FXOpen

The VWAP indicator has long been a favorite of day traders. With crypto trading volumes growing, some have begun employing the VWAP to help them decipher this volatile market. In this article, we’ll explain what the VWAP is, how it’s used, and offer two strategies you can start using right away. Let’s dive in!

What Is Volume Weighted Average Price (VWAP)?

The Volume Weighted Average Price (VWAP) is a popular technical indicator in financial markets that offers insights into the average price of a security over a specific time period. Unlike traditional moving averages that only focus on price, VWAP incorporates both price and volume data for a more comprehensive view of market activity.

The power of VWAP lies in its role as a benchmark for evaluating trade efficiency. Traders often compare their executed trade prices to the indicator to determine if they've bought or sold at a favourable or unfavourable value relative to the asset's average price during the specified time period. A position entered above the VWAP suggests a higher price than the average market value for that period, while a trade executed below indicates a lower price.

How to Calculate VWAP

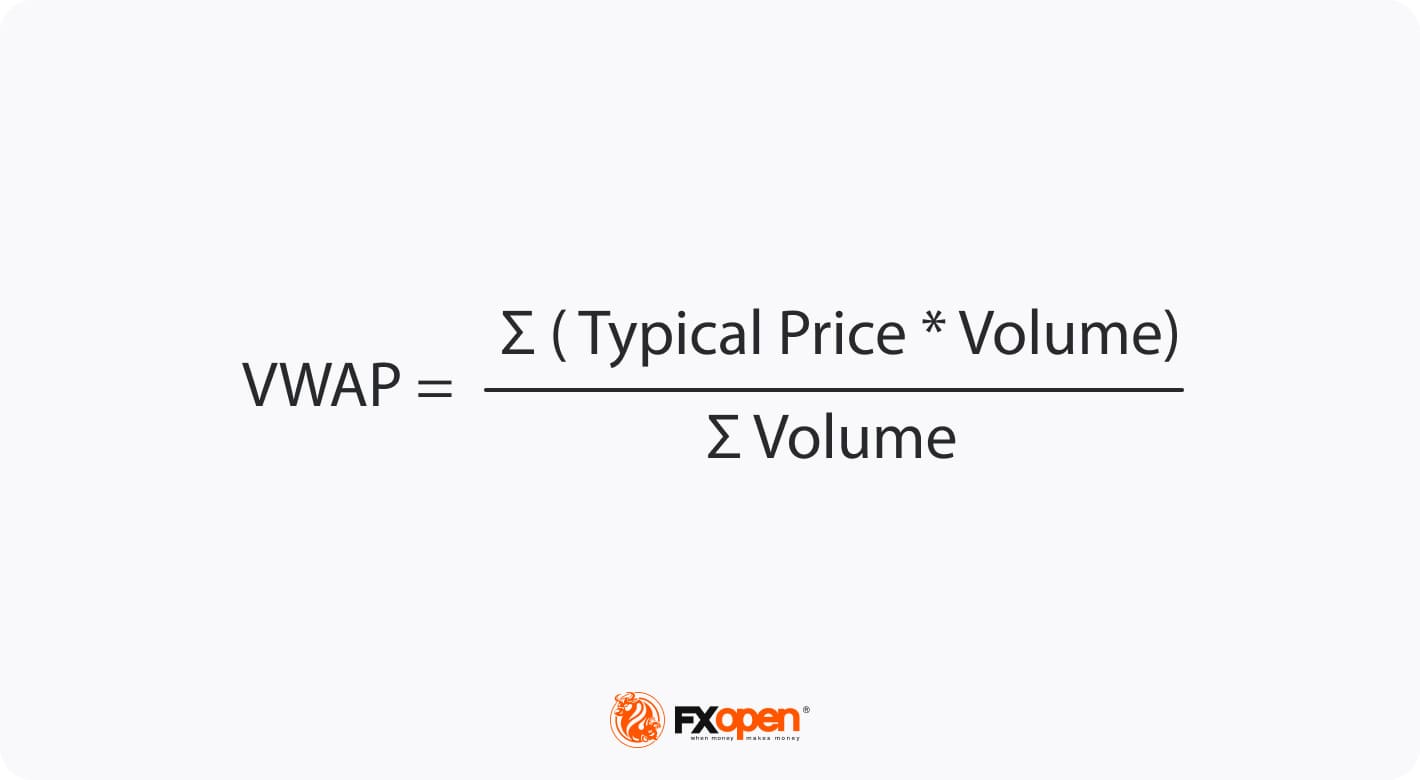

To calculate VWAP, multiply the asset's typical price by the volume traded at that price, sum these values over the chosen time period, and then divide by the total volume traded during that timeframe. This calculation emphasises prices with higher trading volume, as they represent more significant market activity. The formula for VWAP is:

Where:

- Typical Price: The average of high, low, and close prices of the asset at a given time period

- Volume: The volume of the asset traded at a particular period

- Σ: the total sum of values over the specified time period. The figure will change as new data becomes available.

