FXOpen

The new trading year started only three weeks ago, and the US stock market has already gone down by more than 7%. A combination of mixed earnings, rising inflation, and fears of aggressive tightening from the Federal Reserve sent the leading US indices tumbling.

The earnings season started a couple of weeks ago, with the major players in the financial services industry reporting their last quarter’s financial performance. Some of the biggest names, like JPMorgan, Morgan Stanley, or Wells Fargo, reported mixed results, thus contributing to the negative stock market performance. Moreover, fears that the Fed will be more aggressive in tightening the monetary policy are also among the market selloff triggers.

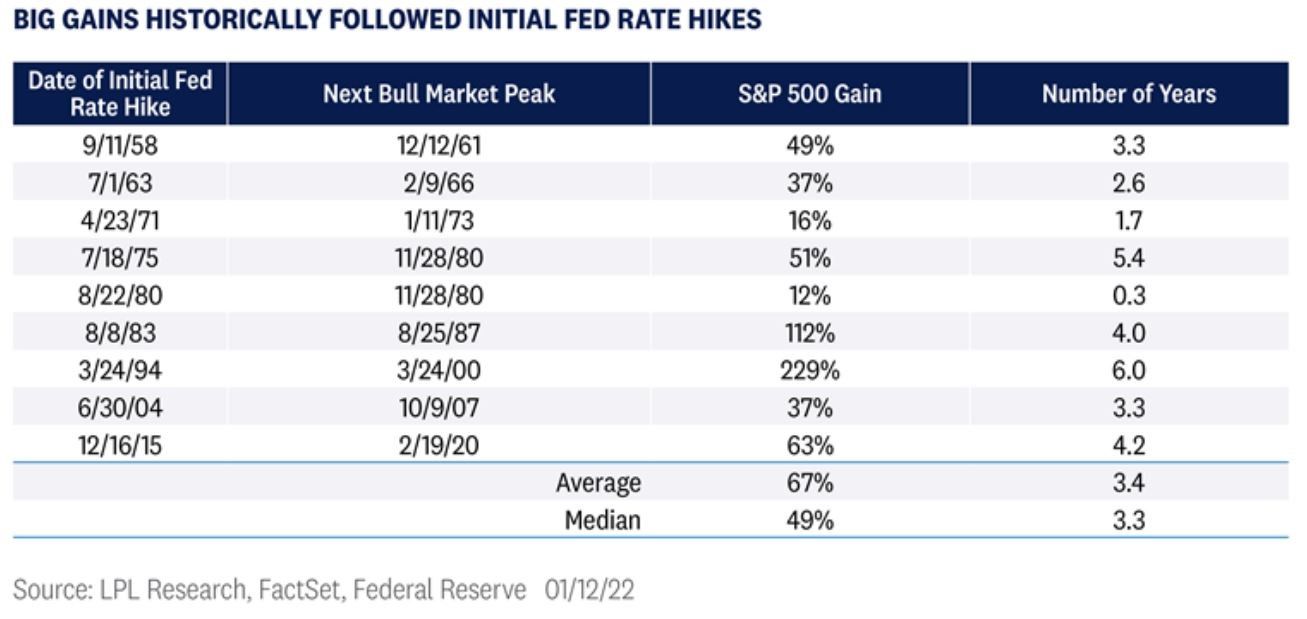

However, a quick look at historical data points to the fact that initial Fed rate hikes are usually followed by big gains. For instance, in June 2004, after the Fed raised the federal funds rate for the first time, the S&P 500 index gained 37% in the next 3 years.

Hence, the recent drops may be seen as an opportunity to accumulate stocks at lower prices. If that is the case, note that three important names are to report their quarterly earnings next week: Apple, Tesla, and Microsoft.

Apple, Tesla, Microsoft – among the big names reporting quarterly earnings

Apple made headlines recently as it became the first company to reach $3 trillion in market capitalization. They pay a hefty dividend, and one of their major shareholders is Berkshire Hathaway, Warren Buffett’s investment vehicle. Apple reports its quarterly earnings on January 27, and investors expect EPS of $1.88.

Tesla reports its quarterly earnings next Wednesday, January 26, the same day the Fed releases its FOMC Statement. The market expects EPS of $2.86 on the quarter, and the stock price closed last Friday below $1,000 after failing at $1,200, which provided stiff resistance.

Another company to monitor this week is Microsoft. It is scheduled to release its quarterly earnings on January 25, and investors expect EPS of $2.32 on the quarter.

All in all, the week ahead is full of market-moving events, from the Fed’s news to the companies reporting their quarterly earnings. As such, expect the financial markets’ volatility to increase significantly.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.