FXOpen

Cryptoсurrencies are known for their volatility. While that may put some traders off, it creates many potentially lucrative scalping opportunities for those with significant experience and who can react quickly. In this article, we’ll explore five top crypto scalping strategies and help you learn how to scalp crypto effectively with a simple framework.

What Does Scalping Mean in Crypto?

As in any other financial market, in cryptocurrency trading, scalping refers to a type of trading where traders aim to profit from short-term market movements. This approach involves entering and exiting trades within minutes, or even seconds, aiming to capitalise on small fluctuations in price.

Scalpers typically use high leverage and execute many trades to accumulate small profits over time. The objective is to make seemingly insignificant gains that add up rather than seeking larger, less frequent returns. Scalping is particularly popular in crypto trading, as digital assets are inherently volatile and experience extreme daily price changes.

How Easy is Scalping in the Cryptocurrency Market?

Compared to longer-term trading styles like swing or position trading, scalping requires more discipline, stronger risk management skills, and a solid understanding of market mechanics. As such, scalping is a more advanced technique and can be considered more complex than other styles. However, through practice, scalping crypto can become easier.

What Is the Best Time to Scalp Crypto?

While crypto markets are open 24/7, volumes often pick up during regular trading hours for other markets. Generally, the London and New York sessions, particularly their overlaps, are the most active, with plenty of volume and volatility for scalpers to take advantage of.

In terms of timeframes, scalping is usually done on the 1, 2, or 3-minute charts. 5-minute and 15-minute charts are often used to help set a directional bias.

Pros and Cons of Scalp Trading Cryptocurrency

Scalp trading in the cryptocurrency market has its advantages and disadvantages. Let’s examine some of the most notable pros and cons.

Pros:

- Frequent Opportunities: The volatility of crypto can present more scalping opportunities compared with other assets, boosting the potential profits a scalper can make.

- Lower Risk: The frequent in-out nature of scalping means that scalpers have less exposure to adverse market events, like regulatory changes or macroeconomic events.

- Psychologically Easier: For some traders, scalping is preferable since it allows them to bank small profits. This can be easier psychologically since there’s no anxious wait to see if a trade hits a longer-term target.

Cons:

- Risk of Significant Losses: As mentioned, scalping requires discipline. Given the need for high leverage, poor risk management can wipe out a scalper’s account within a few trades if they aren’t strict with their strategy.

- Time-Consuming: Scalping requires constant monitoring of the market, which can be both time and energy-consuming. The ongoing need for quick decision-making may also be particularly draining for some traders.

- High Costs: The fees associated with frequent trading, like spreads and transaction costs, can eat into profits.

5 Cryptocurrency Scalping Strategies

Let’s dive into particular strategies.

Range Trading

Range trading is a popular strategy among crypto scalers. It involves identifying a specific consolidation range that an asset is likely to fluctuate within. Scalpers aim to buy at the lower end of the range (support) and sell at the upper bound (resistance).

To get started with range trading, traders first need to identify a ranging market on a low timeframe, like the 1 or 5-minute charts. Then, support and resistance levels near the highs and lows of the range are identified. These levels then serve as entry and exit points, with a trader entering at support looking to exit at resistance and vice versa.

Some will look for reversal candlestick patterns, like hammers or shooting stars, at support or resistance, respectively, before entering with a market order. Others will simply set limit orders at their chosen entry point.

Stop losses are typically placed beyond the range’s high or low, depending on the direction of trade. Scalpers usually use a 1:1 risk/reward ratio or don’t place stop-loss orders, but the latter is a highly risky approach.

