FXOpen

As XRP navigates the volatility and uncertainty of digital currencies, its price trajectory remains a subject of keen interest and speculation. This article delves into the historical price movements, current challenges, and future potential of XRP, offering various analytical predictions into its likely direction in the years 2024 to 2030.

XRP Price History

XRP has experienced significant volatility since its inception, marked by rapid price changes and key developmental milestones. Initially launched in 2013, XRP did not see substantial market activity until 2017.

During this period, Ripple took advantage of heightened interest in digital currencies and formed several high-profile partnerships with financial giants like American Express and Santander. These partnerships helped propel XRP to unprecedented highs, reaching an all-time peak of $3.31 on January 4, 2018, according to CoinMarketCap.

Following its peak, the price suffered during the 2018 cryptocurrency market downturn, dropping below $0.30. The situation was exacerbated by a long crypto "winter" from 2018 to 2021, with the price hitting a low of around $0.11 in March 2020 amid a global sell-off caused by the COVID-19 pandemic.

Despite a recovery later in 2020, XRP faced another significant challenge in December when the Securities Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging XRP to be a security. This led to delisting from many exchanges and pushed the price down to $0.17.

In 2021, the token showed resilience, with prices rebounding to around $2.00, although it still struggled to revisit its all-time highs. In 2022, a new wave of market decline saw the price drop to $0.29.

After securing a partial win against the SEC in mid-2023, when a judge ruled XRP wasn’t a security in this case, XRP spiked to $0.92. However, it has since fluctuated amid the continuing legal battle, reaching a low of $0.422 in April 2024 and priced around $0.50 at the time of writing.

Head over to FXOpen’s free TickTrader platform to explore real-time XRP charts.

XRP Price Outlook for 2024

As of 2024, XRP faces a complex landscape marked by a broader bull run in crypto prices, yet it has struggled to achieve significant gains compared to Bitcoin, which has reached new all-time highs.

A critical factor influencing the token’s trajectory is the ongoing legal case with the SEC, which remains unresolved and casts significant uncertainty on Ripple's future. This legal battle, centring on whether XRP was sold as an unregistered security, is a determination that could significantly sway Ripple’s operational freedom and market position.

Amidst these challenges, it also contends with strong competition from other digital currencies that offer broader functionalities, such as Ethereum and Solana, which include smart contracts and decentralised applications. These features present a competitive edge over Ripple's more narrowly focused transactional utility.

The outlook for XRP in 2024 is seen as hinging heavily on the outcomes of the SEC case. Market analysts offer varied XRP projections, reflecting the high degree of uncertainty and the mixed sentiment surrounding Ripple’s potential to navigate regulatory hurdles and leverage technological advancements for growth.

