FXOpen

The trading year ends in a couple of weeks from now, and everyone is planning for the holiday season. December, traditionally, is a short month for traders as markets slow down in the second half of the month.

As such, it is the best time to review what happened throughout the year, what moved financial markets, and what might happen in the period ahead.

Meta Platforms’ stock price dived in February

The year started with the US stocks at all-time highs. Investors’ optimism continued into the next year despite inflation starting to show its teeth in developed economies.

But in February, the first warning sign appeared that the year would not be easy for stock market investors. The tech sector especially looked vulnerable as Meta Platforms, the parent of Facebook, plunged 26% on missing earnings.

In one single day, it wiped $230 billion of its market capitalization, triggering a bearish movement in the tech sector.

Russia Invaded Ukraine

At the end of February, the world discovered in shock that Russia had invaded its neighboring country, Ukraine. War on the outskirts of Europe is something that few envisioned at the start of the year.

Moreover, the implications of a prolonged conflict in Europe have started to move markets. As a result of the invasion, oil traded above $100/barrel for the first time since 2014.

Furthermore, Western nations imposed sanctions on Russia, but those sanctions also affected the European economies. With inflation rising, a war in Eastern Europe was another reason to worry for the European Central Bank and the common currency.

USD/JPY Bullish Breakout

One of the most surprising things in the currency market happened after Russia’s invasion of Ukraine in February. Up until that point, the Japanese yen acted like a safe-haven currency.

That means that investors bought the currency when uncertainty hit markets and sold it in good times. But that changed abruptly, as shown by the USD/JPY currency pair.

A major bullish breakout followed an ascending triangle pattern. After closing above 116, the market kept moving higher and higher in what turned out to be a strong bullish trend.

One thing led to another, and the pair traded as high as 152 before correcting recently. It only stopped rising because the Bank of Japan had intervened in the market by selling US dollars and buying Japanese yen.

It did so twice – once at 146 and the second time when the USD/JPY was trading above 150. But the bullish breakout happened when the market closed above 116 for the first time as the correlation with any other financial market ended then.

