FXOpen

TRUMP coin sits at the intersection of politics, speculation, and crypto market psychology. Launched in early 2025 with direct ties to Donald Trump, the token has experienced extreme volatility, rapid hype cycles, and sharp reversals.

This article reviews TRUMP’s price history since launch, examines the key drivers shaping analytical TRUMP predictions from 2026 onward, and outlines the risks and catalysts that could define its longer-term trajectory.

Price History

TRUMP is a meme coin launched on 17th January 2025, endorsed by US President Donald Trump. Positioned as the "only official Trump meme," it features a cartoon image of the President and is built on the Solana blockchain.

Launch and Initial Surge (17-19 January 2025):

Upon its release, three days before Trump’s inauguration on 20th January, the coin was priced at approximately $7. Within two days, the price skyrocketed to an all-time high of $74.27 on 19th January (source: Coinbase). This rapid appreciation resulted in a market capitalisation exceeding $14.5 billion, making it one of the most valuable cryptocurrencies at that time.

The initial surge in value can be attributed to its association with the President and the speculative interest it generated among investors. It was also shortly followed by the MELANIA coin, a similar project based on Melania Trump.

Subsequent Decline and Volatility (20 January – Present):

Following its peak, the token began to sink on the 20th. By the 21st, the price had declined to a low of $31.61, a drop of more than 50% from its high. By 11th February, the meme cryptocurrency plunged to $15.3. One of the factors are trade tariffs President Donald Trump imposed on Mexico, Canada, and China, since crypto is about freedom to make and conduct trades.

Although the TRUMP coin briefly surged above $22.50 on 15th February, a sharp reversal soon followed. By 24th February, its price had dropped to $12.50. Another spike occurred on 2nd March after Mr. Trump announced five digital assets he plans to include in a proposed US crypto strategic reserve. Yet again, the speculative rally was short-lived and followed by another decline.

After trading near $7.50 in early April, TRUMP coin experienced a notable rally later that month. On 23–24 April, the token surged sharply as the project announced an exclusive dinner event for top holders, briefly lifting prices to around $14–$16 before pulling back into May’s volatility. This spike marked one of the few larger upticks following the spring downturn and underscored how community-driven events and exclusive perks continued to drive speculative interest. However, this bump proved short-lived as broader market dynamics and profit-taking weighed on the price throughout May and June.

From June, TRUMP traded mostly sideways within a $8–$11 range, reflecting weak sustained buying pressure and a shift in retail interest towards other meme coins and utility tokens. By September, the price had moderated further, with a drop to below $7 on 22nd September.

Into October, broader crypto market weakness and elevated memecoin fragility pushed TRUMP down towards its lowest levels since launch—near $3.8 on 10th October in intraday trading—before forming a rebound into November.

While a peak brought TRUMP back above $9.50 on 10th November, selling pressure quickly returned. With a lack of buyers and broader bearish sentiment hurting meme coins, TRUMP continued to fall, currently standing at $5.13 as of 19th December, 2025.

To track how the token has moved since its launch, you can check out the TRUMP CFD chart on FXOpen’s TickTrader trading platform.

Analytical TRUMP Coin Forecasts for 2026

2026 is where TRUMP coin might stop being “new” and start trading like a politically linked risk asset with identifiable catalysts. The pattern in 2025 was clear: TRUMP moved hardest when there was a concrete hook that tied token ownership to visibility, narrative, or momentum in the wider crypto tape.

Policy Momentum and “Headline Beta”

TRUMP’s upside in 2026 is still likely to be driven by Trump-led headlines that pull the whole crypto complex higher. A good example is November 2025, when crypto markets and TRUMP lifted after Trump floated a “tariff dividend” plan of at least $2,000, which fed straight into a risk-on narrative. In 2026, similar macro-policy headlines (trade, fiscal plans, executive actions on crypto) may act as fast catalysts for sentiment and liquidity, even if TRUMP itself is not directly referenced.

Promotional Catalysts and Narrative Engineering

TRUMP has already shown it can pump hard on event marketing. In late April 2025, it jumped more than 50% after an announcement offering a dinner invite for top holders, briefly trading around the mid-teens before fading. The 2026 implication is simple: if the team repeats token-gated promotions (access, perks, partnerships), traders will front-run them. If those promotions slow down or fail to land, attention can quickly fade.

