FXOpen

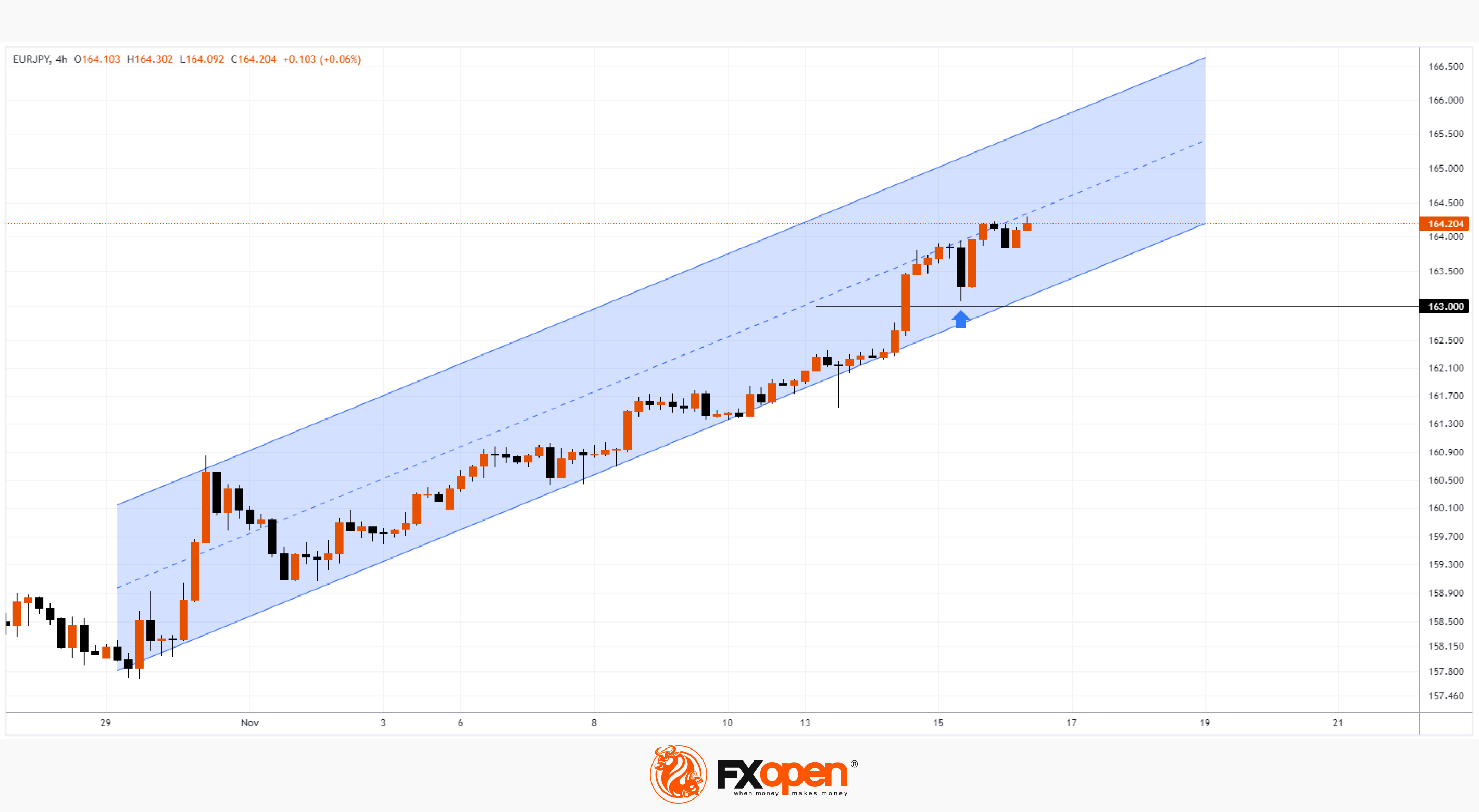

This morning on Forex one euro was given 164.25 yen - the last time this happened was back in 2008, at the height of the financial crisis. The growth of EUR/JPY since the beginning of 2023 is already about 17%.

How far can the rate rise?

From a fundamental point of view, the growth of the exchange rate is due to the difference in the policies of the ECB and the Bank of Japan. However, this may change. “The Bank of Japan is probably now in the process of looking for the right time to raise interest rates,” a source told Reuters. Insiders say the Bank of Japan's tightening tone is preparing markets for an end to negative interest rates, which could happen in the first few months of next year.

From a technical point of view, the bulls have a clear advantage:

→ the price confidently broke through the level of 163 yen per euro, after which a test of the breakdown occurred - the bears tried to lower the price to the round level, but their pressure quickly dried up (shown by the arrow). The price rose sharply indicating that this was only a short-term correction.

→ if the dominance of demand continues, the price may reach the upper limit of the ascending channel, which will mean a rise in the euro to 165 or even 166 yen.

In such a situation, when the rate updates its highs of the year every week, the idea of a long position may be too obvious. What if the accelerating growth of the EUR/JPY exchange rate is the initial stage of a stock exchange bubble, which may burst against the backdrop of decisions from the Bank of Japan?

Bank of Japan Governor Kazuo Ueda said last week that it would not be necessary to wait for real wages to become positive to phase out stimulus. What is this if not a hint at an end to the monetary policy pursued by the bank's previous head, Haruhiko Kuroda (who is blamed for a host of problems, including the sharp fall of the yen)?

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.