FXOpen

Cryptocurrency traders and investors are cheering the recent bitcoin rally. The leading cryptocurrency is trading back above $60,000, coming close to a new all-time high.

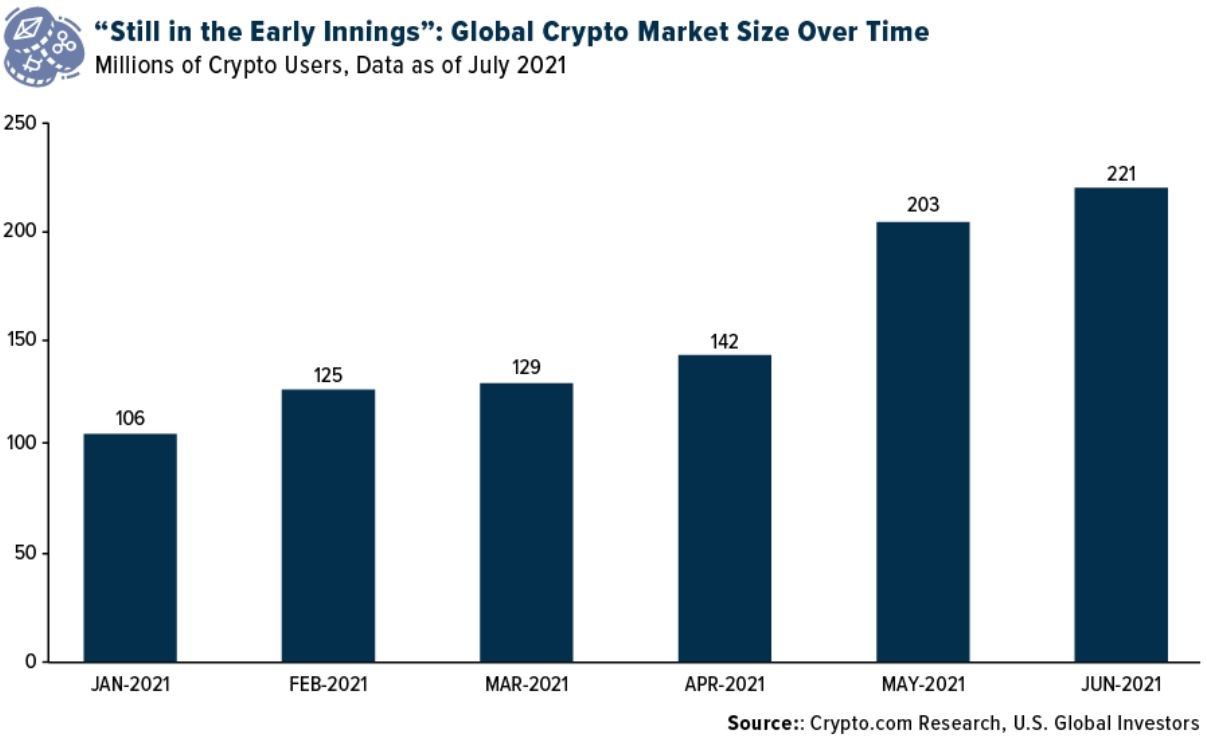

The most recent data related to the crypto market size explains why bitcoin has attracted so many buyers in the latest months. The global crypto market size keeps growing, with more and more people shifting their gaze to crypto assets. In a single month, from May to June 2021, the crypto market added 18 million new users. Because bitcoin is the most popular coin, it is likely that the new funds injected into the crypto space went to it.

Bullish Developments in the Crypto Space

Besides the increased popularity in the cryptocurrency space, as suggested by the rising number of crypto users, some other recent bitcoin-related events can be characterized as bullish.

One comes from the Security and Exchange Commission (SEC). It is poised to approve the first-ever bitcoin ETF, which would open the space to a much wider investors base. This news alone was largely responsible for bitcoin’s recent rally. An ETF is an exchange-traded fund that tracks the price movements of its underlying – in this case, bitcoin. Investors favor ETFs due to them being a cost-efficient way of trading expensive assets.

Another such driver is the Bank of America’s decision to introduce coverage of digital assets as the cryptocurrency market reached $2 trillion in market value.

The recent developments triggered enthusiasm among crypto traders, and so the crypto market continues to rise. In the meantime, bitcoin has surpassed Facebook in terms of market value and is on track to take the silver.

Bitcoin traded close to $65,000 back in April this year, and it corrected after Elon Musk, the CEO of Tesla, suggested that the digital asset is too expensive. The current upwards movement also helps Tesla, as the company holds more than $1 billion worth of bitcoins on its balance sheet.

FXOpen offers the world's most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.