FXOpen

Last week, European currencies renewed their recent lows, while the yen and commodity currencies managed to remain in their old ranges. However, this week, everything can change dramatically since the fundamental data of the coming trading sessions is as saturated as possible. Data on the consumer price index in the Eurozone will be released today, and tomorrow, a similar index will be published in the UK. Also, central banks in the US and UK will announce their interest rate decisions on Wednesday and Thursday.

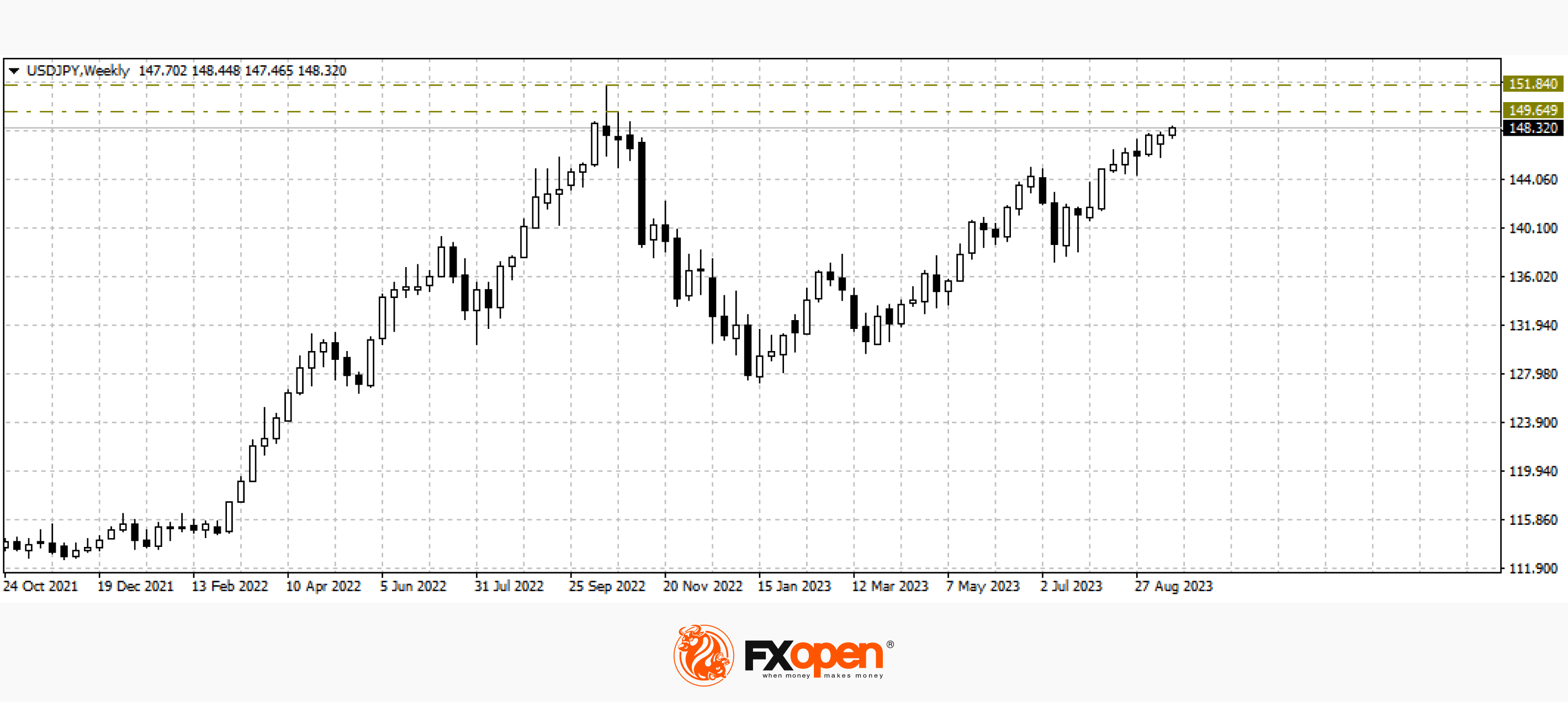

USD/JPY

The dollar/yen currency pair is stuck between 146 and 148. After a sharp rise in early September, the price switched to sideways movement and, apparently, is accumulating strength for growth. If greenback buyers manage to gain a foothold above 147.80, the start of a new upward impulse towards last year's highs at 150.00-151.00 may occur. However, if we see a sharp pullback from the current levels or there is a false breakout at 148.00-150.00, a full-scale downward correction may happen.

The pair's pricing will depend almost entirely on tomorrow's Fed verdict (21:00 GMT+3). If a pause in the hawkish policy of the American regulator is announced, USD/JPY could instantly be at 144.00-145.00. If officials declare the need to further increase the rate, a test at 150 may occur.

