FXOpen

The USD/CAD exchange rate has seen sharp swings over the past two years, shaped by shifting interest rates, trade policy, and commodity prices. This article breaks down the major economic drivers behind the pair, recent performance trends, and analytical USD to CAD exchange rate forecasts for the years ahead.

Recent Performance of the USD/CAD Pair

Over the past several years, the USD/CAD exchange rate has experienced a variety of shifts, reflecting broader economic trends and specific events in both the United States and Canada. To see how the pair’s movements have unfolded over the years, you may consider heading over to FXOpen’s TickTrader platform to interact with live USD/CAD charts.

Throughout 2019, the USD/CAD exchange rate moved in a narrow range, fluctuating between 1.30 and 1.35. This period was marked by heightened trade tensions between the US and its key trading partners, primarily China, which had a ripple effect on the pair due to both the US and Canada's significant trade relationships.

The onset of the COVID-19 pandemic in early 2020 brought unprecedented volatility to global financial markets, including the USD/CAD pair. Initially, the CAD weakened significantly against the USD as investors sought refuge in the US dollar, which is considered a so-called global safe haven.

Simultaneously, oil prices—one of CAD’s key drivers—fell sharply, leading the pair to reach a high of 1.46 in March. However, as the year progressed, the CAD recovered some of its losses as commodity prices, particularly oil, began to stabilise. USD/CAD closed in 2020 at 1.27.

The year 2021 initially saw a strengthening of the Canadian dollar, driven by the recovery in oil prices and a general improvement in global economic conditions. This recovery was supported by aggressive expansionary fiscal and monetary policies that helped to stabilise economies and boost demand for commodities, supporting CAD. The pair reached a multi-year low of around 1.20 in June, before retracing to close the year at around 1.26.

Throughout 2022, the Canadian dollar generally weakened against the dollar, influenced by fluctuating oil prices and changing market sentiments about the pace of economic recovery. Most importantly, both the Bank of Canada (BoC) and the Federal Reserve began to hike interest rates in March 2022, which coincided with a peak in oil prices. A decline in oil throughout the rest of 2022 drove CAD lower, with USD/CAD closing 2022 at around 1.35.

In 2023, the pair experienced minor fluctuations, ranging between around 1.31 and 1.39. Inflation began to fall sharply in both economies, though still with some persistence. Commodity prices began to rise in the second half of the year amid general optimism around the state of the global economy and potential Fed rate cuts, benefiting the Canadian dollar.

From early 2024 onward, USD/CAD has been defined by policy divergence, oil swings, and shifting trade sentiment. The pair climbed sharply in mid-2024 as the Bank of Canada began cutting rates well ahead of the Federal Reserve, widening the yield gap and driving CAD weakness. By late 2024, USD/CAD surged above 1.44, its highest since the pandemic.

Momentum began to shift in February 2025. The US dollar weakened broadly as markets priced in slower US growth and the prospect of Federal Reserve rate cuts amid aggressive tariff rhetoric from newly inaugurated US President Donald Trump. While tariffs posed significant risks for Canada’s fragile economy, especially for its manufacturing and energy sectors, the 4th April “Liberation Day” US tariff announcements sent the dollar tumbling. The pair fell below 1.36 in June.

From there, easing tariff rhetoric helped restore some confidence in the dollar. Simultaneously, a softening oil price and rate cuts from the Bank of Canada hurt the loonie.

As of October 2025, USD/CAD sits near 1.40, indicating a relatively balanced economic backdrop for the US and Canada.

Canadian Economic Outlook 2025

Canada entered 2025 with a constrained but stabilising economic backdrop. Growth is expected to hover near 1.0%, according to the OECD’s Economic Outlook, as export weakness, slower immigration, and tariff pressures weigh on momentum. Earlier Bank of Canada forecasts in January had projected a stronger rate—around 1.8%—but those assumed lighter trade frictions. In its July update, the Bank signalled that activity should pick up in the latter half of the year as export conditions stabilise.

One of the more positive angles lies in residential investment. The Bank expects a rebound in housing and resale activity in the second half of 2025, driven by lower mortgage rates and pent-up demand that was constrained in early 2025. Still, supply constraints—zoning, land, labour—will cap how fast this sector can expand.

The inflation picture is more favourable now than in recent years. After peaking above 3%, Consumer Price Index (CPI) is expected to settle close to the BoC’s 2% target through 2025, although the most recent September reading came in at 2.4%. Core inflation (which excludes volatile items) is projected to moderate gradually as shelter inflation slows and energy costs stay benign. That said, tariff-related pressures could cause short-lived blips above target, an uncertainty the Bank flags in its scenario analysis.

On the monetary front, the BoC is operating with a dovish tilt. However, after cutting the overnight rate to 2.25% in October, many analysts believe the cutting cycle could conclude by late 2025 or early 2026. The Bank’s own projections suggest those moves should help absorb excess supply and support domestic demand.

Because population growth is slowing, consumption growth per person becomes more crucial. The BoC sees real consumption per capita rising about 1% in 2025, supported by rate cuts, income gains, and accumulated household wealth. But weaker export demand and cautious business investment will mute broader demand growth.

Heading into early 2026, the first quarter may carry over structural softness—investment likely sluggish, and external demand still adapting to trade dynamics. That said, once uncertainty eases and policy actions feed through, Canada has room to regain traction into mid-2026.

