FXOpen

Continuation candlestick patterns are a common tool traders use in technical analysis of price charts to identify when a prevailing trend is likely to continue after a pause. In this FXOpen guide, we explain how candlestick continuation patterns work and how you can use them to identify market trends and make informed trading decisions.

What Is a Continuation Candlestick Pattern?

Candlesticks on price charts correspond to the open, close, low, and high prices for an asset over a certain period. Traders look for continuation candle patterns on platforms such as TickTrader to identify the continuation of a trend and decide when to buy or sell.

Bullish continuation candlestick patterns form when a rising price pauses, consolidates and then continues moving higher. Bearish continuation candlestick patterns form when a falling price pauses, consolidates and then continues moving lower. They often occur when buyers and sellers pause to reassess their trading positions, allowing the market to gather momentum for the next move in the direction of the trend.

Candlestick patterns form across 1-5 candles, unlike chart patterns that form across 10-50 candlesticks. Continuation candles are typically characterised by the price stabilising after a sharp move in either direction, although some, such as gaps, indicate that the move is accelerating.

How to Use Continuation Patterns

Trend continuation candlestick patterns are relatively straightforward to interpret, making them easy to use for traders with any level of experience. They help traders to filter out noise on charts so they can focus on the prevailing market direction to improve their trading strategy.

You can analyse them to:

- confirm the market’s direction and momentum

- choose an entry or exit point for a trade

- manage risk by setting pending orders above or below candles based on the momentum and sentiment of the market

Rules to Follow When Using Candlesticks

There are some basic guidelines traders follow to make informed and profitable trading decisions:

- Analyse the trend. You need to identify a trend before looking for a continuation pattern, as they only make sense in the context of an existing trend.

- Wait for confirmation. If you use a single candlestick pattern, the theory suggests traders wait for at least two or three consecutive candles to take shape before making a trade to avoid false signals.

- Use support and resistance levels. Check how the patterns relate to significant support and resistance boundaries, as they are typically more reliable when they coincide.

- Combine with other technical indicators. Use candlestick patterns in combination with other technical indicators, such as moving averages and oscillators, to confirm whether they are valid.

Top 5 Continuation Patterns

You can identify patterns from the shape and structure of the candlesticks. Here are five commonly used shapes to look for.

1) Gaps

Gaps occur when there is a significant difference between the closing price of one candlestick and the opening price of the next. Gaps tend to occur at the opening of a trading session, reflecting a change in sentiment overnight.

Bullish and Bearish Tasuki Gap

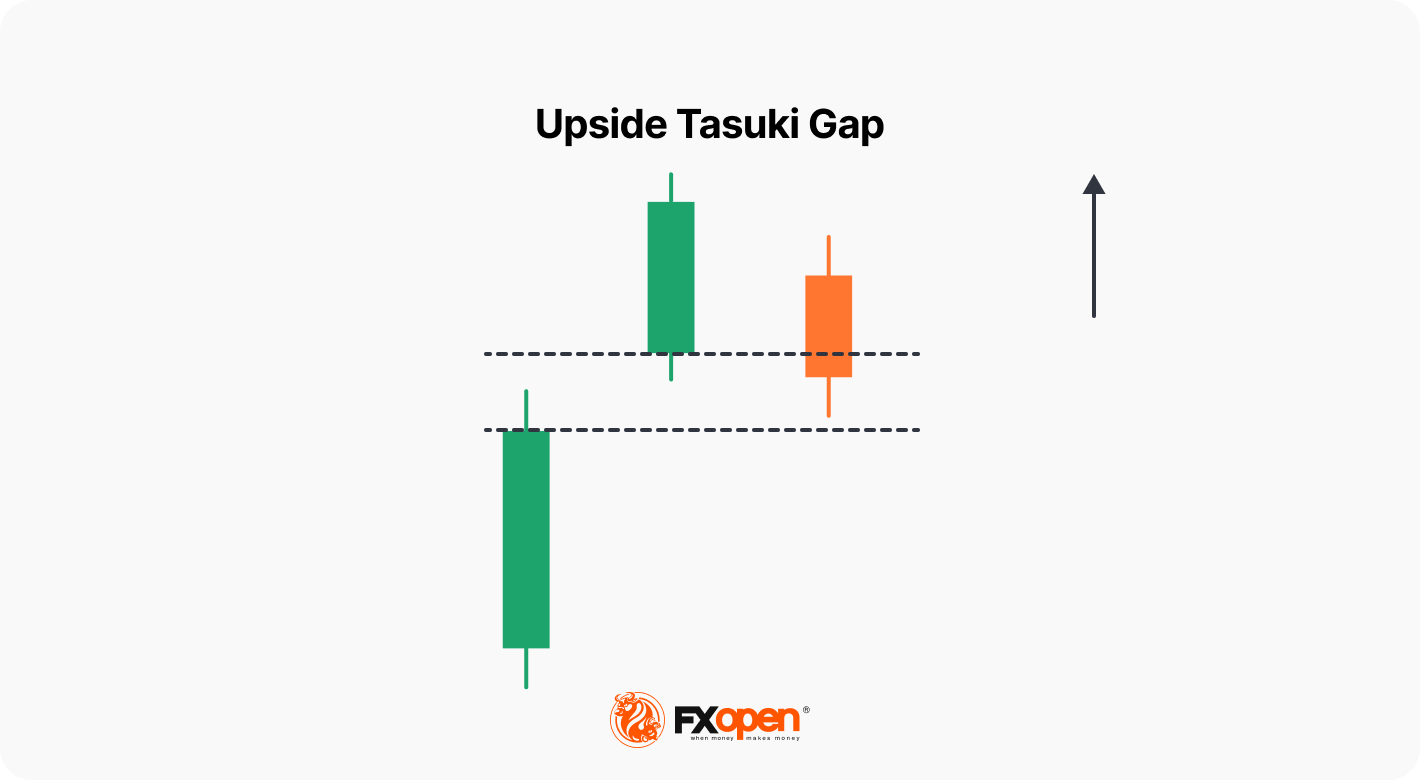

The Tasuki Gap is a three-candle pattern. In a bullish or Upside Tasuki Gap, the first candle is large and bullish, the second candle moves upward with an opening price gapping up from the previous close, and the third is a red that partially closes the gap.

The gap and the second bullish candle indicate the strength of buyers. The third denotes a pause in the trend as sellers attempt to move the price lower but fail to close the gap, which suggests that the rally is likely to continue.

