FXOpen

A Heikin Ashi (HA) chart is a specific type of candlestick chart that traders use in technical analysis to identify the direction of asset price trends. What are Heikin Ashi candles, and how are they formed? How is the difference between regular candles and Heikin Ashi candles explained?

In this FXOpen article, we provide an overview of this charting technique and explain how to trade Heikin Ashi candles.

What Is Heikin Ashi?

This charting technique was created by Japanese merchant Munehisa Homma in the 1700s to track commodity prices, although it is now used to analyse other types of assets.

Heikin means “average” or “balance” in Japanese, and Ashi means “bar” or “foot.” The technique modifies a standard candlestick chart to use two-period averages in calculating each candle. This smooths out the data to filter out noise, making it easier to identify market trends and reversals, although it also hides gaps and some of the price information.

Traders use Heikin Ashi chart analysis to help them decide when they should hold a trade open, pause, or exit ahead of a reversal. They can adjust their positions based on this information to take profits or avoid losses.

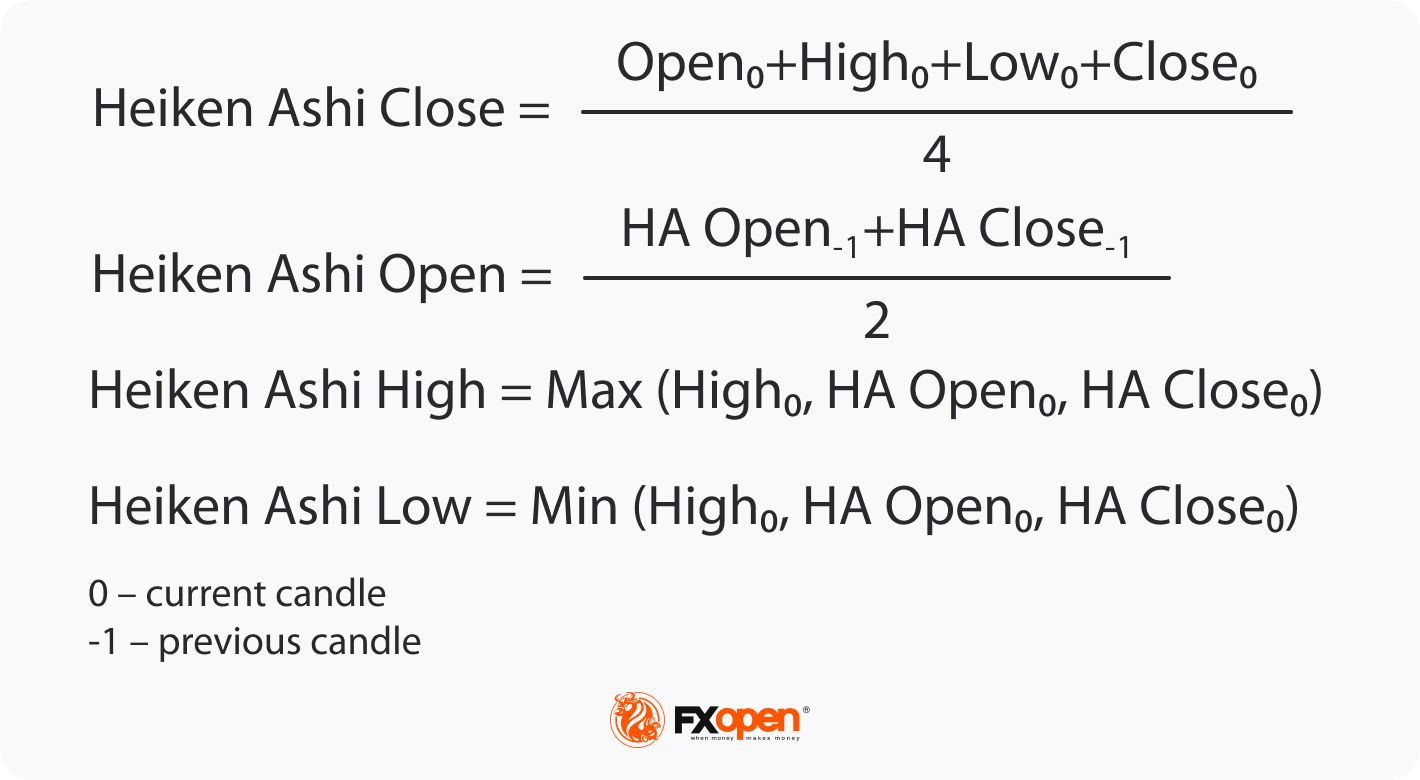

Heikin Ashi Calculation

The Heikin Ashi formula takes the opening and closing values from the previous session and the opening, high, low and closing values from the current session to construct candlesticks. The opening of the candlestick always lines up with the midpoint of the previous candlestick’s body, and the close is the average price of the current candle.

The top of the upper wick on the candlestick refers to the highest value of the current high, open and close. The bottom of the lower wick represents the lowest value of the current low, open and close.

The difference between the session’s opening and closing prices determines the body. The candlestick is green when the close is higher than the open and red when the close is lower than the open.

Trading platforms such as TickTrader have charts that use the Heikin Ashi calculation and can be set to display different time frames, such as intraday, weekly, monthly, and so on.

Heikin Ashi and Japanese Candlesticks: Differences

The Heikin Ashi chart looks like regular candlesticks, but the former comprises the open, high, low and close (OHLC) values. Instead, Heiken Ashi candlesticks are calculated with the modified close, open, high and low (COHL) formula. As a result, they appear smoother because price movements are averaged out.

Japanese Candlestick

Heikin Ashi

HA candles tend to remain bearish when an asset’s value is in a downward trend and remain bullish during an upward trend, unlike standard candlesticks that sometimes alternate directions even when the movement is predominantly going the same way.

Because HA candlesticks use averages, they do not necessarily match the price at which the market is trading, whereas standard candles do match the current asset price.