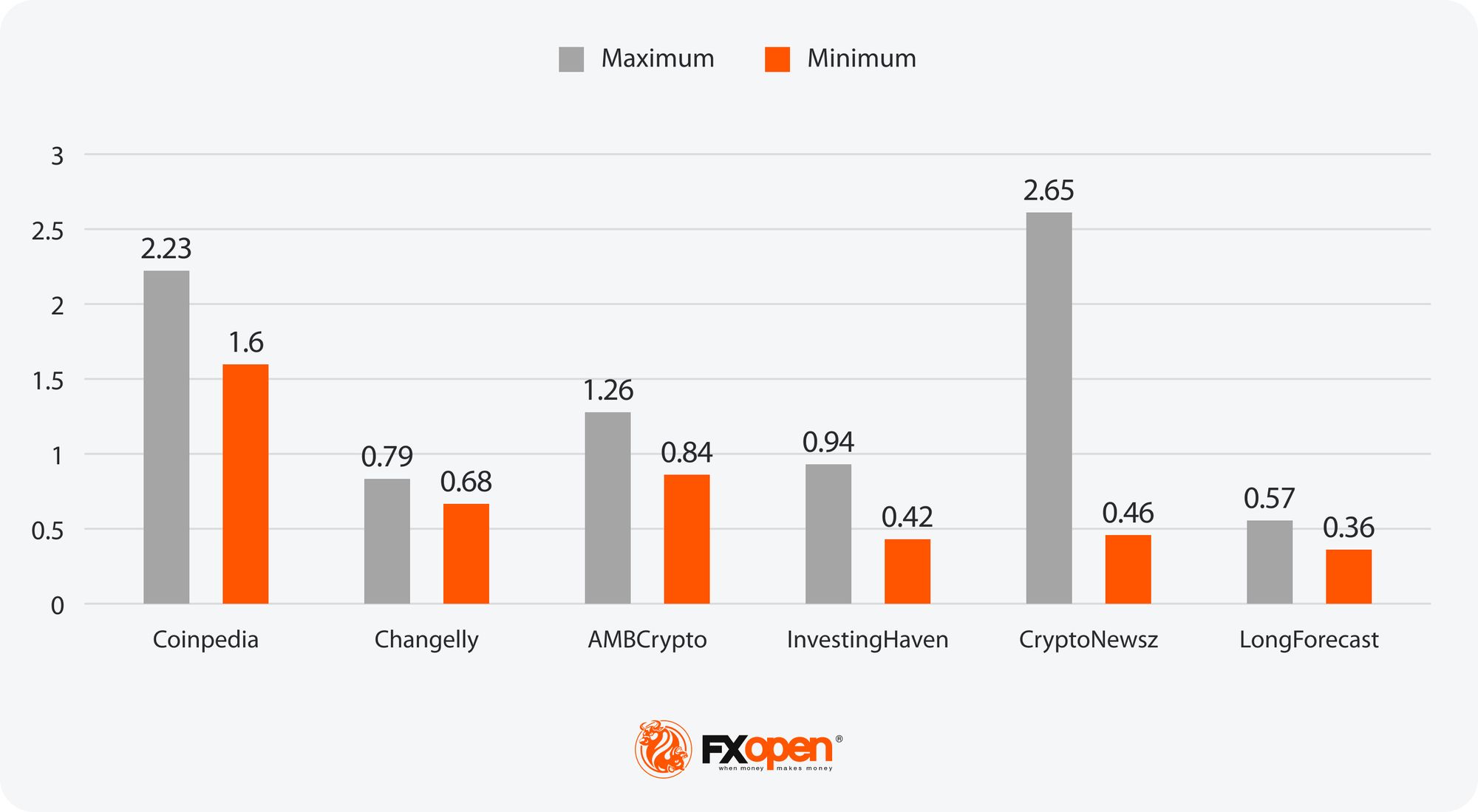

Analytical XRP Price Prediction in 2024

- Highest Projection for 2024: 2.65 (CryptoNewsz)

- Lowest Projection for 2024: 0.36 (LongForecast)

Analytical XRP Price Prediction in 2025, 2026, and Beyond

As the calendar turns to 2025 and beyond, the outlook for XRP becomes increasingly uncertain. Ripple has established numerous significant partnerships with major financial institutions such as Santander, American Express, and Bank of America. These alliances are seen as supporting its position as a leading cross-border payment solution and could suggest a strong potential for long-term price appreciation due to its entrenched brand and legacy.

However, the landscape is riddled with challenges. The ongoing SEC case looms large, with outcomes that could pivotally shape Ripple's future. Additionally, the rollout of central bank digital currencies (CBDCs) presents a dual-edged sword: while they could diminish XRP's role by offering an alternative for cross-border transactions, Ripple's technology might also integrate with or complement these new digital currencies, thereby sustaining its relevance. Moreover, the competitive environment is intensifying with other blockchain technologies vying for market share in the financial transactions space.

Despite these challenges, there is a general consensus among XRP price forecasts. If Ripple can navigate its legal and regulatory hurdles and effectively position itself as a viable alternative to the traditional SWIFT system, its value could climb significantly higher than current levels. Conversely, a loss in its legal battles or diminished relevance in the wake of CBDCs could lead to a decline in XRP’s future price.