Federal Reserve Delivers the Biggest Rate Hike Since 2000

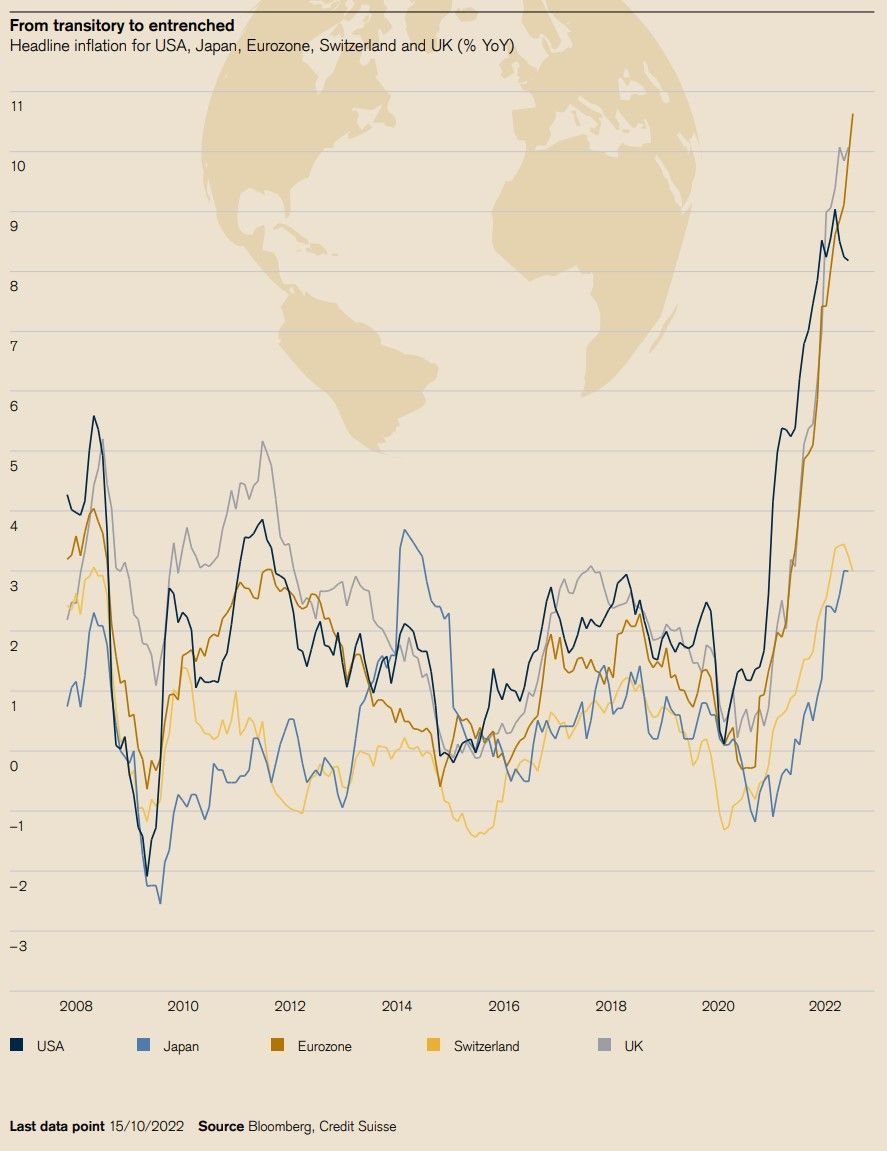

2022 was a year when inflation put pressure on economies and financial markets. As such, central banks were forced to react to prices of goods and services reaching four-decade highs in the United States.

Because the United States exports inflation to its trading partners, it quickly became a global phenomenon.