You can analyse HA charts alongside Japanese candlestick charts to make it easier to discern market trends and predict how prices could move in the future.

How to Interpret an HA Chart

Traders use Heikin Ashi bars to determine when to stay in trades and when to exit as the trend pauses or reverses course. Like with standard candlesticks, when the price rises, the candles are bullish (usually green or white), while when the price declines, the candles are bearish (usually red or black).

Traders can find standard patterns, including head and shoulders and inverted head and shoulders, wedges, pennants, and triangles, on the HA chart too. However, they should remember that although Heikin Ashi candle patterns are typically considered to be reliable, they can give false signals like all technical indicators.

How do you read HA candlesticks, and how might you use them to direct your trading strategies?

Trend Strength

A HA chart smooths out directional movements with more consecutive bars of the same colour, eliminating brief corrections or consolidations to provide a clearer view of the strength of the trend. The most common way to use the chart is to identify the start of a strong trend.

Hollow or green candles indicate a bullish trend, and a series of green candlesticks with no lower shadows provides a strong signal, so in this situation, you might choose to open or add to a long position.

As filled or red candles point to a downtrend, and a series of red candlesticks with no upper wicks provide a strong signal, you might opt to go short when you observe these indications.

When a trend is strong, you will likely want to stay in the trade and use a trailing stop loss to limit risks and maximise profits.

Trend Reversal

A change in the colour of the candlesticks and a shift to candles with small bodies and long upper and lower wicks – known as Doji candlesticks – indicate a potential change in the direction of the market. This helps you determine when to exit a trend-following trade or enter a new position.

If the candles indicate a reversal of a bearish trend, you might choose to go long, or if the candles point to the reversal of a bullish course, you might choose to go short. You could also decide to wait for confirmation of a reversal before making a move, as the market could be pausing rather than reversing.

The chart above shows how the bottom wicks on long red candles get longer as the price continues to fall, indicating that it was being pushed back up as buying pressure began to increase, eventually resulting in a strong upward move.

Conclusion

Understanding how to read Heikin Ashi candles can help you to identify trends and reversals more easily than standard candlesticks. You can use the price signals provided by this useful form of technical analysis to decide when to enter and exit trading positions to maximise your profits.

You can open an FXOpen account to practise using HA charts and other technical indicators and then start trading when you are ready.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.