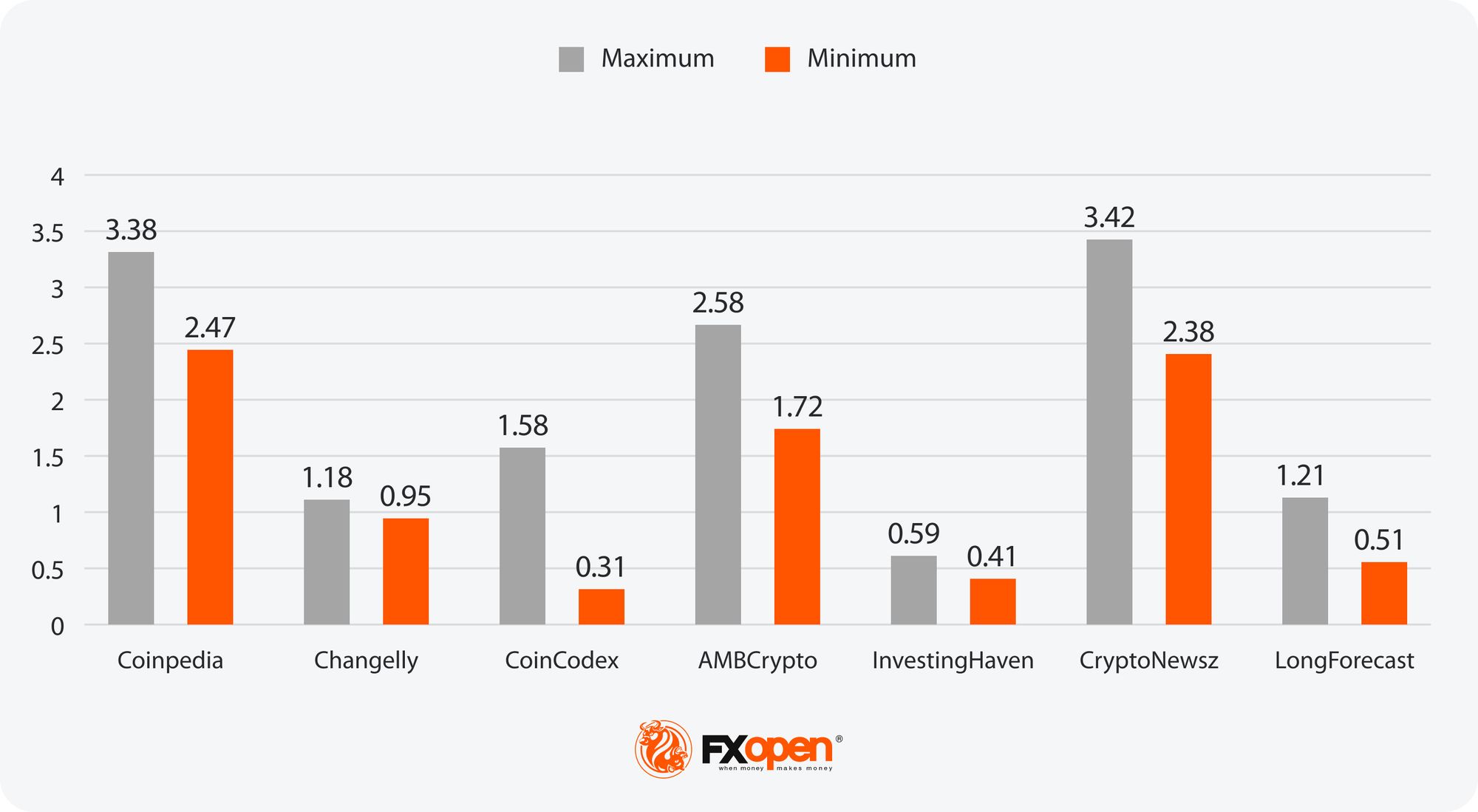

XRP Price Prediction in 2025

- Highest Projection for 2025: 3.42 (CryptoNewsz)

- Lowest Projection for 2025: 0.31 (CoinCodex)

