FXOpen

The price index published in the United States on Friday added 0.2% in December after -0.1% a month earlier, and the base indicator grew by 0.2% compared to 0.1% recorded in the previous month. In annual terms, the index slowed down from 3.2% to 2.9% with a forecast of 3.0%. This indicator is actively used by the US Fed when calculating average inflation and can significantly affect the results of the upcoming meeting of the regulator.

On Wednesday, January 31, market participants will follow the results of the two-day meeting of the US Federal Reserve, from which they currently do not expect a change in the interest rate, which is at the level of 5.50%, however, updated forecasts and comments from the regulator's officials will be important, given that analysts still are betting on a fairly high probability of a correction of the cost of borrowings in March. At the end of the week, a report on the labour market will be presented in the United States, which may affect the market at the beginning of the next week. Forecasts suggest that the number of new jobs outside the agricultural sector will increase to 173,000 in January after increasing to 216,000 in the previous month, the unemployment rate may be corrected from 3.7% to 3.8%, and the average hourly wage, from 0.4% to 0.3%.

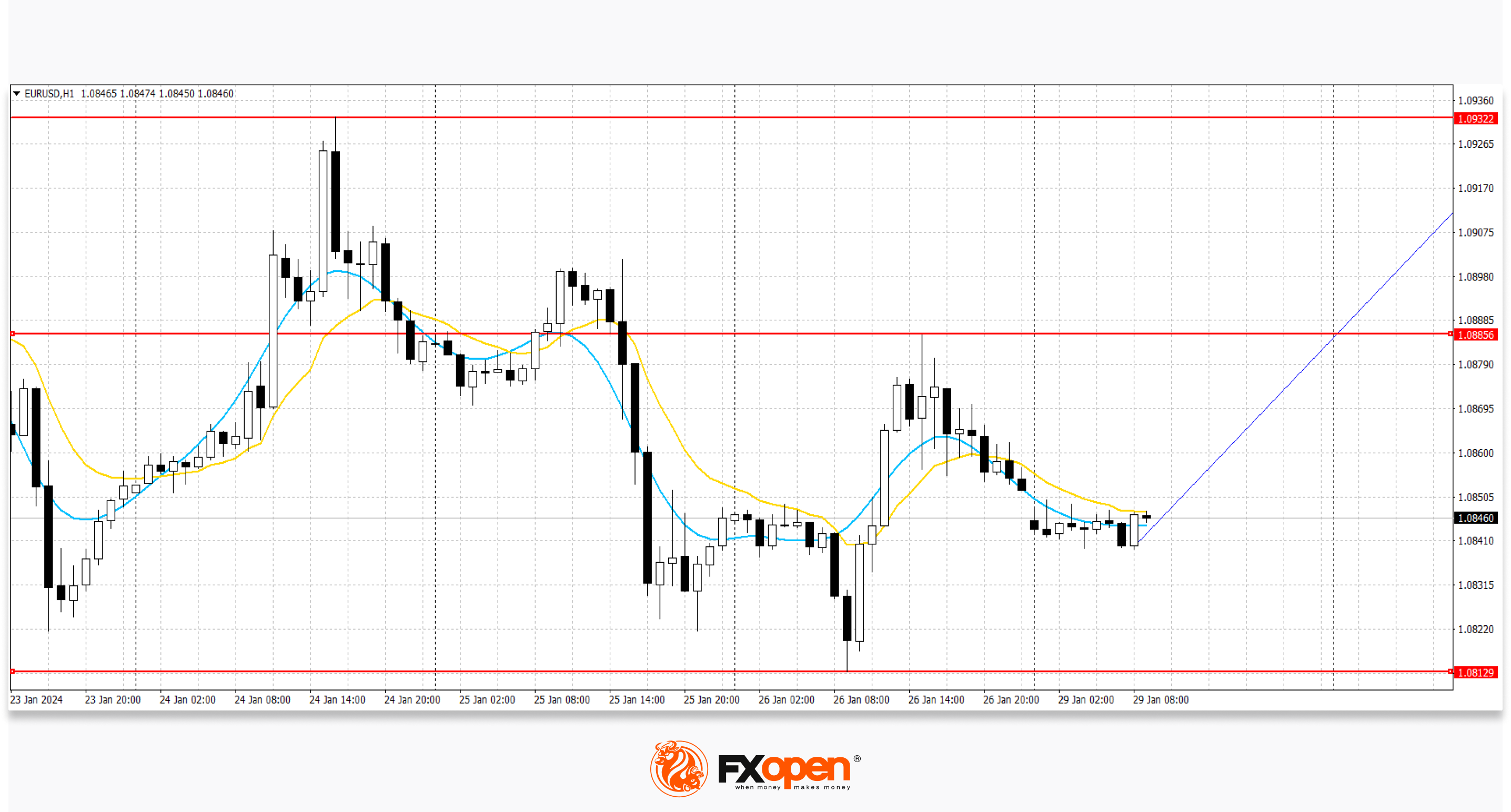

EUR/USD

The EUR/USD pair is holding close to the 1.0850 mark. The immediate resistance can be seen at the mark of 1.0885, a breakthrough can provoke a rise to 1.0932. On the other hand, the nearest support is visible at the level of 1.0812, a break below can lead to a pair of 1.0800.

Market activity at the beginning of the week will remain low due to the lack of key macroeconomic publications, and investors will continue to analyze last week's data. In the center of investors' attention are the results of ECB meetings and the comments of its head, Christine Lagarde. The regulator left interest rates unchanged: key — at 4.50%, deposit — 4.00%, and margin — at 4.75%. At the same time, representatives of the department pointed out that against the background of inflationary pressure, it is still too early to discuss the correction of monetary policy. Speaking at a press conference, Christine Lagarde said that it is necessary to ensure the steady movement of the consumer price index to the target level of 2.0%. The risks of an economic downturn in the eurozone remain due to conflicts in Ukraine and the Middle East. January data on consumer inflation will be presented in the Eurozone on Thursday: it is expected that the annual index will slow down from 2.9% to 2.8%, and the base indicator will be from 3.4% to 3.2%.

The technical analysis of the EUR/USD pair shows that the previous trading range with the limits of 1.0815 and 1.0932 is preserved. Now the price is in the lower part of the range, from which it is possible to move upwards.

