FXOpen

Yesterday’s decision by the US central bank became the main driver of market movement, confirming a shift towards a more accommodative monetary policy path. Markets were particularly sensitive to Jerome Powell’s comments, as he repeatedly stressed that inflation remains too high while the labour market is showing clear signs of significant weakening.

The Fed Chair noted that the negative job growth — averaging around minus 20,000 per month — and potential distortions in the data caused by missing figures for October and November require a cautious approach to upcoming releases. At the same time, he emphasised that the economy does not appear overheated, demand is cooling, and inflation in the services sector continues to decline steadily.

These signals were interpreted by the market as confirmation that further support for the economy may be needed, increasing pressure on the dollar and triggering a sharp rise in demand for European currencies.

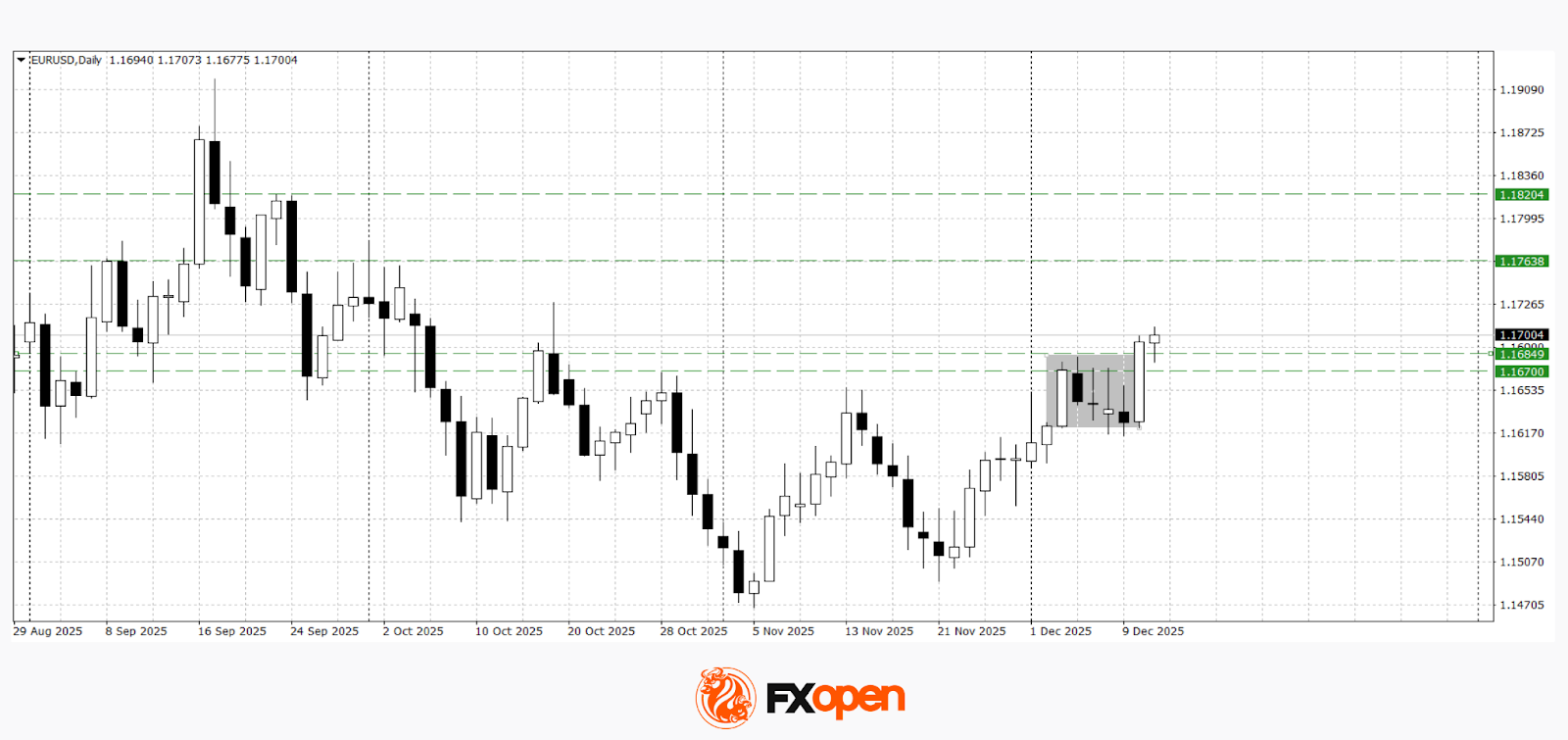

EUR/USD

Following the Fed meeting, EUR/USD buyers managed to break out of the 1.1620–1.1670 consolidation range and hold above 1.1700. If the 1.1670–1.1690 zone turns into support, the pair may extend yesterday’s impulsive rise towards 1.1760–1.1820. A sustained move below 1.1670 could lead to a retest of 1.1600.