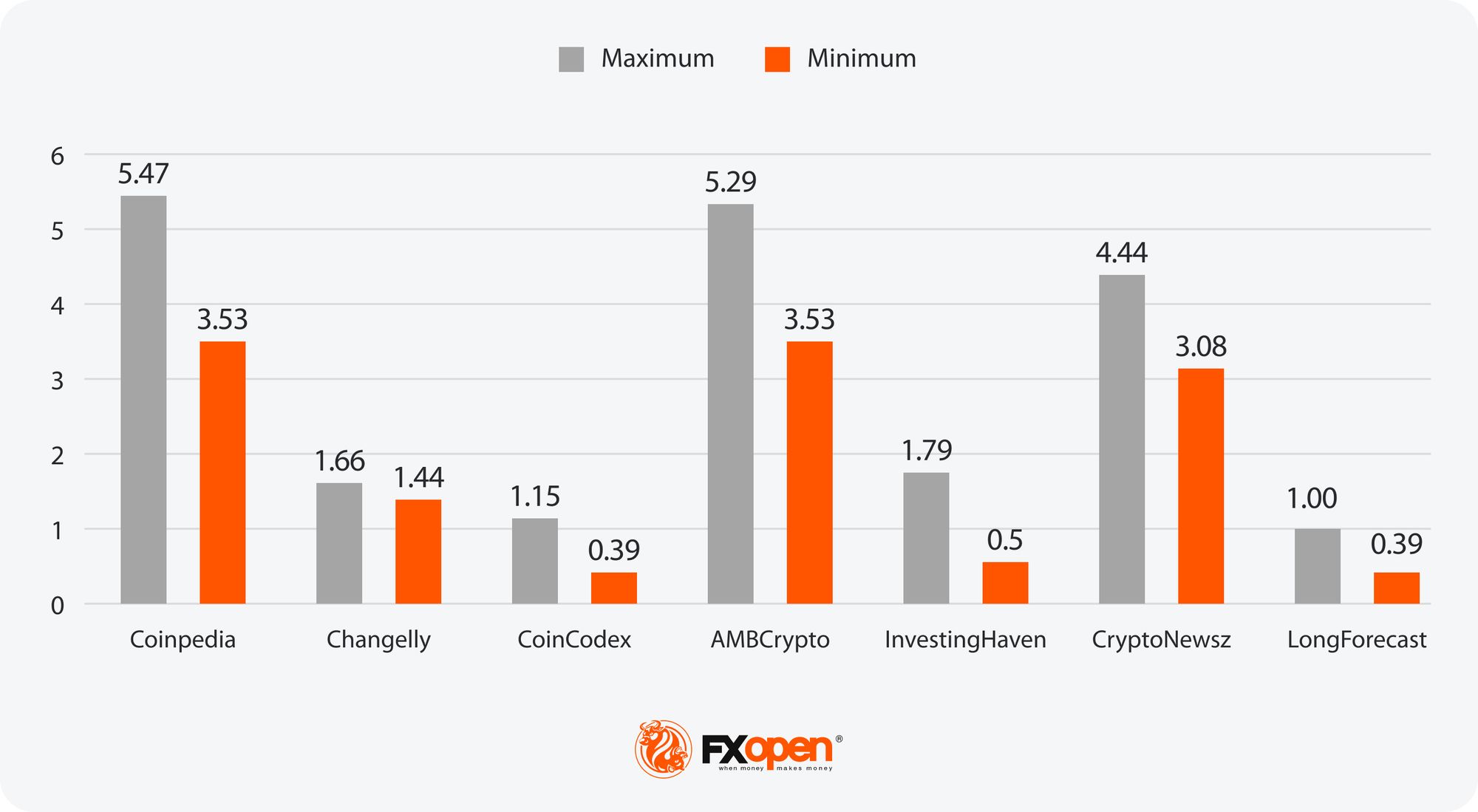

XRP Price Prediction in 2026

- Highest Projection for 2026: 5.47 (Coinpedia)

- Lowest Projection for 2026: 0.39 (CoinCodex, LongForecast)