Trump Media’s Finance Expansion as a Spillover Driver

Trump Media’s push into crypto finance could add tailwind by keeping Trump-adjacent crypto in the public eye. Reuters reported the launch of Truth.Fi with up to $250m allocated towards "exchange-traded funds, separately managed accounts (SMAs), Bitcoin, and other cryptocurrencies." Even without direct TRUMP integration, that kind of infrastructure narrative can support speculative flows into Trump-branded tokens in 2026, especially during broader market rallies.

Supply and Unlock Optics

2026 is also when supply dynamics matter more. As circulating supply expands via scheduled unlocks, the market will increasingly trade “unlock risk” as an event. Even in bull conditions, those dates can create sell pressure, volatility spikes, and whipsaw price action.

TRUMP Coin Price Predictions for 2026

Minimum 2026:

- Most Bullish Projection: 10.43 (Cryptopolitan)

- Most Bearish Projection: 1.77 (CoinDataFlow)

Average 2026:

- Most Bullish Projection: 13.34 (Cryptopolitan)

- Most Bearish Projection: 7.10 (Coinpedia)

Maximum 2026:

- Most Bullish Projection: 16.59 (Cryptopolitan)

- Most Bearish Projection: 5.41 (CoinDataFlow)

Analytical Outlook for 2027 and Beyond

By 2027, TRUMP coin is less about whether it can recapture early hype and more about whether it can survive the reputational, legal, and market-structure risks that come with being a politically branded asset tied to a sitting President. If 2026 is about adoption and adjustment, 2027 onward is expected to be about endurance.

Ethics Scrutiny, Investigations, and “Influence-for-Tokens” Optics

TRUMP’s dinner mechanics set a precedent that regulators, lawmakers, and watchdogs can keep pulling on. Reuters notes that buyers spent an estimated $148 million to secure access to a May 22 dinner for top holders.

That sort of “pay-to-be-close” structure invites ongoing scrutiny over transparency and foreign influence, especially given reporting that a large share of top holders were outside the US. Democratic lawmakers publicly attacked the dinner as "pay-to-play politics on steroids" and demanded attendee details and explanations of what was being offered. If investigations or new ethics rules land, TRUMP becomes a headline risk asset again - but not in a good way.

Holder Concentration and Insider Incentives

A structural overhang is the perception that TRUMP is engineered to benefit insiders and whales. Reuters reported the project generated nearly $100 million in trading fees, and Chainalysis data suggested many smaller wallets lost money while large holders experienced very strong performance. Even without fresh token unlocks being the focus, that narrative can cap demand from new participants who fear they are exit liquidity.

Regulatory Blowback Risk From Politicisation

By 2027, the bigger risk may be that TRUMP makes crypto regulation messier, not easier. Recent commentary from Cardano founder Charles Hoskinson argues Trump’s crypto ventures and memecoin launch have politicised the regulatory debate and handed industry critics an easy win, saying "The minute that Trump coin got launched, it went from ‘crypto is bipartisan’ to ‘crypto equals Trump equals bad, equals corruption."

If TRUMP becomes a symbol in that fight, it could become an easy target for restrictive proposals aimed at politically affiliated tokens, disclosures, or marketing practices.

