FXOpen

September 2021 will surely go down in history as the month when the German DAX index went through its biggest reform to date. On September 20th, the index will expand, growing from 30 stocks to 40.

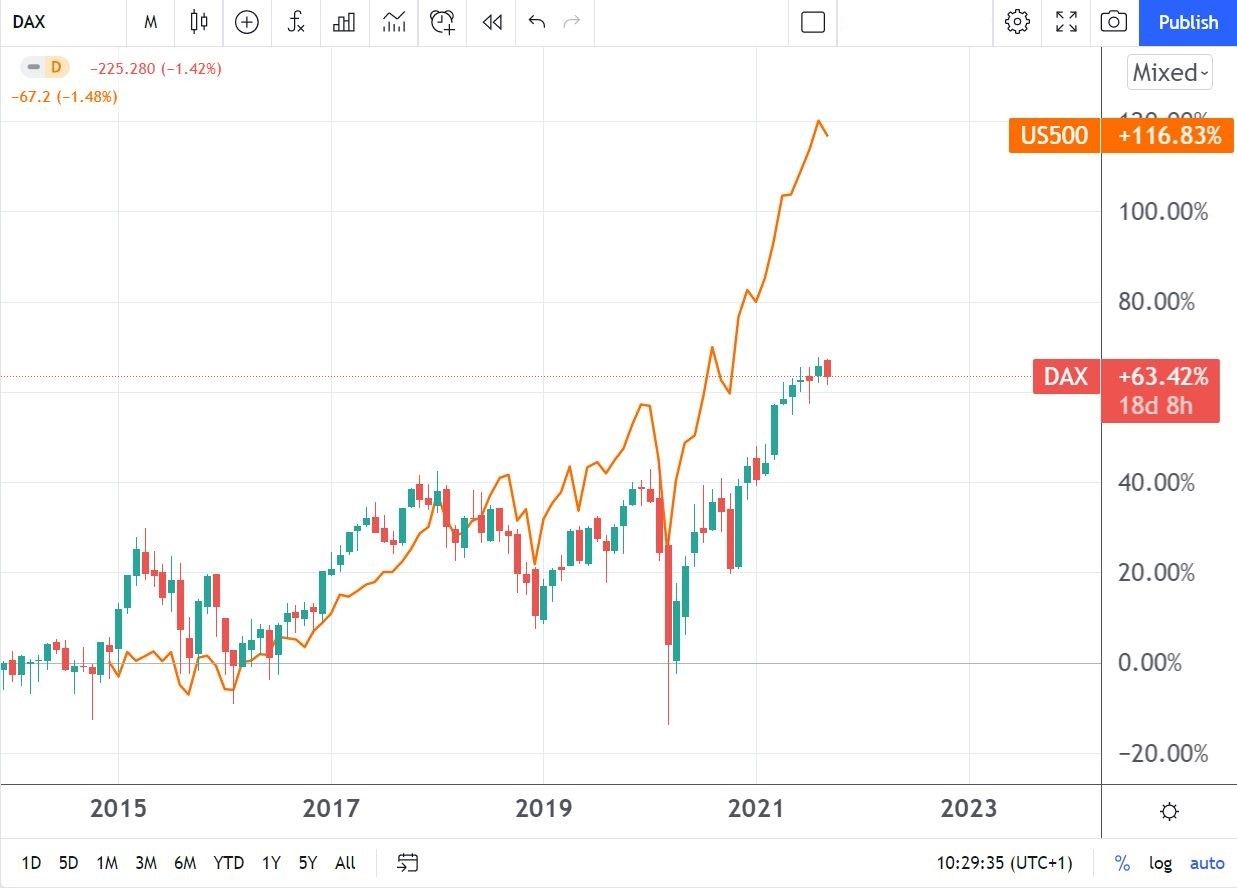

One of the reasons behind the change was the need to add more companies that would better reflect the new economy’s course. Truth be told, Germany’s flagship index has been performing weaker than its counterparts for some time now, with the S&P 500 and other US indices shooting ahead of it.

