FXOpen

As a result of yesterday's trading, AAPL shares fell more than 3.5%.

The reason is in the news that came from China:

→ According to the WSJ, Chinese central government officials have been ordered not to use iPhones or bring them to the office. Apple's business is very vulnerable to tensions between China and the US, as most of the US company's products are made in China.

→ Chinese Huawei has developed a new high-speed phone that can become a serious competitor to the iPhone. The first batch of the phone, the Mate 60 Pro, priced at USD 960 on a limited pre-order basis, sold out in a matter of hours, causing a sensation on Chinese social media.

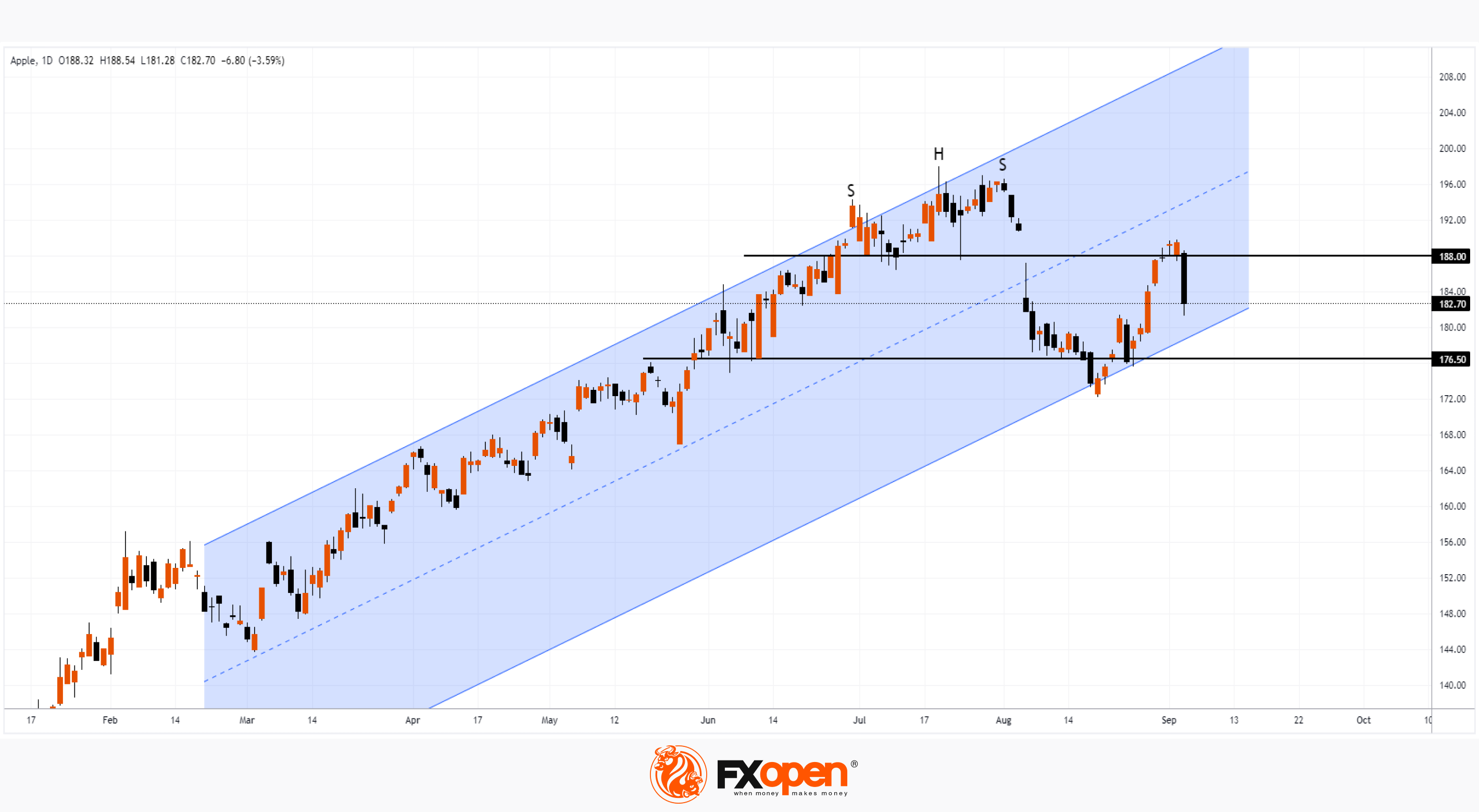

With the SHS pattern in the background, AAPL shares are technically weak:

→ the price has tested the bearish gap formed at the beginning of August;

→ USD 188/share AAPL, which acted as support in July, now appears to be resisting;

→ after the August reversal from the lower border of the channel (shown in blue), the bulls failed to return to the upper half of the channel.

Bulls can oppose a serious argument — the price is in an upward channel. And AAPL is one of the leaders in the NASDAQ Technology Index, which is rising on the AI-related boom.

However, AAPL's share price continued to decline in premarket trading, dropping below the USD 180 level, and thus threatening a bearish breakdown of the rising channel in 2023. The nearest support is the level of 176.50, where earlier the price slowed down the fall or turned up.

Buy and sell stocks of the world's biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.