FXOpen

Last week, there were several local downward trends in dollar pairs. For instance, the pound/dollar pair strengthened to 1.2800, euro/dollar buyers almost updated the recent high at 1.0895, and the usd/jpy pair remained below the crucial resistance at 157.00 for several days. However, the “dollar bears” couldn’t maintain their advantage, and by yesterday, sharp pullbacks and the formation of bullish combinations in usd pairs were observed.

So, what is the main reason for the return of dollar buyers to the market?

- The S&P/CS Composite-20 (USA) housing price composite index, excluding seasonal adjustments, was higher than forecasted at 7.4% versus 7.3%.

- The US Consumer Confidence Index from CB rose to 102.0 against expectations of 96.0.

- The probability of an interest rate cut by the Federal Reserve decreased to 51%, from 65% a week ago.

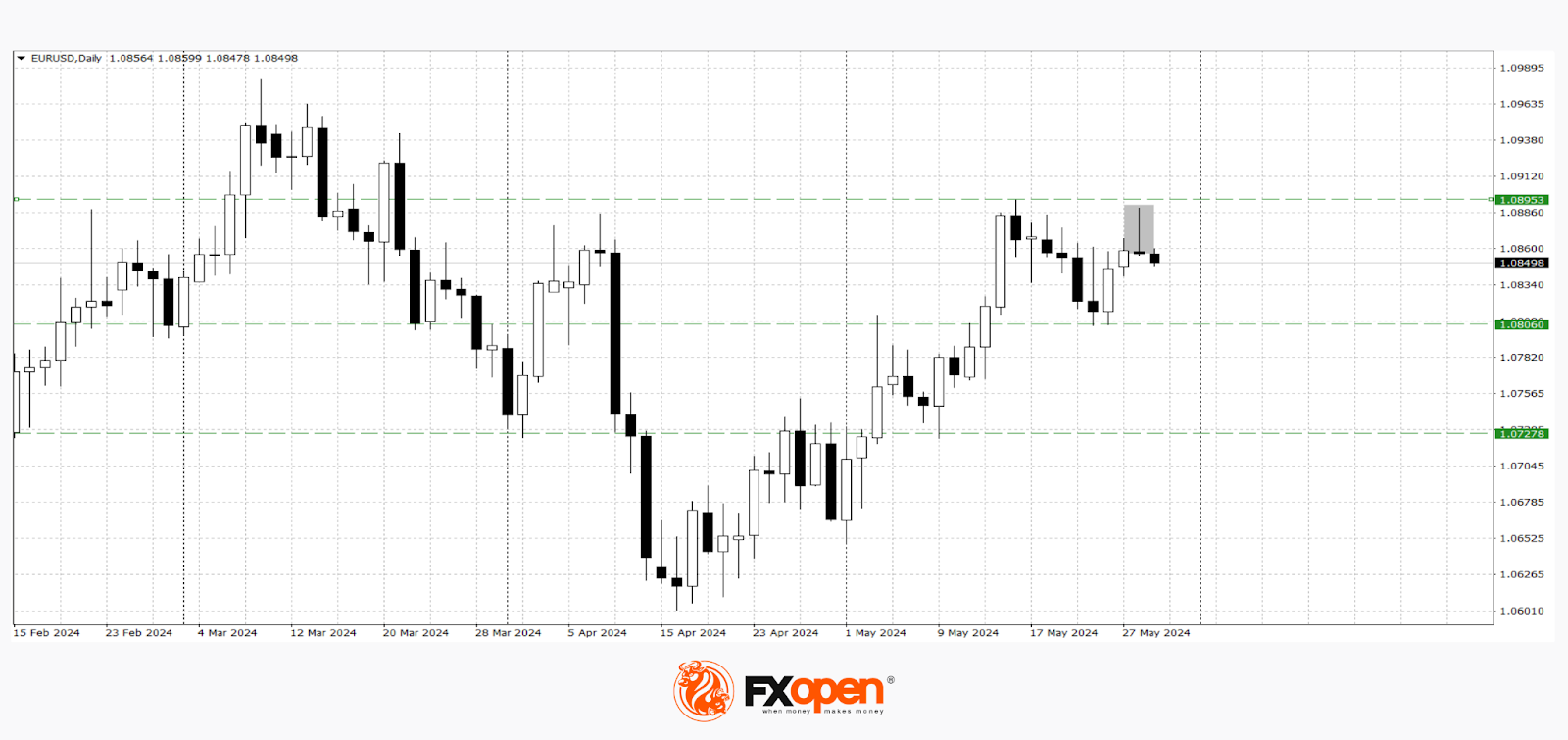

EUR/USD

This week’s movement of the pair once again confirmed the strength of the critical level at 1.0900. Specifically, yesterday, falling just a few points short of this mark, a “bearish hammer” pattern was formed on the D1 timeframe. The technical analysis of the eur/usd pair indicates the possibility of a resumption of downward movement if support at 1.0800 is broken. An upward scenario could be confirmed by a confident hold above 1.0900.