EUR/USD

Sellers of the single European currency last week managed to update the May low at 1.0630. The price has not gone lower yet, but if greenback buyers receive support from the Fed, the pair will most likely test the important range of 1.0500-1.0400. In the event of a negative rate decision for the dollar, buyers of EUR/USD may try to strengthen towards 1.0780-1.0800.

Today at 12:00 GMT+3, we are waiting for the publication of the basic consumer price index in the eurozone for August. A representative of the German Federal Bank, Joachim Wuermeling, will speak a little later.

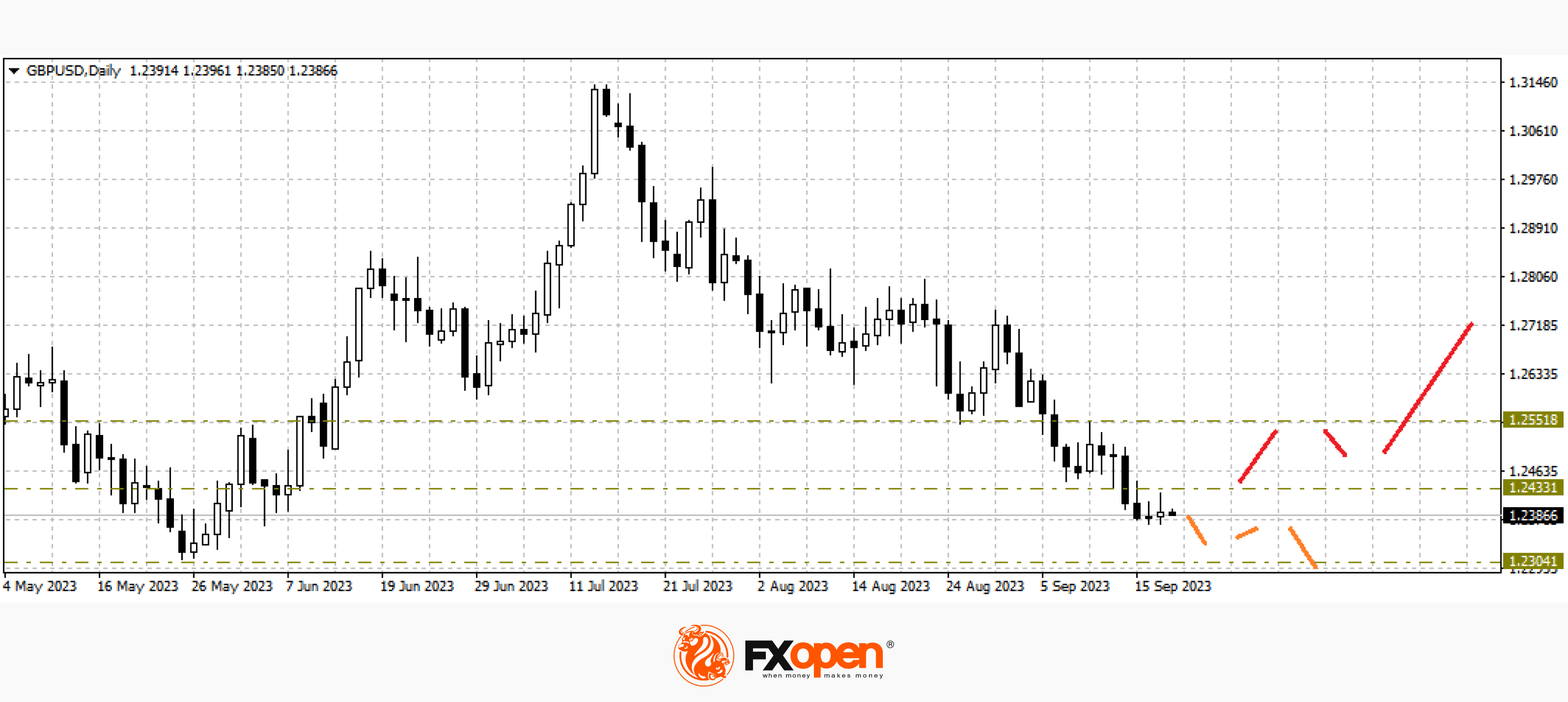

GBP/USD

The GBP/USD currency pair is gradually sliding towards 1.2300. If the current situation does not change, a renewal of the May lows of this year and a continuation of the downward trend in the direction of 1.2200-1.2000 may happen. Cancellation of the downward scenario is possible only after a sharp rise above 1.2600.

We expect important fundamental data for the pair tomorrow morning. In particular, the purchasing price index and the core consumer price index in the UK for August (09:00 GMT+3) will be released.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.