US Economic Outlook 2025

The US economy in 2025 is expected to slow, but it’s unlikely to collapse. The consensus among economists leans toward real GDP growth of 1.6% to 1.8%, moving away from the robust pace seen in 2024. The National Association for Business Economics now forecasts 1.8% growth, up from its mid-year estimate of 1.3%. The OECD projects 1.6% growth, assuming current tariffs remain in place.

Understanding inflation dynamics is critical. The Fed’s preferred measure, core PCE, should remain elevated at around 3% to 3.2% by year’s end, driven partly by ongoing tariff pressures and wage growth.

The labour market is cooling. The unemployment rate moved up to ~4.3% in August 2025, a four-year high, reflecting softening in job gains. Weekly jobless claims suggest layoffs are rising modestly, though the pace is gradual. Because hiring is softening even as inflation remains firm, the Fed faces a delicate balancing act.

Monetary policy in 2025 is cautious and data-driven. The Fed held rates in the 4.25%–4.50% range for months to assess the impact of tariffs and labour trends. It recently cut rates to the 3.75%-4% range at its October meeting, signalling more cuts ahead while emphasising uncertainty and the possibility of upward inflation surprises. Market pricing also pushes for cuts, with a high probability of a cut at December’s meeting.

Tariff policy remains a critical variable. Businesses already report that higher import tariffs are pushing input costs upward. Analysts warn that the tariff shock is among the largest in decades, introducing stagflation risk—slower growth plus persistent inflation.

Moving into early 2026, carry-over effects from late-2025 may impose softness in the first quarter—especially if tariffs remain unchanged and households rein in spending. But should inflation ease more rapidly than expected, the Fed might feel compelled to accelerate cuts.

In short: 2025 for the US looks like a slowdown with friction—not a crash. The economy will wrestle with elevated inflation, tariff headwinds, and a softer labour market, even as the Fed edges toward easing policy.

Analytical USD to CAD Forecasts for 2025

The USD to CAD in 2025 remains tilted in favour of the US dollar heading into the tail end of the year, with monetary policy divergence still the main driver. The Federal Reserve’s policy rate sits roughly 175 basis points above the Bank of Canada’s, sustaining a yield premium that continues to attract dollar demand. Until that gap narrows, the greenback is likely to hold the upper hand.

That said, the momentum behind USD strength is starting to cool. With the Fed already cutting rates in September and October, and another cut possible in December, market sentiment is shifting from "higher and longer" to "gradual normalisation."Meanwhile, the BoC, having taken its overnight rate down to 2.25%, is near the end of its easing cycle. If inflation in both economies keeps moderating, the interest rate differential could begin to narrow in early 2026, giving the Canadian dollar some room to recover.

Short-term moves still depend heavily on risk sentiment and oil prices. Episodes of global volatility or renewed tariff concerns tend to lift USD/CAD, while firmer crude prices or improving trade flows give the loonie a boost.

Overall, USD to CAD predictions say the pair will stay in a moderate range for the rest of 2025, with a mild bias lower into early 2026 as the US economy cools and the Fed’s easing path gains traction.

Will the Canadian dollar go up in 2025? The Canadian dollar could strengthen modestly later in 2025 as US rate cuts narrow the policy gap, though overall gains may stay limited until global trade and commodity conditions improve.

