FXOpen

The Australian dollar/US dollar pair is one of the major pairs traded worldwide. Since 2021, it has been moving in a downtrend. However, the reopening of China, the removal of China’s ban on Australian coal, and the potential weakness of the USD in 2023 allow analysts to make optimistic projections on the AUD/USD exchange rate. In this FXOpen guide, you will find forecasts on the AUD/USD rate and learn the reasons behind them.

AUD/USD: Price History 2021 - the Beginning of 2023

From March 2020 to February 2021, the AUD/USD pair was moving in an uptrend. However, the situation changed in May 2021 when a downtrend came into force as the US dollar was gaining momentum. The pair continues depreciating, and there are a few reasons for this.

The first reason is the problems with exports. It’s also vital to note that the strength of the Australian economy depends on exports. The country is a leader in producing and exporting various commodities, including iron ore, coal, lithium, gold, uranium, and bauxite. China is one of the major importers of Australian goods.

Due to the Covid-19 pandemic, China had to close the country, which affected its economic growth and curbed domestic steel production. A slowdown in its economic growth affected Australia’s economic development, too.

Another reason for the weakness of the Australian dollar was the strength of the US dollar. Despite the 2022 crisis, the US dollar was rising in value. Some analysts explain this by saying that the USD is a safe-haven asset that appreciates in periods of market turbulence. Others doubt the USD’s status as a refuge currency but agree that the Federal Reserve’s (the Fed) monetary policy is the primary driver of the USD rate.

The Fed's hawkish monetary policy encouraged the appreciation of the US dollar– in 2022, the central bank raised the interest rate seven times – from 0.25% to 4.50%. However, it’s vital to highlight that the Reserve Bank of Australia (RBA) also raised its interest rate even more often than the Fed. During 2022, there were eight rate hikes, so the rate reached 3.10%. Why was the AUD weaker than the US dollar? Despite the smaller number of hikes, the interest rate in the US is higher than in Australia.

Analysts say that the Australian dollar will appreciate only if the pace of the US dollar’s strengthening calms down. This may happen in the near future as the Fed is expected to soften its monetary policy, raising rates at a slower pace. Still, not all analysts agree with that. The Federal Reserve can’t beat the rising inflation rate. Therefore, it may maintain its aggressive approach, and the AUD/USD pair will continue moving in a downtrend.

Let’s consider factors that may affect the direction of AUD/USD in 2023.

The Australian Dollar Forecast: What Will Affect the Currency in 2023?

Analysts highlight several factors that may affect the AUD/USD exchange rate in 2023.