Traders can use a rising Tasuki Gap to enter a position on the close of the third candle and place a stop-loss order below the bottom of the first candlestick, in the expectation that the trend will resume upward. Another option is to place a buy order slightly above the second candle’s high and place a stop under the low of the third candle.

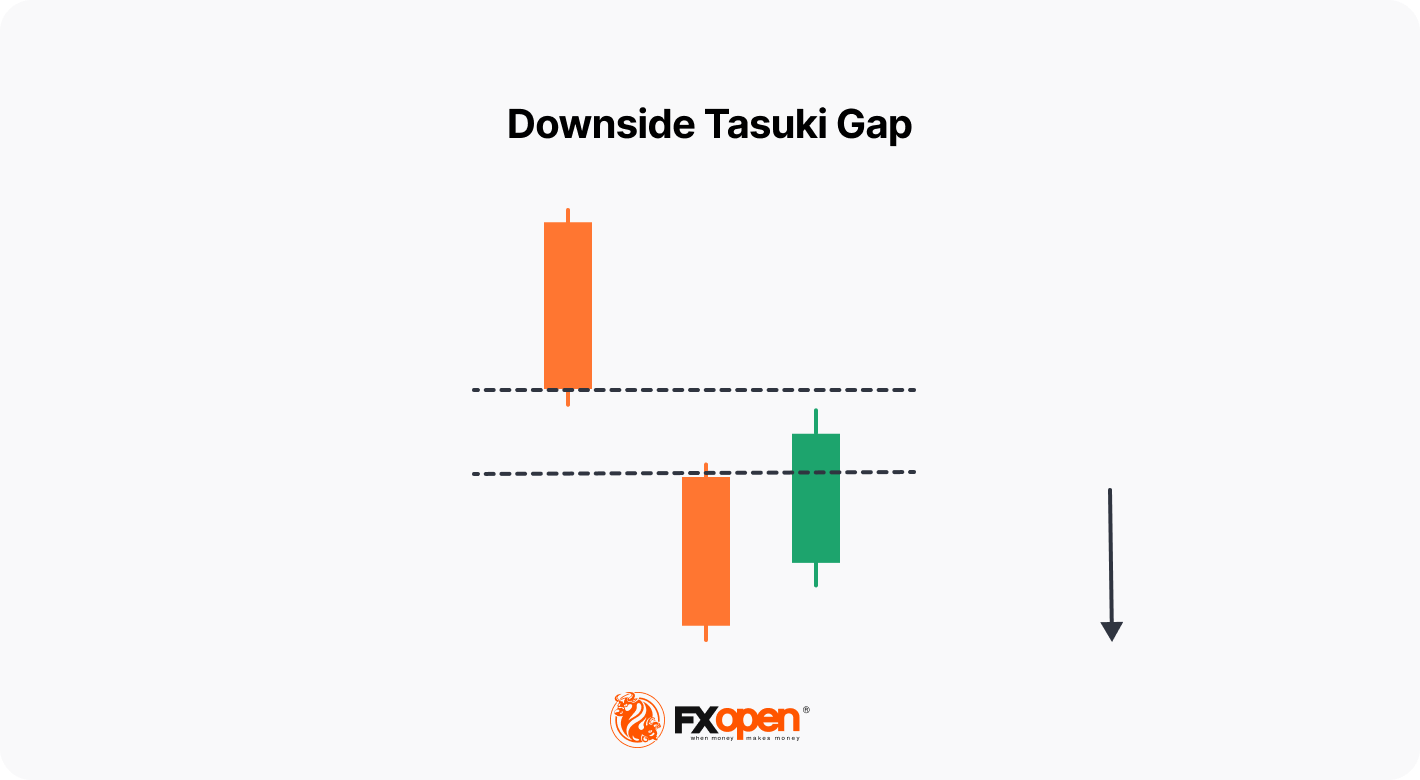

In a bearish or Downside Tasuki Gap, the first candle is large and bearish and the second gaps down from the close of the first. The third candlestick closes above the opening price of the second but does not cover the gap.

The Downside Tasuki Gap indicates the momentum behind a downward trend. The strength of the trend is indicated by the price gapping lower and a new red candle forming. This move is followed by a pause as buyers attempt to push the price higher. However, the price does not fill the gap, and the selloff is resumed.

Traders can open a short position near the close of the third candle, expecting the downtrend to continue. Alternatively, they can wait for the price to drop below the bottom of the third candle to confirm the downtrend is resuming.