US Dollar/Canadian Dollar Forecasts for 2025

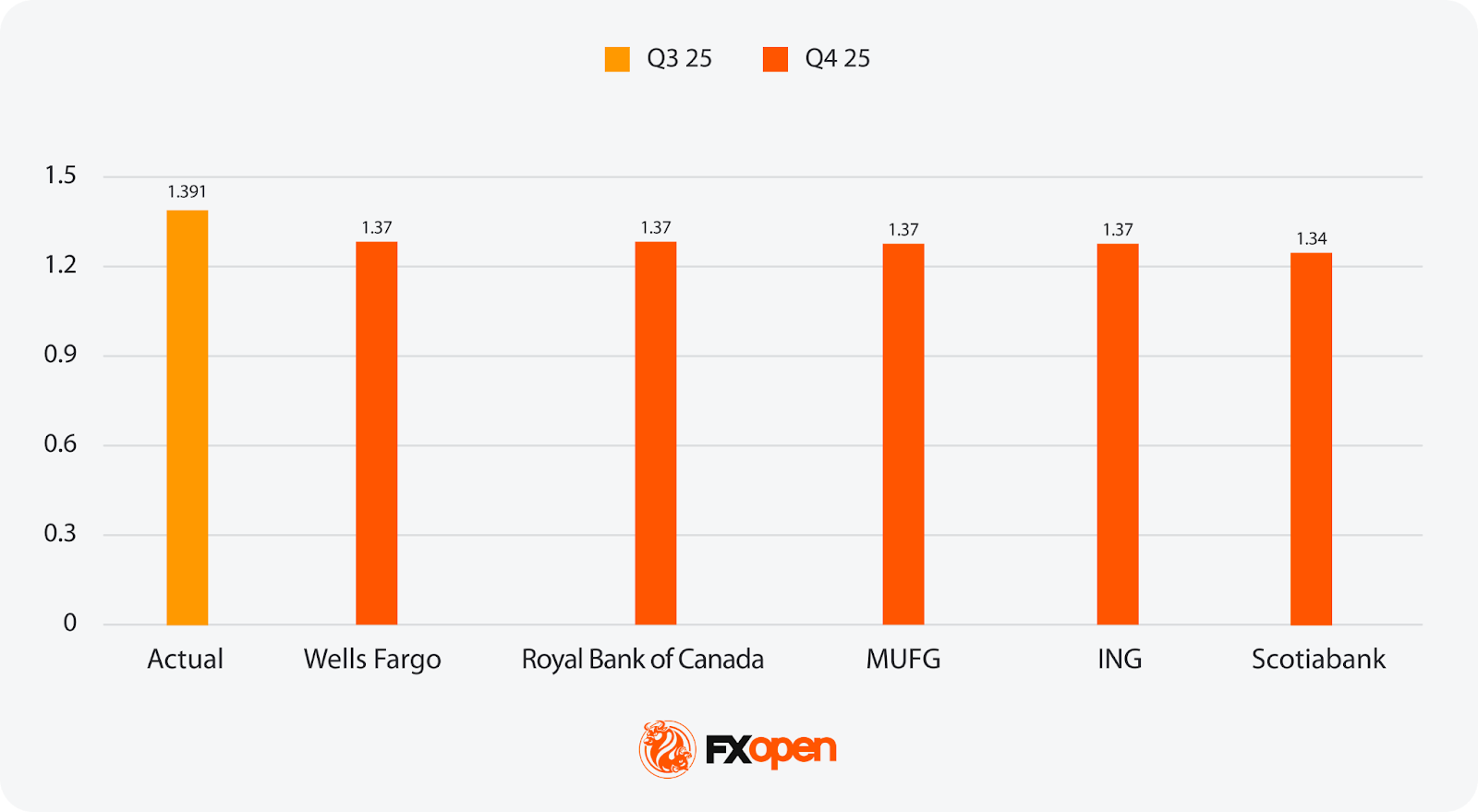

Bank-Based

Q4 2025:

- Most Bullish Bank Projection: 1.37 (Wells Fargo, Royal Bank of Canada, MUFG, ING) )

- Most Bearish Bank Projection: 1.34 (Scotiabank)

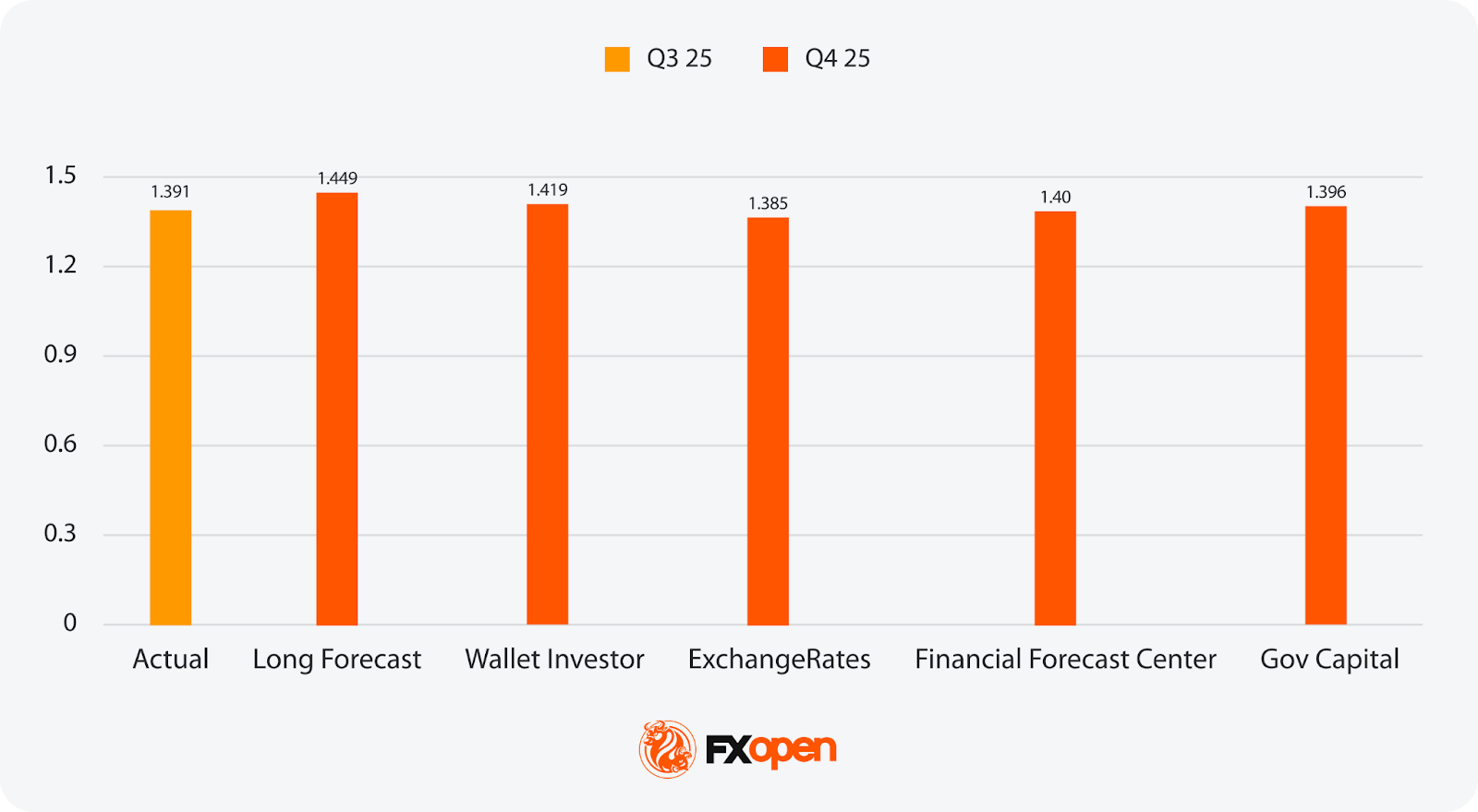

Algorithm-Based

Q4 2025:

- Most Bullish Algorithm-Based Projection: 1.449 (Long Forecast)

- Most Bearish Algorithm-Based Projection: 1.385 (ExchangeRates)

Analysts and algorithmic models project that the USD/CAD exchange rate may fluctuate within a wide range of 1.34 to 1.45 in the Q4 2025. Such variability reflects the complex trade relations between the United States and Canada, as well as the relatively weak position of the US dollar. Given these factors, setting more precise forecasts remains challenging.

Analytical USD to CAD Forecasts for 2026 and Beyond

Heading into 2026, the USD to Canadian dollar prospect starts to look more balanced as the rate gap between the Federal Reserve and the Bank of Canada narrows. Both central banks are expected to reach neutral territory—around 3.0% for the Fed and 2.25% for the BoC, according to the OECD’s long-term projections. This gradual convergence means the yield advantage that’s supported the US dollar through 2024–2025 should fade over time, opening the door for a modest recovery in the Canadian dollar.

By early 2026, traders could begin to see USD/CAD drift lower as US rate cuts gain pace and Canada’s easing cycle ends. The BoC is seen as unlikely to push policy much further, given the risk of reigniting housing demand and inflation pressures, while the Fed still has more room to trim rates as US growth cools. In this environment, Canada’s currency should find firmer footing, especially if global demand stabilises and oil prices recover.

Longer-term, TD Economics expects Canada’s real GDP growth to be below trend in 2026 at 1.1% before picking up to around 1.7%-1.8% throughout the rest of the decade, supported by steady immigration and easier financing conditions. Over the same period, real GDP growth in the US is expected to hover between 1.8%-2.2%, leaving little divergence in growth potential. That balance suggests USD/CAD could settle back toward the mid-1.30s range over the next few years.

Still, several structural factors will shape how that plays out. Energy transition policies, the 2026 USMCA review, and ongoing productivity differences between the two economies all carry weight. If trade relations normalise and Canada manages to lift productivity, the loonie could strengthen further. But renewed global uncertainty could keep USD demand intact.

In short, USD to Canadian dollar projections for 2026 look more even—a slow return to equilibrium where fundamentals, not rate gaps, drive USD/CAD direction. However, projections for 2027 and beyond look more favourable for the US dollar.

Will the Canadian dollar get stronger in 2026? The Canadian dollar is expected to firm gradually in 2026 as interest rate differentials shrink and global demand steadies, though gains will likely remain moderate and data-dependent.

