FXOpen

The most important trading week of the month has started, and traders are preparing for a sharp increase in volatility. No less than four central banks are expected to announce their monetary policy decisions, which will raise the currency market’s volatility.

Moreover, the moves may be exacerbated by lower liquidity levels typical for December. After all, December is known for most of the investment houses decreasing their market activity in light of the end-of-the-year holidays.

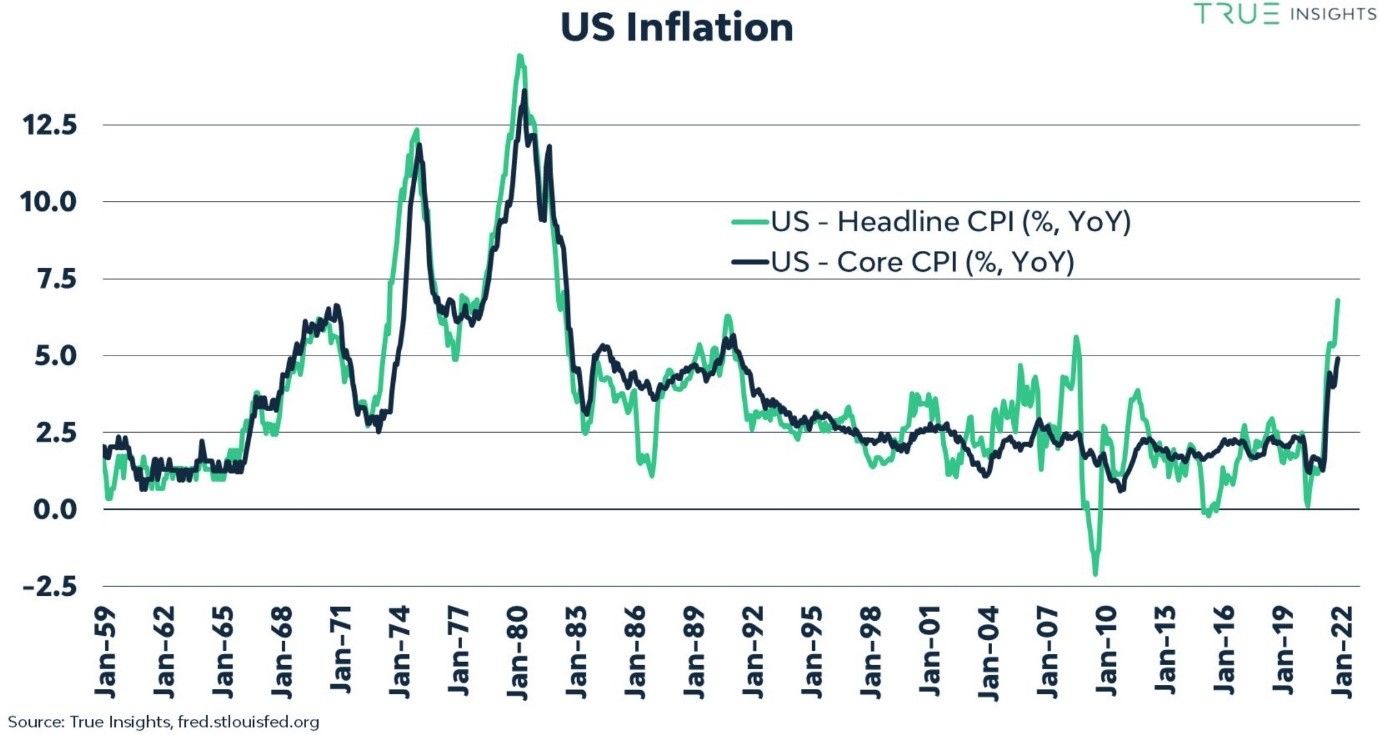

Inflation pressures central banks to tighten the monetary policy sooner than they would have wanted too. Last week, the US November inflation data showed that the prices of goods and services increased by 6.8% YoY, a rate not seen in the last 39 years. Therefore, the pressure on the Fed and other central banks increases to normalize their policies.

What to expect from the FOMC meeting on Wednesday

The Fed is due to announce its decision on Wednesday. The risk is that it will have a more hawkish tone than the markets expect as higher inflation is threatening the Fed’s mandate of price stability.

A couple of weeks ago, the Fed’s chair, Jerome Powell, announced that it is time to stop describing inflation as “transitory”. The problem with higher inflation in the States is that it will be exported to other parts of the world due to global trade partnerships, and also to the fact that the US is the largest economy in the world.

Three central banks to announce policy decisions on Thursday

One day after the Fed’s decision, three central banks will announce their monetary policy stance: the Swiss National Bank, the Bank of England, and the European Central Bank. Out of the three, the focus will be on the BOE and the ECB, because the Swiss National Bank is not expected to change its policy.

In the UK, while no rate hike is expected, the market participants will focus on the MPC asset purchase facility votes. Just like in the case of the Fed, the risk is that the BOE will be hawkish.

Finally, the ECB is facing a tough decision. The euro was weak all year, reflecting the bank’s dovishness. On the one hand, it does not plan to hike in 2022, in sharp contrast with the Fed. On the other hand, higher inflation forces its hand to taper asset purchases, a move that may be perceived as hawkish by financial markets.

This is what makes this trading week the most important in December. After Friday, volatility will decline as investors prepare for the end of the year festivities and holidays.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.