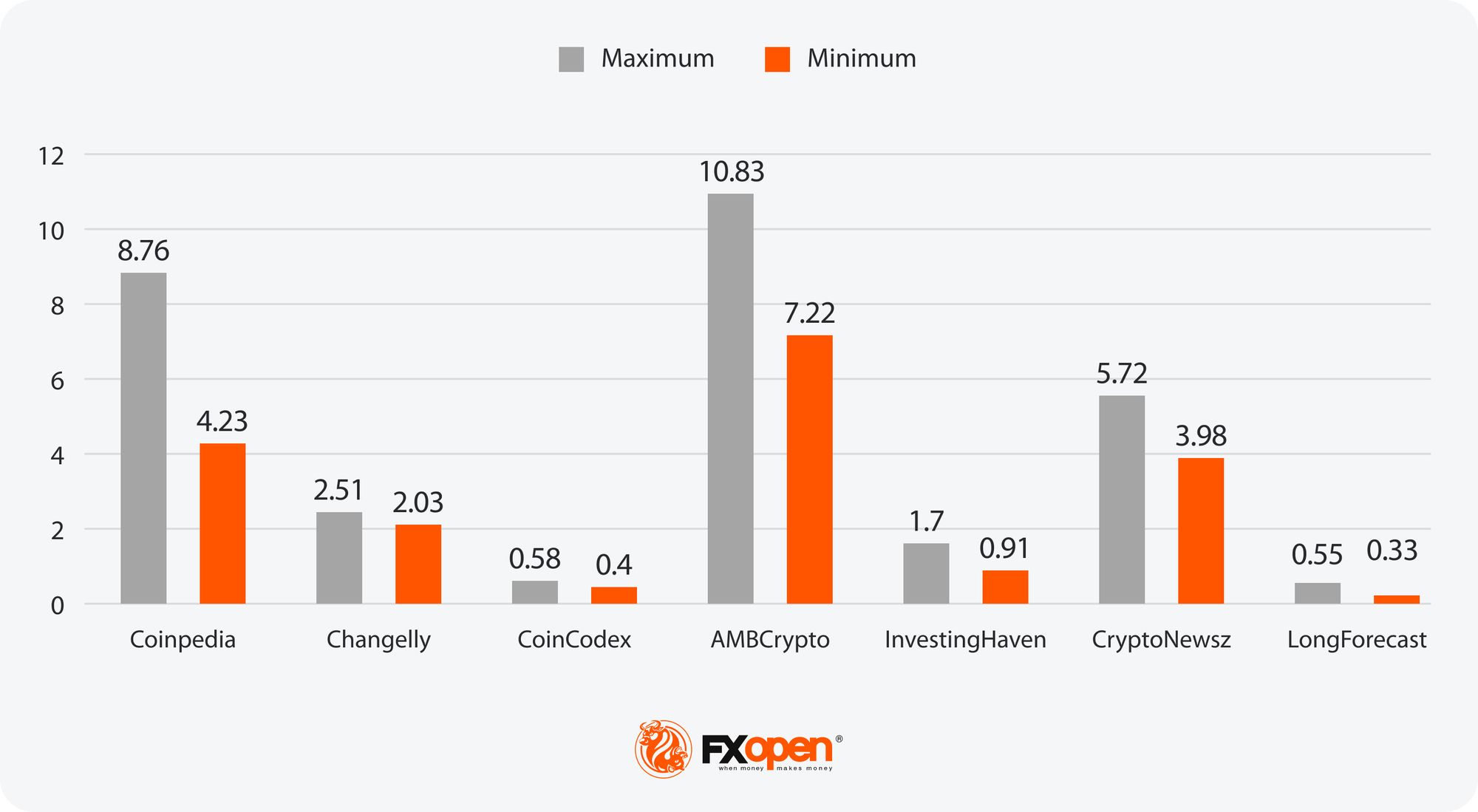

XRP Price Prediction in 2027

- Highest Projection for 2027: 10.83 (AMBCrypto)

- Lowest Projection for 2027: 0.33 (LongForecast)