Market Sentiment

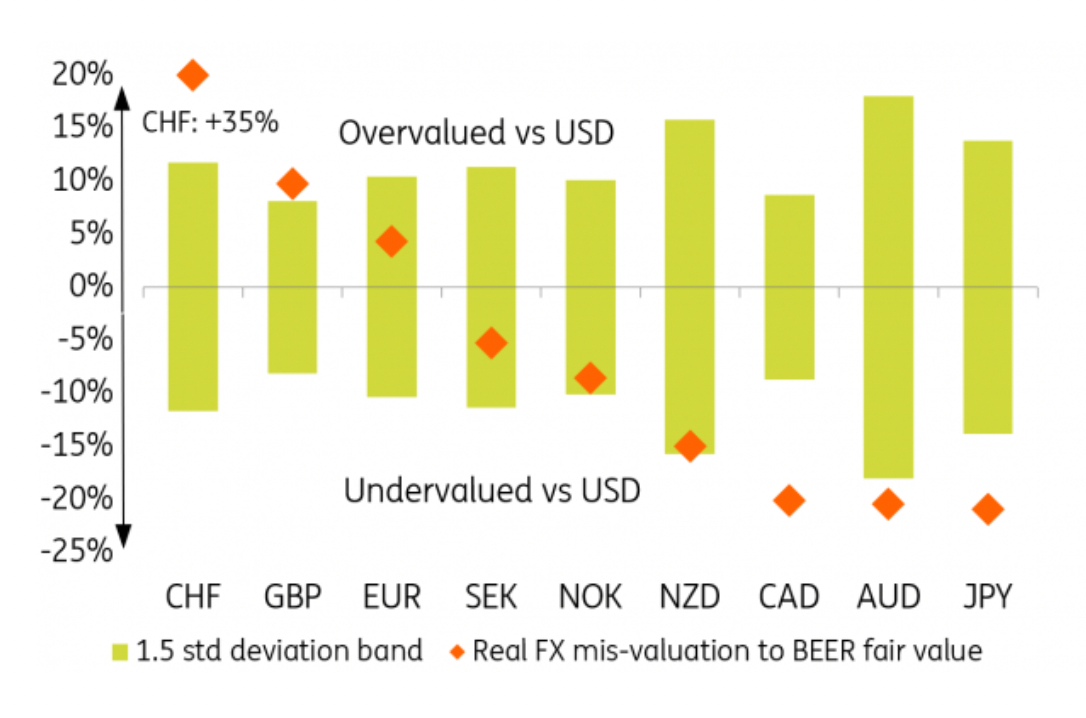

According to ING, the Australian dollar is undervalued against the US dollar. However, it doesn’t necessarily mean that the currency will appreciate in 2023. Analysts call a stabilisation in risk sentiment the key factor that may support commodity currencies, including AUD.

House Price Contraction

ING’s analysts think that the forthcoming house price contraction may negatively affect the commodity currencies. This may happen because commodity-exporting countries usually show the most overvalued property markets among G10 countries. Although central banks may try to prevent the uncontrolled fall of the housing sector, the risk is still high.

China

As Australia is a world leader in commodity export, an upside in this sphere may cause AUD to appreciate. ANZ’s chief economist, Richard Yetsenga, believes that the Australian dollar will outperform New Zealand (NZD) and Canadian dollars (CAD). One of the reasons is the reopening of China, Australia’s largest importer.

The country decided to remove most of its Covid restrictions. Carol Kong, a currency strategist at the Commonwealth Bank of Australia in Sydney, believes that if China has a successful exit from Covid-19 restrictions, this will boost the global economy and will support the AUD/USD pair. Analysts at ING agree with this outlook and highlight China’s medium-term development as one of the aspects that will determine the strength of AUD.

Also, there are rumours that an unofficial ban on Australian coal export to China, that was imposed due to worsening relations between Australia and China two-and-a-half years ago, would be removed. As of February 2023, there is news on the first shipments of coal, but there is also news about issues with them. The situation may become clearer in the coming months.

Currency analysts at Westpac say that not only an increase in Australian industrial commodity exports to China but also the return of high-value Chinese tourists and students that may support Australia's service exports, will boost the Australian dollar.

At the same time, analysts at CIBC are cautious. They warn that the market may be over-optimistic regarding the reopening of China. Still, their medium-term outlook for commodity currencies is positive.

Exports

It’s also worth remembering that the supply of industrial metals is very tight. Which, in combination with the reopening of China, may become a driver for the Aussie dollar.

ING Group’s global head of markets and CEE Chris Turner and FX strategist Francesco Pesole believe that oil and natural gas prices may contribute to AUD’s rise as these are Australia’s second- and third-largest exports.

The Department of Industry, Science and Resources forecasts a surge in Australian resources and energy exports to a record $459 billion in 2022–23 but predicts a decline to $391 billion in 2023–24.

Weakness of the US dollar

According to ANZ’s chief economist Richard Yetsenga, the USD may reduce its dominance in 2023 – the strength of other global currencies will mostly depend on internal factors.

Other analysts believe the RBA will continue raising interest rates in 2023. If the Fed moves to a more accommodative monetary policy, the RBA rate hikes will be a positive factor for the Australian dollar.

Will AUD Rise Against USD? Analyst Forecasts

The AUD/USD pair set an all-time high in December 1973 when it traded at $1.49. If we consider the 2000s, the highest pair value was near $1.10 in July-August 2011. Will the pair be able to move to 1 in the coming years?

*You can see the current rate of the AUD/USD pair in the TickTrader chart below.

AUD to USD Forecast for 2023

Considering the factors above, analysts from leading banks and corporations made AUD to USD projections for 2023. We will also consider predictions of algorithmic forecast sources; some of them involve technical analysis.