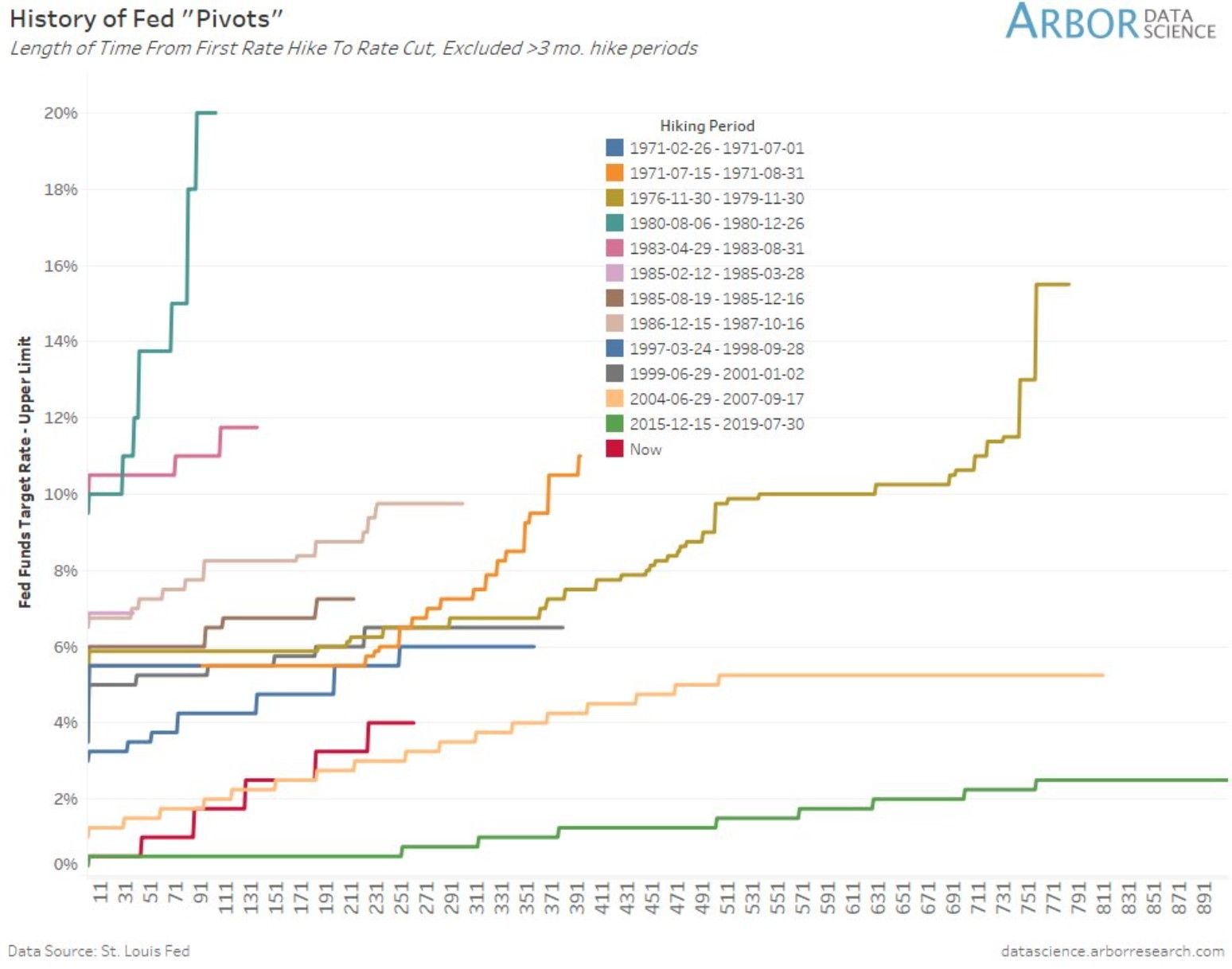

When the Federal Reserve started to raise rates, no one expected that it would keep hiking at such a fast pace as it did. In May, the Fed launched the biggest rate hike since 2000 – a 50b rate hike.

But it was not done.

The Fed delivered three consecutive 75bp rate hikes in the following three meetings. All this time, stocks suffered, and the US dollar kept rallying against its peers.

Inflation kept rising; in September, the US inflation report put US stocks under severe pressure.

Stocks dropped the most since June 2020 after inflation surprised to the upside in September. It forced the Fed to deliver a 75 bp rate hike at its September meeting, and from that moment on, the focus turned to when and if the Fed would pivot and end up the tightening cycle.

The UK Mini-Budget Sent the Pound Lower in September

Still, in September, the UK markets were taken by surprise by the announcement of the UK mini-budget. The budget was supposed to increase the deficit significantly, and financial markets responded by selling the pound and selling gilts too.

As a result, the pound dropped against the US dollar to levels not seen since 1985. The selling was so aggressive and pronounced that it triggered similar US dollar strength across the board.

Eventually, a new Prime Minister arrived, and the budget was scrapped. The pound quickly bounced from the lows and the local markets stabilized.

EUR/USD Dropped Below Parity

One of the major events in financial markets in 2022 happened in the FX market. The EUR/USD, the main currency pair on the FX dashboard, dropped below parity during the summer months.

Parity is the level where one euro equals one dollar. The pair dropped below 0.96, to the delight of US tourists visiting Europe in the summer months.

However, the EUR/USD only found buyers below parity. It bottomed in October, together with the US equity market, and then rallied.

US Midterm Elections Were a Concern

The midterm elections in the United States concerned financial market participants in 2022. Held in November, they could have potentially influenced the stock market and the US dollar if the Republicans had won more seats in the House and Senate.

As it turned out, they did not, and the result only sealed the bottom for stocks in October.