Bullish and Bearish Gapping Play

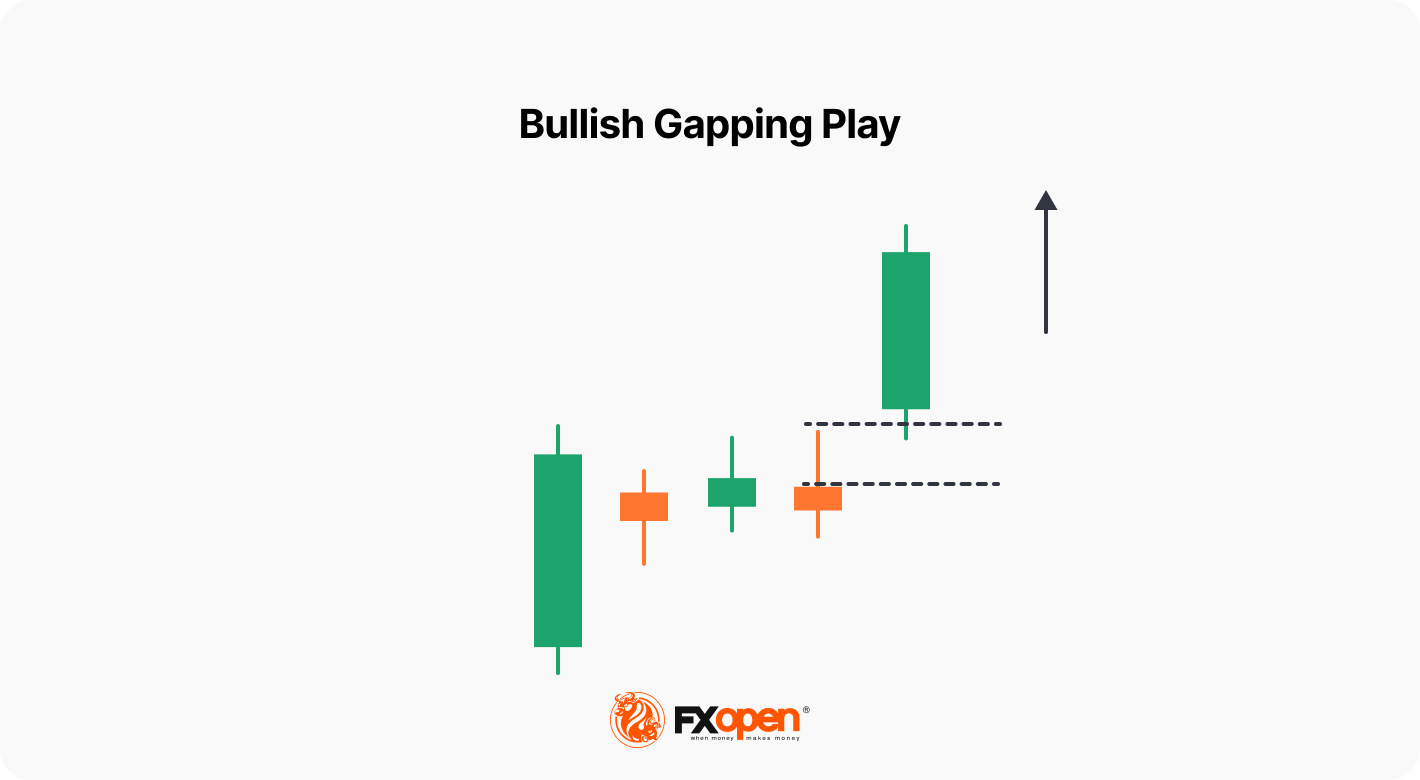

A bullish gapping play structure occurs when there is a large upward candle, followed by several small candles forming at almost the same level and a large bullish candle with an upward gap. Small candles reflect a period of hesitation and must be in the upper area of the previous candle.

The bullish gapping play provides traders with a strong signal that the bullish momentum is expected to continue. Therefore, the theory suggests that a trader opens a buy trade after the fifth candle is formed. A stop-loss order can be placed below the fifth candle.

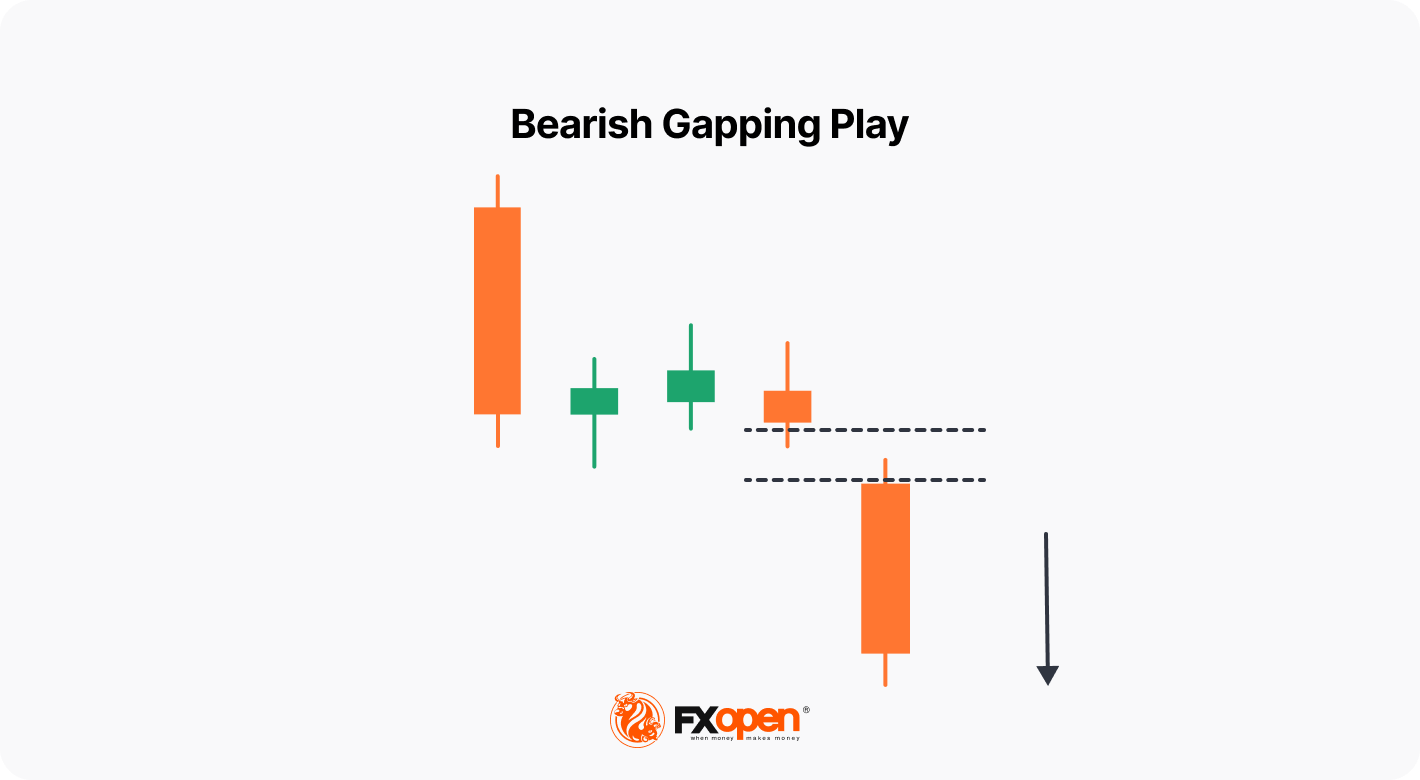

A bearish gapping play has one long bearish candle, several small candles, and a large downward candlestick opening with a gap down. The structure follows a pause in the trend indicated by the small candles occurring after a series of large downward candles. The small bars before the gap must be in the lower area of the previous large falling candle.

A bearish gapping play offers a strong signal that the bearish momentum will continue. Traders usually open a sell position after the fifth candle is formed. A stop-loss level is placed above the fifth candle.

