FXOpen

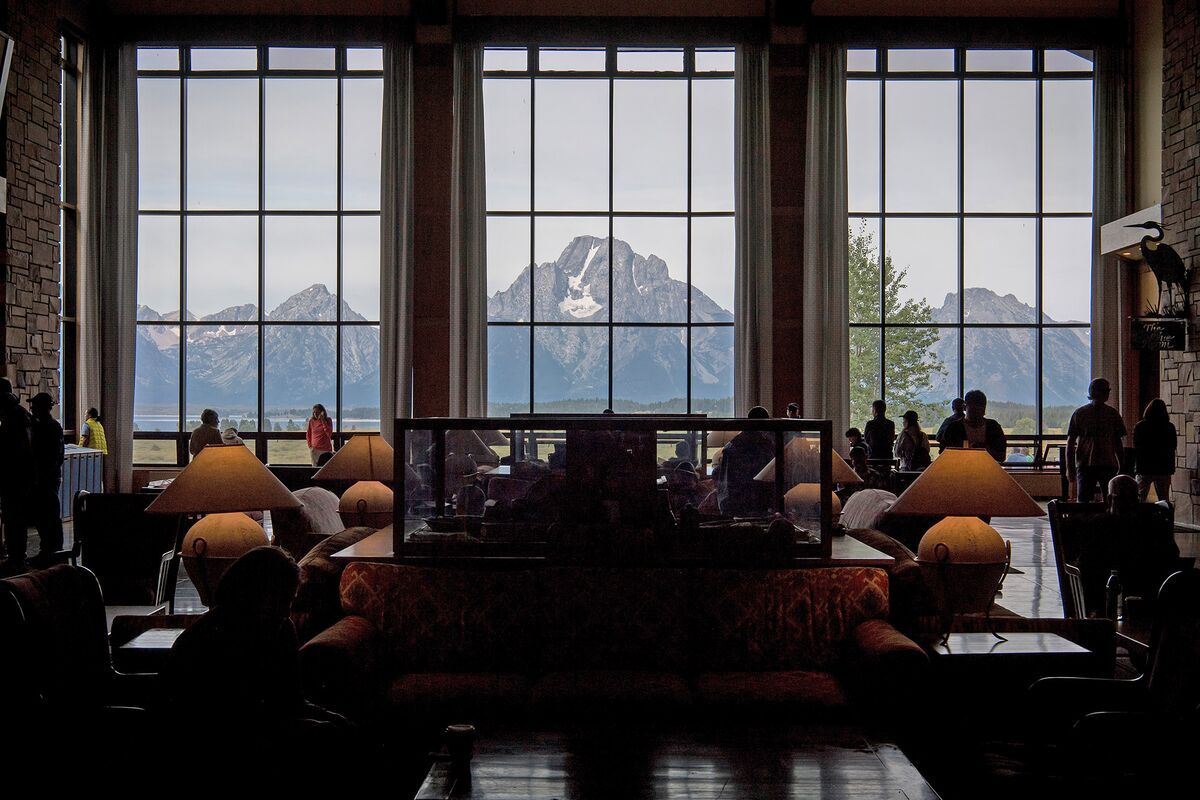

The Fed’s Jackson Hole Economic Policy Symposium will start on Friday and span into the weekend. Traders will focus on Fed Chair Jerome Powell’s speech on Friday (17:05 GMT+3). Although the risks of high inflation persist, the strength of labour-market activity and consumer spending metrics calls into question future rate hikes. The strength of the US dollar will depend on the central bank’s sentiment.

Nvidia’s second-quarter earnings report is expected on Wednesday after the closing bell. Some analysts have already raised their price targets for NVDA stocks; however, there are also sceptics. The company’s stocks are up around 200% on the year, but growth has slowed along with the broader market since the middle of July. Traders and investors will pay close attention to the company’s success in the AI industry.

Due to the seasonality effect, the stock markets are correcting. Last week, the major indexes and leading stocks suffered significant losses. The S&P 500 index declined by 2.1%, and the Nasdaq 100 plunged by 2.6%. On Friday, the markets tried to rebound, but it’s still unclear whether a rally will occur. This week, the Jackson Hole symposium and the Nvidia earnings report will determine the direction of the stock market.

Canadian Retail Sales data will be released on Wednesday (15:30 GMT+3). According to the forecast, MoM and YoY retail sales for June may decline, showing that Canadians are cutting their spending due to higher interest rates. This may negatively impact the strength of the Canadian dollar. Later this week, the USD/CAD pair may be affected by Jerome Powell’s speech at the Jackson Hole Symposium.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.