Breakout Trading

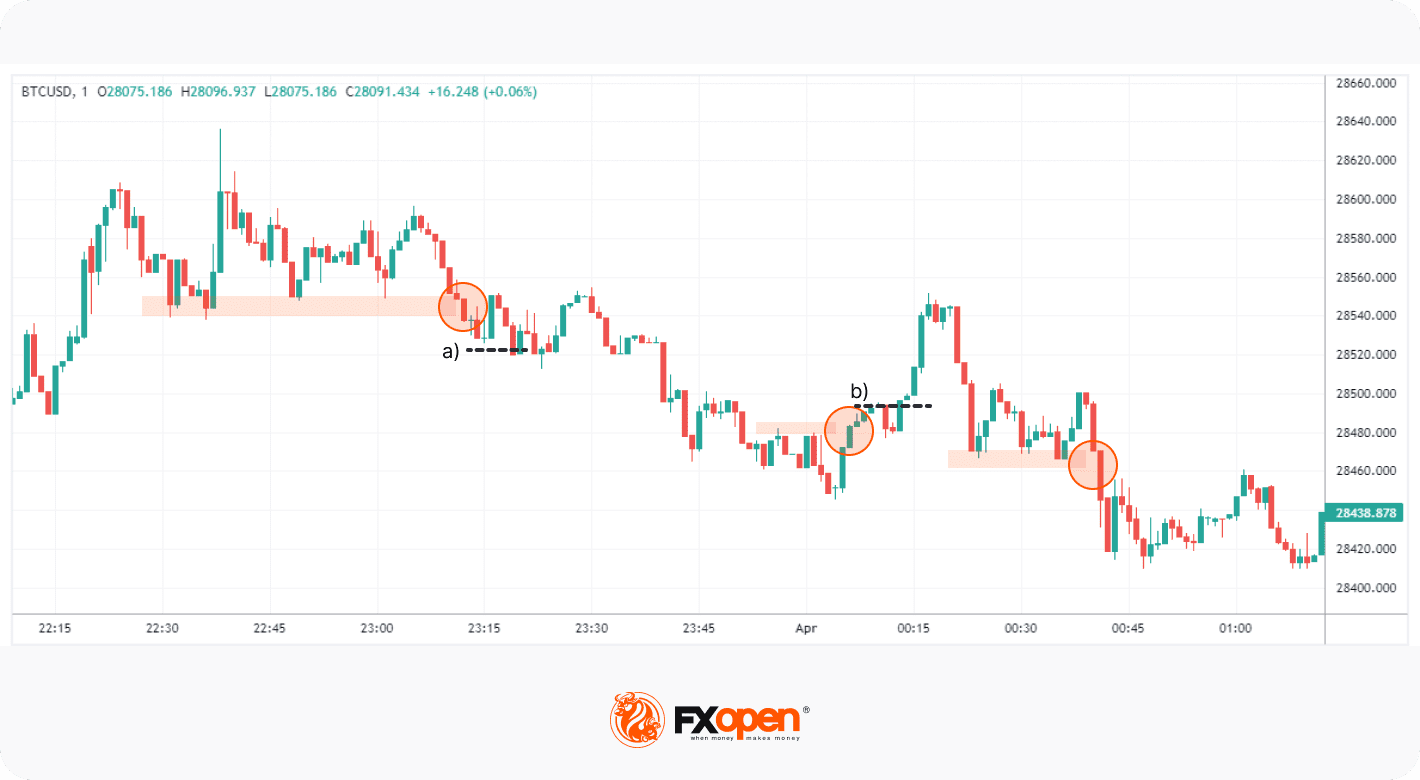

Breakouts occur when a level of support/resistance is broken through, often indicating the start or continuation of a trend. There are several ways you can take advantage of breakouts, but it’s not uncommon for a false breakout to occur. We can use a filter to increase our chances of success.

To start, we need to identify a support or resistance level. The easiest way is to look for relatively equal highs or lows forming, like in the chart above. When the level is broken with a strong impulsive move, we can enter on the close of the breakout candle. However, if the move isn’t particularly strong, like at a) and b), then we could wait for a pullback. Traders can place a stop order to enter as the pullback itself breaks out, as marked by the dotted lines.

Profits can be taken at an opposing support or resistance level. However, some scalpers may prefer to attempt to ride the trend and trail their stop loss above or below swing points as the move progresses. Similarly, stop losses can be placed above or below the nearest swing points.

Chart Patterns

Chart patterns can be a powerful tool for scalping, helping traders to identify potential trend continuations and reversals. While there are many different chart patterns out there, it’s best to stick to just one or two to avoid confusion, at least until you master their use. We’ll use rising and falling wedges in this example, as they often lead to strong moves.