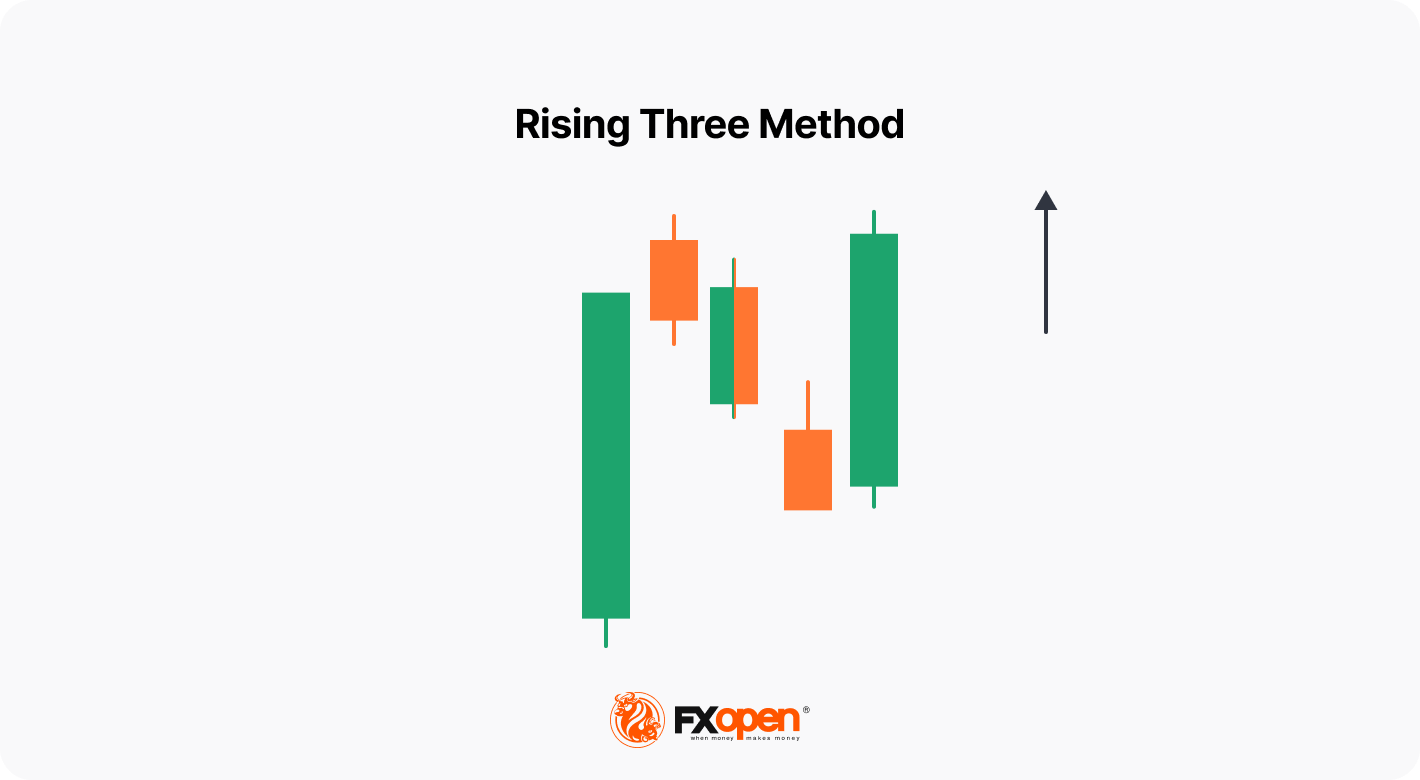

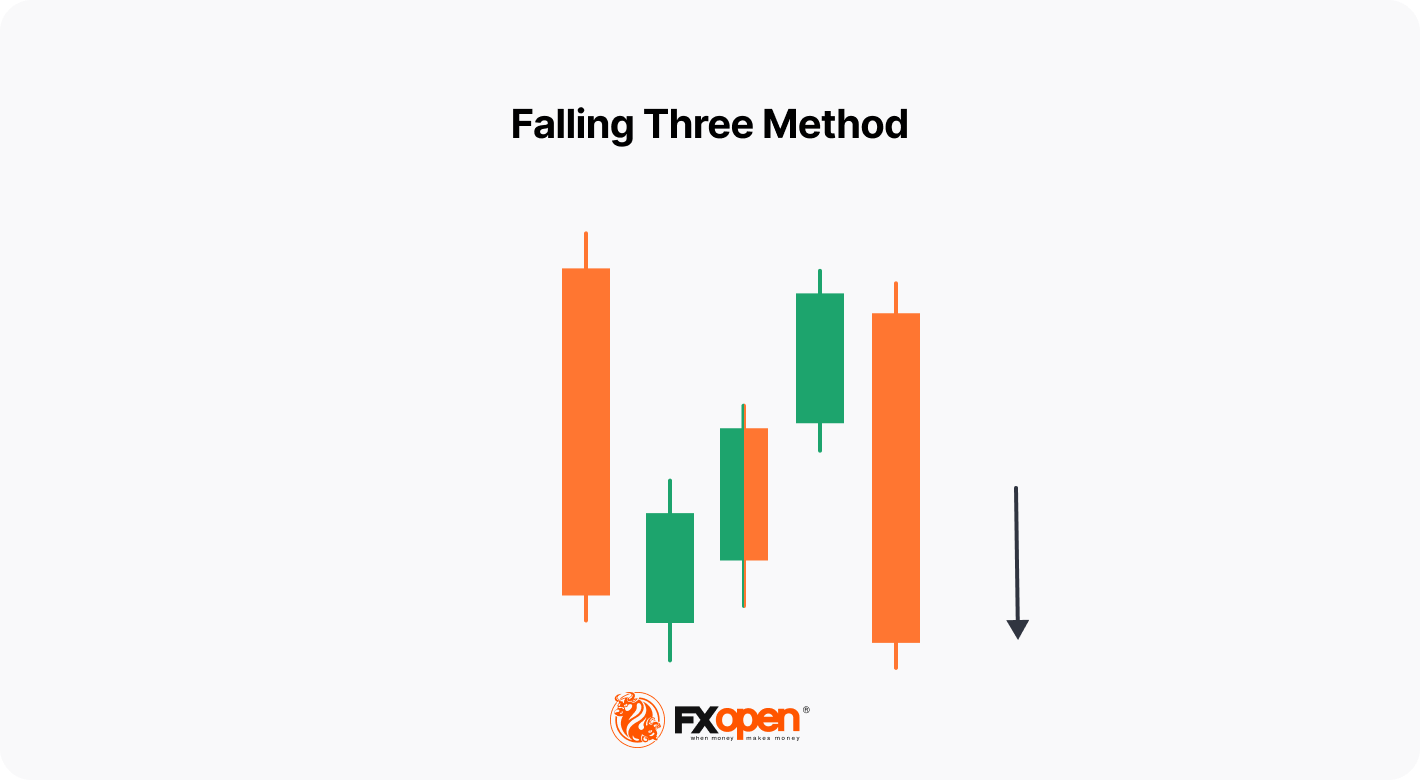

2) Rising and Falling Three Method

The rising three method forms when a market is consolidating, but the momentum remains intact, and the upward trend may continue after the pause. The structure is formed from five candles, with a long upward bar followed by three shorter downward bars that remain within the range of the first. The next bar is long and continues the trend higher.

