FXOpen

In the first trading hours of the current five-day period, the American currency made a number of attempts to regain the positions lost last week and begin an upward correction. Thus, the USD/JPY pair found support just above 146.00 and tested resistance at 147.50, USD/CAD buyers defended support at 1.3500, and the EUR/USD pair dropped to the important level of 1.0800 yesterday. Whether there will be a continuation of yesterday's movements can be understood after the release of the incoming fundamentals of the current five-day period.

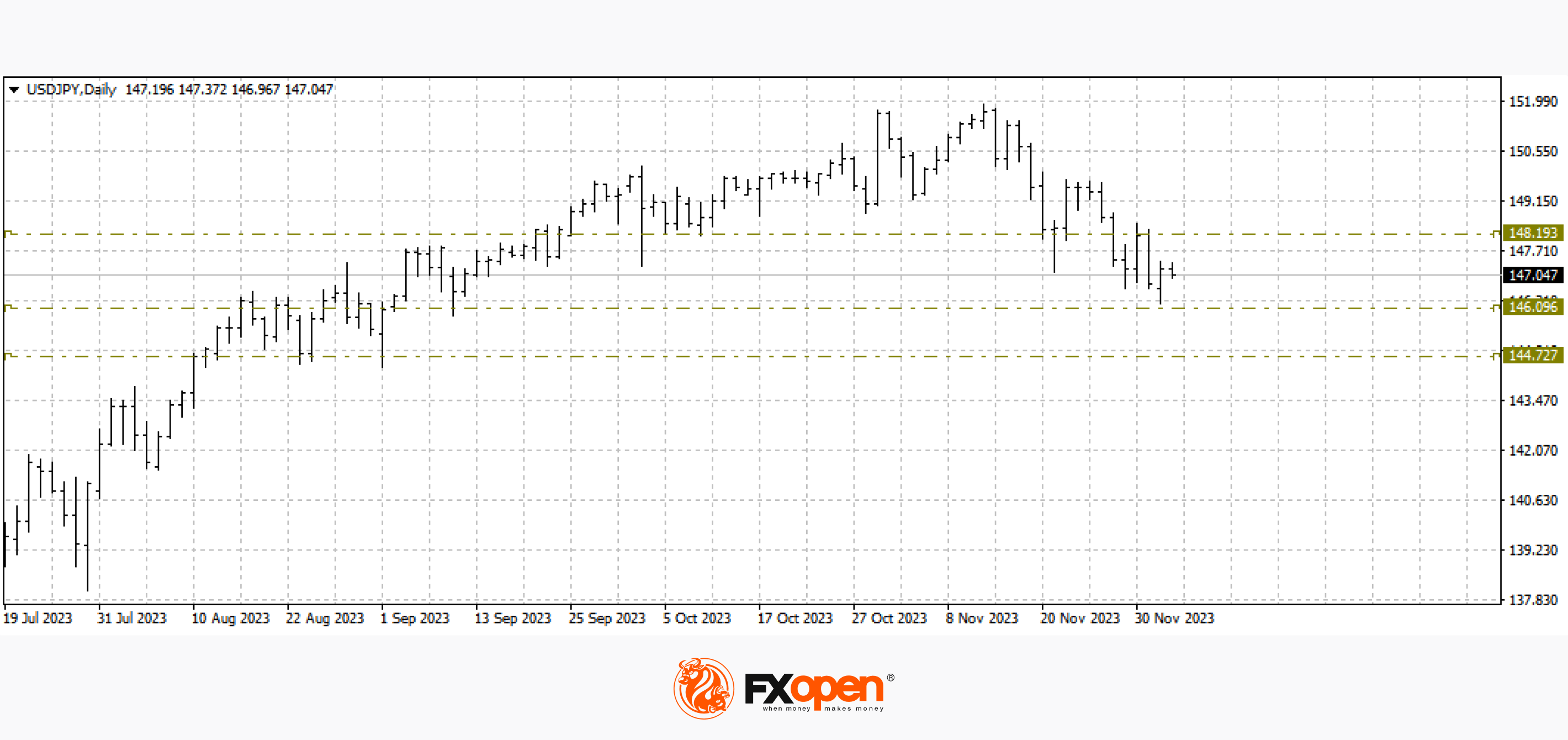

USD/JPY

Growing expectations among market participants regarding a reduction in the Fed's base interest rate next year is pushing the USD/JPY pair to new lows. If data on inflation and the labour market in the US disappoint officials, the timing of changes in monetary policy could change dramatically, which in turn could return the USD/JPY pair above 150.00.