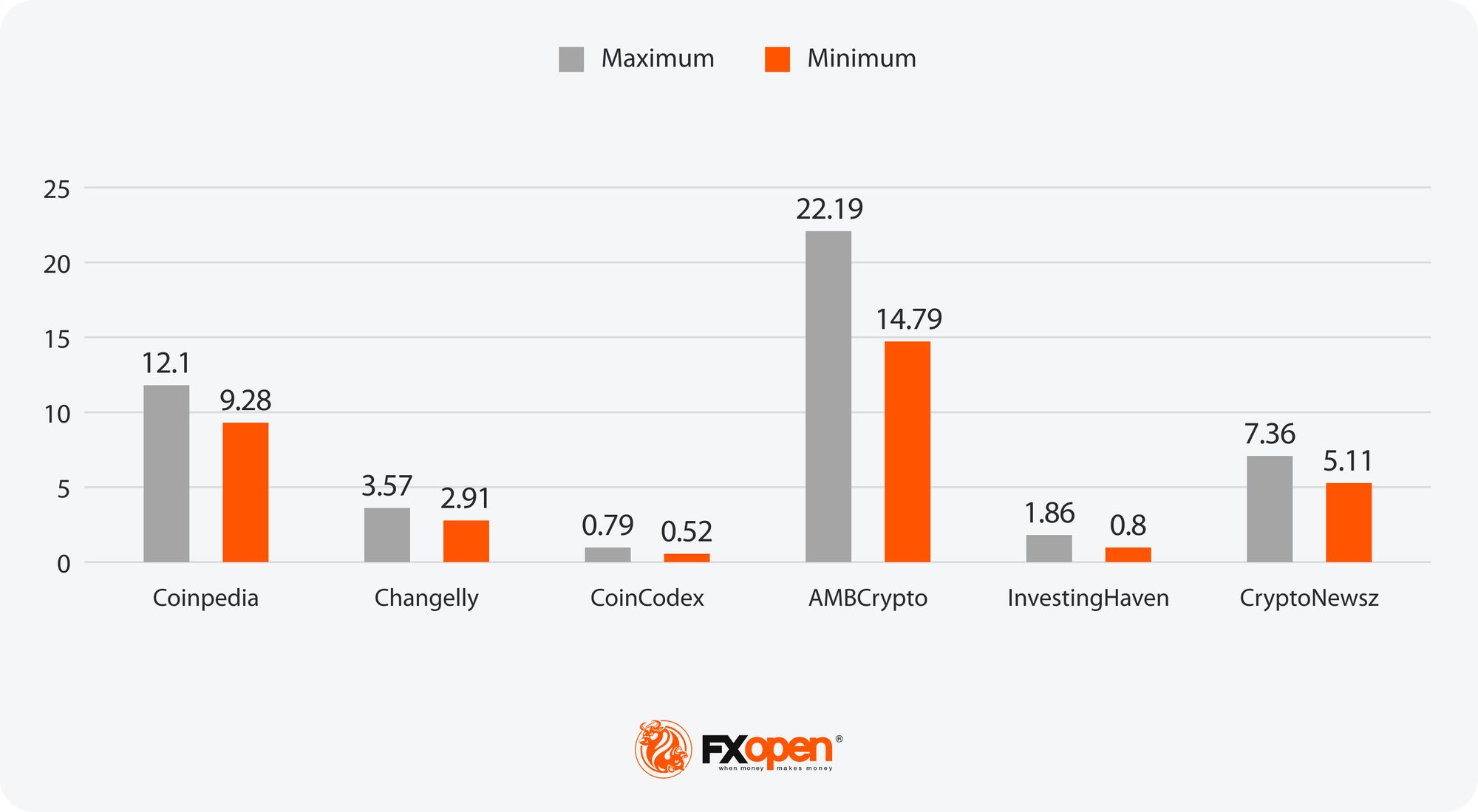

XRP Price Prediction in 2028

- Highest Projection for 2028: 22.19 (AMBCrypto)

- Lowest Projection for 2028: 0.52 (CoinCodex)