In a conservative approach, traders enter the market after the fifth candlestick closes. In an aggressive approach, traders can enter the market while the fifth candle is forming. A stop-loss level is usually below the fourth candlestick in conservative trading and below the first candle when trading is aggressive.

The falling three method forms when bearish momentum remains intact, and the downward trend may continue after a period of consolidation. The first long downward candle is followed by three shorter rising bars that remain within the range of the first. The fifth bar is long and continues the trend lower. The pattern is established when the bulls begin to take control but are unable to complete the turnaround and are overwhelmed by the bears.

Conservative traders wait for the fifth candlestick to be formed to go short. In an aggressive approach, traders open sell positions while the fifth candlestick is forming. A stop-loss level can be placed above the fourth candlestick in a conservative approach and above the first candle in an aggressive one.

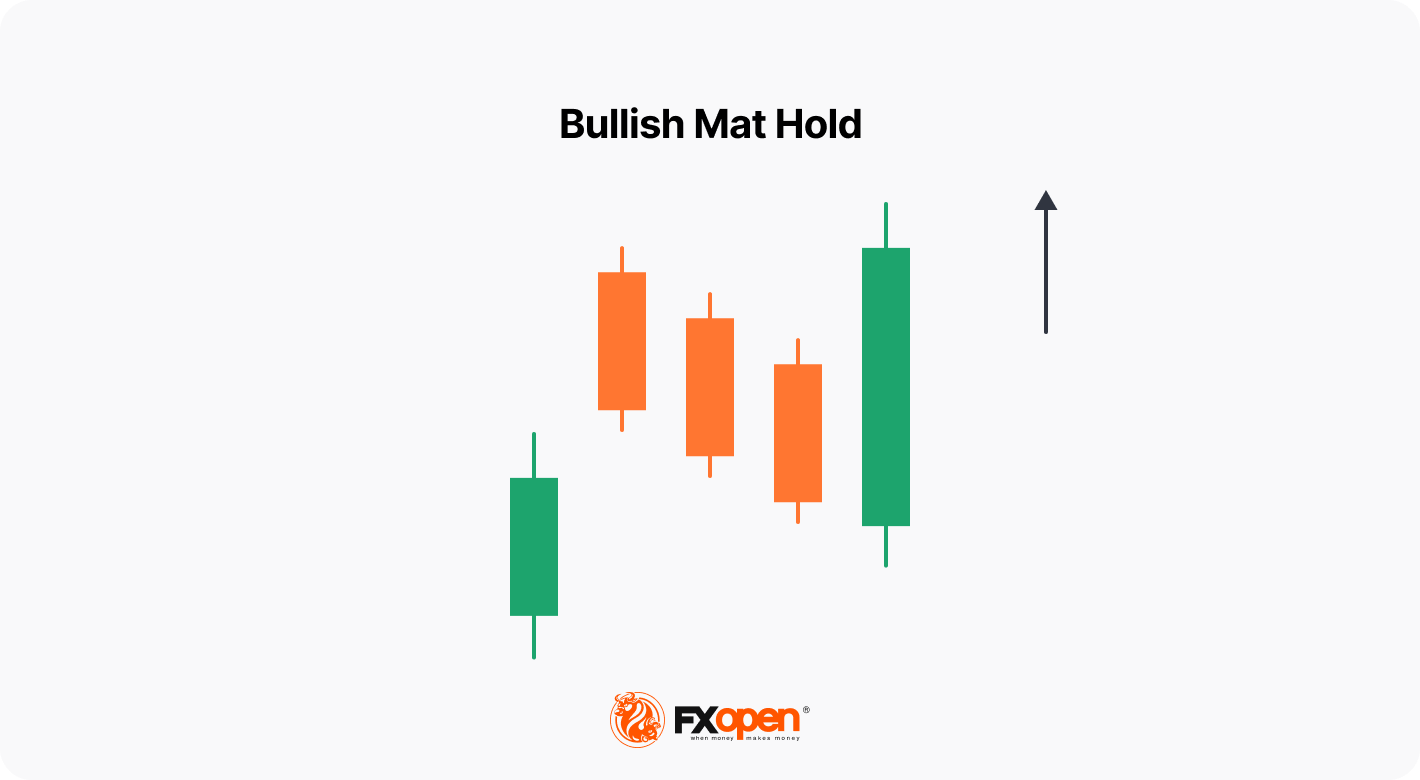

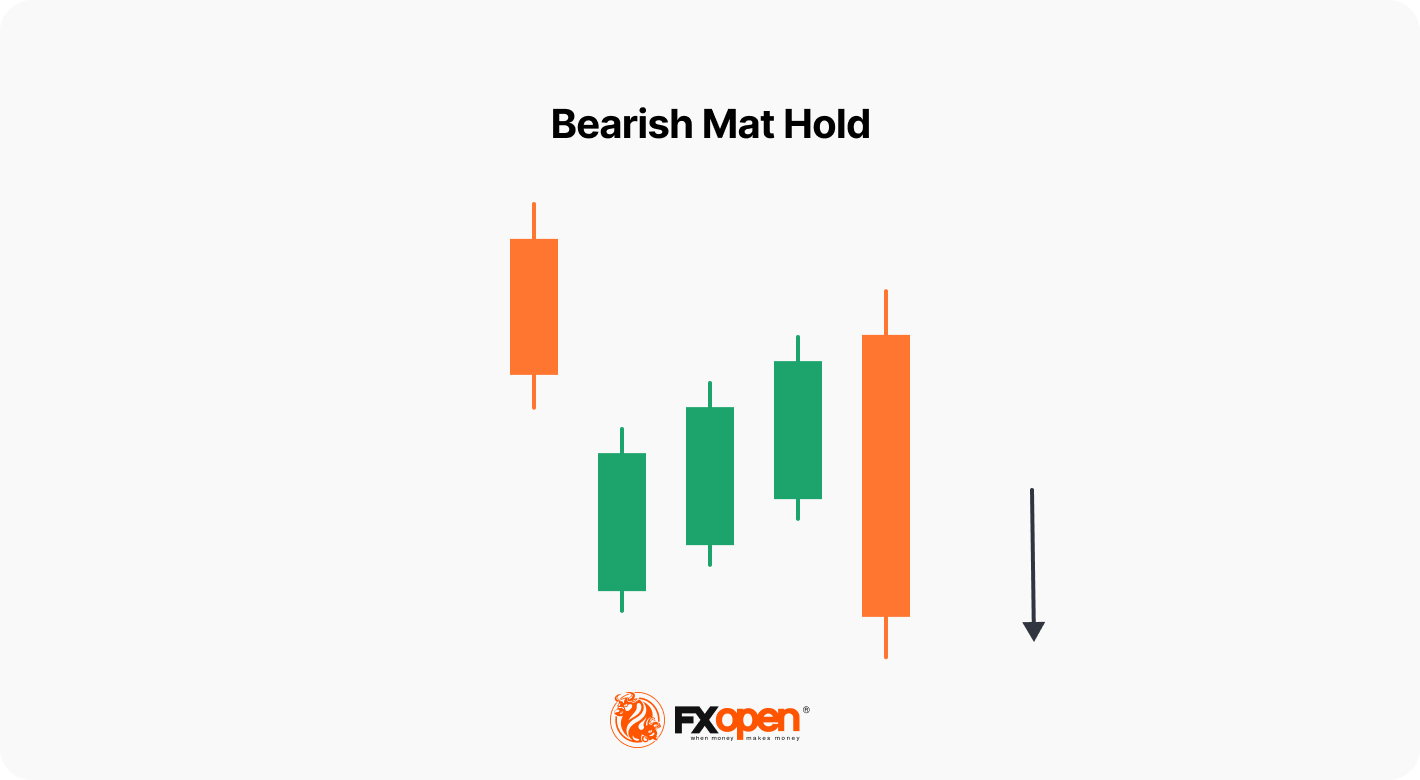

3) Mat Hold