Today at 17:45 GMT+3, we are waiting for the publication of data on the business activity index (PMI) in the US services sector for November. A little later, at 18:00 GMT+3, indicators on the number of open vacancies on the US labour market for October and the Purchasing Managers' Index for the non-manufacturing sector from ISM will be released. Tomorrow we are waiting for a preliminary report on employment in the US from ADR.

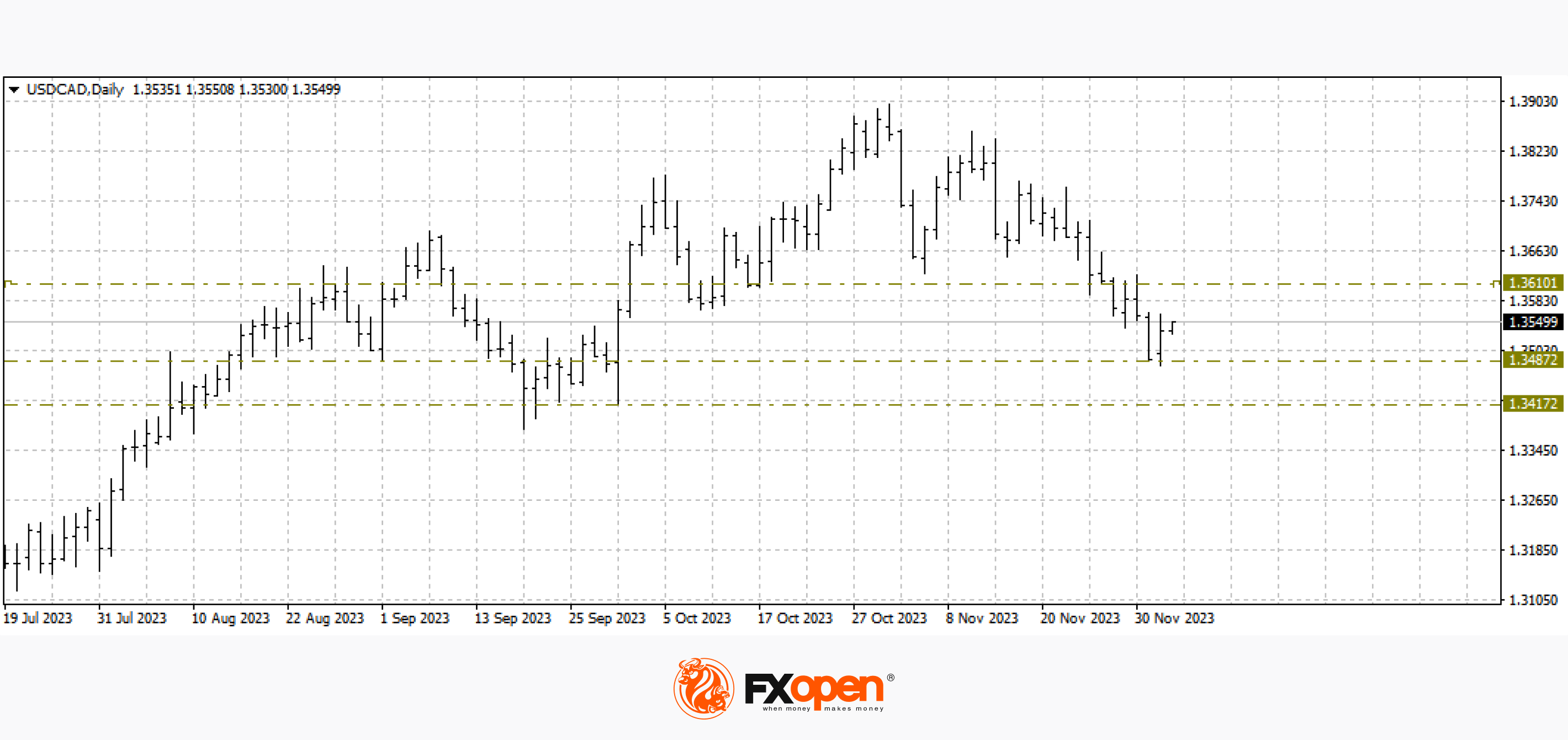

USD/CAD

On the USD/CAD chart, the pair is consolidating between 1.3550-1.3480. Declining oil prices and a corrective pullback on the greenback are helping to slow down the price decline, but most likely this balance of power will not last long.

In addition to the publication of today's data from the US, a meeting of the Bank of Canada is scheduled for tomorrow, at which a decision on the base interest rate will be announced.