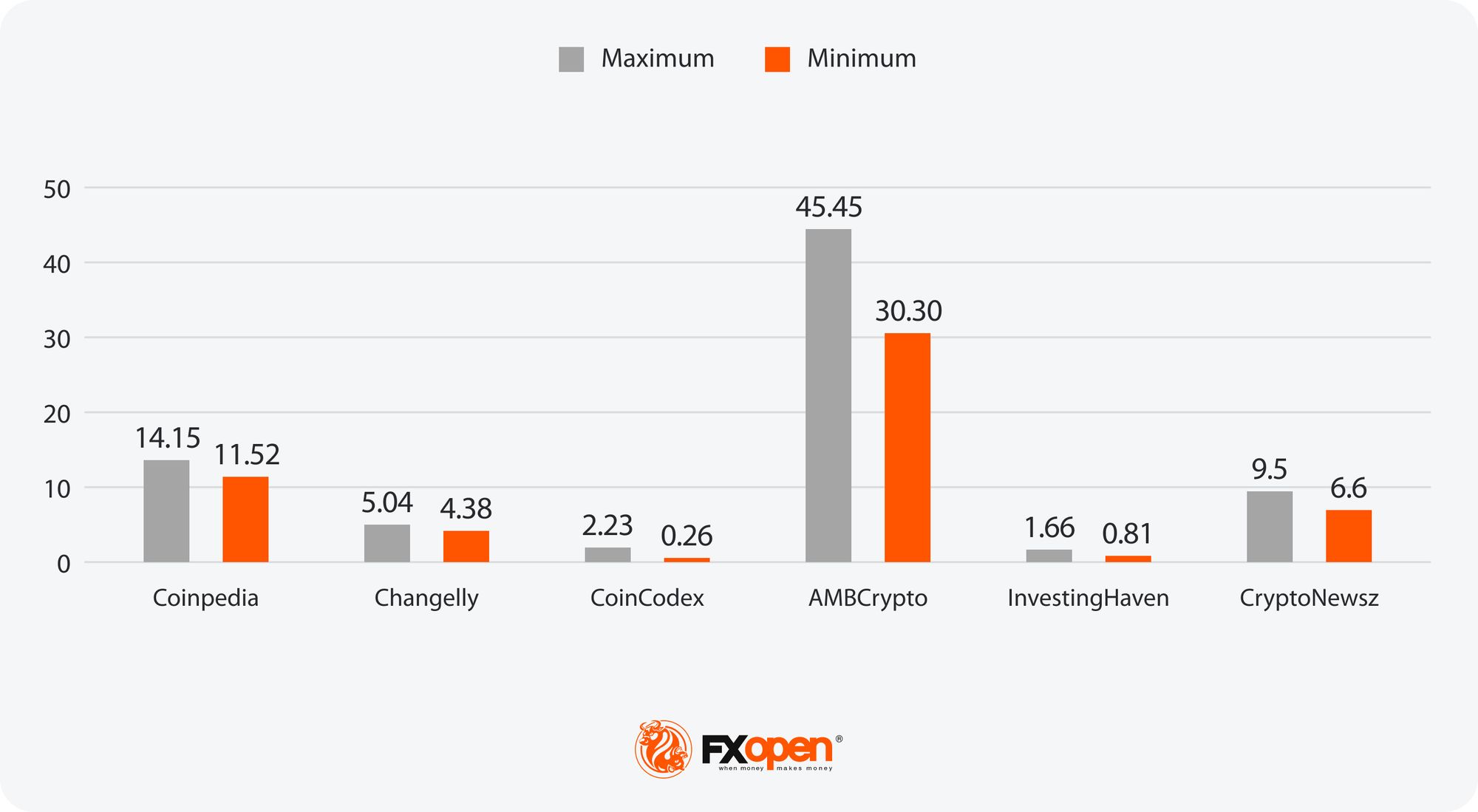

XRP Price Prediction in 2029

- Highest Projection for 2029: 45.45 (AMBCrypto)

- Lowest Projection for 2029: 0.26 (CoinCodex)

