FXOpen

Last week was one to remember. Financial market participants were “spooked” by the hawkishness of the two major central banks in Europe – the Bank of England and the European Central Bank.

On Thursday, both central banks presented their monetary policy decisions. The Bank of England delivered a rate hike, as expected. But it turned out that four of its MPC members wanted a hike of 50 basis points instead of only 25. Hence, a more hawkish stance than expected, and the British pound soared.

Yet, it was nothing compared to what was to follow. A few hours later, the European Central Bank released its statement, and it took everyone by surprise.

It did not hike the rates, but said that the risks to inflation are tilted to the upside. In simple language, it means that the ECB is ready to consider hiking the rates as inflation moves higher.

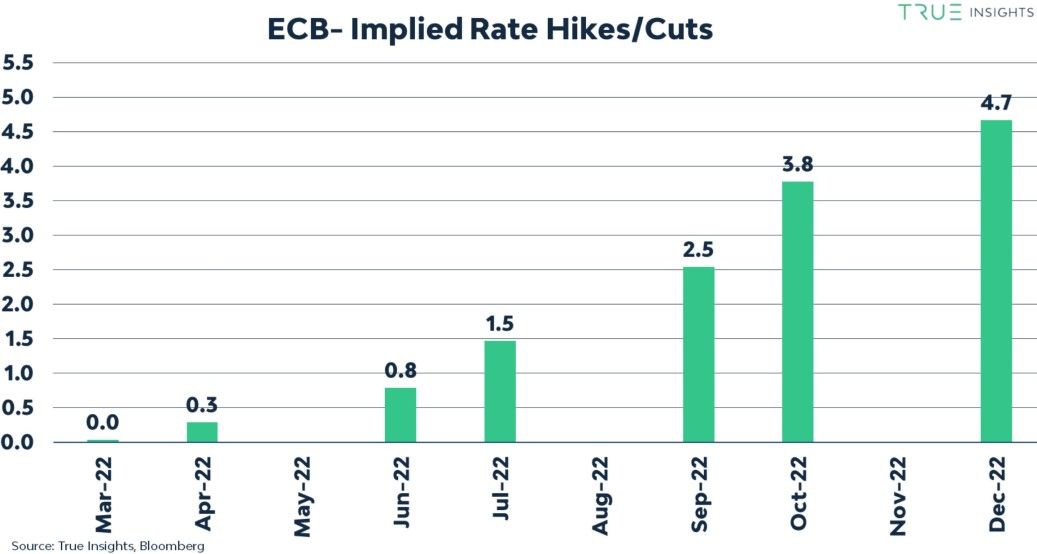

It was a surprise to markets because the ECB insisted up until last week that it would not hike the rates in 2022. But after last week’s message, the market started to price in a rate hike as soon as June.

The Move in European Rates Was Gigantic

With the ECB’s unexpected decision, the euro surged across the board, gaining against its peers. Even the EUR/GBP reversed the daily losses triggered by the hawkish Bank of England and ended the day higher by more than one big figure (i.e., one big figure equals one hundred points).

But more impressive were the moves in the European rates. For example, the German 2-year bond move was an eight standard deviation move, where a two standard deviation move is considered a large one.

As for the peripheral economies, higher rates mean an increasing financial burden. However, the ECB signaled that it would not tolerate higher inflation as rising prices of goods and services has been the dominant theme during the COVID-19 pandemic.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.