There are two ways to enter: either on the breakout or on the retest of the broken trendline. As you can see in the example, entering retests might be a more accurate method, but it’ll mean you miss out on some trades. Conversely, entering on the breakout is riskier, as it could just as easily be a false breakout.

Your profit target and stop loss will depend on the pattern you’re using. Given that wedges typically prompt a prolonged trend, you could look for significant areas of support/resistance to start taking profits. For a more conservative approach, you might take profit at the most extreme point of the pattern. Likewise, stop losses can be set at the most extreme opposing point. For example, you may set a profit target at the high of a bullish wedge and a stop loss beneath its low.

Using the Relative Strength Index and Bollinger Bands

Some scalpers rely heavily on technical indicators to help them determine entries and exits. One popular combination is the relative strength index (RSI) and Bollinger Bands.

Relative Strength Index (RSI): The RSI measures the strength of price movements and can be used to identify overbought/oversold conditions and divergences. RSI can be particularly valuable for pinpointing short-term reversals.

Bollinger Bands: Bollinger Bands help traders identify periods of high or low volatility and potential price reversals using standard deviations. Scalpers often look to short when price reaches the upper band and go long when it touches the lower band.

When RSI crosses 70, indicating overbought conditions, or below 30, showing the asset is oversold, traders can look to confirm a reversal entry with Bollinger Bands. If an asset is overbought and crosses above the upper band, a short position can be considered. If the asset is oversold and price breaches the lower band, a long position could be entered.

As for exit conditions, some scalpers may prefer to take profits at the midpoint of the Bollinger Bands or the opposing band. Others take profit when RSI crosses above or below 50, depending on the direction of trade. In terms of stop losses, above or below a nearby area of support or resistance is often suitable. Alternatively, you could choose a set distance for each trade.

At FXOpen, we offer both of these indicators in our free TickTrader platform. There, you’ll also discover a whole host of additional indicators and tools ready to help you navigate the markets with confidence.

Bid-Ask Spread

The bid-ask spread refers to the gap between the maximum price a buyer can offer (bid) and the minimum price a seller can accept (ask) for a specific asset. Scalpers can take advantage of the bid-ask spread to generate quick profits.

When spreads are wide, traders place buy orders and sell orders simultaneously. They buy at the bid price and sell at the ask price, capturing the spread as profit. This strategy can be particularly effective in less liquid cryptocurrencies where spreads are naturally wider.

How to Create a Scalping Crypto Strategy

Now, it’s time to create your own scalping trading strategy for crypto! While your strategy will ultimately be unique to you and your preferences, you can try these steps to begin developing a system.

- Choose a Timeframe: Select a short timeframe that suits your trading style, such as 1-, 3-, or 5-minute, to base your trades on. Try to balance choosing one that allows you to capitalise on short-term movements while giving you enough time to think through your decisions.

- Identify Support and Resistance Levels: Use trendlines and horizontal levels to pinpoint potential entry and exit points. You can also look for psychological or dynamic levels if desired. Set a rule that you’ll only enter and exit at these levels to avoid impulsive decision-making.

- Employ Indicators: Use indicators like moving averages, RSI and Bollinger Bands to confirm your entries and exits. You can set specific criteria to help filter out potential losing trades, like only trading a resistance level when RSI is overbought.

- Develop a Risk Management Plan: Risk management is almost as important as your strategy itself. Use stop-loss orders, limit orders, and proper position sizing to manage potential losses and protect your capital. Set defined loss limits and rules for avoiding emotional decision-making.

- Test and Refine: Continuously backtest and optimise your strategy using past price action, and make adjustments as needed to improve its performance. It’s a good idea to keep a trading journal to record your trades and analyse your decision-making process.

Ready to Put Your Strategy to Work?

Of course, these steps aren’t exclusive to the crypto market. While scalping crypto may be preferable for some traders, you can also apply a similar strategy to the forex, commodities, and stock markets – you may just need to adjust it slightly to suit these markets.

Once you feel ready to deploy your strategy for real, you can open an FXOpen account to gain access to dozens of tradable assets in our advanced TickTrader platform. Or, if you want to practise before putting capital on the table, we also offer a free demo account that simulates live trading conditions. Happy trading!

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.