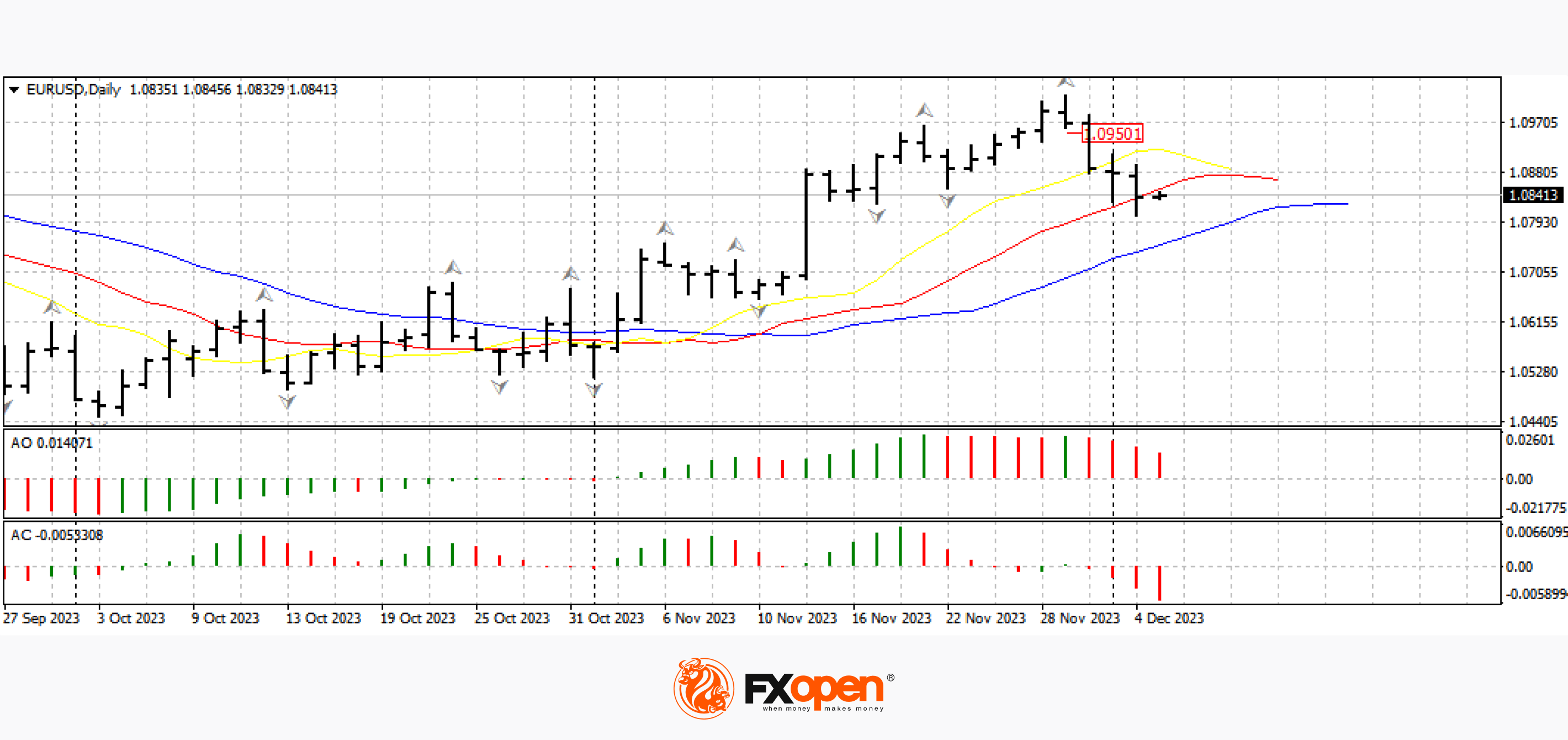

EUR/USD

According to EUR/USD technical analysis, there is a bearish reversal bar from November 29 working out. Important for further pricing of the pair will be the price behaviour at the support in the form of alligator lines on the daily timeframe, located at 1.0800-1.0750. If buyers keep the price above this range, we could expect another move to 1.1000. Otherwise, the downward impulse in the direction of 1.0600-1.0400 may strengthen.

Today at 12:00 GMT+3, we are waiting for data on the business activity index in the eurozone services sector for November. Also at 16:20 GMT+3, it is worth paying attention to the speech of Anneli Tuominen, member of the supervisory board of the European Central Bank.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.