FXOpen

The days of the old school computer hardware firms dominating the stock market were over a long time ago, however there has been one particular company that has been riding a wave of success long after its printed circuit board producing peers slid down the ranks.

That company is internal graphics card manufacturer NVIDIA and its success until recently can be attributed to a very unorthodox set of circumstances, that being the reliance on computer graphics cards for the mining of cryptocurrency and in particular Bitcoin.

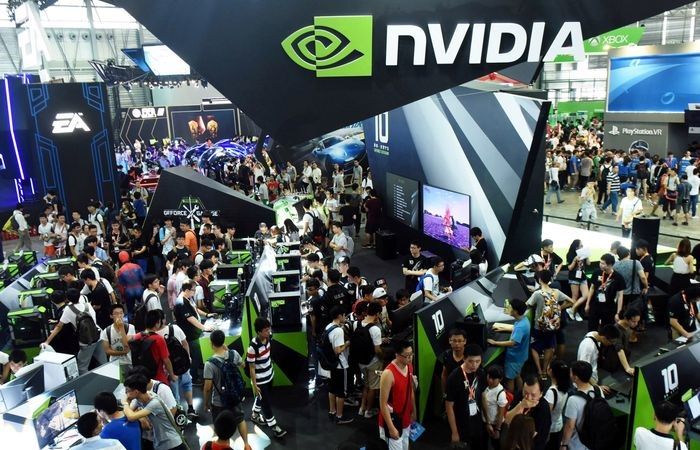

Many of the industrial-scale Bitcoin mining rigs that have either been custom built or available off the shelf over the past few years have used NVIDIA graphics card for what is known as 'GPU mining', therefore NVIDIA's hardware sales have been very buoyant and their graphics cards very much in demand especially among Chinese miners which accounted for over 70% of all Bitcoin mining over recent years.

When the Chinese government swept across the country and enforced cessation orders onto many large scale Bitcoin miners earlier this year, operators of large mining rigs across mainland China appeared to begin to dump their systems and many became available on the used market for very low prices.

This flooded the market with used NVIDIA hardware, which reduced the cost of brand new equipment, therefore over the past few months, NVIDIA stock has been less buoyant than it had been previously.

However, a very interesting turn of events occurred subsequent to the Chinese government's blanket ban on Bitcoin mining, in that a large number of Chinese mining rigs were resurrected and exported to Kazakhstan, the United States, South America and parts of Eastern Europe and resumed operation in areas with cheap electricity.

This resulted in the demand for new NVIDIA graphics cards being in higher demand once again, and the stock price to rise.

However, this week begins with NVIDIA stock very much on the backfoot. At the end of the New York trading session on Friday November 17, NVIDIA stock was down 2.06% to $278.01 compared to $285.91 at the peak of its trading during the morning session.

The interesting dynamic here is that it spiked on Friday, rising to a very high $311.40 at 9.30am Eastern Standard Time, but then tailed off again immediately, taking it down to the same value that it had been trading at on Thursday December 15.

Despite that interesting bit of volatility on Friday, NVIDIA stock is now at its lowest value for a month.

With so many Bitcoin miners now establishing themselves in many regions of the free world and using powerful mining rigs previously used by Chinese miners, there could be a further wave of volatility in NVIDIA stock as it remains one of the graphics cards of choice for crypto miners.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.