US Stocks Bottomed in October But Remain Negative on the Year

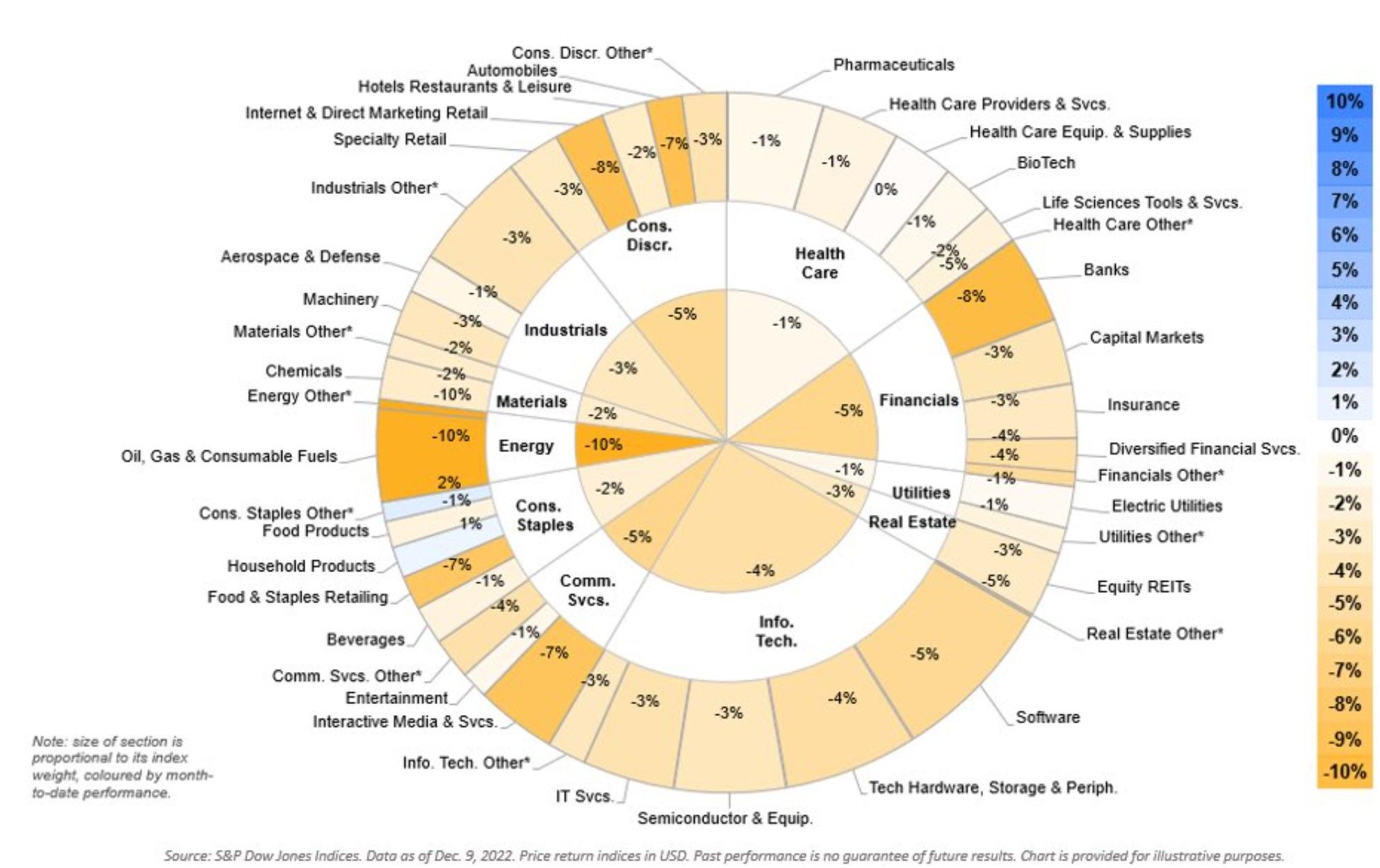

2022 was a tough year for stock market investors. The Fed’s aggressive tightening cycle and the strength of the US dollar led the major US indices lower.

By October, the main indices were down double-digit numbers.

But stocks bounced back sharply as the November inflation report showed that the prices of goods and services in the United States cooled off. While remaining elevated, inflation likely peaked – a fact confirmed by the December US inflation report too.

As such, stocks rallied in anticipation of a Fed pivot. Sure enough, the Fed will keep tightening as inflation remains well above its desired target.

However, the slowdown in the pace of the Fed rate hikes triggered a rally in the stock market and a broad US dollar selloff.

