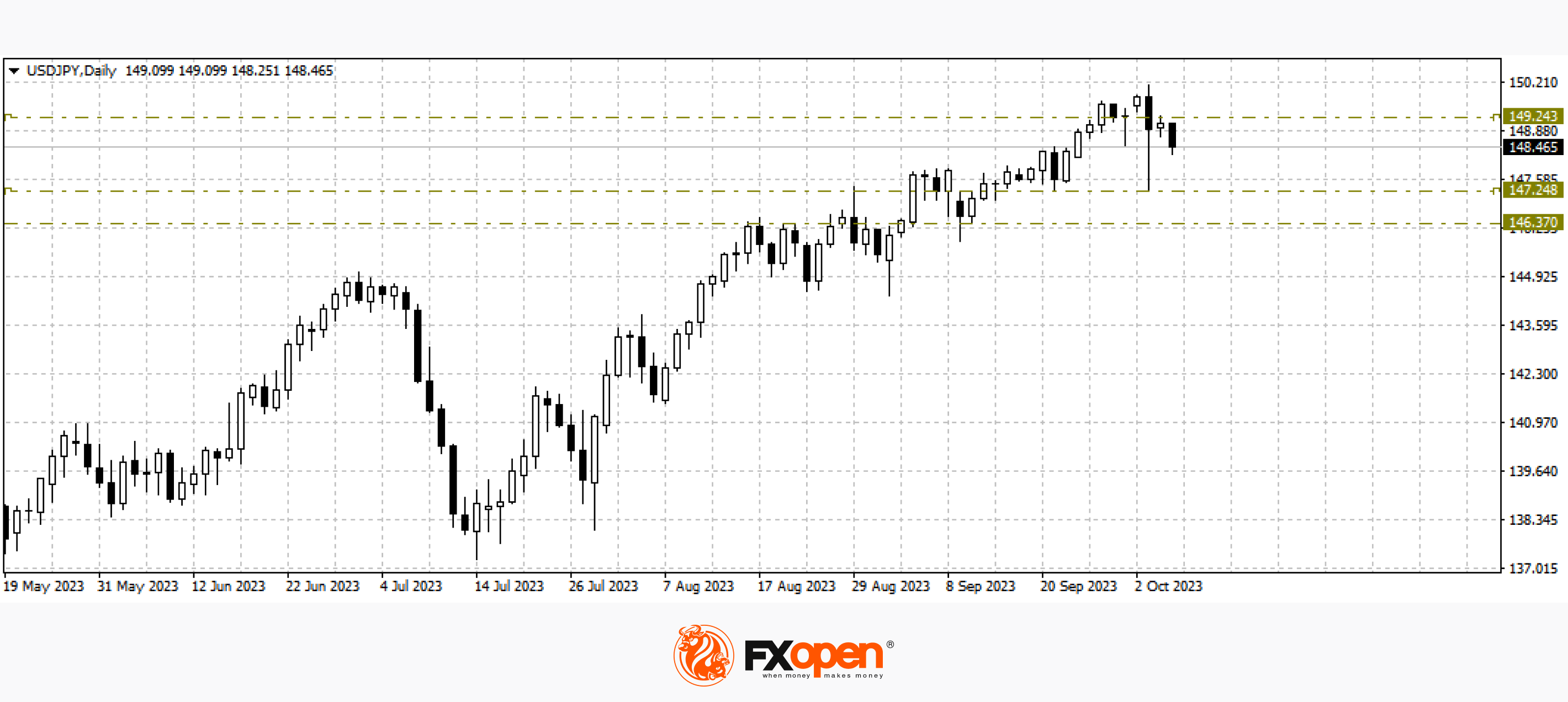

USD/JPY

The rebound from the psychological level of 150.00 contributed to the beginning of a corrective pullback in the USD/JPY pair. The nearest area where the price may find support may be the range of 147.30-146.40. Important resistance is located at 149.00-149.30.

Important for the pair’s pricing will be weekly data on the number of applications for unemployment benefits in the US, the publication of which will take place today at 15:30 GMT+3. Tomorrow, the US employment report for September is anticipated.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.