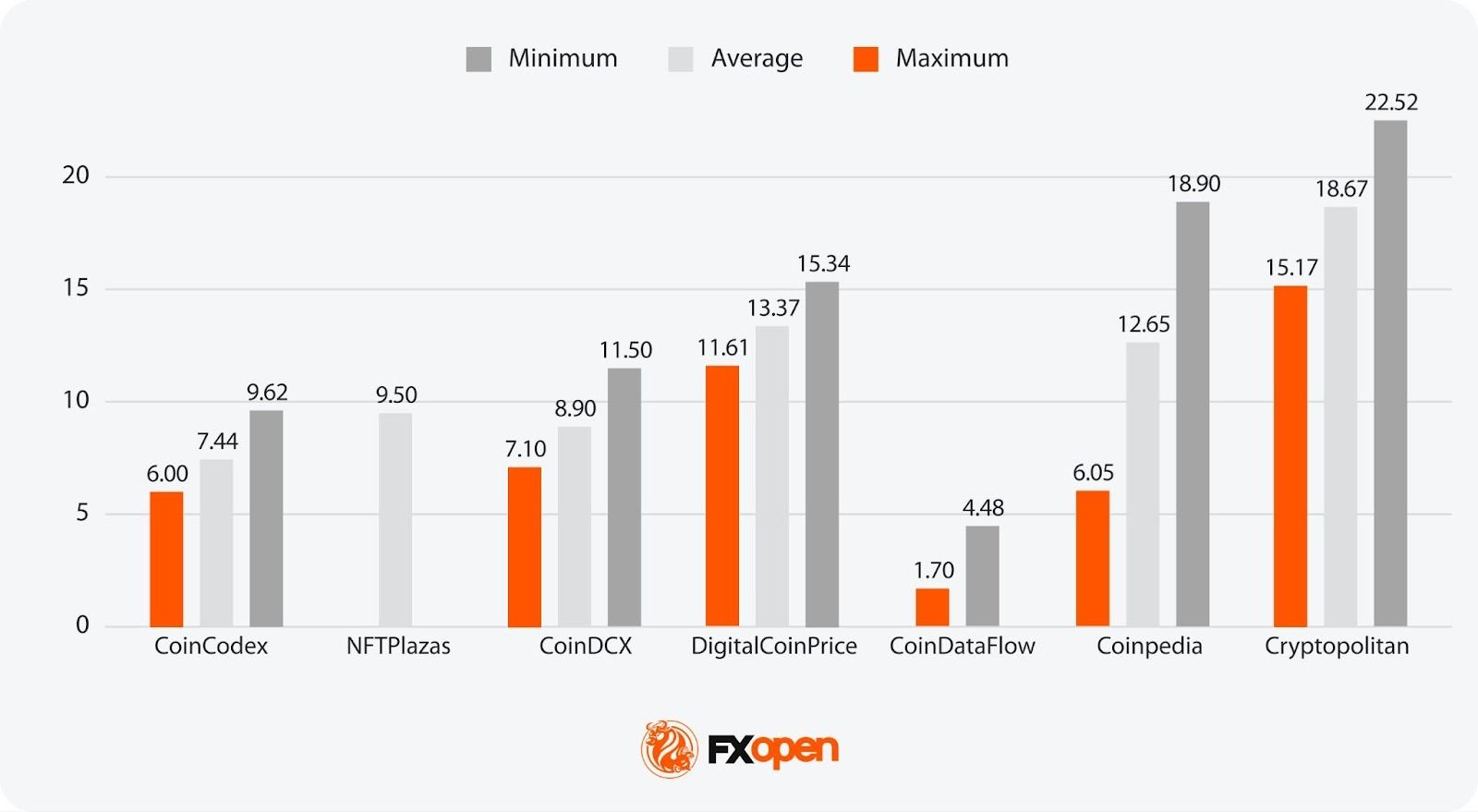

TRUMP Coin Price Predictions for 2027

Minimum 2027:

- Most Bullish Projection: 15.17 (Cryptopolitan)

- Most Bearish Projection: 1.70 (CoinDataFlow)

Average 2027:

- Most Bullish Projection: 18.67 (Cryptopolitan)

- Most Bearish Projection: 7.44 (CoinCodex)

Maximum 2027:

- Most Bullish Projection: 22.52 (Cryptopolitan)

- Most Bearish Projection: 4.48 (CoinDataFlow)

