FXOpen

The British pound posted a solid advance yesterday, despite UK GDP data coming in weaker than expected. The economy showed virtually no growth, underscoring persistent pressure on domestic demand and the manufacturing sector. However, the market appears to have used the release as an opportunity to cover short positions after a prolonged decline, which supported the pound in both major pairs.

Another factor behind the gains in GBP/JPY and GBP/USD may have been the end of the longest government shutdown in US history. The reopening of federal agencies removed some of the risks linked to delays in economic releases and uncertainty surrounding the budget process. Investors are assessing the consequences of the 43-day halt in US government operations, which has already shaved nearly 1.5 percentage points off GDP growth and created a significant gap in key macroeconomic data. Delayed employment and inflation reports are expected to begin appearing only by mid-November, and it will take longer for statistical accuracy to be fully restored.

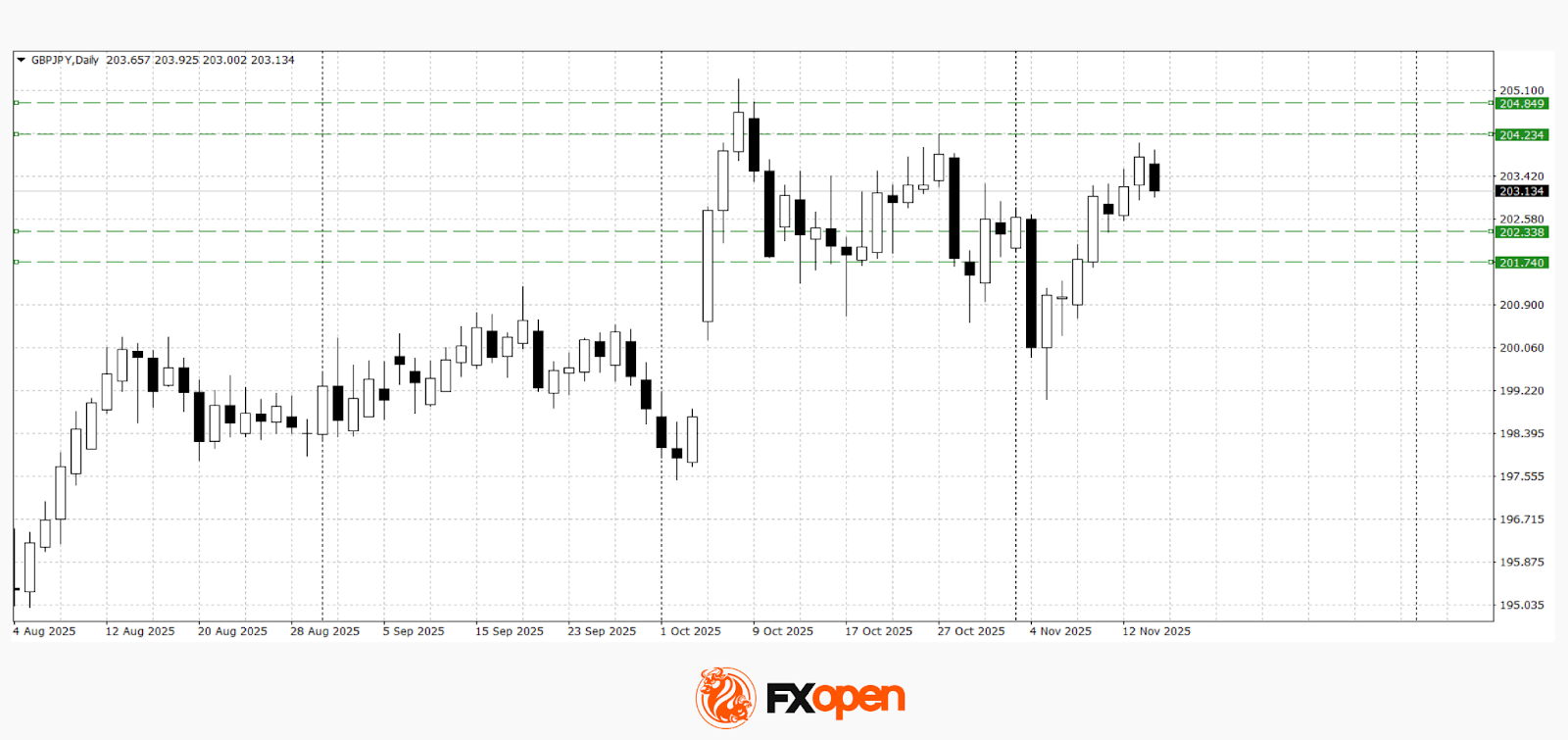

GBP/JPY

Despite two weeks of steady gains, GBP/JPY buyers have so far been unable to break above the October high at 205.30, the current yearly peak. Yesterday, the pair traded near 204.00, but failed to secure a firm close above this level.

