FXOpen

The downward movement in the American currency, which began at the end of October, resumed with renewed vigour at the beginning of the current five-day trading period.

Thus, the euro/US dollar pair is consolidating at 1.0900, the pound/US dollar pair has confidently strengthened above 1.2600, and USD/JPY sellers have broken through the resistance at 149. Nevertheless, the coming trading sessions are quite saturated with the fundamentals, so it is possible to see both the strengthening of existing trends and the beginning of corrective pullbacks from the main movements.

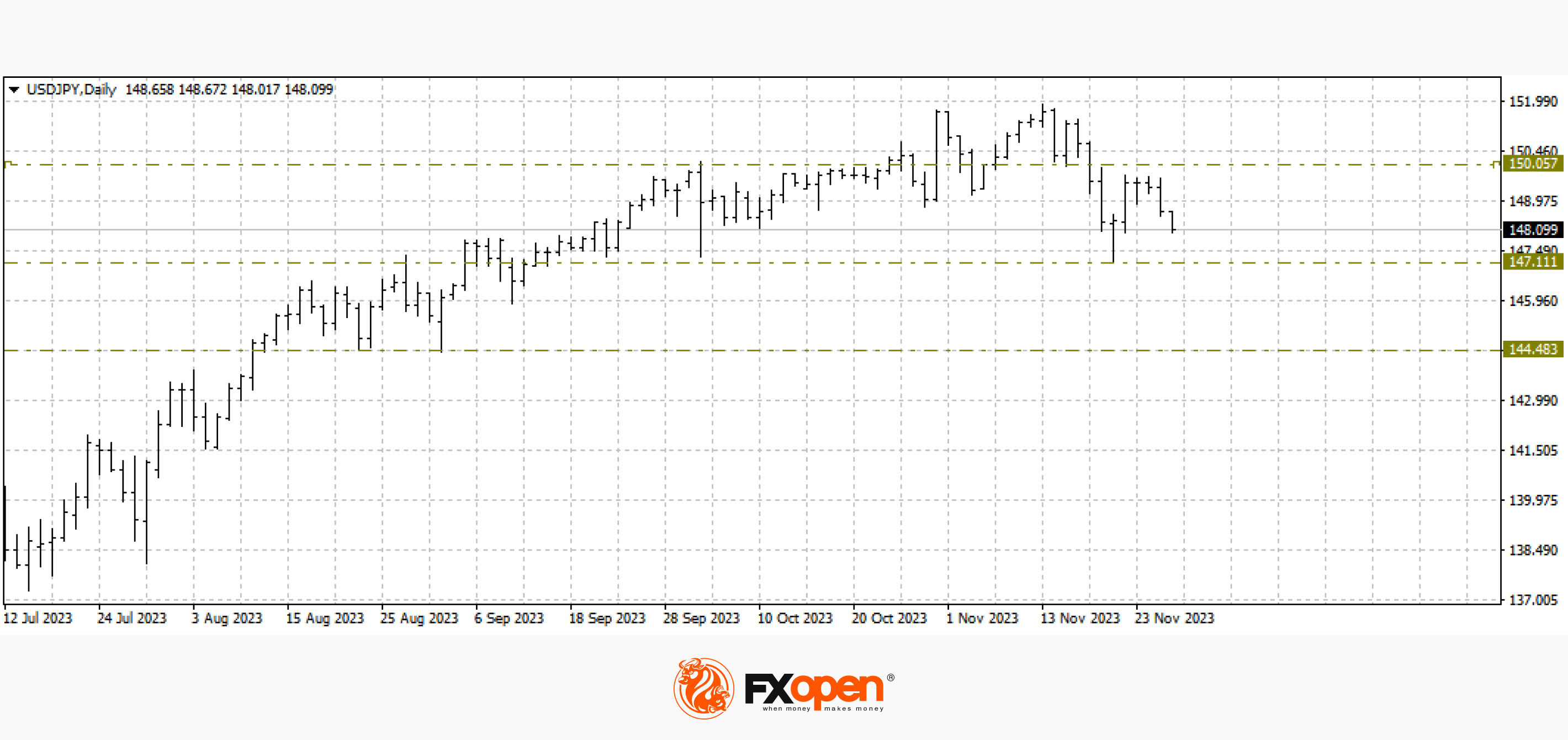

USD/JPY

The cooling of the US labour market and lower inflation are contributing to increased bearish sentiment on the dollar. More and more market participants are becoming confident that the most aggressive rate-tightening cycle of the last couple of decades is behind us, and the Fed could cut its benchmark interest rate as soon as the first quarter of 2024. On the contrary, the Bank of Japan has been adhering to a policy of ultra-low interest rates for a long time, and if it decides to change the current vector of monetary policy, the dollar/yen pair may suffer significant losses.

Last week, on the USD/JPY chart, the pair almost tested a significant support level at 147.00. Greenback buyers managed to correct to 149.70, but yesterday evening the pair was trading below 149.00.

Today we are waiting for data on the US consumer confidence index from CB for November. Analysts expect a decline in the indicator, which may contribute to a retest of 147.00. We could consider cancelling the downward scenario only after a confident strengthening above 150.00.

GBP/USD

On the GBP/USD chart, buyers of the British currency are approaching the September extremes of this year at 1.2700-1.2800. If in the coming trading sessions the price is able to consolidate above these levels, the upward movement to the psychological level of 1.3000 may continue. We can consider cancelling the upward scenario if it goes below 1.2500.

Today at 19:00 GMT+2, it is worth paying attention to the speech of Jonathan Haskel, a member of the Monetary Policy Committee.

EUR/USD

The single European currency is consolidating near 1.0900. With appropriate fundamental momentum, the price may test the psychological support at 1.1000. According to EUR/USD technical analysis, if buyers of the pair manage to strengthen above 1.1000, growth may continue towards the current year’s highs at 1.1200.

Today at 09:00 GMT+2, the consumer climate index in Germany for December will be published. At 14:30 GMT+2, a speech by member of the supervisory board (ECB representative) Elizabeth McCall is scheduled.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.