FXOpen

The main event of the trading week is ahead of us, and the US dollar is flexing its muscles. The Federal Reserve of the US (aka the Fed) is to announce its monetary policy decision on Wednesday, and the market’s consensus is that it will reveal the tapering of its bond-buying program.

As a reminder, the Fed embarked on a bond-buying program in response to the COVID-19 pandemic. The program, dubbed quantitative easing, represents purchasing US government’s bonds with newly created money. A consequence of it is rising inflation, which is a game-changer for the Fed and the US dollar.

At first, the Fed (and other central banks in the developed world) said that it expected inflation to be transitory. However, after several months of rising prices it turned out to be not so transitory, reaching decade-high levels. Therefore, policymakers have started having doubts about the transitory effect and, as such, are preparing to lift the rates.

This is the risk going into this week’s Fed decision – a hawkish Fed may hint at more hikes next year besides the tapering of the asset purchases.

US Dollar Liquidity Shrinks

The Fed, therefore, is set to announce the tapering of its asset purchases to start in December. On top of that, the central bank is in the ingrate position of watching inflation rise while having the interest rates at the lower extreme.

Tapering is not hiking, but it is definitely a type of monetary tightening. As such, the bias for the US dollar heading into Wednesday’s decision and press conference is bullish.

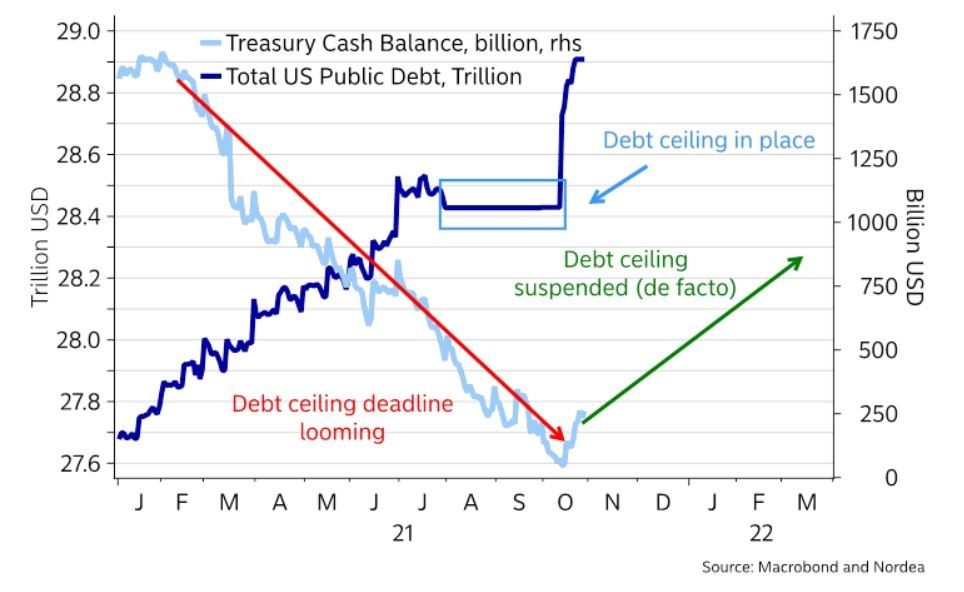

In addition, the Treasury General Account (TGA) will be rebuilt during the next 3-4 months. The consequence is that the US dollar liquidity shrinks, putting even more tailwind behind the greenback.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.