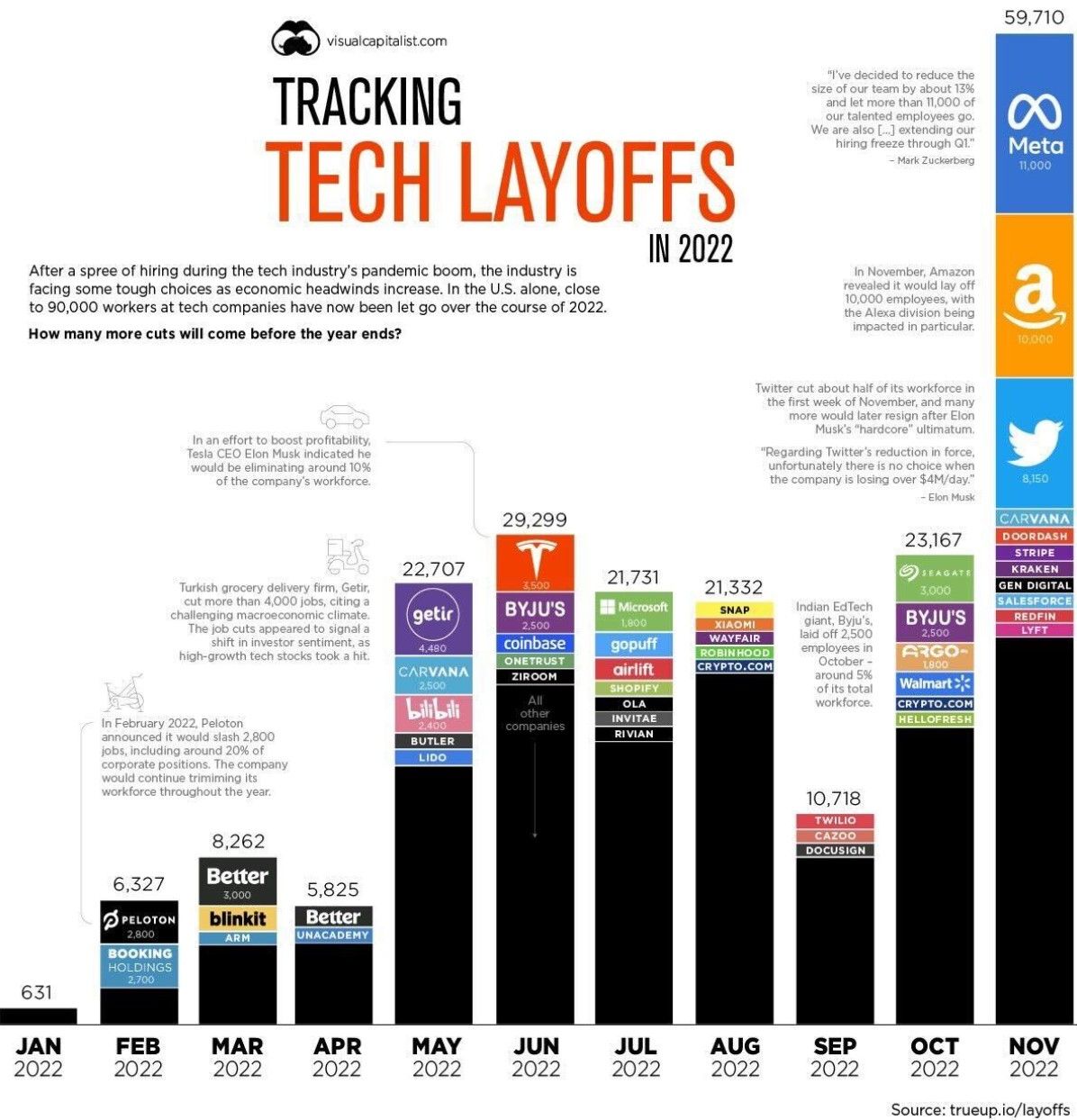

US Tech Sector Announced Major Layoffs in November

Everybody watches the US economy in order to anticipate the shape of the global economy. An economic recession is expected in the euro area in 2023, and when the major US tech sector players announced massive layoffs in November, markets worried.

Meta Platforms announced that it would reduce the size of its team by about 13%. Moreover, Amazon announced that it would lay off 10,000 employees. Furthermore, Twitter fired half of its workforce in November.

This was a dominant theme in 2022, amplified in the months following summer. Because the Fed has a dual mandate of price stability and job creation, if the trend continues in the months ahead, it may lead to a change in the Fed’s monetary policy, with severe implications for financial markets.

To sum up, 2022 was a year where the US dollar’s strength dominated. As a result, the Fed embarked on a tightening cycle, one copied by other major central banks in the world, such as the European Central Bank, the Bank of England, and even the Swiss National Bank, which ended the era of negative rates in September.

But one central bank decided not to join the race of hiking rates – the Bank of Japan. The divergence between the Fed’s policy and the Bank of Japan led to one of the strongest trends of 2022, which was the rapid decline of the Japanese yen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.