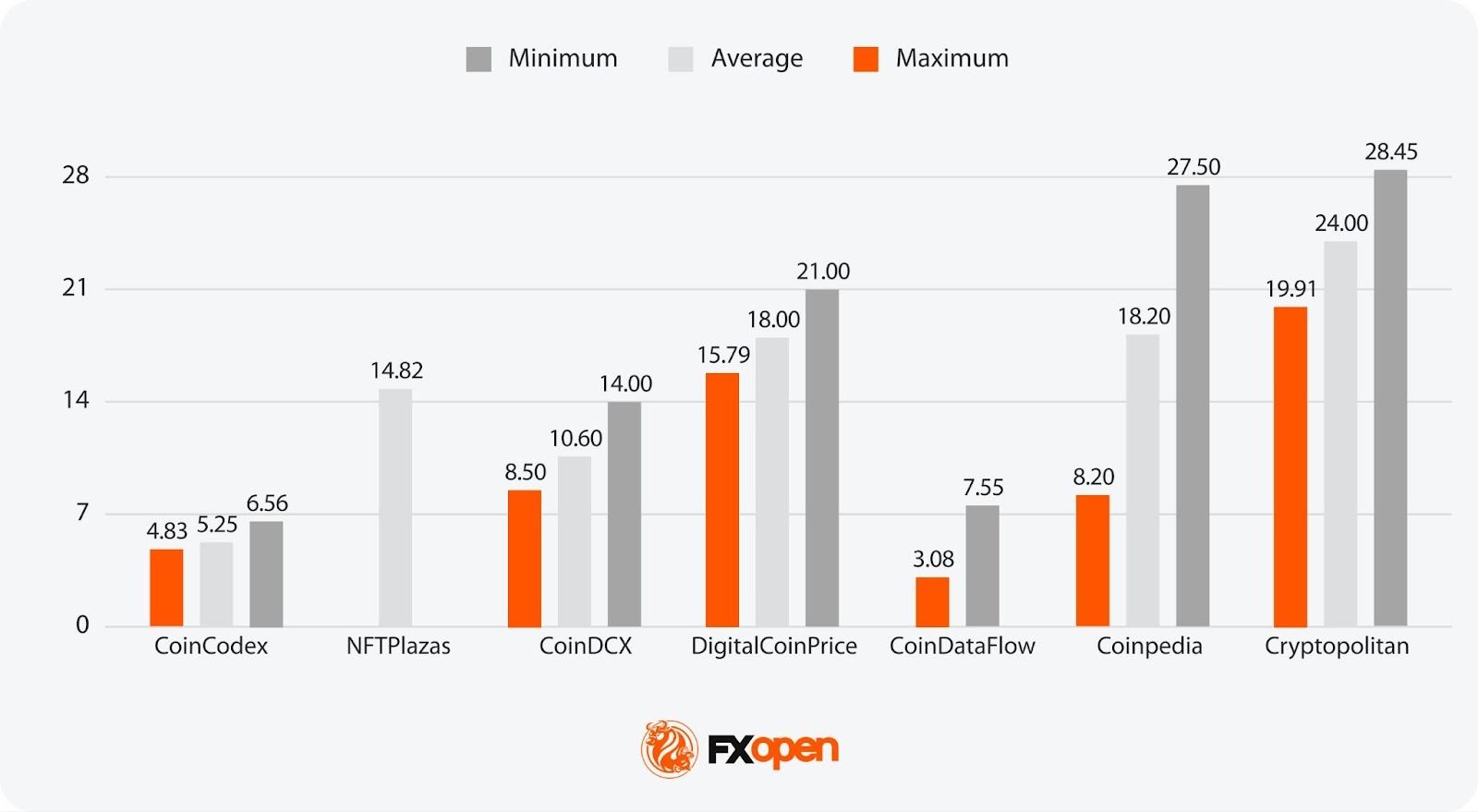

TRUMP Coin Price Predictions for 2028

Minimum 2028:

- Most Bullish Projection: 19.91 (Cryptopolitan)

- Most Bearish Projection: 3.08 (CoinDataFlow)

Average 2028:

- Most Bullish Projection: 24.00 (Cryptopolitan)

- Most Bearish Projection: 5.25 (CoinCodex)

Maximum 2028:

- Most Bullish Projection: 28.45 (Cryptopolitan)

- Most Bearish Projection: 6.56 (CoinCodex)

