FXOpen

After the Fed signaled last week that rates may be higher for longer than expected, the US stock market has received a strong bearish boost. And among the most vulnerable assets were technology stocks (considered risky). The NASDAQ index has already fallen by about 6% since last Wednesday (when the FOMC meeting took place). And the negative backdrop from the Fed is one of the 4 issues that give reason to doubt the bullish outlook for AMZN stock.

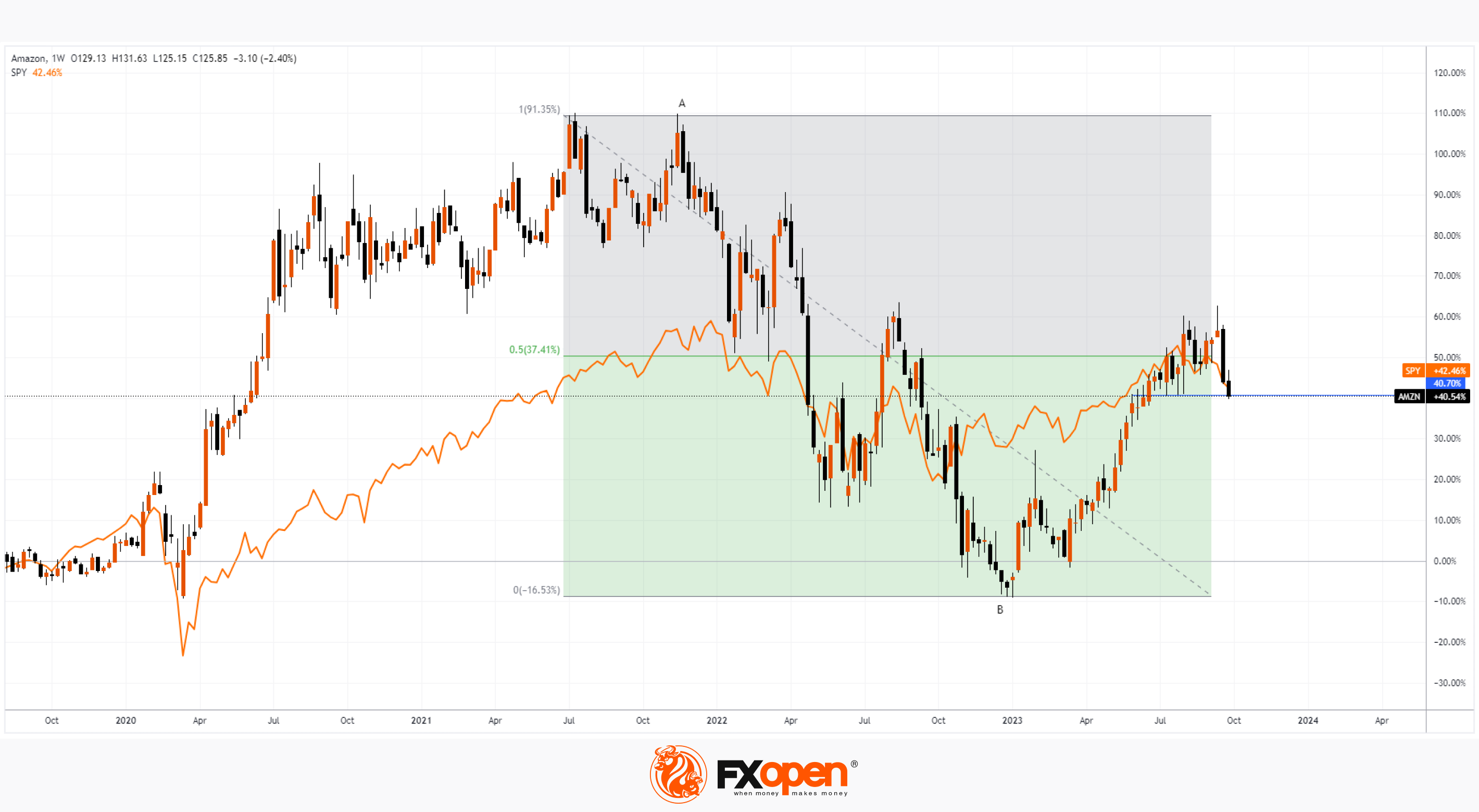

The second reason is that AMZN has fallen 9% in value since last Wednesday. That is, AMZN is falling faster than the overall market. And this problem is not new. Compare the dynamics of the index and Amazon shares on a weekly timeframe and you will see that the shares have been performing weaker than the index since the summer of 2020. That is, the leadership status that was held for many years has been lost.

The third reason is that yesterday, it became known that the Federal Trade Commission and 17 states sued Amazon, claiming that its online commerce policies illegally stifle competition. The litigation could put further pressure on the stock price.

The fourth reason is volume analysis. The last two spikes in large volumes of trading in AMZN shares on the NASDAQ exchange were recorded on August 4 and September 15. After the first surge, the price stopped growing as part of a bullish trend that has lasted since the beginning of 2023. After the second, it began to decline. Perhaps large players took profits from the rally and reversed positions in anticipation of lower prices?

It is also worth noting that the 2023 rally did not reach the level of 50% of the A→B decline, so the level of USD 126 per share of AMZN (providing support in July) may be broken against the backdrop of these problems, opening the way to the psychological mark of 100 USD per share.

Buy and sell stocks of the world's biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.