FXOpen

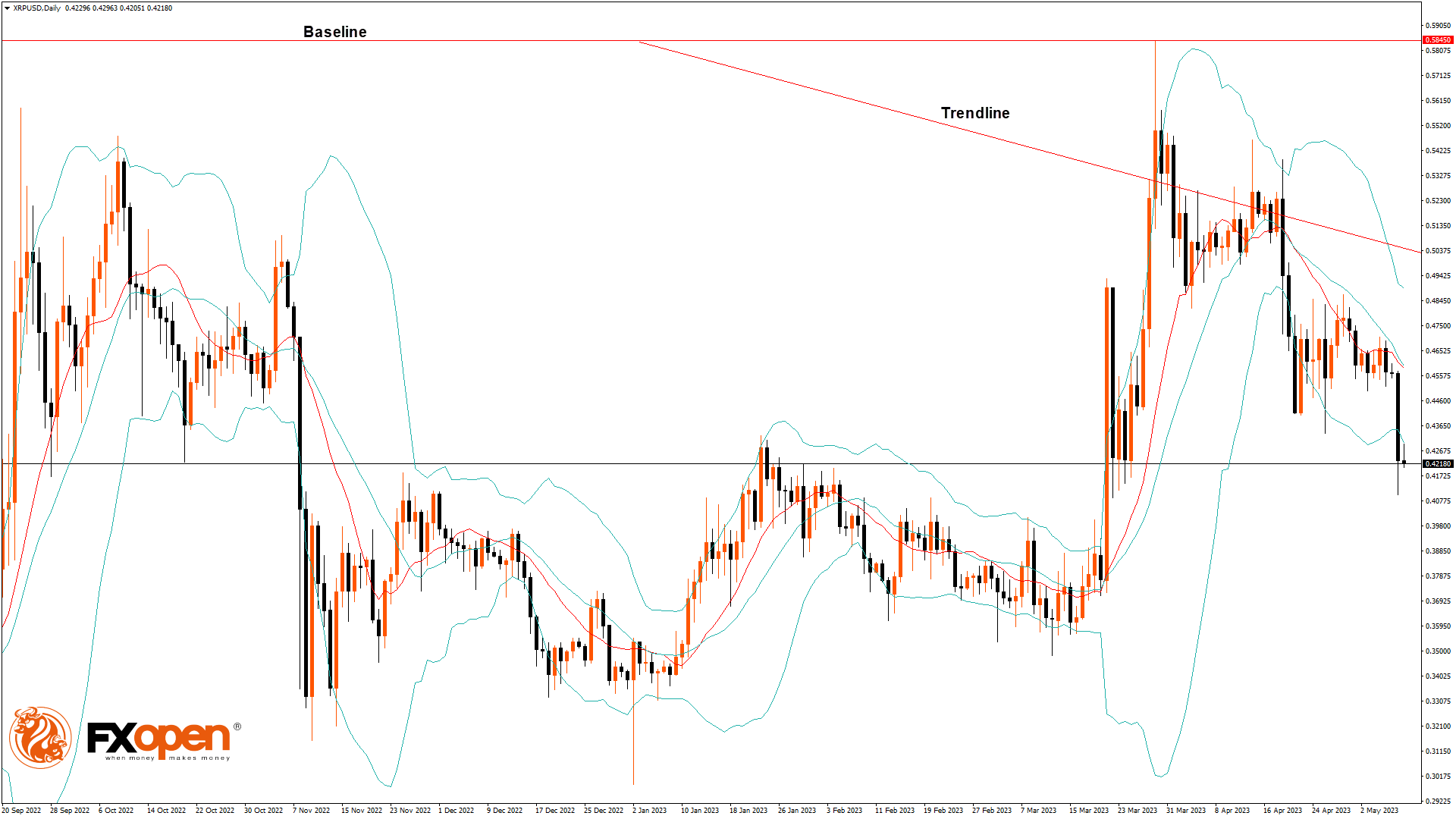

Ripple was unable to continue its bullish momentum from last week, and after touching a high of $0.4706 on May 05, we can see a continuous decline in the Ripple price, with immediate targets located in the range of $0.4000 and $0.3800.

On the hourly chart:

- The relative strength index is at 39.25, which signifies a very weak demand for Ripple at the current market prices and the continuation of the bearish phase in the market.

- Moving averages signal a downward price movement at the current market level of 0.4236.

- The Ultimate oscillator is in the neutral zone, which means the price is expected to consolidate further.

- Ripple is now trading just above its pivot level of 0.4229 and is facing its classic support at 0.4153 and facing Fibonacci support at 0.4211, after which it will be able to move towards 0.4000.

- The markets opened bearish this week.

- Ripple to USD exchange rate is ranging near a new record low for one month.

Some of the major technical indicators are bearish.

- Ripple bearish reversal is seen below 0.4706.

- The price is just above its pivot level.

- Average true range indicates less volatility.

- RSI is back under 50.

- Ichimoku price is under the cloud, indicative of the bearish pressure.

We have also detected the formation of bearish engulfing lines in the 4-hourly timeframe.

Ripple Bearish Reversal Seen below $0.4706

We can see that Ripple continues to move bearish, and further downsides are located at 0.4000 and 0.3800. There is a bearish trend reversal pattern with the adaptive moving average AMA20 and AMA50 in the weekly timeframe.

With a weak global investor sentiment we are looking to enter into a consolidation phase after the recent decline in the prices of Ripple.

The short-term outlook for Ripple has turned bearish, the medium-term outlook is bearish, and the long-term outlook is neutral.

We can see an increase of around 5.05% in the trading volumes of Ripple as compared to yesterday, which is normal.

This Week Ahead

The price of Ripple continues its bearish momentum and remains in a downtrend as confirmed by the major technical indicators and moving averages. The next visible targets are located at $0.4000 and $0.3800.

Now, the Ripple prices have entered the consolidation zone, and a mild bearish momentum is visible on the daily timeframe.

The resistance level is located at $0.4594, at which the price crosses 9 day moving average.

We can see a continuous progression of a bearish trend line formation from $0.4706 to $0.4103.

The support level is located at $0.4035, which is 3-10 day MACD oscillator stalls, and at $0.4015, which is a 38.2% retracement from 52 week low.

The weekly outlook for Ripple is $0.3800 with a consolidation zone of $0.4000.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.