FXOpen

Yesterday's news from the FOMC is unlikely to have much impact on participants' views that the Fed's tightening cycle is over. According to published protocols:

→ The Fed will act cautiously;

→ all FOMC participants considered it appropriate to keep rates at current levels;

→ everyone also agreed that they would raise interest rates only if progress in controlling inflation slowed. In doing so, they left the door open to the possibility of further tightening, even as data showed a sustained slowdown in inflation.

Market participants are almost confident that the Fed will keep rates at its December meeting, while estimating the likelihood of a rate cut as early as March at about 30%, according to CME's FedWatch Tool.

The reaction of the foreign exchange market was a slight strengthening of the dollar index relative to other currencies, in particular AUD/USD.

By the way, yesterday, the head of the Reserve Bank of Australia, Michelle Bullock, warned that wages are growing at a pace that cannot be sustained without reversing the decline in productivity in the country, which indicates the possibility of another rate hike to suppress inflation.

“Inflation will be the most important issue in the next one to two years,” she said on Tuesday.

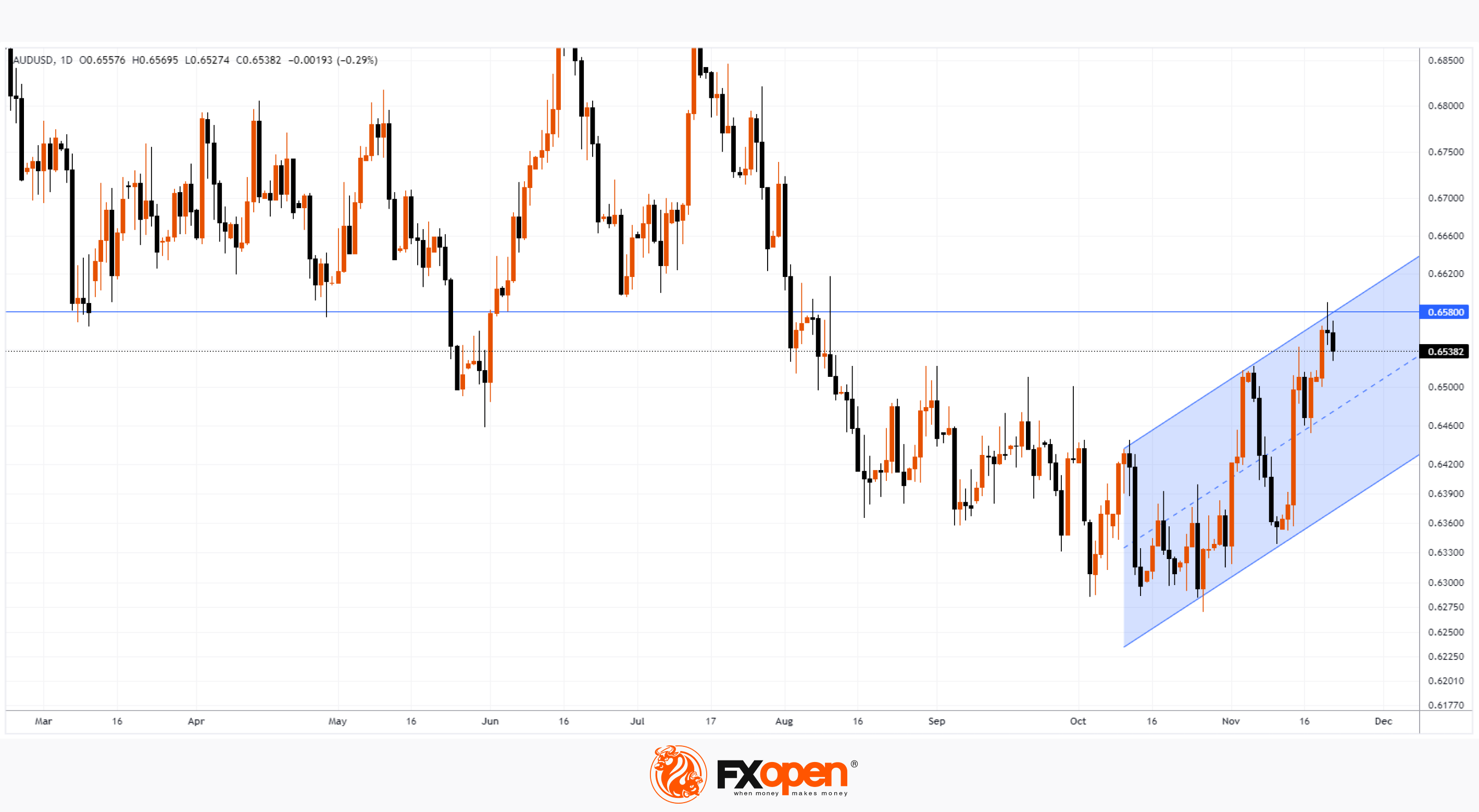

The AUD/USD chart meanwhile shows that:

→ the rate is at an important resistance of 0.658 – the rate has repeatedly formed reversals from this level;

→ the upper boundary of the ascending channel (shown in blue) may increase resistance;

→ the upper long shadow on yesterday's candle indicates the activation of sellers.

With AUD/USD up over 5% from the October lows, some correction from the above resistance levels looks like a worthwhile scenario.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.