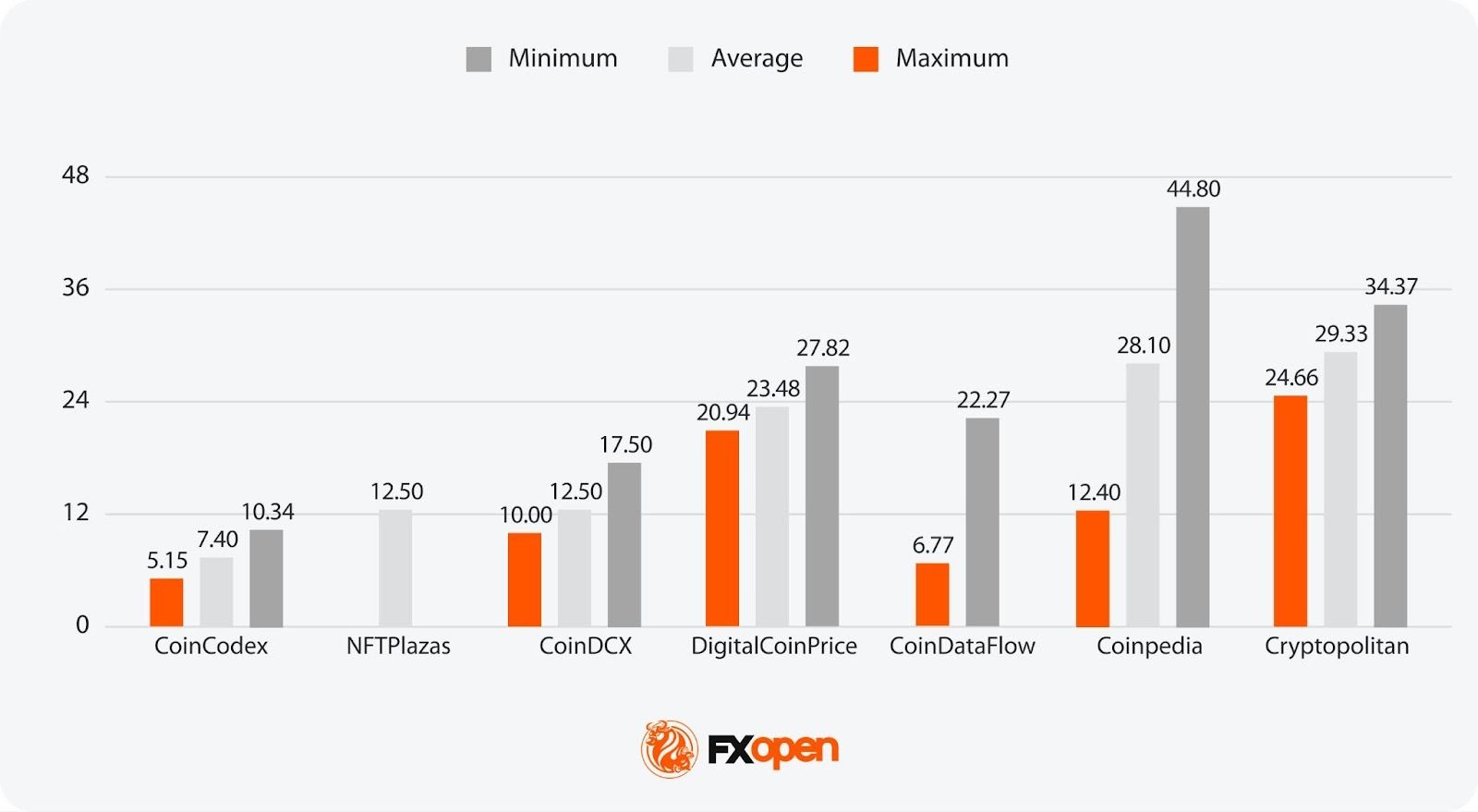

TRUMP Coin Price Predictions for 2029

Minimum 2029:

- Most Bullish Projection: 24.66 (Cryptopolitan)

- Most Bearish Projection: 5.15 (CoinCodex)

Average 2029:

- Most Bullish Projection: 29.33 (Cryptopolitan)

- Most Bearish Projection: 7.40 (CoinCodex)

Maximum 2029:

- Most Bullish Projection: 44.80 (Coinpedia)

- Most Bearish Projection: 10.34 (CoinCodex)