What news might affect eur/usd pricing?

- Today at 15:00 (GMT +3:00), Germany’s Consumer Price Index (CPI)

- Tomorrow at 12:00 (GMT +3:00), the Eurozone Consumer Confidence Index

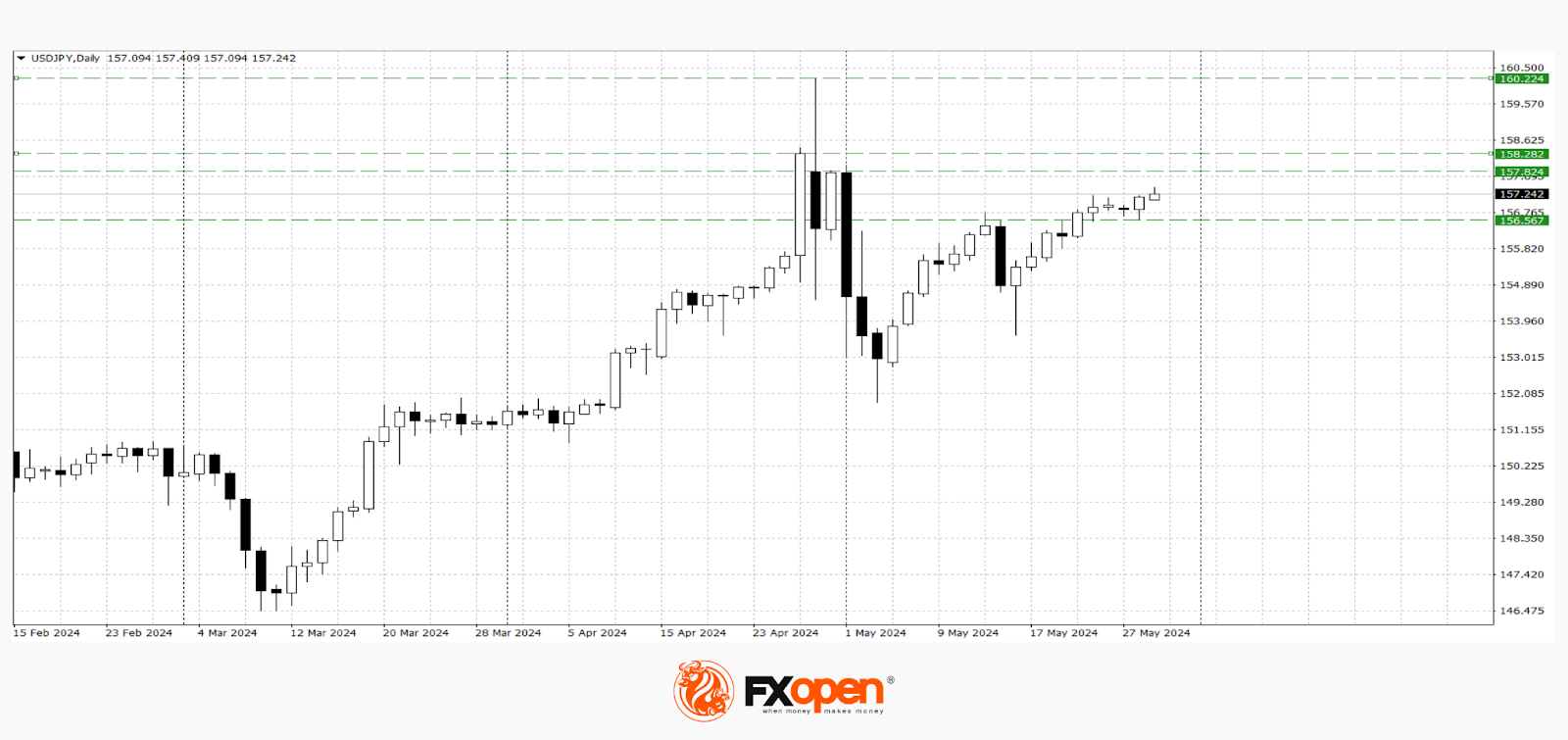

USD/JPY

After breaking the resistance at 156.70, the usd/jpy pair traded in a fairly narrow flat corridor for several days. Yesterday, buyers managed to secure a position above 157.00. Technical analysis of usd/jpy indicates that if this level becomes medium-term support, the pair’s growth could continue to 158.30-157.80. A resumption of the downward pullback is possible after breaking yesterday’s low at 156.60.

Important for the pair’s movement in the upcoming trading sessions will be the publication of the US GDP indicator for the first quarter and the Japanese Consumer Price Index data.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.