The mat hold is a variation of the rising or falling three methods.

In a bullish mat hold structure, the initial candlestick has a large upward body. It is followed by a gap up (which is not seen in a rising three method) and then three smaller bars that move downward but above the low of the first bar. The fifth bar has a large body and moves higher.

The shape suggests a pause in the upward trend, but as the fifth candle closes higher than the first, it indicates the momentum remains strong and the market could continue in the same direction. Traders can use the pattern to buy near the close of the fifth bar or open a long position on the next candle, with a stop loss being placed below the fifth candle’s low.

In a bearish mat hold formation, the first downward candle is followed by a gap down and then three small candles that move higher but below the high of the first. The fifth bar has a large body and closes lower than the first.

Traders can use a bearish mat hold to sell near the close of the fifth candle or on the next one and place a stop loss above the high of the fifth candle.

4) Separating Lines

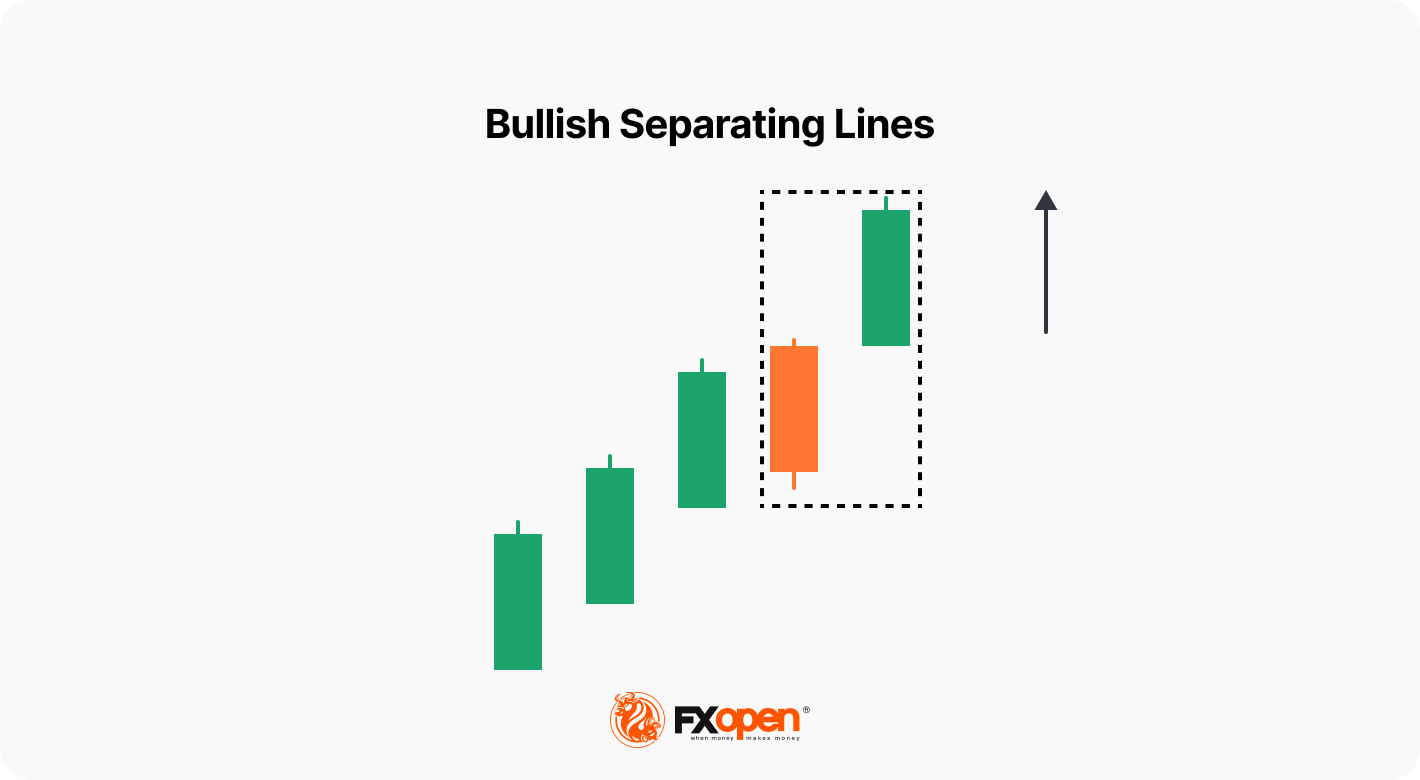

Separating lines are formed by two opposite candlesticks.