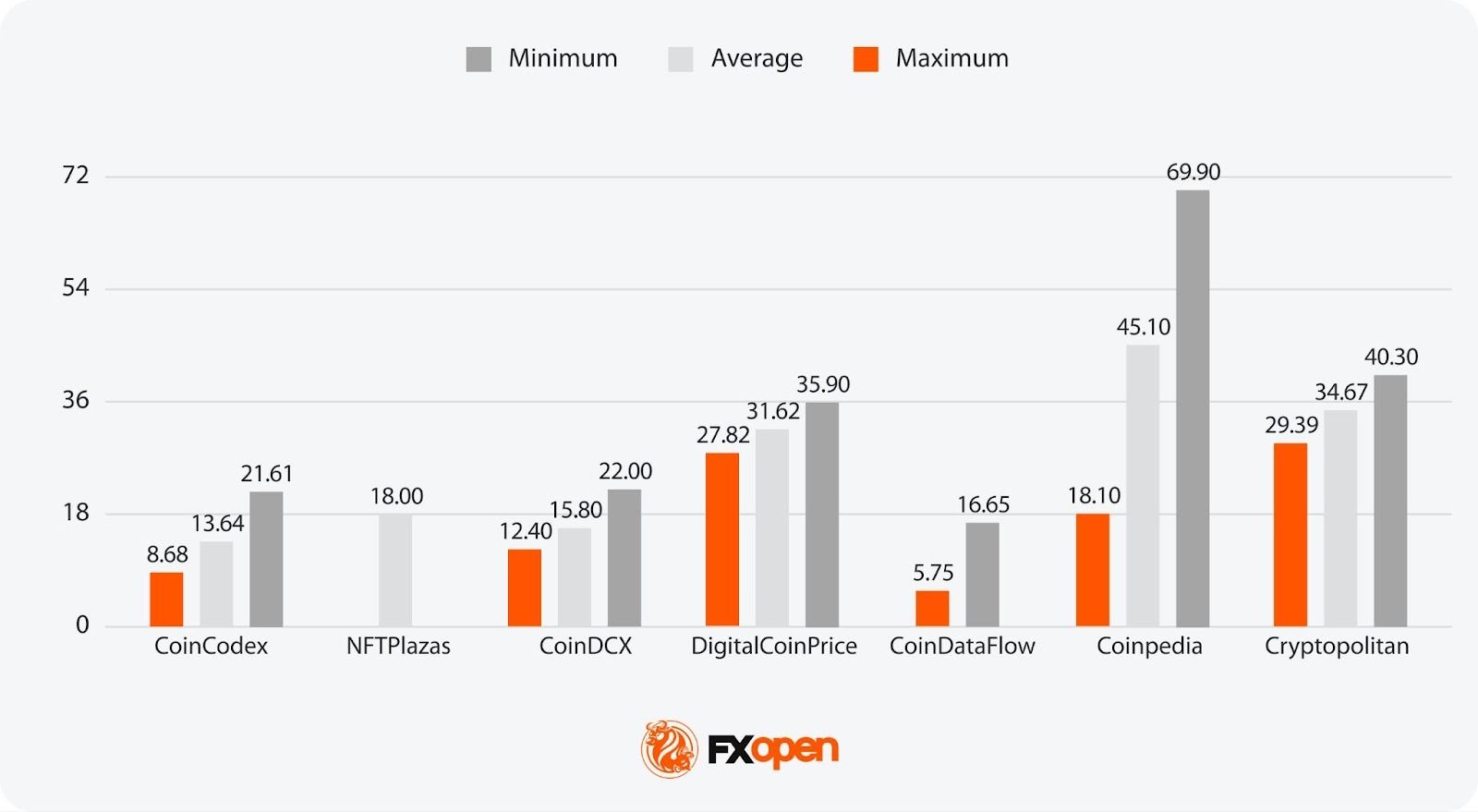

TRUMP Coin Price Predictions for 2030

Minimum 2030:

- Most Bullish Projection: 29.39 (Cryptopolitan)

- Most Bearish Projection: 5.75 (CoinDataFlow)

Average 2030:

- Most Bullish Projection: 45.10 (Coinpedia)

- Most Bearish Projection: 13.64 (CoinCodex)

Maximum 2030:

- Most Bullish Projection: 69.90 (Coinpedia)

- Most Bearish Projection: 16.65 (CoinDataFlow)

TRUMP Coin Forecasts for 2035 and Beyond

TRUMP predictions for 2035 and beyond are rare, but there is some speculation about the TRUMP coin’s future:

1. 2040:

- CoinCodex: $32

2. 2050:

- CoinCodex: $112

- CoinLore: $270

Analytical Forecast Summary

2026

Forecasts range from roughly $1.77 to $16.59, with most averages clustering around $7–$10. Price action is expected to remain volatile, driven by token unlocks, sentiment shifts, and Trump-linked catalysts.

