FXOpen

EUR/USD

The euro fell on Friday as the dollar rose after the August jobs report showed that the labor market is still strong despite some signs of deterioration. Employers added 187,000 jobs in August, beating expectations for an increase of 170,000. But data for July was revised down to show 157,000 jobs added instead of the previously reported 187,000. The unemployment rate rose to 3.8%, higher than expected 3.5%. Average hourly wages rose 4.3% year-on-year, below expectations for a 4.4% increase. The US dollar index last rose 0.58% to 104.23. It gained 0.08% over the week, overcoming a price drop earlier in the week caused by softening economic data. The euro fell 0.59% to USD 1.0773. Immediate resistance can be seen at 1.0847, an upside break could trigger a move towards 1.0859. On the other hand, immediate support is seen at 1.0763, a break lower could take the pair to 1.0740.

At the lows of two days, a new downward channel has formed. Now the price has moved away from the lower border of the channel and may continue to grow.

GBP/USD

The British pound fell against the dollar on Friday after the long-awaited US jobs report for August showed rising unemployment and slower-than-expected wage growth, bolstering expectations that the Federal Reserve will leave key interest rates unchanged at its September policy meeting. The Department of Labor payroll report showed more jobs than expected in the US economy last month. But rising unemployment and economic activity, as well as a welcome slowdown in average hourly wage growth, have bolstered expectations that the Fed will let key interest rates hold their ground next month. According to the CME's FedWatch Tool, traders in federal funds futures are now estimating a 93% chance of the Fed leaving rates unchanged at the September meeting and only seeing a 36% chance of an increase in November. Immediate resistance can be seen at 1.2644, an upside break could trigger a rise towards 1.2688. On the other hand, immediate support is seen at 1.2577, a break lower could take the pair to 1.2538.

At the lows of two days, a new downward channel has formed. Now the price has moved away from the lower border of the channel and may continue to grow.

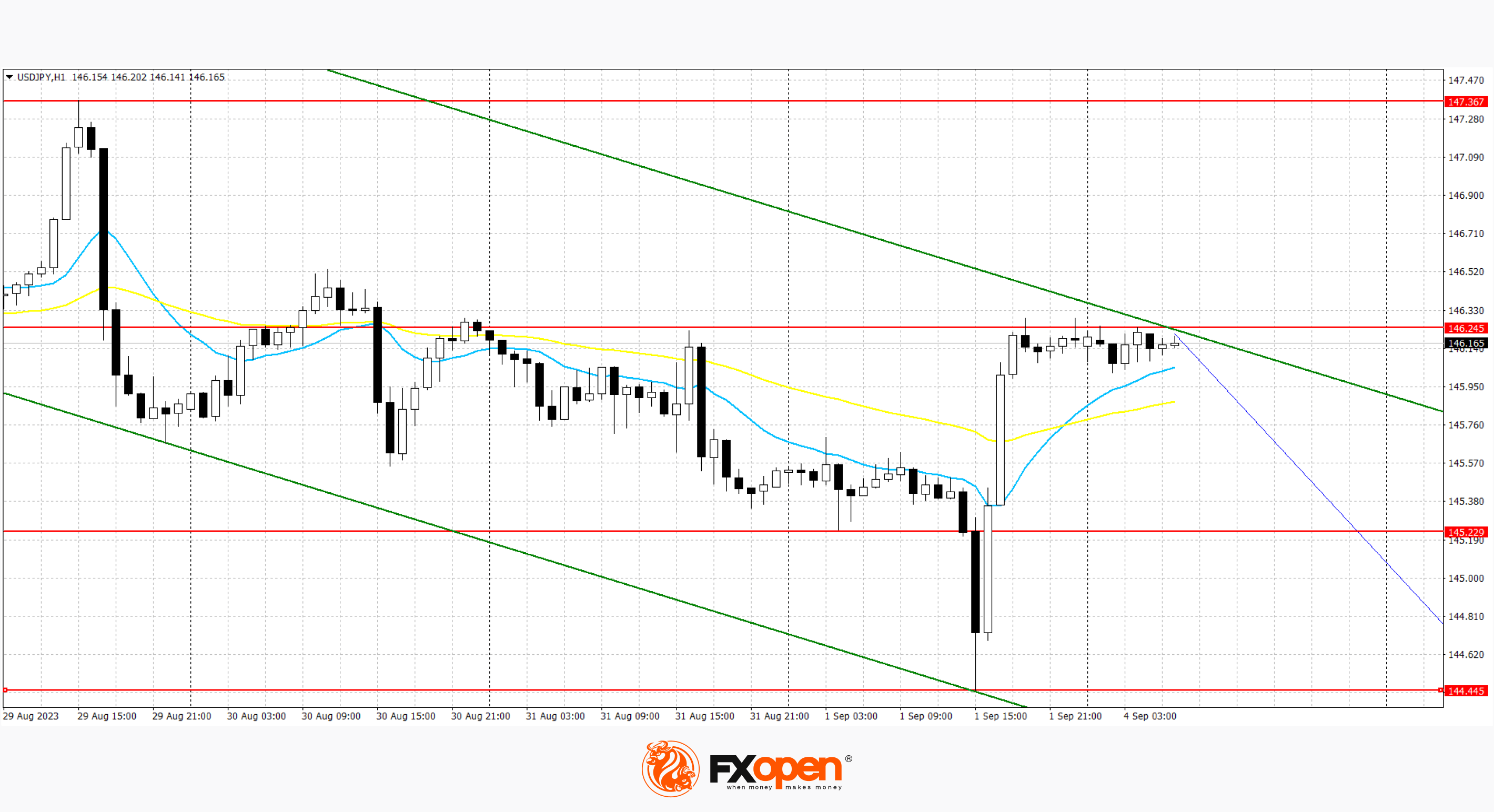

USD/JPY

The dollar rebounded from an early fall on Friday after a mixed US jobs report for August. The Labor Department said on Friday that US nonfarm payrolls increased by 187,000 jobs last month. The July number has been revised down to show an addition of 157,000 jobs instead of the previously reported 187,000. Economists polled by Reuters had forecast nonfarm payrolls to rise by 170,000 in August this year. Wage growth slowed down a bit. Average hourly wages rose 0.2% after a 0.4% increase in July. In the 12 months to August, wages rose 4.3% after a 4.4% increase in July. Strong resistance can be seen at 146.22, a break higher could trigger a rise towards 147.48 (Aug 29 high). On the downside, immediate support is seen at 144.448, a break lower could take the pair to 143.03.

At the lows of last week formed a new downward channel. Now the price has moved away from the upper border of the channel and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.