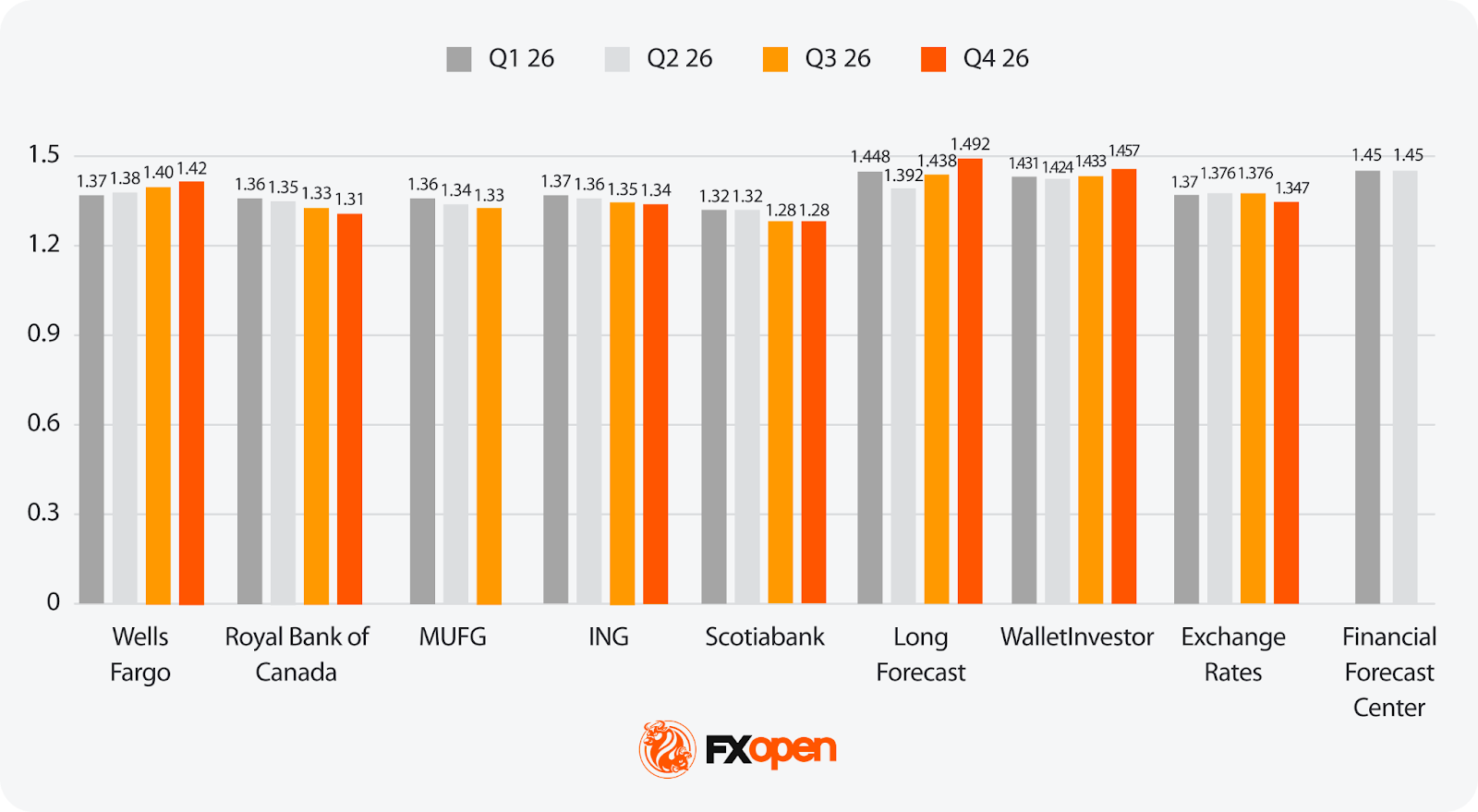

USD/CAD Forecasts for 2026

Q1 2026:

- Most Bullish Projection: 1.448 (Long Forecast)

- Most Bearish Projection: 1.32 (Scotiabank)

Q2 2026:

- Most Bullish Projection: 1.45 (Financial Forecast Center)

- Most Bearish Projection: 1.32 (Scotiabank)

Q3 2026:

- Most Bullish Projection: 1.438 (Long Forecast)

- Most Bearish Projection: 1.28 (Scotiabank)

Q4 2026:

- Most Bullish Projection: 1.492 (Long Forecast)

- Most Bearish Projection: 1.28 (Scotiabank Rates)

According to several market sources, the USD/CAD rate could move between 1.28 and 1.45 in 2026 — an even broader range compared to Q4 2025. Elevated market uncertainty, the unpredictable policy direction of US President Donald Trump, potential domestic economic pressures, and ongoing trade and geopolitical tensions all contribute to this volatility.