2027

Estimates span approximately $1.70 to $22.52, reflecting wide uncertainty. Many projections centre near $9–$13, suggesting modest growth if relevance holds, but downside risk remains elevated without sustained demand.

2028

Predictions broaden to around $3.08 to $28.45, with averages typically in the mid-teens. Outlooks diverge sharply, highlighting uncertainty around long-term utility versus continued speculative trading.

2029

Forecasts fall between $5.15 and $44.80, with bullish models assuming renewed attention and favourable crypto conditions. Conservative views still cluster below $15.

2030

Longer-term projections range from roughly $5.75 to $69.90, showing extreme dispersion. Optimistic scenarios rely on sustained visibility and market strength, while bearish cases assume fading relevance and dilution pressure.

Factors to Watch That Could Move TRUMP Meme Coin

The token’s price is influenced by a range of factors, from political events to broader cryptocurrency trends. Traders may monitor the following drivers.

1. Political Actions

As a politically linked coin, TRUMP’s value is closely tied to the President’s activities, policies, and public statements. Campaign developments or policy shifts could spark price volatility.

2. Regulatory Changes

US crypto regulation remains fluid rather than clearly settled. While enforcement pressure has eased under a more market-friendly administration, politically branded tokens sit in a grey area. Increased scrutiny around disclosure, ethics, and foreign participation in Trump-linked crypto projects could indirectly affect TRUMP’s trading activity and accessibility.

3. Market Sentiment

Like many meme coins, TRUMP’s value fluctuates based on social media hype, investor sentiment, and news coverage. Increased engagement could fuel rallies, while negative press may trigger declines.

4. Broader Crypto Trends

The performance of Bitcoin and Solana could affect the token’s liquidity and investor interest. A strong bull market may push the token higher, while downturns could limit upside potential.

The Bottom Line

TRUMP’s future is expected to be shaped by political developments, regulatory shifts, and market sentiment. With its ties to the President, the token's volatility remains high. Longer-term performance will depend on whether TRUMP maintains relevance beyond headline-driven rallies and navigates supply expansion without eroding demand. As a result, it is likely to remain a risk-driven, sentiment-led asset rather than a fundamentals-driven cryptocurrency.

Traders looking to watch TRUMP swings and explore TRUMP CFDs, can consider opening an FXOpen account and gain exposure without directly holding the asset.

FAQ

What Is a TRUMP Coin?

TRUMP is a meme coin launched in January 2025, inspired by the US President Donald Trump. It has gained traction due to its political branding and speculative trading interest.

Which Blockchain Is the TRUMP Coin Based On?

TRUMP is built on the Solana blockchain, taking advantage of its high-speed transactions and low fees.

What Is the TRUMP Coin Prediction for 2026?

Analytical TRUMP coin predictions for 2026 are far more conservative than early launch estimates. Most projections range between $3 and $17, with average targets clustering around $7–$10, reflecting dilution risk, sentiment-driven trading, and policy-linked catalysts.

What Is the Future of the TRUMP Coin?

Analytical TRUMP coin price predictions see its future as highly speculative. Analysts see its trajectory driven by political relevance, promotional activity, and broader crypto cycles rather than fundamentals, leaving the token vulnerable to sharp rallies, deep pullbacks, and fading interest over time.

Where to Buy a TRUMP Coin?

For those wondering “TRUMP coin crypto, where to buy?”, the token is available on major cryptocurrency exchanges, including decentralised platforms on the Solana network. Additionally, traders can access CFDs through FXOpen, allowing exposure to price movements without directly holding the asset. This allows traders to take advantage of rising and falling prices without the need to own the asset.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.