FXOpen

Currency pairs GBP/USD and EUR/GBP continue to exhibit moderate volatility, consolidating within narrow ranges as markets await the release of GDP figures from both the UK and the eurozone. Market participants remain cautious, awaiting key economic indicators that could set the direction for these currency pairs.

Additional attention is focused on today’s US trading session, which will feature a speech by Federal Reserve Chair Jerome Powell, along with the release of US retail sales data and the Producer Price Index (PPI). Against a backdrop of persistent disinflation and rising geopolitical uncertainty, investors will be closely analysing Powell’s comments for any signals regarding the timing of future interest rate changes.

Any clear assessment of the US economy or a dovish shift in tone could have a significant impact on the dollar’s trajectory — and by extension, influence the GBP/USD pair. Until then, the market is expected to remain in wait-and-see mode, with sideways movement likely to dominate.

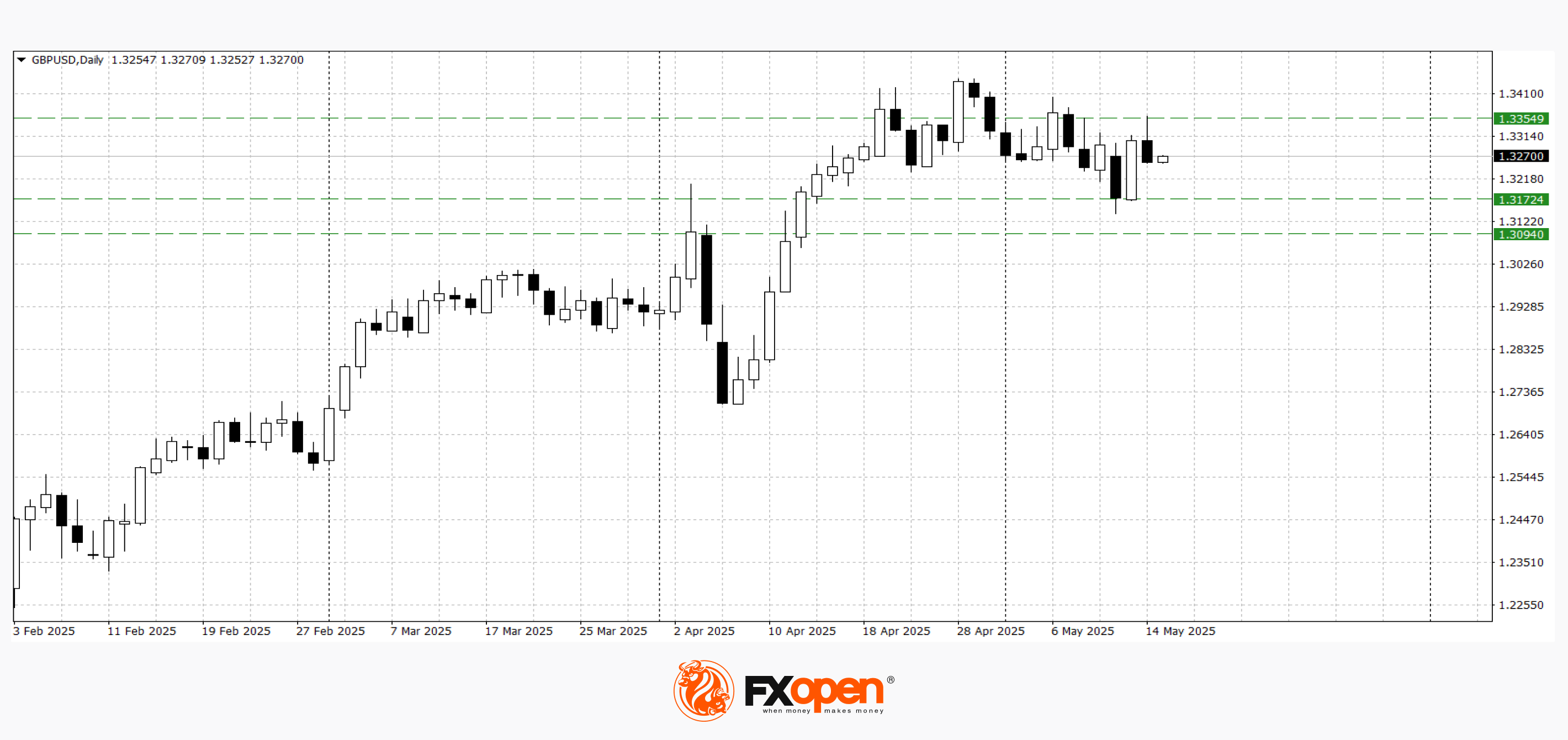

GBP/USD

The GBP/USD pair is fluctuating in the 1.3350–1.3180 range, indicating a neutral bias. Technical analysis suggests the potential for a move towards the yearly highs, should the pair break above 1.3350. Conversely, a firm close below 1.3300 could increase selling pressure, with the next target likely to be the support zone around 1.3180–1.3100.

Key events that may affect GBP/USD pricing include:

- 09:00 (GMT+3): UK Gross Domestic Product (GDP) release

- 09:00 (GMT+3): UK Industrial Production data

- 09:00 (GMT+3): UK Services PMI release

- 11:30 (GMT+3): UK Labour Productivity report

EUR/GBP

Following a sharp decline in April from 0.8720, the EUR/GBP pair found support near 0.8400, reflecting balanced expectations regarding the economic outlook for both the eurozone and the UK. Volatility remains limited in anticipation of fresh macroeconomic signals.

EUR/GBP technical analysis indicates the potential for a short-term rebound towards 0.8500–0.8470, as a bullish engulfing pattern has emerged on the daily timeframe.

Key events likely to influence EUR/GBP pricing:

- 12:00 (GMT+3): Eurozone GDP release

- 13:15 (GMT+3): Speech by European Central Bank Vice-President Luis de Guindos

- 15:40 (GMT+3): Speech by US Federal Reserve Chair Jerome Powell

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.