FXOpen

As it became known yesterday:

→ Tim Cook sold shares, selling 511k of his existing package of more than 3 million shares. For information: in 2023, he took a salary reduction of approximately 40%, but increased the size of the bonus (tied to the company's success) in the form of shares from 50% to 75%.

→ Investment bank KeyBanc Capital Markets downgraded AAPL shares. Analysts believe the company's sales will fall amid lower consumer spending.

Alarm bells continue to ring for investors in AAPL stock. Let's remember that we wrote on September 3 about Apple's problems, but since then important changes have occurred in the chart:

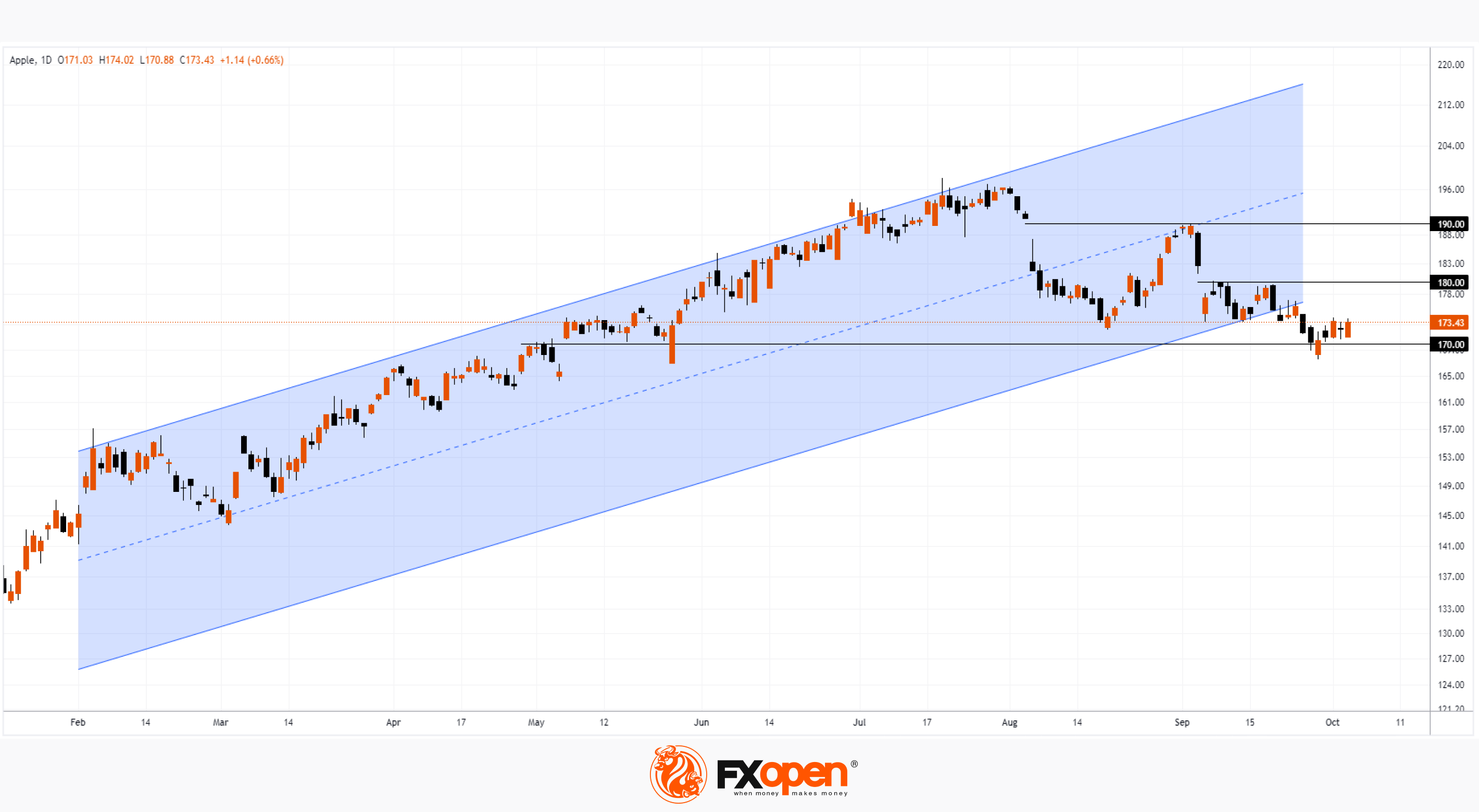

→ the ascending channel (shown in blue) has been broken, the price is below its lower border, which may resist growth attempts;

→ since the beginning of August, the price of AAPL has been underperforming the market and other technology stocks (for example, GOOGL);

→ psychological levels acquire the properties of resistance. This is noticeable in the price action around the USD 190 and USD 180 per share levels. The USD 170 level is providing support for now (for how long?).

What if Tim Cook moved shares into cash because he has more bearish arguments regarding the company's fundamentals? Q3 earnings season is getting closer.

Buy and sell stocks of the world's biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.