FXOpen

The US dollar is showing cautious dynamics: the USD/JPY pair is holding within a range, reflecting the market’s wait-and-see stance, while USD/CAD is gradually approaching August highs. This divergence highlights that investors are carefully allocating positions amid uncertainty over the Federal Reserve’s next steps.

The main focus is on a block of US statistics — consumer price indices, jobless claims, and inflation expectations from the University of Michigan. Weak inflation and labour market figures would increase pressure on the dollar, while stronger data could temporarily restore support.

Thus, the market remains in search of fresh momentum: whether levels are broken or consolidation persists will depend on whether macro data confirm the scenario of policy easing or, conversely, postpone its implementation.

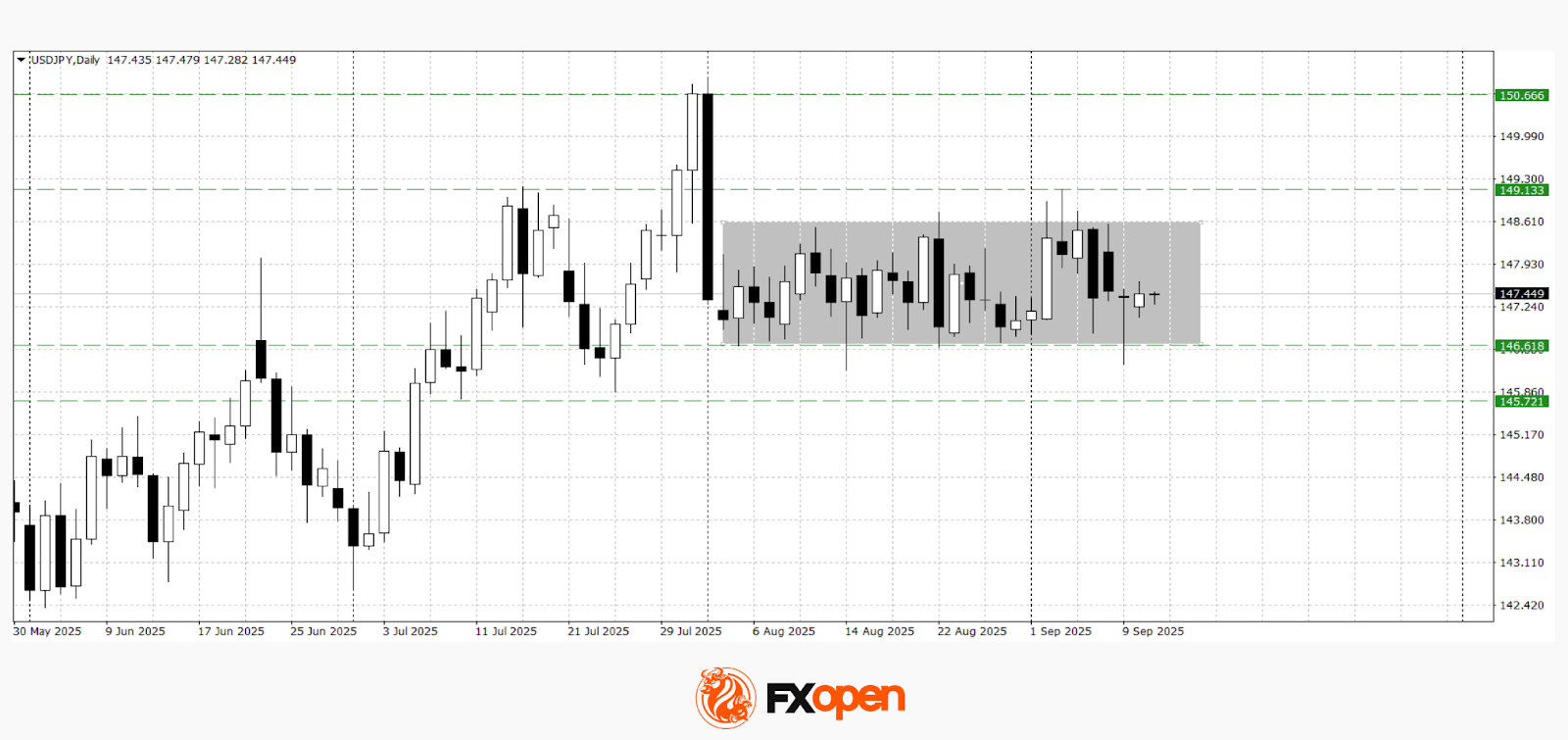

USD/JPY

Despite disappointing US employment data released at the end of last week, USD/JPY continues to trade within a six-week range of 146.40–148.60. Early this week, sellers attempted to break through the lower boundary of the corridor but have so far been unsuccessful. Technical analysis of USD/JPY suggests a possible strengthening towards 148.00–148.60, as a hammer candlestick has formed following the rebound. A bounce from current levels could also lead to a retest of support at 146.30–146.60.

Events that could influence the direction of USD/JPY:

- Today at 15:30 (GMT+3): US Consumer Price Index (CPI)

- Today at 15:30 (GMT+3): US Initial Jobless Claims

- Today at 21:00 (GMT+3): US Federal Budget Statement

USD/CAD

As expected, following the formation of a bullish engulfing pattern, USD/CAD managed to test the key 1.3800–1.3860 range. Should the dollar receive a positive news driver, the pair might strengthen towards 1.3880–1.3900. The nearest support could be within the 1.3790–1.3830 area.

Events that could influence the direction of USD/CAD:

- Today at 15:30 (GMT+3): Canadian Building Permits

- Today at 17:00 (GMT+3): University of Michigan Consumer Sentiment Index

- Today at 19:00 (GMT+3): US Department of Agriculture (USDA) Report

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.