The ten DAX newcomers are essentially being promoted from the MDAX, an index tracking middle-sized businesses in Germany. Puma, Zalando, and Airbus are some of the best-recognized migrants. While not as popular, the other companies are equally important — among them Symrise, a producer of flavors and fragrances; Sartorius, an international pharmaceutical and laboratory equipment supplier; and Qiagen, a global provider of solutions to transform biological materials into molecular insights.

Will the upcoming changes make the DAX more attractive to investors? It remains to be seen.

Euro Traders Prepare for German Federal Elections

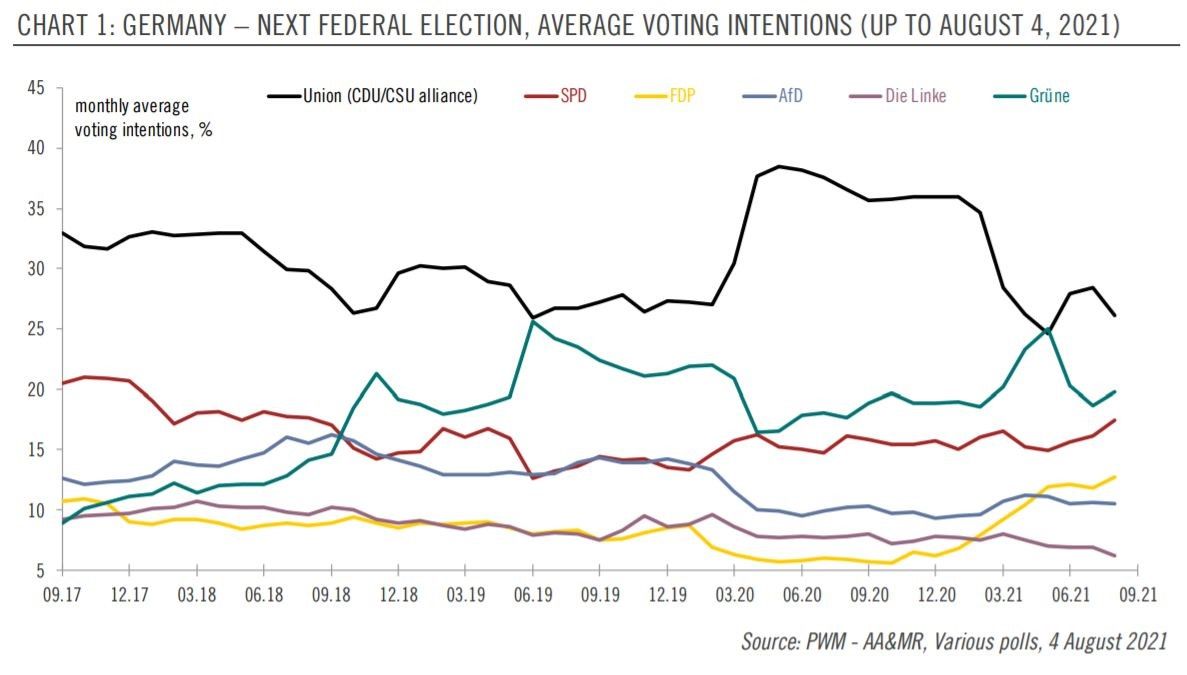

The 2021 German federal election is to be held on 26 September. Clearly, in the Euro Area, the event will hold its #1 status for the rest of the year. The importance of it cannot be understated, as Angela Merkel will step down as the German chancellor, ending her long-lasting political career.

With only two weeks left before the election, the Social Democratic Party of Germany is leading the polls. Olaf Scholz, the SPD leader, is viewed as the candidate who has the best chance to win the post of German chancellor. In case the socialists win, not only will this signify changes in the German leadership, but also changes in the fiscal space too, that markets will have to embrace.

All in all, an interesting September lies ahead for the traders paying close attention to the events in Germany. Since Germany is the Eurozone's largest economy, the happenings in the country will definitely affect the euro.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.