A bullish separating lines formation occurs in an upward trend. The first candlestick is a long downward candlestick counter to the prevailing trend, and the second one is upward, opening with a gap up or at the same level as the previous closing price. This suggests that the rally’s momentum may be slowing, but it is still likely to continue.

Traders can take the pattern as a signal to buy above the bullish second candle. They would place a stop loss beneath the first bearish candle to protect the long position from retracement.

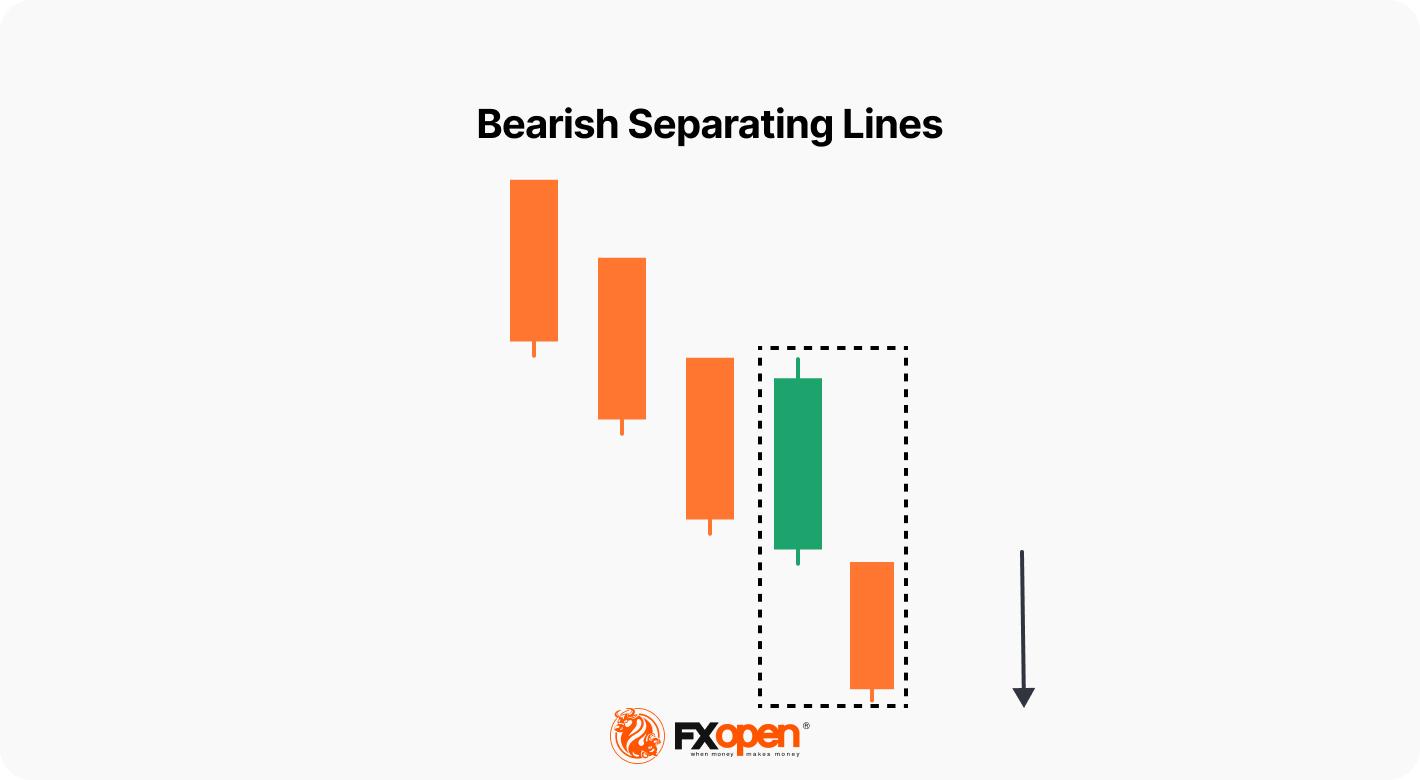

The bearish separating lines pattern forms during a price decline. The first candle is long and upward, countering the prevailing trend, and the second one is bearish, opening with a gap down or at the same level as the closing price on the first.

Traders can take the formation of separating lines as a signal to sell below the bearish second candle, with a stop loss above the first pattern’s candle.

