FXOpen

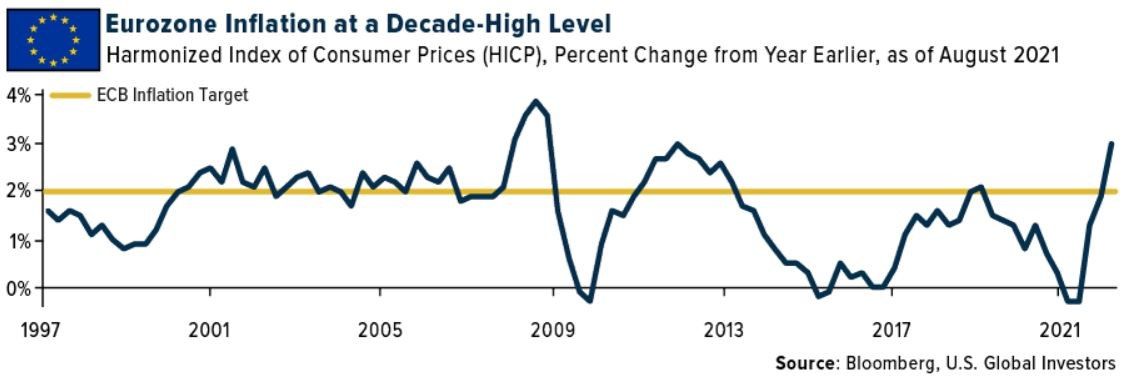

Inflation is running hot all over the world, and the Eurozone could not differ. Ahead of the ECB meeting scheduled this Thursday, the inflation rate in the Euro area reached a 10-year high.

Unlike the Federal Reserve of the United States, the ECB has only one mandate – price stability. The ECB measures price stability by bringing inflation below but close to 2%. It recently adjusted its target to a more symmetrical one, something similar to the average inflation targeting in the United States.

But the bottom line is that the ECB only looks at inflation before changing its monetary policy. The Fed, on the other hand, looks at inflation and job creation. Therefore, while inflation is way above the target in the United States, the Fed will not act on rates until the job market recovers. As we saw last Friday, the last NFP report disappointed – the U.S. economy only created one-third the jobs the market expected.

The Euro Trades with a Bid Tone Ahead of the ECB Meeting

The common currency, the euro, bounced recently from its lows. The EUR/USD exchange rate is up from below 1.17 and traded briefly above 1.19 after last Friday’s NFP report in the United States.

Similar to the EUR/USD, the EUR/JPY is in a bullish trend too. It regained the 130 level and trades with a bid tone.

The market expects that the ECB will signal the removal of its monetary accommodation, and thus the euro is bid against its peers. However, the risk is that the ECB will do nothing and the recent strength in the euro pairs will vanish.

All in all, an interesting week for financial markets lie ahead. Inflation is a problem in Europe, and the ECB will likely reiterate its view that inflation is transitory. If that is the case, and the ECB does nothing to address inflation fears, the euro bulls will be disappointed.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.