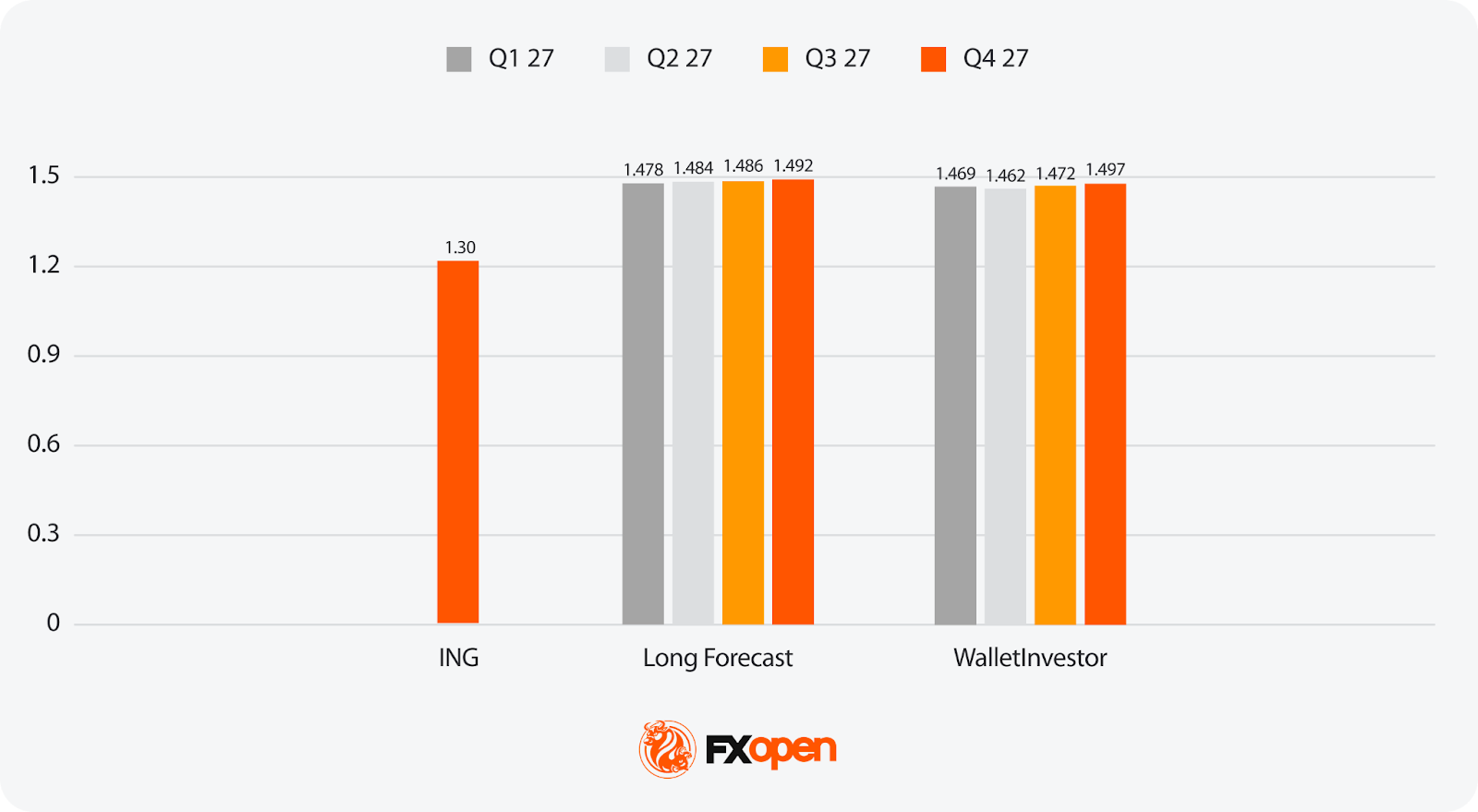

USD/CAD Forecasts for 2027

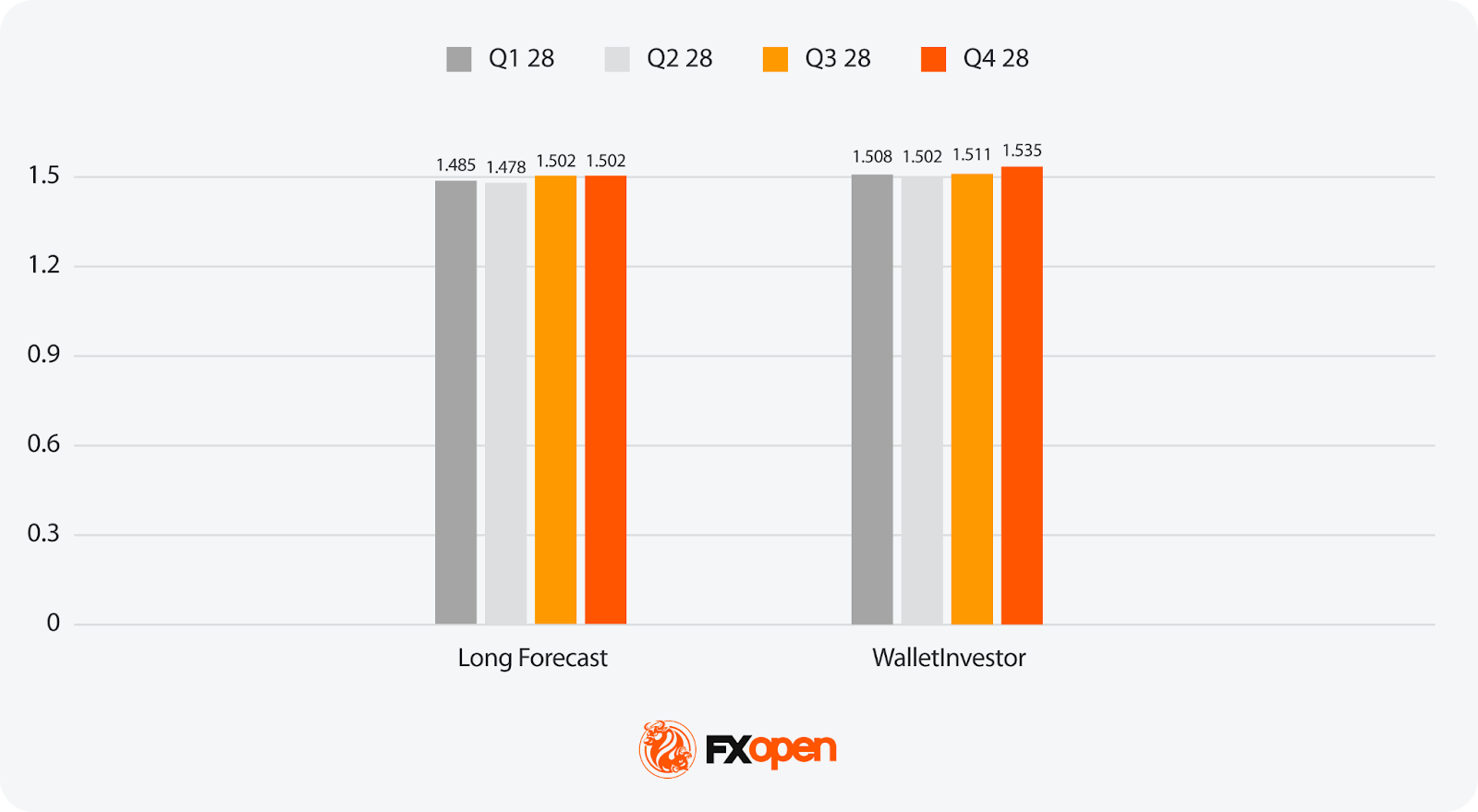

USD/CAD Forecasts for 2028

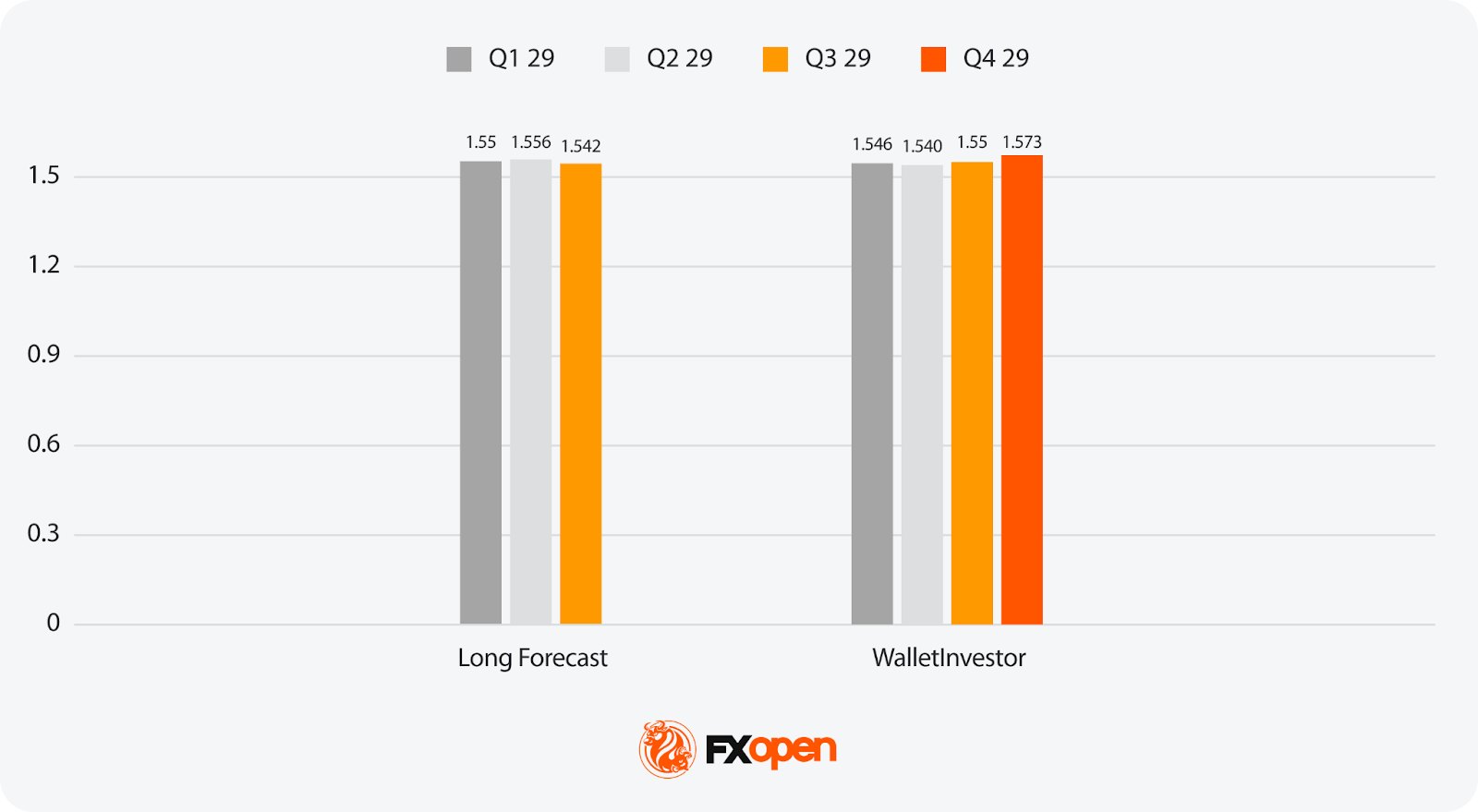

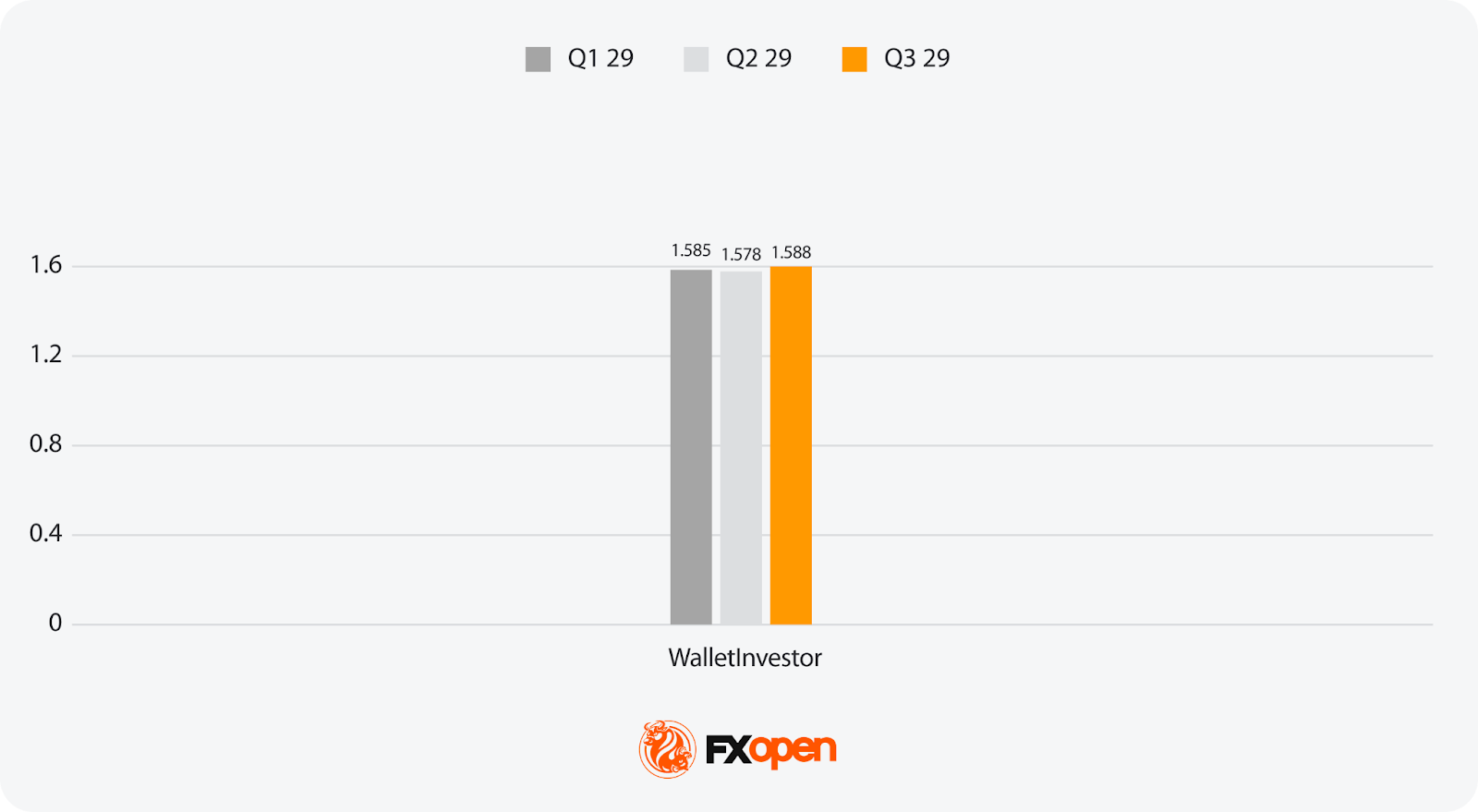

USD/CAD Forecasts for 2029

USD/CAD Forecasts for 2030

By 2030, the USD/CAD exchange rate could rise to 1.60, a level not seen since 2002. Analysts attribute this potential surge to the weakening fundamentals of the Canadian dollar, including possible structural economic challenges and declining competitiveness. These factors lead market experts to forecast a continued strengthening of the US dollar against the Canadian dollar over the long term.

General Factors Influencing the USD/CAD Pair

The US Dollar/Canadian Dollar pair is influenced by a variety of factors ranging from economic indicators to geopolitical events. Here are some elements that traders and investors consider when analysing the potential movements of USD/CAD:

- Commodity Prices: As a commodity-driven economy, Canada's currency often fluctuates with changes in the prices of key exports, notably oil. Higher commodity prices typically boost the CAD.