5) Three Line Strike

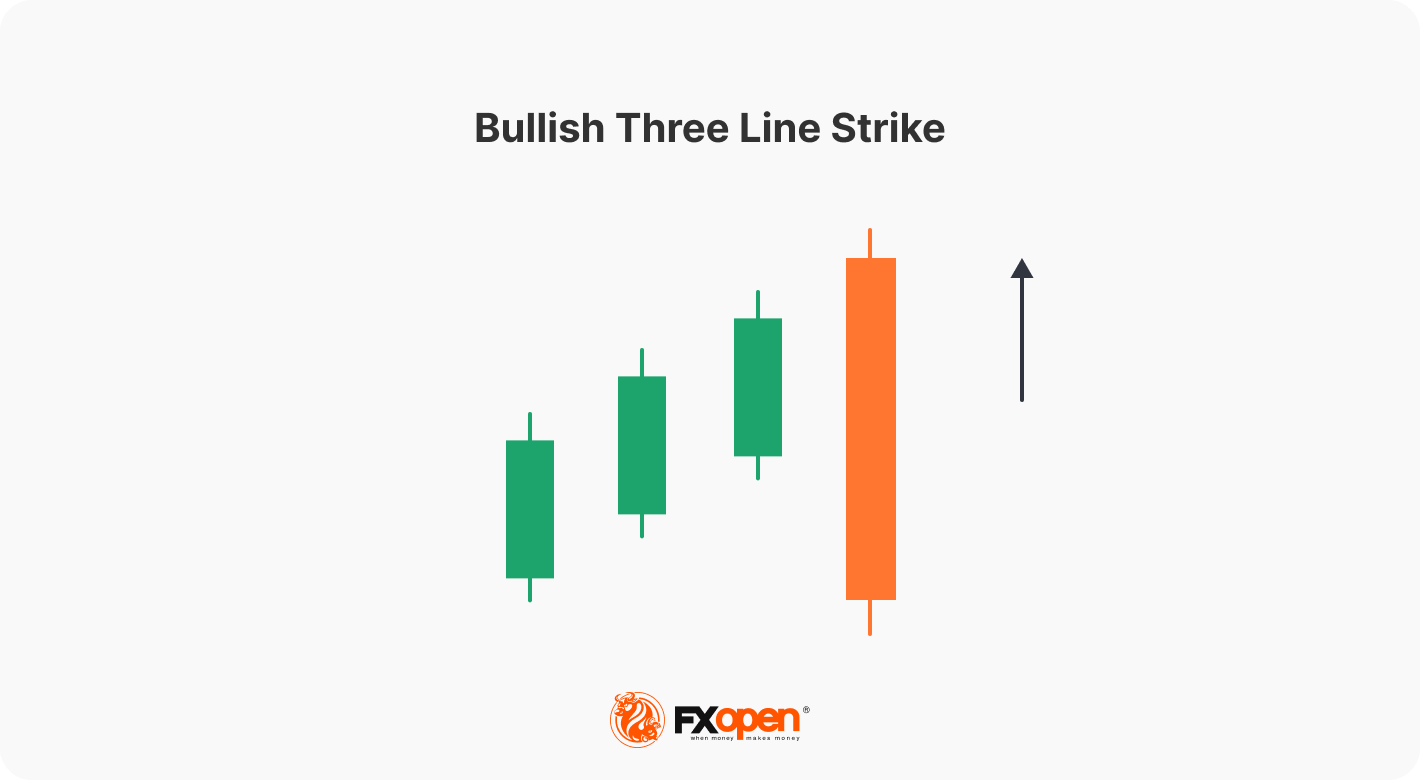

The three line strike consists of four candlesticks.

In a bullish market, the first three candles are long and continue upward with higher closing prices, the second and third open within the previous candle’s body, and the fourth opens at a higher price but closes lower than the first candle’s open.

Traders use the fourth candle as an entry point to capture profits from the subsequent continuation of the rally until it reverses. They would place a stop loss below the fourth and adjust it higher as the price rises.

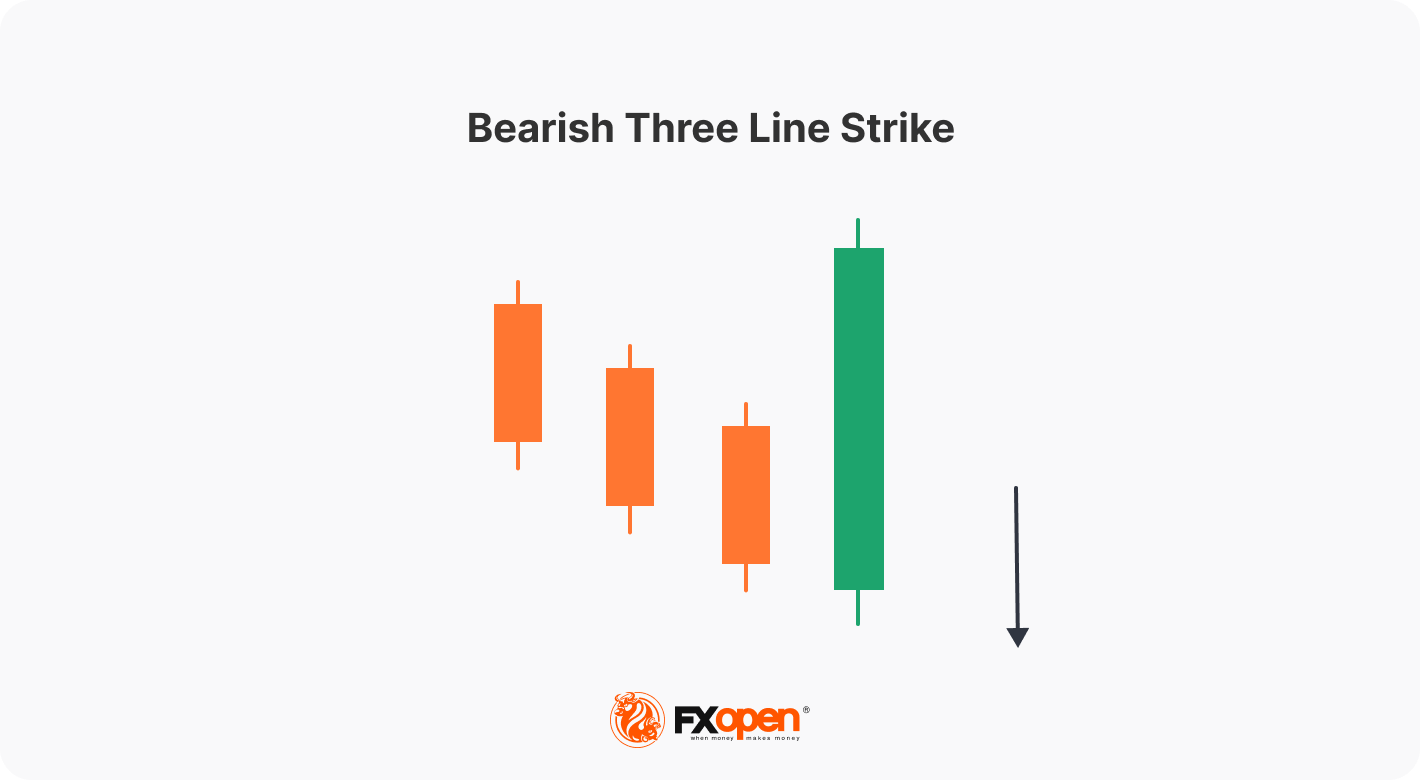

In a bearish market, the first three candles continue downward with lower closing prices, the second and third open within the previous candle’s body, and the fourth opens at a lower level but closes at a higher level than the first candle’s open.

Traders can take the fourth candle as a signal to sell, with an entry point at the bottom and a stop loss above the high of the fourth candle to protect the position in the event of a reversal.

Final Thoughts

Analysing candlestick continuation patterns helps traders to identify when trends are likely to continue and when they are running out of steam. They can be easily recognised on a price chart and help traders decide where to set entry and exit points for trades. You can open an FXOpen account and learn how to use them on live charts.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.