Using VWAP With Crypto

So how do traders use the VWAP indicator for crypto? In four ways: assessing fair value, market sentiment and trends, support and resistance levels, and entry quality.

Fair Value

One of the primary uses of the indicator is to assess the fair value of an asset. By comparing an asset’s current value to its VWAP, traders can determine if the security is trading above or below fair value.

A current price above VWAP may suggest the security is overvalued, while a current price below may indicate undervaluation. Armed with this information, we can make informed decisions, such as taking long or short positions based on the deviation from the VWAP.

Market Sentiment and Trends

It can also shed light on the cryptocurrency market’s sentiment and trends. If an asset’s current price consistently trades above its VWAP, it could signify bullish sentiment and a potential uptrend. Conversely, if the current price is consistently valued below, it may signal bearish sentiment and a potential downtrend.

Traders may use this information to identify market trends and adapt their strategies accordingly. For instance, in a bullish market, traders might seek buying opportunities when the price approaches VWAP, while in a bearish market, traders could look for selling opportunities when the price nears the indicator.

Support and Resistance Levels

VWAP can be instrumental in pinpointing support and resistance levels. These key levels on a price chart represent areas where buying or selling pressure might be strong, leading to possible reversals or breakouts.

Traders can leverage VWAP to recognise potential support or resistance levels and integrate them into their trading strategies. For example, if a security's price falls close to VWAP and then rebounds, it may suggest a potential support level, and traders might look for buying opportunities. On the other hand, if the asset surges close to the indicator but fails to break above it, this may signal a potential resistance level, prompting traders to seek selling opportunities.

Entry Quality

Finally, it can also help traders assess the quality of entry points for their positions. By comparing their entry price to the VWAP indicator, crypto traders can determine the effectiveness of their trade executions.

An entry price near VWAP may indicate a high-quality entry, as the trade was executed close to the average market price during the specified time period. Conversely, an entry price that deviates significantly from VWAP could suggest a lower-quality entry, as the trade was entered at a value far from the average market price. Traders could use this information to evaluate their trading strategies' performance and make necessary adjustments.

How to Use VWAP for Crypto Trading

Now that you understand what the VWAP is, how it’s calculated, and how it’s used, let’s take a look at some VWAP crypto strategies. You can follow along in the free TickTrader platform by FXOpen, where you’ll find the VWAP and dozens of other tools ready to help you navigate the markets.

VWAP Retracement

In this strategy, we set a bias based on the overall trend, then look to enter trades in that direction when the price moves back above/below the VWAP, depending on the directional bias.

- Requirements: Your preferred cryptocurrency pair on the 15-minute chart, a standard VWAP indicator, and a directional bias.

- Entry: In an uptrend, look for the price to cross below the VWAP. Then, when it shoots back above, we may enter on the close of the candle. You can do the opposite for a downtrend.

- Stop Loss: Just beyond the nearest swing low/high, depending on the direction of your entry.

- Take Profit: Here, we’ve used a fixed 2.5 risk/reward ratio to take profit, although you may prefer to use other technical factors, like support/resistance or indicators, to determine your exit point.

In the example shown, we see that Bitcoin is in a solid uptrend, cooling off slightly to test the VWAP. When it moves below, we see a rejection and close back above the VWAP that offers us an entry signal. Subsequent retests fail to move below our stop loss before the price accelerates higher.

VWAP and Relative Strength Index (RSI)

Using the idea of fair value, we can combine VWAP with the relative strength index (RSI) to pinpoint overvalued and undervalued conditions, allowing us to anticipate a reversal. We’ve set the RSI to only signal overbought/oversold areas when the indicator reads above 80 and below 20, respectively, to filter out any false signals.

- Requirements: Your preferred crypto asset on a 5-minute chart, VWAP with default settings, and an RSI with boundaries set at 80 and 20.

- Entry: When the price is above the VWAP, we wait until RSI moves above 80. When it crosses back below 80, we can enter on the close of that candle. When it’s below the VWAP, we wait for RSI to read below 20, then enter when it moves back above 20.

- Stop Loss: Beyond the nearest swing high/low, depending on the trade direction.

- Take Profit: Traders may exit their positions when the price returns back to the VWAP.

In this chart, we see that the price moves far above the VWAP, pushing RSI above 80. When the index moves back below 80 on the next candle, we can enter in anticipation of the price falling back to the VWAP line.

The Bottom Line

In summary, VWAP is a powerful technical indicator that can provide valuable insights into market activity and help traders make informed trading decisions. While it’s best to combine the indicator with other forms of technical analysis, the two strategies described should give a great jumping-off point to begin developing your own system.

It’s worth noting that the information offered in this article can be applied to virtually all asset classes, like forex, stocks, and commodities – not just crypto. Once you’ve honed your VWAP trading skills in the TickTrader platform, why not consider opening an FXOpen account? You’ll be able to access over 600+ markets, low-cost trading, and ultra-fast execution speeds, and trade with confidence knowing you’re partnered with Traders Union’s Most Innovative Broker of 2022. Good luck!

At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.