- Interest Rate Differentials: The difference in interest rates set by the Bank of Canada and other major central banks, particularly the Federal Reserve, significantly affects the CAD. Rate hikes typically strengthen the CAD, while cuts can weaken it.

- Trade Relationships: The US is Canada's largest trading partner. Thus, trade policies and economic health between these two nations can heavily impact the pair’s value.

- Geopolitical Events: Global uncertainties, including geopolitical conflicts or economic crises, can cause fluctuations in USD/CAD as investors seek so-called refuge in the US dollar.

- Economic Indicators: Domestic economic performance, including GDP growth, employment rates, and inflation, plays a crucial role in shaping the strength of domestic currencies.

The Bottom Line

These USD to CAD forecasts point to a more balanced landscape ahead. As the rate gap narrows and global demand steadies, the loonie has room to regain ground while the dollar’s dominance gradually fades, but the picture remains uncertain. Traders following these shifts can stay ahead of market turns and adapt their strategies. To access advanced tools and real-time currency markets, consider opening an FXOpen account.

FAQ

Will the Canadian Dollar Get Stronger in 2025?

Analytical CAD forecasts expect the Canadian dollar to stay under modest pressure through late 2025 as the US retains a rate advantage. However, with inflation near target and the Bank of Canada nearing the end of its cuts, the loonie could strengthen into early 2026.

Will the Canadian Dollar Get Stronger in the Future?

Analysts project that the Canadian dollar may strengthen in 2026, given that the Bank of Canada will end its rate-cutting cycle. However, US economic outperformance over the remainder of the decade could cause CAD to decline relative to the US dollar.

What Will Be the US Dollar to Canadian Dollar Exchange Rate in 2026?

US dollar to Canadian dollar predictions say the pair will gradually trend lower in 2026 as the Fed cuts rates more aggressively and the yield gap with Canada narrows. The pair is projected to stay around the mid-1.30s if growth and inflation remain aligned.

What Is the Canadian Dollar Forecast for the Next 5 Years?

Over the next five years, the Canadian Dollar may see varying strength as it responds to shifts in commodity prices, trade dynamics, and domestic economic policies.

Will CAD Ever Be Equal to USD?

Given the current analytical forecasts and the fundamental differences between the two economies, it is highly unlikely that the CAD will reach parity with the USD in the foreseeable future.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.