Technical analysis suggests the pair may continue rising towards 204.30–204.80 if 204.00 confirms itself as support. A daily close below 203.00 could open the way for a deeper decline towards 201.70–202.30.

Upcoming events that may influence GBP/JPY price action:

- Today, 16:00 (GMT+3): UK Monthly GDP Tracker by NI;

- Today, 23:30 (GMT+3): Net speculative GBP positions from the CFTC.

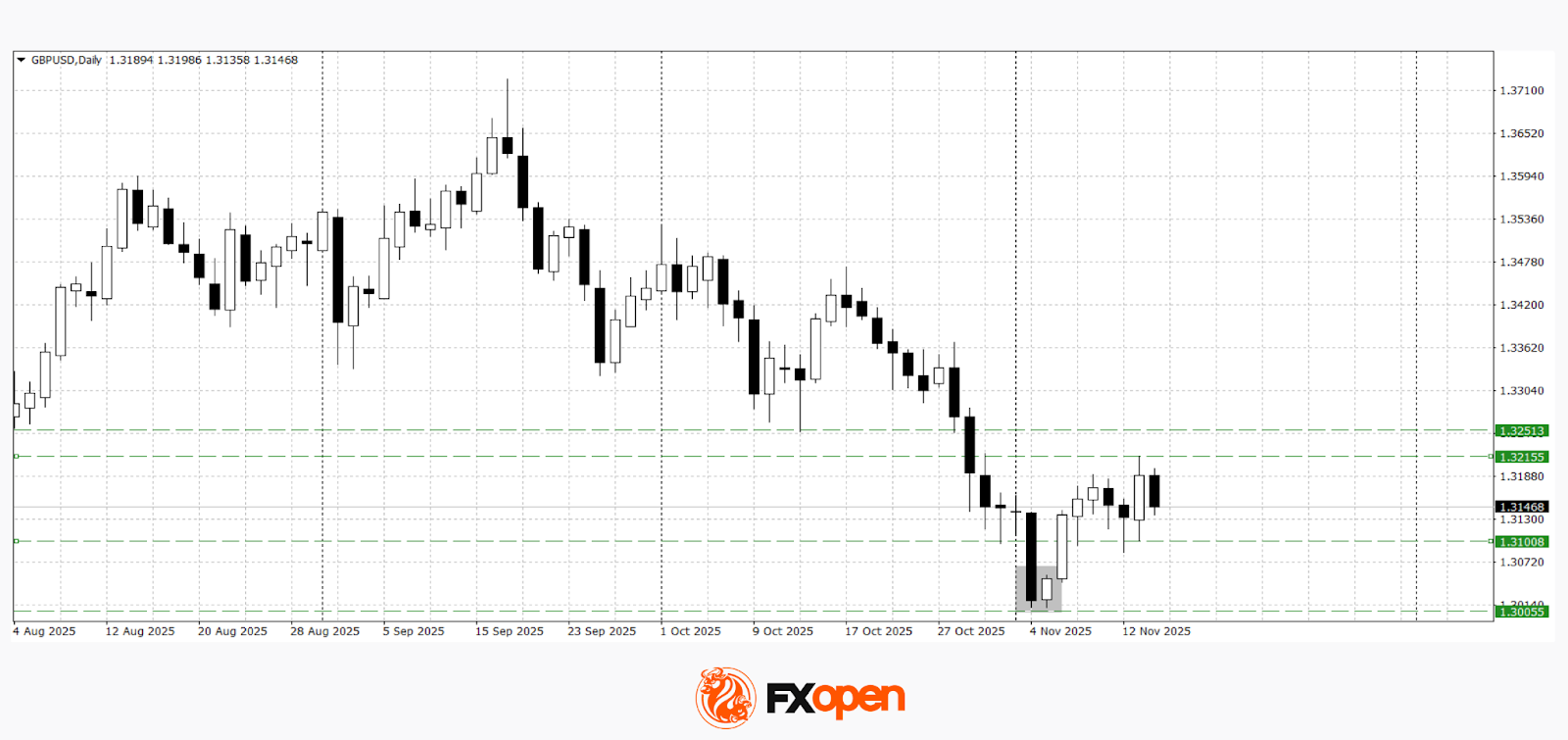

GBP/USD

Last week’s test of the key 1.3000 support level resulted in the formation of a bullish “piercing line” pattern. The follow-through on this setup allowed buyers to retest the major resistance at 1.3200. A break above this area may extend the corrective move towards 1.3250–1.3300. A sustained move below 1.3100 could lead to a retest of recent lows.

Upcoming events that may affect GBP/USD pricing:

- Today, 15:30 (GMT+3): US Initial Jobless Claims;

- Today, 17:20 (GMT+3): Speech by FOMC member Raphael Bostic;

- Today, 20:00 (GMT+3): Atlanta Fed GDPNow estimate.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.