FXOpen

The dark cloud cover is a two-candlestick pattern that suggests a potential reversal from an uptrend to a downtrend. It may benefit traders and technical analysts seeking to identify selling opportunities. In this article, we will discuss how to spot the setup on a price chart and interpret its signals.

What Is a Dark Cloud Cover?

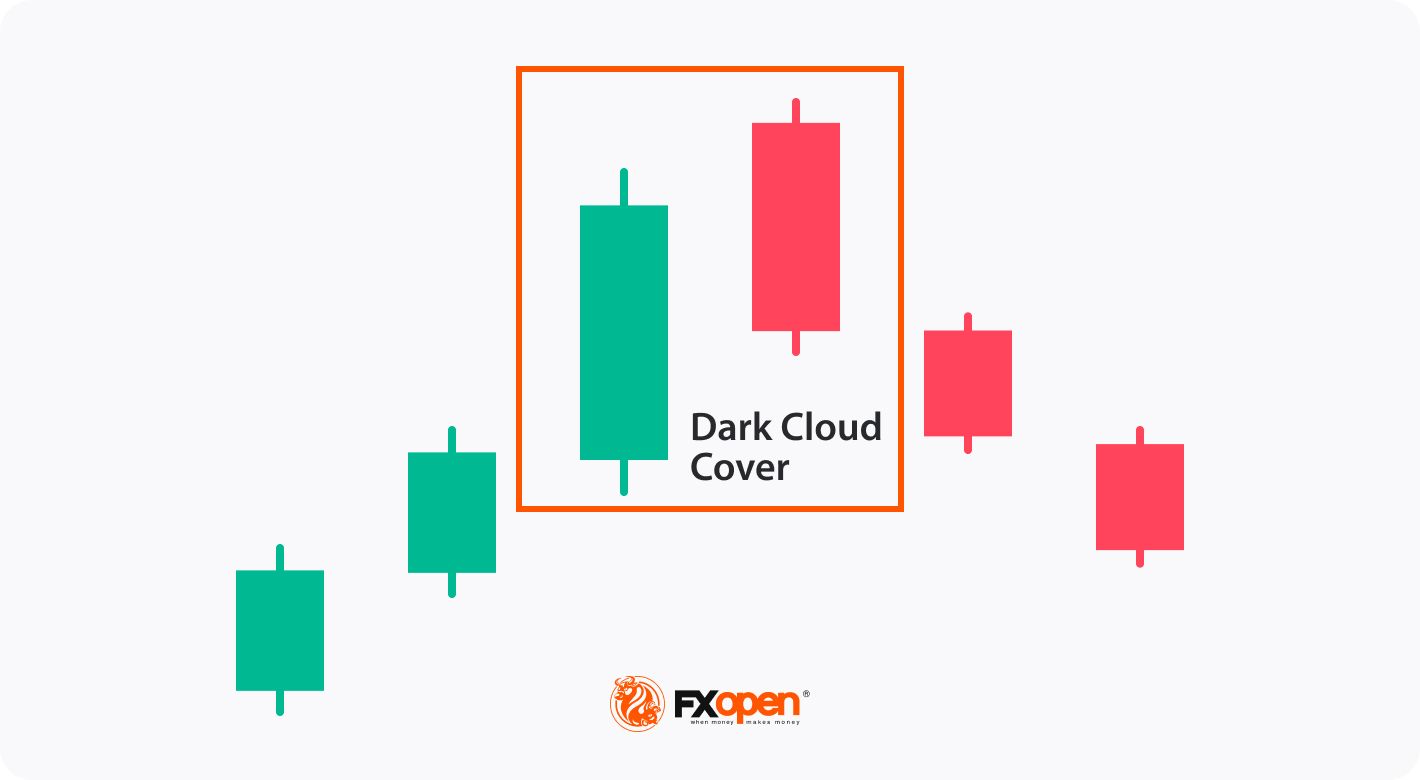

It is a two-candlestick chart pattern that typically appears at the end of an uptrend and signals a potential bearish reversal in the price of an asset. It consists of a long bullish candlestick, followed by a long bearish candle, where the second candlestick opens above the first candlestick's high but closes below its midpoint.

The dark cloud cover in forex or other markets suggests that the bulls have lost control of the market, and the bears are starting to take over, creating a resistance level that the bulls are unable to break.

Regardless of the timeframe, the setup can be observed in any financial instrument, such as stocks, cryptocurrencies*, ETFs, indices, and forex. At FXOpen, market participants can trade all these via CFDs.

How to Identify the Dark Cloud Cover Candlestick Pattern on a Chart

To identify this formation on a trading chart, traders look for the following characteristics:

- The pattern should occur after a prolonged uptrend. The longer the uptrend, the more reliable the signal.

- The first dark cloud cover candlestick should be long and bullish, indicating that the bulls control the market.

- The second candlestick in the pattern should be long and bearish, with a close below the midpoint of the first dark cloud cover candle. The second candlestick's open price should be above the high of the first one.

- The second candle should have a body that is at least half of that of the first one.

If these conditions are met, traders can identify a setup on the trading chart. It is important to note that traders never use this formation in isolation and confirm it with other technical indicators and analysis techniques to increase the probability of a correct signal.