GBP/USD

The GBP/USD pair is trading with insignificant upward dynamics, testing the 1.2700 mark for an upward breakout. The immediate resistance can be seen at the mark of 1.2743, a breakthrough can provoke a rise to 1.2774. On the other hand, the nearest support is visible at the mark of 1.2649, a break below can lead to a pair of 1.2596.

Activity on the market remains restrained, as the participants of the trade are in no hurry to open new positions on the eve of the meetings of the Federal Reserve of the United States and the Bank of England scheduled for this week. The results of the official meeting of the American regulator will be announced on Wednesday, January 31, and the British one on Thursday, February 1. Both banks do not expect changes in the vector of monetary policy, while the comments of officials, as well as updated forecasts, may affect the dynamics of the pair. Investors place in the current quotations the probability that the Bank of England will launch the interest rate reduction program significantly later than the US Fed, whose representatives also declare that it is moving to soften monetary conditions somewhat prematurely. The pound receives insignificant support from statistics on the index of consumer confidence from the analytical portal Gfk Group: the indicator rose from -22.0 points to -19.0 points with expectations at the level of -21.0 points, reaching the maximum since January 2022, as the British households have improved their financial condition against the backdrop of a gradual decline in inflation in the country.

The previous trading range between 1.2649 and 1.2774 is preserved on the GBP/USD chart. Now the price is in the middle of the range and tends to grow.

USD/JPY

The USD/JPY pair is decreasing today, although the quotes remain at the level of the previous week. Strong resistance on the USD/JPY graph can be seen at the mark of 148.70, a breakthrough can provoke a rise to 149.00. On the other hand, the nearest support is visible at 146.65. A breakout below can lead to a pair at 146.00.

The index of consumer prices in the metropolitan region of Tokyo decreased from 2.1% to 1.6% year-on-year, and the basic indicator, from 2.1% to 1.6%, significantly more than expected by experts (1.9%), reaching at least for the last two years. Thus, the inflationary pressure turned out to be lower than the Bank of Japan's target of 2.0%, which significantly increases the probability of the regulator's officials maintaining negative interest rates. Experts hope that this year, the positive dynamics of consumer prices will be supported by an increase in salaries.

The descending channel is saved. Now the price has moved away from the upper border of the channel and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.