FXOpen

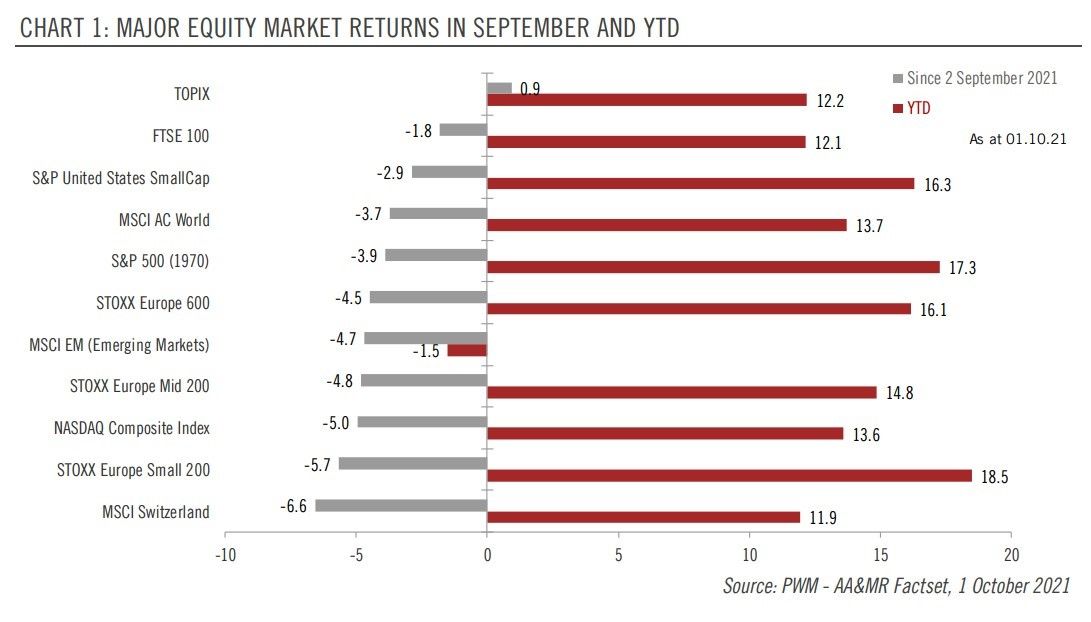

In September, financial markets celebrated the change in the Japanese leadership by sending up the stocks. Likewise, the news of the Japanese prime minister’s resignation has spurred a stock market rally, and in September, the TOPIX index outperformed its peers like NASDAQ or MSCI AC World Index.

Since a new prime minister was approved by the parliament, the stock market has been rallying on the news that the new leadership is preparing a new stimulus package to support economic recovery.

But there is something else behind the Japanese equities rally. As it turns out, the new prime minister, Fumio Kishida, is backing down on his talk of raising corporate taxes. The news has spurred a further rally in the stocks and a lowering of the Japanese yen.

What About the Japanese Yen?

The Japanese yen has been dropping like a rock recently, as seen in the main JPY pairs like USD/JPY and EUR/JPY. USD/JPY, in particular, seems very strong. The market trades now close to 113, up close to 100 pips points since the start of the current trading week.

The move higher in the Japanese yen diverges from the rest of the financial markets. The yen is typically viewed as a risk-off currency, and the stock market decline in September failed to trigger a stronger yen. Instead, it correlates now with the Japanese equities.

Another factor driving Japanese equities higher is the successful vaccination campaign. While the campaign started slow, it is now fast approaching herd immunity levels.

All in all, the momentum in the Japanese equity market seems strong, fueled by local developments. Unless we see a major correction in the US equity markets that will be able to derail the Japanese yen trend, chances are that we will see more of the same in the months left in the trading year.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.