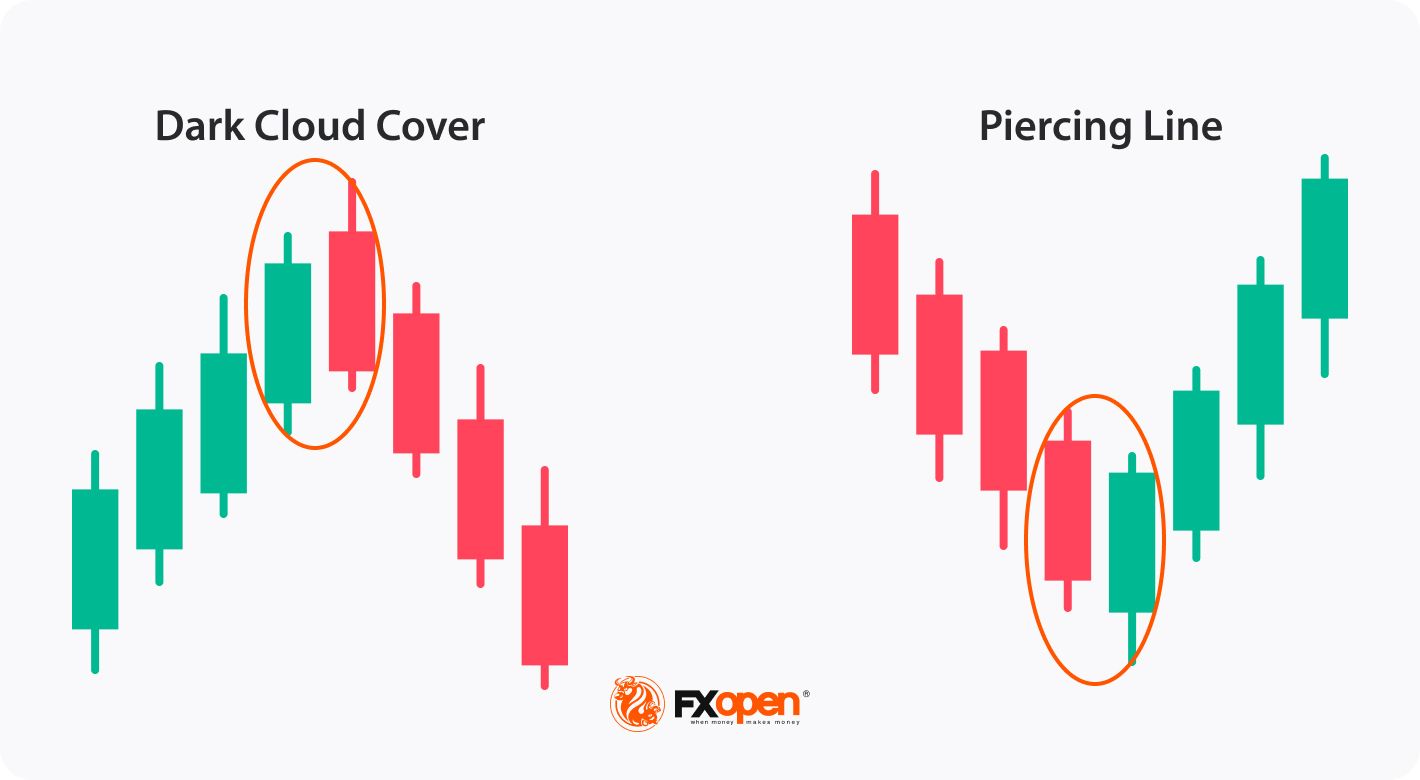

Dark Cloud Cover vs Piercing Line

The piercing line is also a two-candlestick pattern, but it consists of a long bearish candlestick followed by a long bullish candle. The bullish candle opens below the low of the previous bearish candle and closes above its middle point, indicating that the bears have lost control of the market, and the bulls are starting to take over.

The main difference between the bearish dark cloud cover and the piercing line is the direction of the trend preceding the formation. The former appears at the end of an uptrend, while the latter appears at the end of a downtrend. Additionally, the piercing line is considered a stronger reversal signal than its counterpart.

You can examine both formations on charts of different assets and on multiple timeframes for free using the FXOpen TickTrader platform.

Trading the Dark Cloud Cover

Here are the steps you can use to trade this formation:

- In trending markets, traders can look for an uptrend and identify if it's showing signs of slowing down or weakening. They can then wait for a red bearish candle to gap above the previous green one, which opens mostly at the same level as the previous close.

- The bearish candle should proceed lower and close below the midway point of the bullish one, indicating that the bears outweigh the bulls. The theory states that traders can place a sell order at the opening of the next candle after the setup has formed, with a stop loss placed above the recent swing high.

- Traders can set their initial target at key levels or recent areas of support.

Live Market Example

A trader finds a dark cloud cover candlestick pattern (1, 2) on the M1 chart of Alibaba stocks. Following the general approach, they place a stop loss above the swing high with the take profit at the next support area.

Final Thoughts

No trading strategy is foolproof, therefore, traders incorporate risk management strategies and additional technical indicators to increase their chances of success. Furthermore, they should be aware of false signals and adjust their strategies accordingly. Once you have developed confidence in your trading strategy, you can open an FXOpen account and apply it to live trading.

FAQ

Is dark cloud cover a bullish reversal?

No, it is a bearish reversal formation that appears on a candlestick chart and indicates a potential trend reversal from an uptrend to a downtrend. It consists of a long bullish candle followed by a long bearish one that opens above the previous candle's high and closes below its midpoint.

Is dark cloud cover reliable?

Traders don’t rely solely on it for making trading decisions but instead, use it as a confirmation tool along with other technical indicators and patterns and fundamental analysis. No price action is 100% reliable, and there is always a risk of false signals and market fluctuations.

What is the opposite of dark cloud cover?

The opposite of the dark cloud cover is the piercing line which is a two-candlestick formation that appears on candlestick charts and signals a potential trend reversal from a downtrend to an uptrend.

What is the difference between a piercing line and dark cloud cover?

The piercing line and dark cloud cover are two different candlestick patterns signalling trend reversals. The former is a bullish reversal setup that appears after a downtrend, while the latter is a bearish reversal formation that appears after an uptrend. The key difference between the two is their direction and the market conditions in which they appear.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.