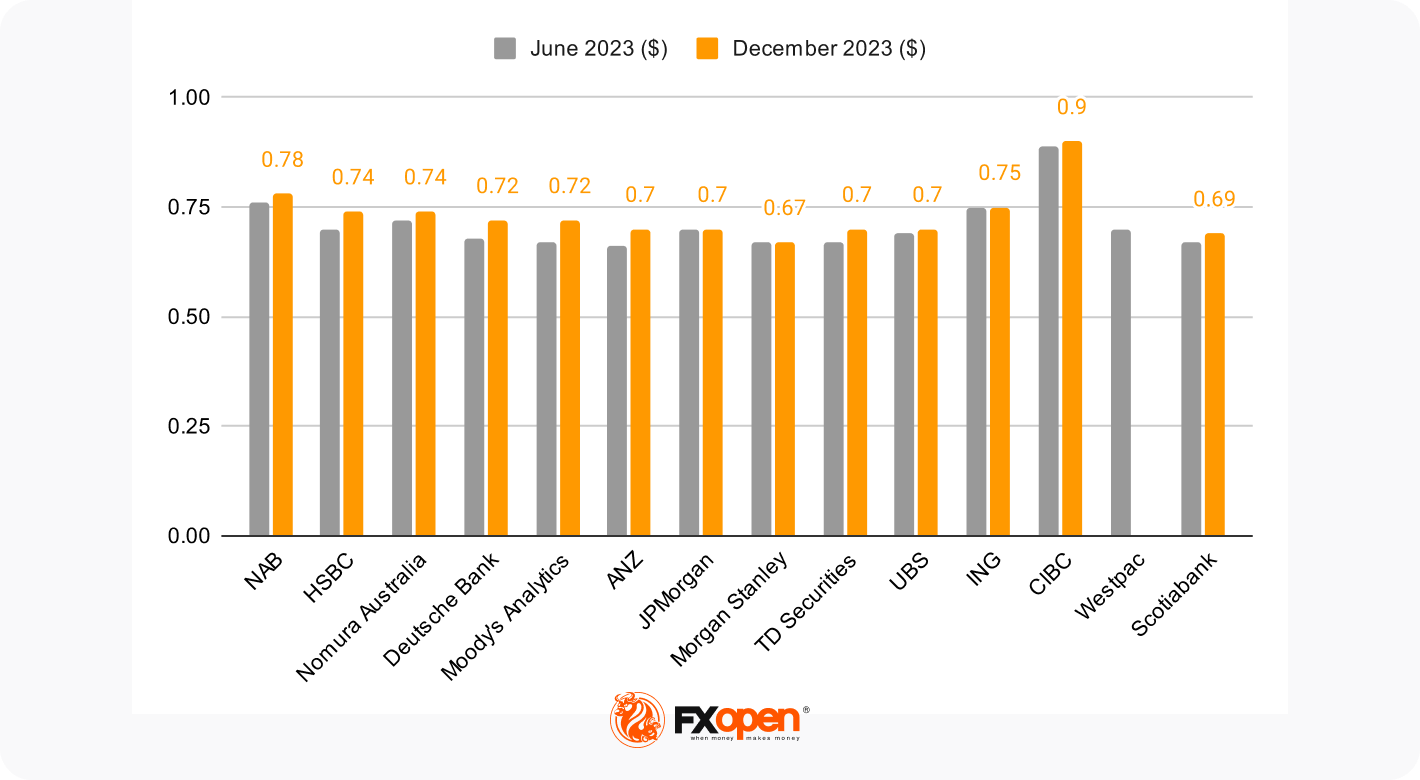

Banks and Corporations

- The most pessimistic prediction for the end of the first half of 2023 is from ANZ – $0.66.

- The most optimistic prediction for the end of the first half of 2023 is from CIBC – $0.89.

- The most pessimistic prediction for the end of 2023 is from Scotiabank – $0.69.

- The most optimistic prediction for the end of 2023 is from CIBC – $0.90.