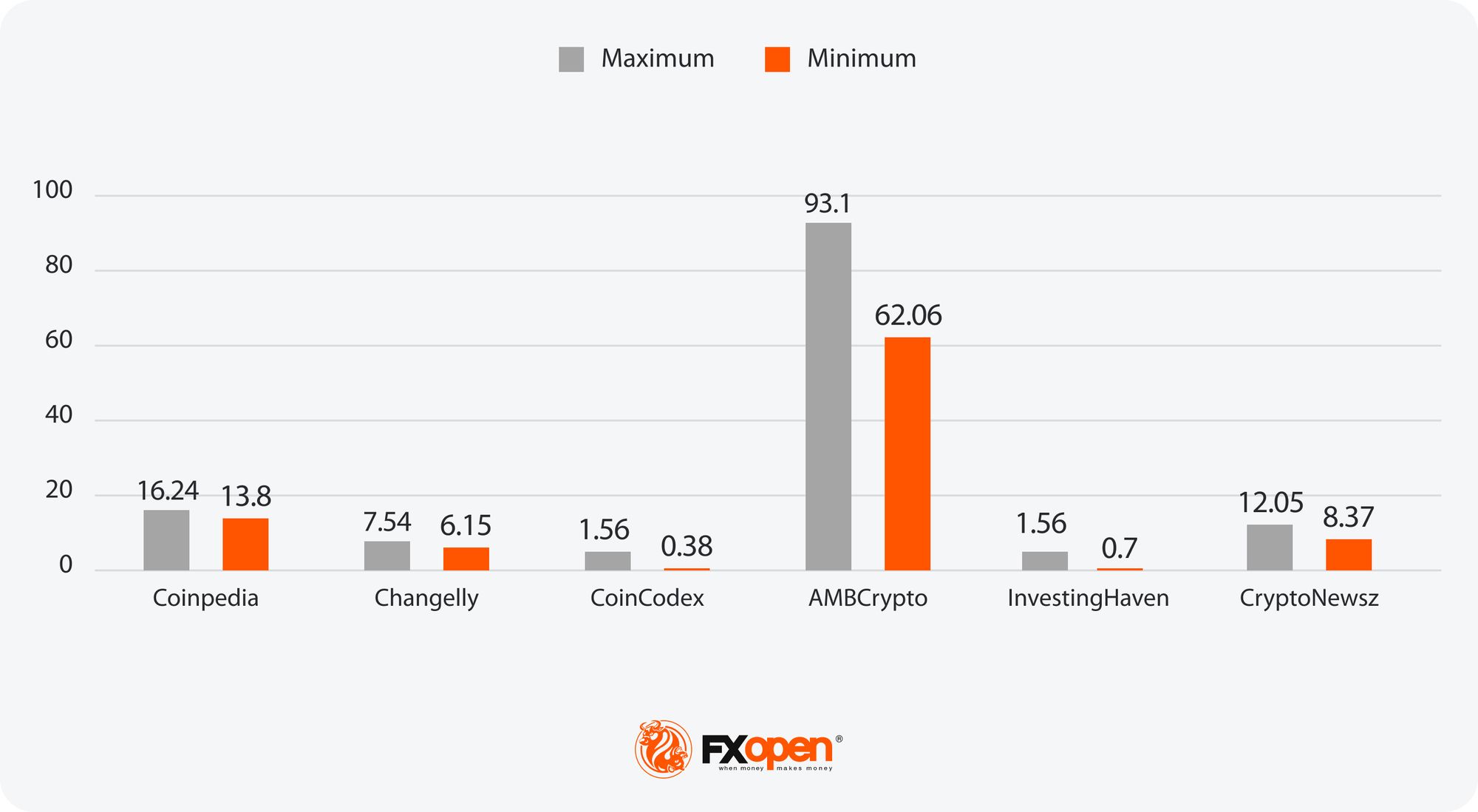

XRP Price Prediction in 2030

- Highest Projection for 2030: 93.10 (AMBCrypto)

- Lowest Projection for 2030: 0.38 (CoinCodex)

General Factors Influencing the XRP Price

Several overarching factors play a crucial role in influencing the price of XRP, shaping its market dynamics and investment potential:

- Regulatory Environment: The ongoing SEC lawsuit is pivotal, with potential regulatory outcomes significantly impacting its accessibility and use by financial institutions.

- Technological Advancements: Ripple’s continuous development, which aims to enhance transaction efficiency and security, could attract more adoption and boost its price.

- Market Competition: The presence of advanced blockchain solutions like Ethereum and Solana, which offer expanded functionalities such as smart contracts, presents stiff competition for Ripple.

- Economic Indicators: Factors such as interest rates and inflation influence the broader financial markets and, by extension, the cryptocurrency market, affecting the token’s performance.

- Strategic Partnerships: Collaborations with major banks and financial entities worldwide enhance Ripple’s credibility and market penetration, supporting its position in the market and growth potential.

The Bottom Line

The journey of XRP through regulatory landscapes and market dynamics suggests a future teeming with both opportunities and uncertainties. For traders looking to leverage these insights and take advantage of XRP’s anticipated volatility, opening an FXOpen account can provide the necessary platform to engage with the token’s potential shifts effectively via CFDs.

FAQs

How High Can XRP Go in 2025?

The potential height of XRP in 2025 is seen as contingent upon various factors, including the resolution of the SEC lawsuit and the adoption rate by financial institutions. However, XRP’s potential price targets are speculative and also depend on broader market conditions.

Will XRP Go Up After Bitcoin Halving?

Historically, Bitcoin halvings have led to bullish sentiment across the cryptocurrency market, often lifting altcoin prices. While XRP may indirectly take advantage of increased overall market interest post-Bitcoin halving, its performance will largely depend on its own market dynamics and developments in the ongoing SEC case.

Will XRP Do Well in the Next Bull Run?

Ripple’s future in the next bull run hinges on its legal standing and ability to maintain relevance amidst rising competition and technological innovations. If Ripple can provide a compelling alternative to traditional financial systems and overcome legal hurdles, XRP is expected to perform well in a favourable market environment, according to market analysts.

At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.