In the coming trading sessions, the following events may influence EUR/USD pricing:

- Today at 14:00 (GMT+3): Eurogroup meeting

- Tomorrow at 10:00 (GMT+3): Germany Consumer Price Index (CPI)

- Tomorrow at 13:00 (GMT+3): ECOFIN Council meeting

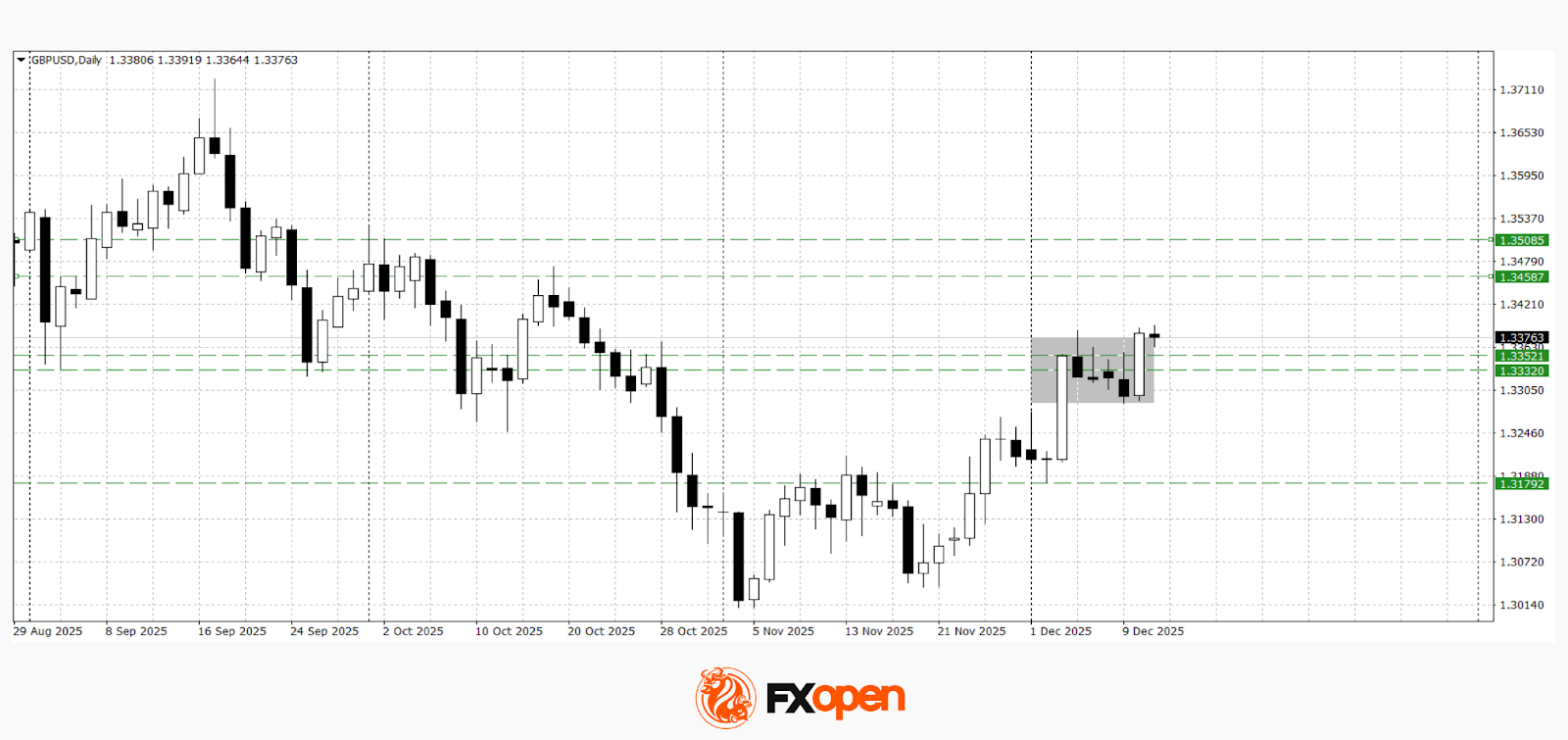

GBP/USD

In GBP/USD, the pair is updating last month’s highs. Technical analysis suggests potential growth towards 1.3460–1.3510, provided the price holds above 1.3330–1.3350. A break below these support levels could return GBP/USD to the 1.3200–1.3300 consolidation range.

Upcoming events that may affect GBP/USD pricing include:

- Today at 12:50 (GMT+3): Speech by Bank of England Governor Andrew Bailey

- Today at 16:30 (GMT+3): US initial jobless claims

- Tomorrow at 10:00 (GMT+3): UK Gross Domestic Product (GDP)

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.