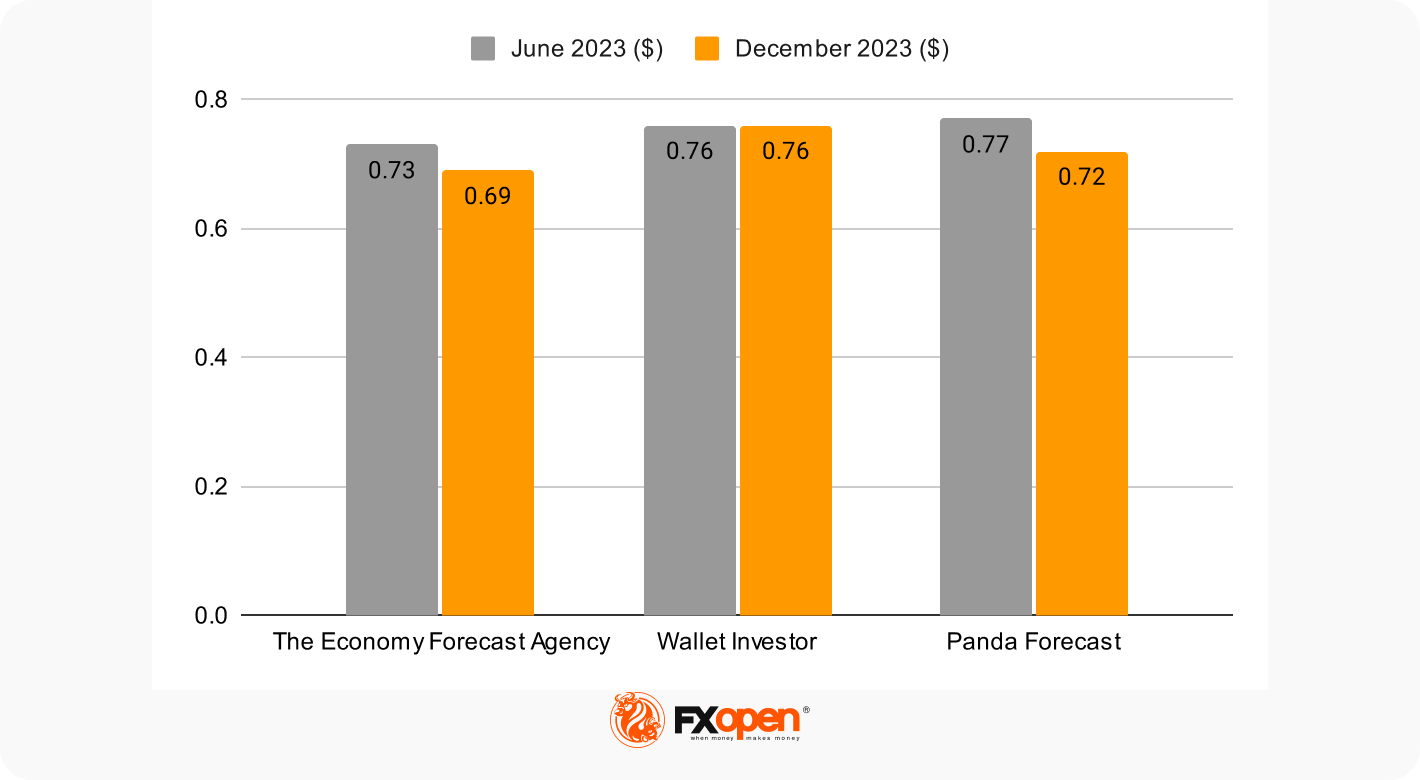

Algorithmic Forecast Sources

- The most pessimistic prediction for the end of the first half of 2023 is from The Economy Forecast Agency – $0.73.

- The most optimistic prediction for the end of the first half of 2023 is from Panda Forecast – $0.77.

- The most pessimistic prediction for the end of 2023 is from The Economy Forecast Agency – $0.69.

- The most optimistic prediction for the end of 2023 is from Wallet Investor – $0.76.

AUD vs USD Forecast: 2024

Will the Aussie dollar continue to rise? According to institutional and algorithmic forecasts, the Aussie will keep rising in the next year.

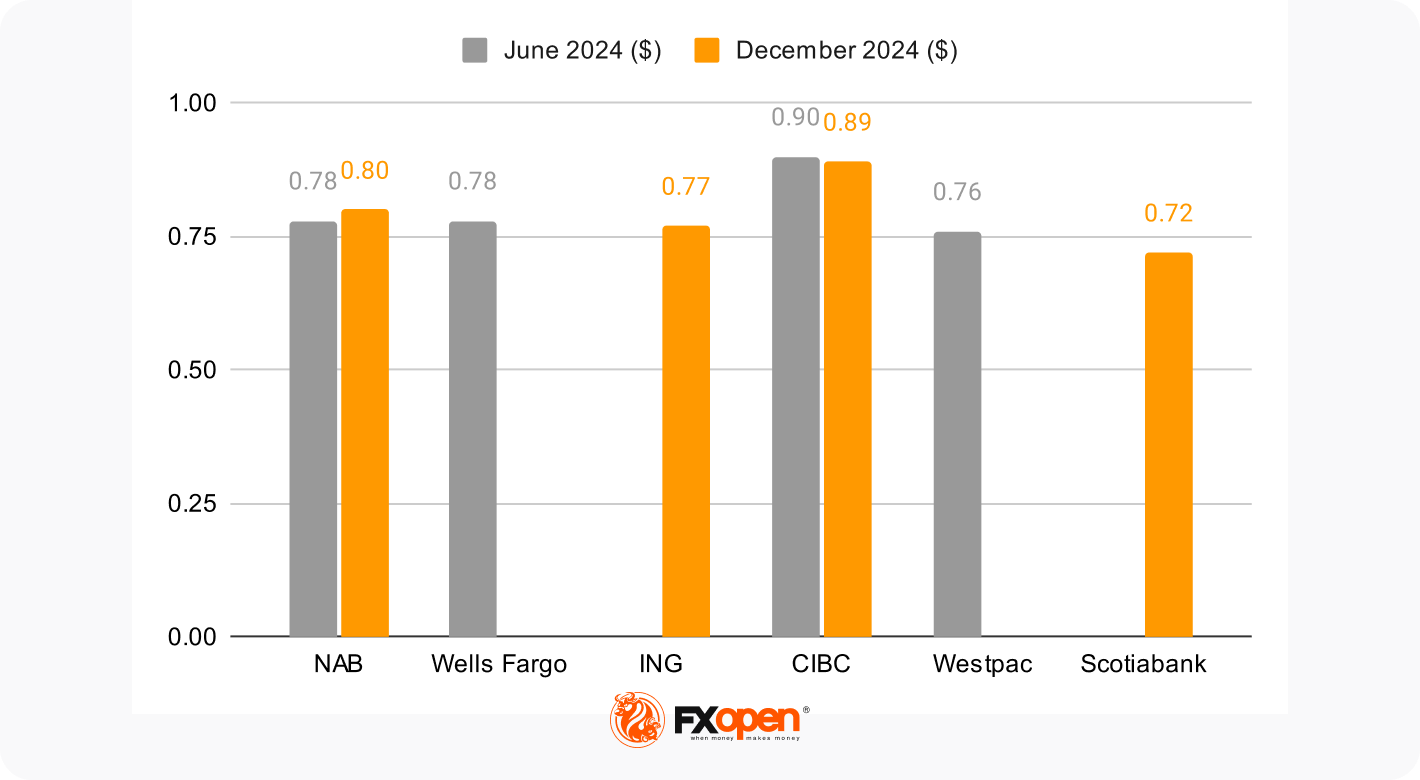

Banks and Corporations

- The most pessimistic prediction for the end of the first half of 2024 is from Westpac – $0.76.

- The most optimistic prediction for the end of the first half of 2024 is from CIBC – $0.90.

- The most pessimistic prediction for the end of 2024 is from Scotiabank – $0.72.

- The most optimistic prediction for the end of 2024 is from CIBC – $0.89.

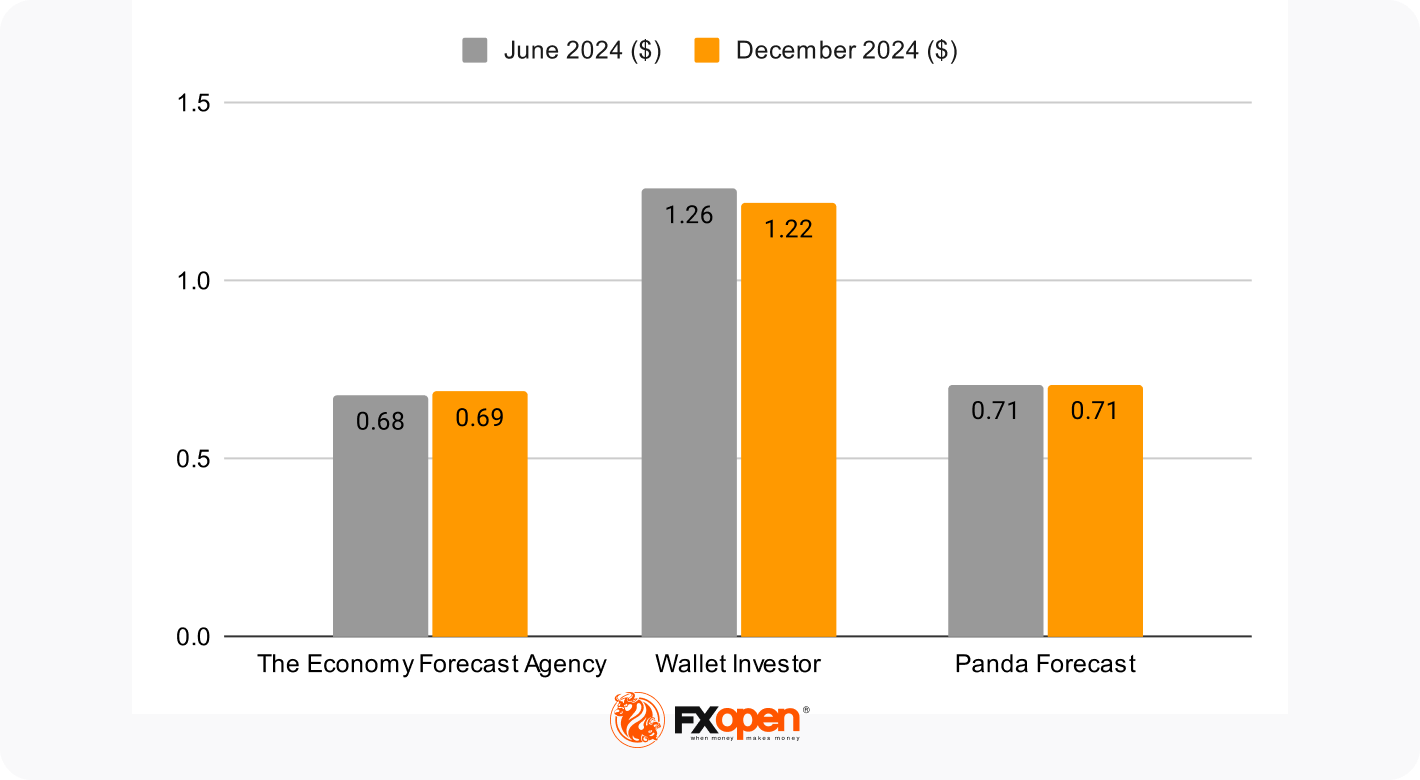

Algorithmic Forecast Sources

- The most pessimistic prediction for the end of the first half of 2024 is from The Economy Forecast Agency – $0.68.

- The most optimistic prediction for the end of the first half of 2024 is from Wallet Investor – $1.26.

- The most pessimistic prediction for the end of 2024 is from The Economy Forecast Agency – $0.69.

- The most optimistic prediction for the end of 2024 is from Wallet Investor – $1.22.

AUD/USD Forecast in the Long Term: 2025

Will the Australian dollar drop? The projections for 2025 aren’t optimistic. However, only two banks could provide a USD to AUD prediction, which is understandable as economic conditions rapidly change.

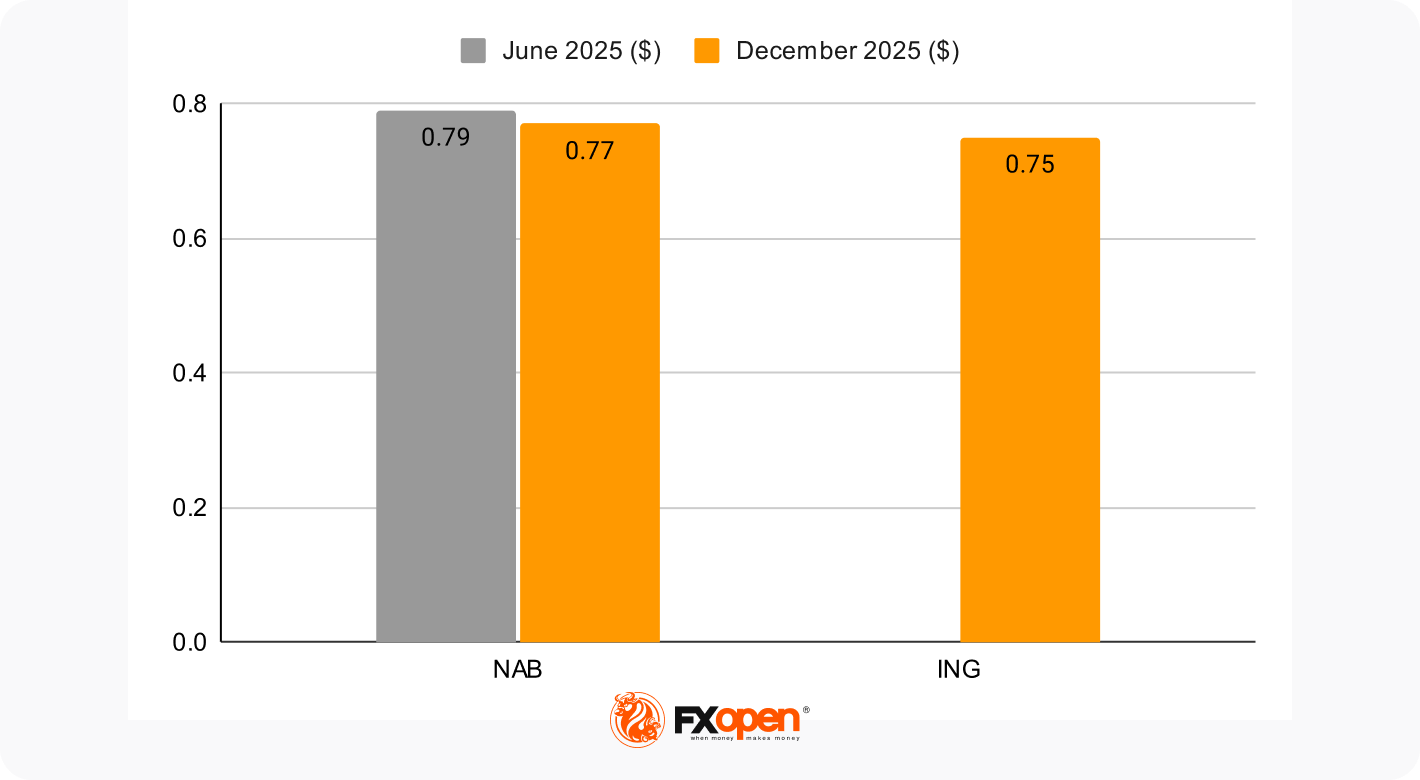

Banks and Corporations

There is only one forecast for the first half of 2025 – $0.79 from NAB. Also, NAB is more optimistic regarding the end of 2025 with $0.79 rather than ING with $0.75.

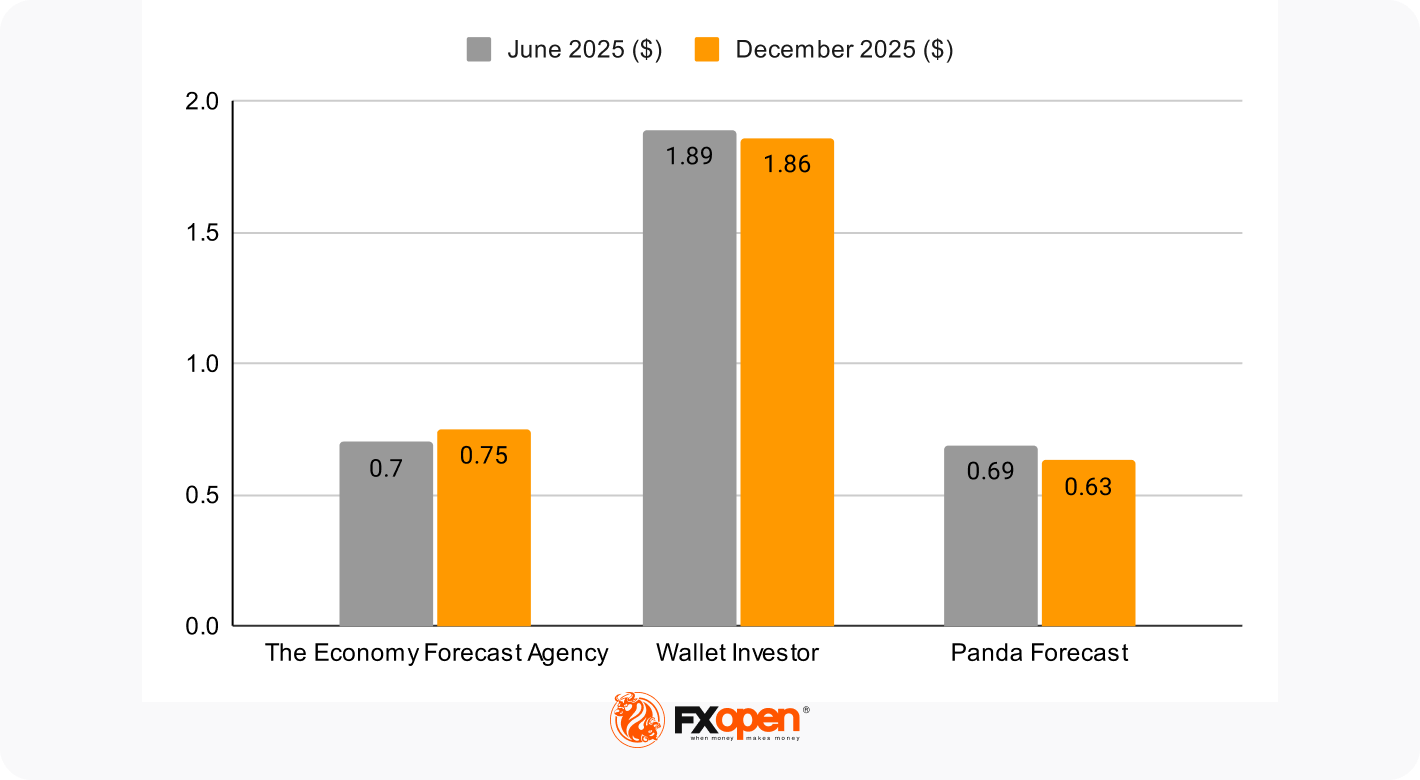

Algorithmic Forecast Sources

- The most pessimistic prediction for the end of the first half of 2025 is from Panda Forecast – $0.69.

- The most optimistic prediction for the end of the first half of 2025 is from Wallet Investor – $1.89.

- The most pessimistic prediction for the end of 2025 is from Panda Forecast – $0.63.

- The most optimistic prediction for the end of 2025 is from Wallet Investor – $1.86.

Will the Australian Dollar Go Up?

Most analysts are optimistic about the future of the AUD/USD exchange rate. The average forecast from banks and corporations for the first half of 2023 is $0.71, while they expect the price to rise to $0.73 by the end of 2023. At the same time, algorithmic forecasts are more optimistic about the first half of 2023, with an average prediction of $0.75. However, the projection for the end of the year is lower – $0.72.

According to banks and corporations, the AUD/USD rate may keep rising in 2024. During the year, it’s anticipated to stay within the $0.80-0.81 range. Algorithmic forecasts are more optimistic with the $0.87-0.88 range.

Projections for 2025 are questionable as only two banks presented their visions. According to them, the AUD/USD rate may decline to $0.76 by the end of the year. Two of three algorithmic forecast sources also see the price below $0.80.

You can open an FXOpen account to make your own predictions and trade the AUD/USD pair.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.